After six months of high-level fluctuations, BTC has been squeezed dry and is ready to take off, but the US macro-economy has temporarily become the core force determining the market.

VX:ZLH1156

Market sentiment is clearly pessimistic. Is the bull market over?

As the U.S. stock market weakens, Bitcoin continues to fall but not rise, which makes the pessimism in the market more obvious, and some people even think that the bull market is over.

I don't think that's the case, but it could be.

Cryptocurrencies have been falling this week. The weakness of the entire market can be clearly seen from the options data. The recent decline in the biggest pain point has not kept up with the speed of price decline. The IV of the main term has increased. As the US election approaches, the IV bump on October 8 is gradually being smoothed out. Last week, we mentioned the trading data of previous years. September is generally slightly flat, but the market seems to be a little overly pessimistic. We prefer to believe that there will be a bull market at the end of the year.

So, is the bull market really over? I think the crypto market bull market is not over. Although the crypto market is expected to remain weak in September and October, this is a good opportunity.

Bitcoin's decline may be a good time to increase your position

Historically, September is a weak month for the U.S. stock market. Due to macroeconomic factors, Bitcoin is expected to remain weak even if the Federal Reserve cuts interest rates as expected.

There are more concerns about economic growth right now, so the jobs report and unemployment claims seem to be generating a bigger market reaction. I think this will be the case in September as well.

If the U.S. stock market experiences a 7% to 10% correction in the next two months, the correction of Bitcoin will not be lower than this range, and Bitcoin cannot be ruled out to fall further to between $50,000 and $53,000. But just like the U.S. stock market, as long as Bitcoin falls, it can also be seen as an excellent buying opportunity. Investors should take the opportunity to adjust their investment portfolios and make their assets more diversified, because under the Fed's interest rate cut cycle, the bull market of Bitcoin will not end easily.

The reasons for Bitcoin's decline and the driving force behind its rise

Reasons for Bitcoin’s decline:

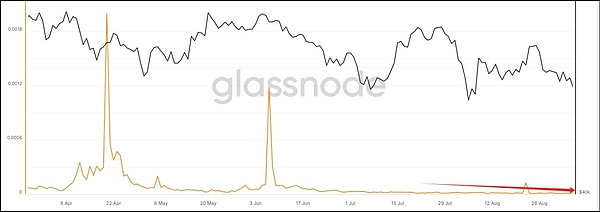

1. After Bitcoin hit $70,000, miners’ selling pressure increased significantly, and at the same time, institutions’ intention to increase their holdings of Bitcoin ETFs also dropped significantly;

2. In addition, Germany continued to sell its BTC at around 60,000. Subsequently, the United States, Mt.Gox, Genesis, etc. also sold their Bitcoins, which created huge selling pressure.

Under the huge selling pressure, I don’t think that the interest rate cut can directly boost Bitcoin. However, if Bitcoin continues to be weak in September and October, it will give Bitcoin enough time to digest the selling pressure, and institutions can also easily take over Bitcoin at a low level, thus accumulating power for future increases.

In addition, another reason why Bitcoin is difficult to rise directly is the lack of innovation. This can be intuitively felt from the on-chain data of Bitcoin and Ethereum.

However, in the first half of next year, innovation in the crypto market may begin to show results. Judging from the current development of Bitcoin and Ethereum, Ethereum is more like an innovation test field for Bitcoin. The hot inscriptions and runes in this round of Bitcoin bull market are similar to MEME, and Bitcoin's second-layer concepts and technologies also benefit from the development of Ethereum's second-layer technology. However, due to the slowdown in Ethereum's innovation, Bitcoin's development has essentially stagnated. So, where will the innovation results of the crypto market be reflected in the first half of next year?

One of the main reasons why Ethereum is weak in this round of bull market is the Layer2 strategy, which has divided Ethereum's value capture ability, but there are too many Layer2s, which directly leads to liquidity fragmentation and makes the Ethereum ecosystem fight for itself. However, with the breakthrough of cross-Layer2 interoperability, this situation is expected to be broken, so that applications based on Layer2 interoperability will break out of the circle.

In addition, the Ethereum Pectra upgrade is expected to be launched in the first quarter of 2025, which will be the most anticipated event in the entire crypto market. Pectra merges the Prague (execution layer) and Electra (consensus layer) updates. This will also be something to look forward to for Ethereum.

Next year's bull market is worth looking forward to

From a macro perspective, the US stock market is expected to rebound at the end of October. Considering the linkage between Bitcoin and US stocks, Bitcoin is expected to have a wave of market at the end of the year (starting in November), which is mainly a macro linkage market. However, by the first half of next year, Bitcoin is expected to start a new round of large-scale rising cycle driven by innovation in the encryption market and sufficient macro-financial liquidity.

The article ends here. Follow the official account: Web3 Tuanzi for more good articles.

If you want to know more about the crypto and get first-hand cutting-edge information, please feel free to consult me. We have the most professional communication community, publishing market analysis and high-quality potential currency recommendations every day. There is no threshold to join the group, and everyone is welcome to communicate together!

Welcome to join the exchange group →→ VX: ZLH1156