Source: Social Capital Markets; Translated by: Tao Zhu, Jinse Finance

In recent years, the U.S. Securities and Exchange Commission (SEC) has increased its regulatory oversight of the cryptocurrency industry to ensure transparency, protect investors, and enforce legal compliance.

These fines highlight the importance of regulatory compliance as the digital asset space continues to evolve.

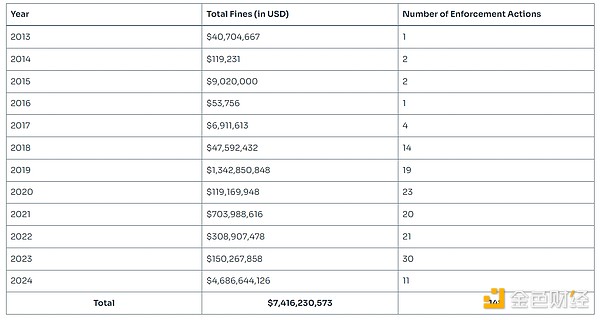

This report analyzes fines imposed by the U.S. SEC on major cryptocurrency companies from 2013 to 2024, focusing on significant cases, fine amounts, and violations.

It provides an in-depth look at the changing regulatory landscape and its impact on the cryptocurrency industry.

Key insights and statistics

Total fines: Since 2013, the SEC has imposed more than $7.42 billion in fines on cryptocurrency companies and individuals, with 63% of that amount, or $4.68 billion, occurring in 2024 .

The amount of fines increased from US$150.26 million (2023) to US$4.68 billion (2024), an increase of 3018% .

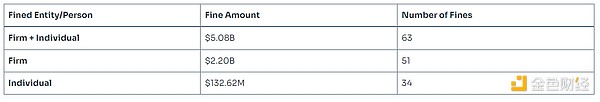

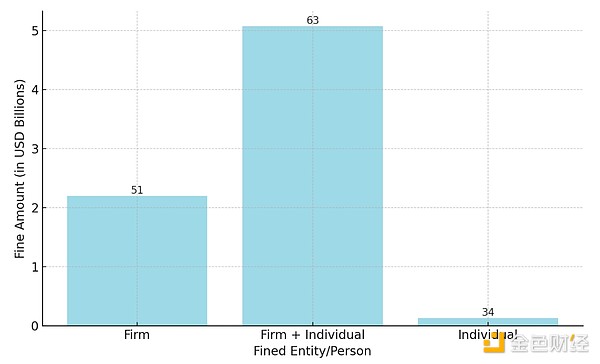

“Company + individual” fines accounted for $5.08 billion across 63 enforcement actions .

The massive $1.24 billion fines imposed on Telegram Group Inc. and TON Issuer Inc. in 2019 increased the average penalty by nearly 2,000% and marked a significant change in the SEC’s approach.

The $4.68 billion fine against Terraform Labs sets a new precedent in enforcement, demonstrating the SEC’s willingness to impose record-breaking fines for serious violations.

It is worth noting that the 11 enforcement actions in 2024 resulted in an average fine of $426 million, far exceeding the average fines in previous years. The average fine rose from $3.39 million (2018) to $426 million (2024) , indicating the growing financial risks faced by cryptocurrency companies that fail to comply with regulatory standards.

In 2013, the SEC imposed fines totaling $40.7 million, one of the early regulatory actions in the cryptocurrency space.

SEC fines by year (2013 to 2024)

2014-2016: Fines during these years were relatively low, ranging from $53,755 in 2016 to $9.02 million in 2015. This period reflects the SEC’s initial involvement in crypto regulation, primarily enforcing smaller violations.

2017: Fines increase to $6.91 million as more crypto companies begin to face regulatory action, especially during the ICO boom.

2020: So far in 2020, the SEC has imposed a $65 million fine in the high-profile Robinhood Financial LLC case, marking the beginning of more aggressive enforcement in more prominent cases.

2021: Fines reach $125 million, with Ripple Labs becoming a prominent case as the SEC classifies XRP as an unregistered security. This year has focused on high-profile companies.

2022: Fines totaled $102.64 million, led by cases such as Barksdales’ fraudulent ICO, reflecting a shift toward prosecuting individual actors.

2023: Fines increase significantly as the SEC charges Coinbase and other key players, demonstrating continued efforts to regulate large cryptocurrency exchanges.

2024: Terraform Labs and Do Kwon slapped with a record $4.68 billion fine This year has been the most aggressive for the SEC, with a clear focus on high-profile cases and unregistered securities violations.

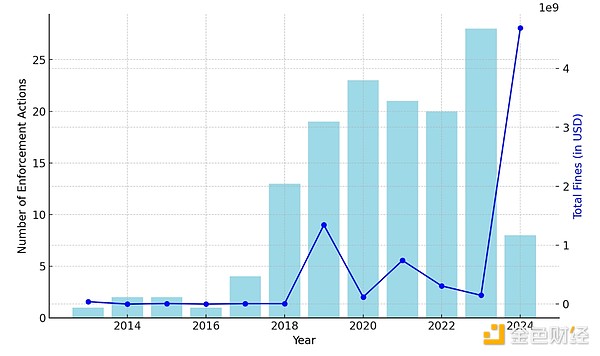

The SEC's fines have increased dramatically, especially in 2024, which was the largest single fine to date. The increase in fines indicates that the SEC is increasing its regulatory scrutiny.

In 2021 and 2024, high-profile companies such as Ripple, Telegram, and Terraform Labs were charged with unregistered token sales and securities violations.

Starting in 2022, fines were imposed on companies and individuals such as John Barksdale and JonAtina Barksdale, demonstrating the SEC’s intent to hold key company officials accountable.

The largest fine in history: $4.68 billion in fines in 2024

2024 is already a record-breaking year with $4.68 billion in fines, driven primarily by the U.S. Securities and Exchange Commission’s massive fine against Terraform Labs PTE, Ltd. and its co-founder Do Kwon.

The fine is the largest enforcement action to date, far exceeding previous fines and sets a new precedent in regulatory oversight in the cryptocurrency space.

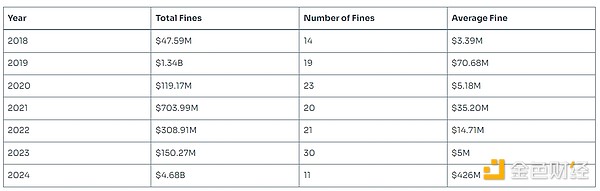

From 2019 to 2024, SEC enforcement actions show a clear upward trend in average penalties, reflecting an increased focus on high-profile cases and larger penalties against major cryptocurrency companies.

Driven by significant enforcement actions, average fines in 2019 increased significantly by 1,979.05% compared to 2018.

The average fine in 2018 was $3.39 million, increasing to an average of $426 million in 2024, an increase of 12,466.37%.

1. Explosive growth in 2019:

In 2019, the average fine jumped significantly to $70.68 million, mainly due to major cases such as Telegram Group Inc., which was fined $1.24 billion for its unregistered digital token sales through its TON blockchain project. This figure increased by 1,979.05% compared to 2018, indicating a significant shift in the SEC's approach to regulatory violations in the cryptocurrency space.

2. Decline in 2020:

Despite 23 enforcement actions in 2020, the average fine fell to $5.18 million, a 92.67% decrease compared to 2019. This decline suggests that while the SEC continues to enforce regulations, the fines imposed are generally smaller and may target mid-sized companies or less serious violations.

3. Rebound in 2021:

In 2021, the average fine rebounded to $35.2 million, up 579.35% from 2020. The increase was driven by a few high-profile cases, such as the $125 million fine against Ripple Labs. This was the year the SEC began to refocus on major players in the crypto industry.

4. Eased in 2022-2023:

The average fine in 2022 was $14.71 million, down 58.21% from the previous year as the SEC balanced enforcement actions across a large number of smaller cases. However, 2022 also saw significant fines, such as the $102 million fine against John Barksdale and JonAtina Barksdale, and the $150 million fine in 2023 for Kraken — a leading U.S. crypto futures trading platform that was fined $30 million for operating an unregistered securities exchange, broker, dealer, and clearing organization.

5. Unprecedented surge in 2024:

The most significant increase occurred in 2024, when the average fine reached a staggering $426 million—the highest ever recorded.

This growth was primarily attributed to the $4.68 billion fine imposed on Terraform Labs PTE, Ltd. and Do Kwon, the most significant enforcement action in cryptocurrency history.

With 11 enforcement actions issued in 2024, this year marks a turning point in the SEC’s enforcement strategy.

Average Penalty Fluctuations: Average fines fluctuate wildly between 2019 and 2024, reflecting the SEC’s alternating focus between high-profile, high-penalty cases and more frequent, smaller violations.

The trend signals a shift in the SEC’s strategy toward fewer but larger fines, with an emphasis on far-reaching enforcement actions that set precedents for the entire industry.

Crypto companies with the most fines

Here are the largest fines the SEC has ever levied against the cryptocurrency industry:

1. Terraform Labs PTE, Ltd. and Do Kwon (2024):

The U.S. Securities and Exchange Commission has fined Terraform Labs and its founder Do Kwon a whopping $4.68 billion for misleading investors and selling unregistered securities. The case marks a major move by regulators to hold companies accountable for securities violations, especially given the widespread financial losses caused by the collapse of TerraUSD (UST) and its ecosystem.

2. Telegram Group Inc. and TON Issuer Inc. (2019):

Telegram was fined $1.24 billion by the SEC after being found to have illegally sold unregistered digital tokens in its TON (Telegram Open Network) initial coin offering (ICO). The SEC intervened, halted the project, and stressed the importance of registration and compliance when raising funds through token sales.

3. GTV Media Group Inc., Saraca Media Group Inc. and Voice of Guo Media Inc. (2021):

The entities were fined $539.43 million for their unlawful and unregistered offering of GTV common stock and digital asset securities. The SEC’s action is intended to address the lack of transparency and regulatory compliance in its offering and protect investors from fraud and misinformation.

4. Ripple Labs Inc. (2021):

Ripple Labs faces a $125 million fine for selling XRP as an unregistered security. The case is one of the highest-profile in the cryptocurrency space, involving a debate over whether XRP should be classified as a security under U.S. law. The SEC’s enforcement action highlights broader implications for many other digital assets.

5. John Barksdale and JonAtina Barksdale (2022):

A Barksdale couple was fined $102.64 million for orchestrating a fraudulent ICO that falsely promised high returns through a cryptocurrency trading platform.

The SEC brought the case to protect investors from deceptive schemes and to highlight the need for stricter regulation of ICOs and token sales.

These enforcement actions target both companies and individuals and reflect the SEC’s approach to holding organizations and their executives accountable.

Across 63 enforcement actions, fines categorized as “company + individual” totaled $5.08 billion, highlighting the agency’s intent to punish corporate structures and related decision-makers.

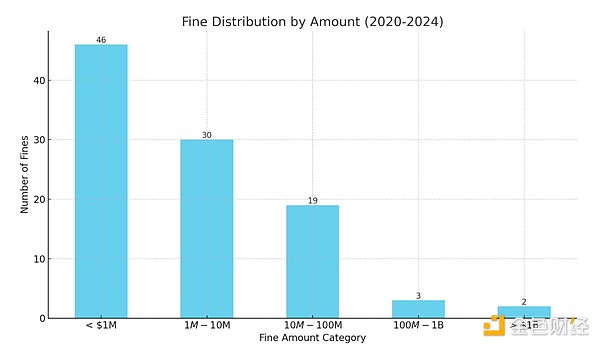

Distribution of fines (2020-2024)

Large fines dominate: Most fines are above $1 billion, mainly due to the record $4.68 billion fine imposed on Terraform Labs in 2024. This reflects the SEC’s focus on major violations.

Mid-range fines ($1 million - $10 million): A large number of fines are in the $1 million - $10 million category, indicating that smaller companies facing compliance issues are frequently penalized.

Smaller Penalties: The <$1 million category indicates that the SEC is reviewing more small-scale projects, emphasizing broad regulatory oversight.

This chart shows the SEC fines imposed on cryptocurrency companies and individuals from 2020 to 2024, categorized by dollar amount. Key observations:

in conclusion

An analysis of SEC fines against cryptocurrency companies from 2013 to 2024 shows a significant increase in regulatory scrutiny and penalties. The trend reflects a growing focus on large companies and serious violations, with fines peaking in recent years.

Despite the fluctuations, the overall increase in fines suggests a strategic shift toward fewer, higher-impact cases.

This evolution underscores the need for cryptocurrency companies to prioritize regulatory compliance as the financial risks associated with breaches continue to escalate.

This underscores the need for cryptocurrency companies to comply with regulations as financial risks increase. As the SEC shapes the future of the industry, compliance will be key to ensuring long-term stability.