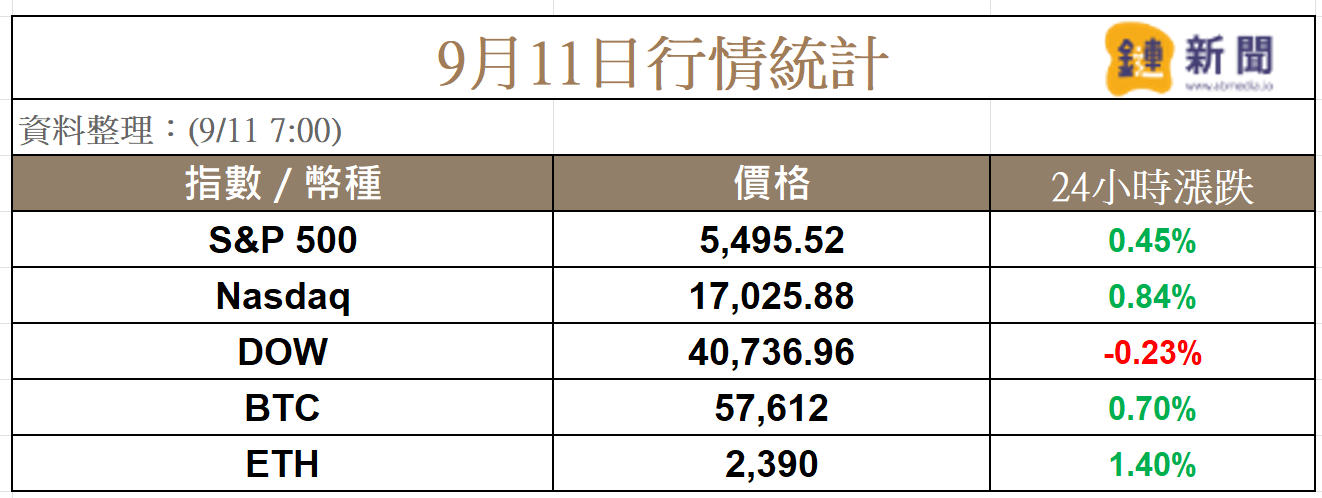

The stock market and cryptocurrencies closed slightly higher yesterday, as the market is awaiting the U.S. presidential debate at 9 a.m. Taiwan time this morning, as well as inflation data later.

Table of Contents

ToggleThe Sichuan-Gaga debate will be held in Taiwan at 9 o'clock

The U.S. presidential election is entering the countdown. Republican candidate Donald Trump and Democratic candidate Kamala Harris will hold the first presidential debate since President Biden withdrew from the race at 9 a.m. on the 11th, Taiwan time.

Cryptocurrency has become a key issue in the U.S. presidential election for the first time, with 73% of cryptocurrency owners saying a candidate’s stance on cryptocurrencies will influence their vote, according to a recent Gemini survey.

Bernstein also believes that the US presidential election may have an extreme price impact on Bitcoin. Because Trump has emphasized that he will make the United States the "Bitcoin and Cryptocurrency Capital", this series of measures may bring major benefits to the encryption industry. Harris never mentioned cryptocurrency in her speech, which may mean that the government will take a conservative stance on encryption policy in the future, which may have a negative impact on the market.

Tonight’s CPI is 9/18 Key data before interest rate decision

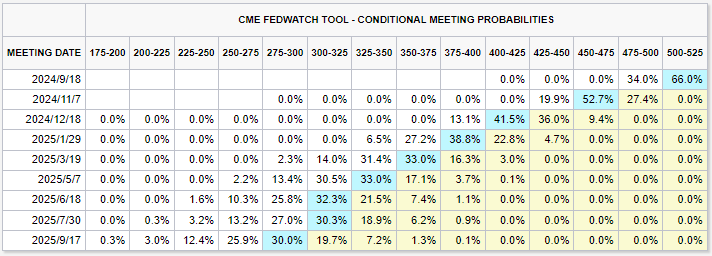

Investors will be closely watching U.S. Consumer Price Index (CPI) data on Wednesday and Producer Price Index (PPI) data on Thursday. This will be important data before the Federal Reserve meeting. A Reuters survey shows that CPI is expected to increase by 0.2% quarterly in August, the same as last month.

According to CME Group FedWatch data, 66% of investors believe that the Federal Reserve will announce a precautionary interest rate cut next week and adjust the benchmark interest rate to 5% to 5.25%.

Bitcoin rebounds to 57K

Bitcoin fell to $52,550 over the weekend, when BitMEX founder Arthur Hayes said he had shorted and believed Bitcoin could fall below $50,000 over the weekend. But he then took profits on Sunday. He pointed to Treasury Secretary Yellen's weekend remarks that the U.S. economy was still healthy, and employment data showed a soft landing.

Hayes believes that increased liquidity in the US dollar will help Bitcoin rise. Bitcoin has slowly recovered this week and was trading at $57,612 at the time of writing.