As an investor in the gaming industry, one of the questions I’m most often asked is:

The success of a game company often depends on a hit game, but the creation and production of ideas in this kind of creative industry often involve huge uncertainties. Does this mean that investing in game companies and teams is actually worthless?

This is a question about the sustainability and replicability of gaming industry products and business models.

My answers are as follows:

① Releasing sequels to hit titles is an effective way to extend the life cycle of game CP companies. In the film industry and the stand-alone game industry, this approach has become common knowledge in the industry, and with the improvement of industrialization, the success rate is constantly increasing.

② For the popular titles, we will build IP in the backend and create the entire IP derivative industry chain for game products. We will continue to make IP shine through other media forms, such as turning novels into comics, animations, movies and TV, and turning TV into games, board games and novels. In the entire content industry, media forms can be transferred. And for each media form, there is a relatively complete business model that can make money. In addition to charging for content, trendy toys, figurines, grains, and cards can all receive money.

③ Use the users and traffic brought by the hit titles to build a platform, first complete the integration of R&D and operation. Then you can transform into a game distribution and game channel company.

The integration of R&D and operation is actually the path chosen by the Caohejing Five Little Dragons, which has effectively established a moat, including everything from IP to traffic to commercialization. The integration of R&D and operation can also effectively improve the gross profit and net profit level of game companies.

Transforming into a game distribution and game channel company is the development path of most overseas large companies. From stand-alone games to PC games to social games, corresponding large companies have completed the steps of transforming into distribution and channel companies.

Someone once asked me, "What is the future of Crypto Game companies?"

I think in addition to creating your own hit products (hit products are defined at two levels: user and business model), you should consider transforming into a game distribution and channel company as soon as possible.

In fact, the largest companies in this field, Animoca Brands and Sky Mavis, do the same.

I am very fortunate to have invested in Catizen and to have seen the team achieve impressive user and commercial results six months after the product was launched. When all other partners/competitors were still hesitating about whether to enter the Telegram mini-game market, Catizen had already taken the lead in developing its own Game Center and launched several mini-games in popular categories, taking the lead again.

The launch of Catizen Mini Game Center means that Catizen has transformed from a TG mini-game to a TG asset and mini-game/application launch/distribution platform.

I tried Game Center right after it went online yesterday, and I’ll give you a report:

First of all, we need to know that after the end of Chinajoy this year, more and more Chinese mini-game companies have noticed the opportunities of Telegram mini-games, but many are still in the stage of learning and hesitation.

We invested in an overseas distribution company and actively searched the market for suitable products to be launched on Telegram, but either the quality was not up to standard or the team was hesitant about whether they should give it a try.

Therefore, we are very familiar with the migration progress of domestic small game teams/products to Telegram.

It is difficult for all the Telegram mini-games that are gradually being launched to catch up with Catizen in terms of quality, and Catizen itself is still undergoing continuous iterations.

While everyone was still hesitating, Catizen, with the experience and capabilities gained in China's Web2 game industry, had already begun to output madly to Telegram.

Opportunity is fleeting.

Several games currently launched in Game Center are very representative of the hot-selling tracks, namely

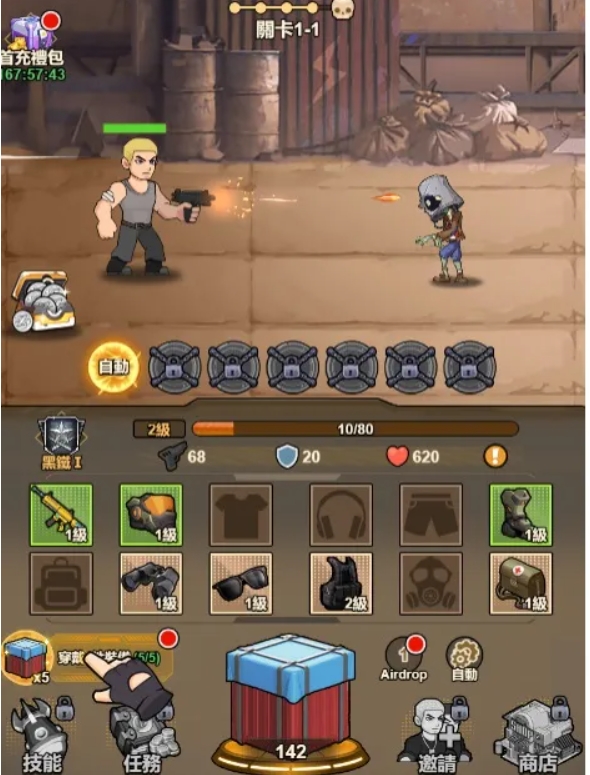

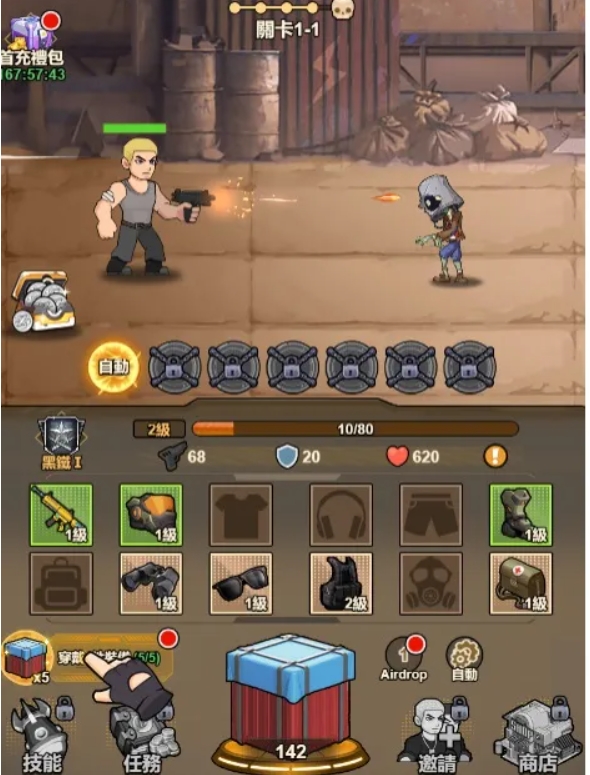

Home Defense, Path of Chaos, Sheep Match, Monkey King Adventure, Sniper Shooting, Star Wing, Bombie.

These 7 tracks have all produced representative games with high DAU and high revenue in the era of mobile games and mini-games.

It is also a game with no barriers to entry and is the most capable of generating traffic.

It reminds me of the VR X-Men and Baseball Fist series from the internet cafe era. As a supplement to heavy online games, players' needs will also be differentiated, and it is necessary to provide players with a variety of casual gameplay in order to effectively retain them.

The choice of track is enough to prove that the team is very familiar with the possible categories of mini-games and has already produced the largest product that can occupy the track.

At present, the experience of these 7 mini-games is that each game can be played for 10 to 20 minutes. After the user's operation feedback loop is established, the numerical values and operation points begin to be clearer, which is also the effective experience accumulated by China's Web2 game industry.

The initial page is a typical points wall, which shows the number of players well, and also gives an airdrop label for games with airdrop rewards.

Currently the game is displayed in English, but it may be necessary to localize the instructions and pages for players in each region.

I haven’t tried recharging yet, but since this is from the Catizen entrance, I assume that these users all have TON wallets, so payment should not be a problem.

Among these 7 games, the one that impressed me the most was actually the placement-type treasure chest opening game Bombie.

When you hear me say that it’s a placement game and you want to open a treasure chest, maybe you can’t immediately react to the specific game type, but if you have played some WeChat mini-games, you must have heard of the famous hit product “Xundao Daqian”.

Xundao Daqian is a placement-type treasure chest opening game launched by Sanqi Interactive Entertainment. Since June 2023, it has been ranked first in the best-selling list of small games for three consecutive months, and it achieved a turnover of more than 1 billion yuan in Q3 2023.

Its active user base exceeded 160 million in February 2024, and it has successfully expanded into overseas markets. In March 2024, the overseas version had accumulated a turnover of 250 million yuan, verifying the popularity of this type of mini-game among foreign players.

This is consistent with the trend of mini-games we have judged. Starting from King of Salted Fish, placement and reducing operations have become the main demands of mini-game players.

The main direction of game design is to enable players to think simply, play without getting tired, and enter the flow experience of the game more easily.

So whether it is King of Salted Fish, Crazy Knights, Seeking the Way of the World, or Monopoly Go, the design direction of these products is to allow players to obtain random rewards after simple operations and get the happiness and sense of accomplishment brought by level upgrades.

Bombie is a perfect tribute to Xundao Daqian. The numerical values and payment depth of the game system remain basically unchanged, only more usability improvements have been made.

We learned from the team that Bombie has accumulated 90,000 users, with a payment rate of an astonishing 11%.

As we all know, the business model of mini-games is highly dependent on buying traffic, and requires a user pool with a particularly low CAC (single user acquisition cost). Telegram just provides this environment.

So compared to the current user payment situation of Bombie, the ROI of each user is very high. It seems that it should be the next popular Telegram game.

In addition to the already excellent payment funnel and product model, Bombie also combines the airdrop concept similar to DOGS, and it is believed that it will be favored by more communities and project partners such as exchanges.

At present, the entire TG mini-game industry is in the stage of building from nothing to something, from zero to one, and this is the time when there is the greatest traffic dividend.

Only after completing this stage will you need to consider going from having to being better.

Since we have been looking at projects and products ourselves, we are quite sure that the quality of all games launched on Catizen Mini Game Center is definitely better than that of many telegram mini games that are about to be launched.

Therefore, if you want to consider creating a hit product on Telegram now, there are only two ways. One is to cooperate with projects that already have a large number of users to gain users (such as Catizen), and the other is to directly open the book to improve the quality.

However, quality assurance requires capital, and according to the current market conditions it is actually difficult to effectively obtain initial capital for quality assurance.

In the past two days, Catizen has also launched a kitten report function. In fact, domestic users should be more familiar with it. It is an emotional feedback to users.

Catizen also actively participates in the activities of rescuing stray cats, which brings good reputation and brand to the product. This is a reflection of the operational experience of the domestic Web2 team.

As a person who is experiencing the third industry cycle, I increasingly feel that the scale of Web2 is influencing Web3, and the formation of products and business models is becoming more and more important. If the cycle of 21 years is equivalent to the Internet in 2000, then now it is equivalent to 2004. In theory, companies with games and SMS deduction SP as business models should have been born.

We are fortunate to have invested in Catizen and a number of excellent Crypto Game companies in this cycle. Let us look forward to the birth of a new era of Shanda, Tencent and MiHoYo here!