From August 27 to September 7, Bitcoin continued to fall, falling below $60,000, triggering panic in the market. During this period, the US spot Bitcoin ETF showed net outflows for 8 consecutive trading days, with a cumulative net outflow of about $1.2 billion, and the total net assets of the ETF shrunk by about $8.8 billion, which is a rare situation since the launch of the US spot Bitcoin ETF.

On the evening of September 9, Bitcoin stopped falling and rebounded. At the same time, data showed that the daily net inflow of US spot Bitcoin ETF turned positive, indicating that market sentiment has improved. However, the market sell signal is still strong.

The selling pressure from large market institutions has basically passed, and Bitcoin's fundamentals are improving. Subsequent price performance needs to focus on the Federal Reserve's interest rate cuts and political changes in the United States surrounding the cryptocurrency industry.

On-chain data shows that risks have not been fully cleared

Judging from multiple indicators on the chain, market risks have not been completely cleared, but the current position may be in the early stages of a bull market.

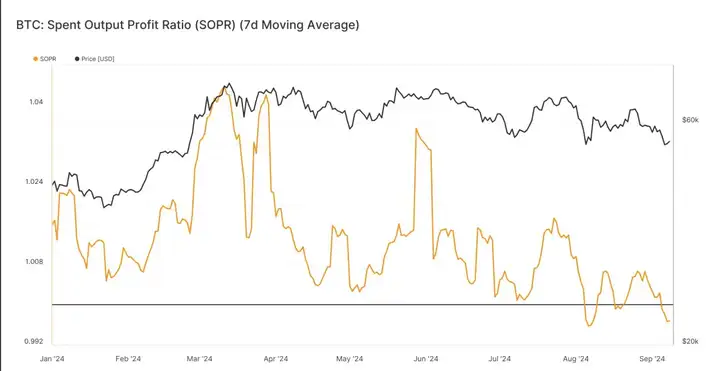

Bitcoin's 7-day moving average SOPR (spent output profit rate) has fallen below 1.0, which means that market sellers are still profitable in transactions on the blockchain, but it should be noted that historically, SOPR tends to fall below 1.0 before market consolidation occurs. The current decline is similar to the bear market phases in 2018 and 2019. If SOPR is below 1.0 for a long time, the market may reverse.

SOPR is used to view the ratio between the USD value of UTXO (UTXO is an unspent transaction output, which refers to the balance in a Bitcoin address) when it is created and the USD value of the UTXO when it is spent. The ratio 0 is the dividing line. A ratio above 0 represents an overall profit in transfers between wallets, and a ratio below 0 represents a loss in sales.

In terms of the ratio of floating profit to floating loss, profits are still 6 times the total losses, and the ratio is higher than the current value on about 20% of trading days. Short-term holders (STH), who represent the new market demand, bear most of the market pressure because their floating losses dominate the market and the loss margin has continued to increase over the past period of time. However, the magnitude of the floating loss relative to the market value shows that the market has not entered a full-scale bear market area, but is closer to the volatility period in 2019.

Based on on-chain data pointing to key indicators such as the seller's risk rate, market volatility may increase in the coming period.

Pay attention to the positive news at the macro level

With the launch of cryptocurrency spot ETFs and the entry of Wall Street funds, the crypto market's trends and macro-correlation have increased.

The selling pressure from the German government, Mt Gox Asset Management and other institutions has basically passed, and the improvement of fundamentals is expected to improve. At the same time, we need to pay close attention to the US labor market, the Federal Reserve's interest rate cuts and US political changes surrounding the cryptocurrency industry.

The market generally expects that the Federal Reserve will most likely announce its first interest rate cut in September.

Generally speaking, interest rate cuts are good news for risky assets. Boosted by macro news, global risky assets and Bitcoin saw a short-term rise.

The next Fed meeting is on September 18. It is currently in a silent period and Fed officials will not publicly express their views on monetary policy unless there are special circumstances.

On September 6, the U.S. Bureau of Labor Statistics released August statistics, showing that the number of non-farm payrolls in the United States increased by 142,000, lower than expected, and the unemployment rate fell by 3 basis points to 4.22%, which was stronger than the expected value of 3.7% and the previous value of 3.6%. The average hourly wage in August increased by 0.4% month-on-month, slightly higher than expected.

The data is not enough for the Fed to cut interest rates by 50BP. A 25BP cut is the basic expectation, but if the labor market continues to deteriorate, the Fed is open to a 50BP cut at subsequent meetings.

In the next two weeks before the rate cut actually comes, market liquidity may be more restricted. In the best case scenario, Bitcoin will fluctuate around the current level.

The fourth quarter of 2024 and the first quarter of 2025 may usher in a wave of opportunities for Bitcoin for four reasons:

1. Although the interest rate cut is not QE, the activity of funds in the market is expected to increase;

2. The general election, which has publicly supported cryptocurrencies and made promises;

3. The BTC halving effect has not been proven to not occur;

4. The new version of FASB will take effect in December 2024, when cryptocurrencies will be able to adopt fair accounting standards and implement fair valuation in financial aspects.

From a macro perspective, BTC ETF has resumed net inflows after 8 trading days, with a total net inflow of 28.6 million US dollars. However, the SEC warned of the risks of Bitcoin and Ethereum ETFs yesterday, calling BTC and ETH highly speculative investment products, and it is necessary to pay attention to the changes in events. The CPI data for August will be released on Wednesday this week. It is the last important data before the Federal Reserve announces a rate cut in mid-September. There may be a second bottoming out of the market caused by the withdrawal of safe-haven funds, and investors need to be alert to risks.