What is financing? What does it mean to complete xx million X rounds of financing?

Financing means raising money. In some cases, it refers to borrowing money. However, in the field of venture capital and new startups, it usually refers to equity financing. Raising funds by giving up equity is called investment stock subscription. , if it is a cryptocurrency project, it is more likely to release cryptocurrency to raise funds, which can also be regarded as a kind of private placement. In the token economic model, we often see allocations to investors under the names of "investors" and "private sale" , "pre sale", etc., refer to this part.

! Financing here means getting investment!

The completion of XX million in financing means that someone invested XX million in the project, but hasn’t the money already been received? This is not necessarily the case. Each investment plan is different, and the details may not be made public.

Not all financings will be publicly announced. Some will disclose the amount and investors, as well as the token private placement price. Some will only disclose the amount or investors, and some will not be disclosed at all. Even if no financing news is found, it does not mean that no one invests in the project. .

X round financing - the growth stage classification of invested companies in the venture capital field

As for the Series The announced rounds can roughly determine the stage of development of the project.

Common venture capital round definitions | |

angel wheel | In the earliest stages, perhaps even in the concept stage, the investment scale is minimal. The funds are usually used to help start the company, start product development or market research, and the investors are usually individuals. |

Seed round | In the early stages of a company's establishment, it is a stage where seeds have been sown and are about to begin to grow. Funds are usually used to develop products, build a team, and market test. From this round on, investors usually take the form of institutions. |

Series A | The company already has preliminary products or services, may already have a group of customers or has begun to generate revenue. Funds are usually used to expand the market, adjust and optimize products, expand the team, etc. |

Series B | After the A round, the company has a basic operating scale and wants to further expand the market or enter new markets. The funds are mainly used to accelerate growth, expand business scope, increase influence, etc. |

C round | After the B round, the company usually has a certain scale and a stable business model and income. If it needs further expansion, such as developing new products, entering more markets, or acquiring financing for other companies, |

After the B round, the company usually has a certain scale and a stable business model and income. If it needs further expansion, such as developing new products, entering more markets, or acquiring financing for other companies,

The scale of investment funds is usually larger in later rounds. This is limited to individual cases. Different rounds of financing for the same project will have larger amounts in later rounds, but the differences in amounts and rounds between different projects are not necessarily the same. Related.

The table is a relatively general definition. In fact, there will be individual differences. However, after understanding these, when you see the X round of financing in news reports in the future, you can quickly know what market stage the project is in and whether there are specific Products and services.

Cryptocurrency financing record - How much financing have cryptocurrency projects received in total?

According toCointelegraph , since 2014, the cryptocurrency field has raised more than US$100 billion in ten years, most of which occurred after the 2020 COVID-19 epidemic.

More detailed trend charts can be viewed on DeFiLlama .

The figure of US$100 billion in ten years is not high compared with the world. According to a report released by KPMG, in 2024 Q1 alone, the global new investment amount in one quarter was as high as US$75.9 billion. During the same period, the cryptocurrency field was only US$2.25 billion, accounting for Less than 3%.

A simple judgment can be made from this figure: Although high-value financing projects have continued to appear in the crypto in recent years, we should still be far away from a bubble. Among the investment funds received by new startups around the world, cryptocurrency projects only account for 3% about.

Why should you focus on financing when investing in cryptocurrency?

After writing so much, I still haven’t answered the most important question: So what does this have to do with me? The project party is invested, what happens after knowing this?

Let’s talk about the conclusion first, mainly in two directions:

Understand the flow of institutional funds and help us find potential tracks

High financing means high valuation, and if there are airdrop opportunities, there is more potential for reward.

Observe the hot spots of institutional layout - Leverage the investment research capabilities of institutions

Most of those who invest in new startup projects are venture capital, or VC (Venture, Capital) for short. They have large sums of cash in their hands, and their most important task is to find the next potential project and invest as early as possible, hoping for high multiple returns in the future.

As cryptocurrency investors, we may have other full-time jobs and may not have the time or ability to research projects. A VC’s job is to research, and they even have a professional research team. Although there is no guarantee that VC investment will definitely make money, compared to ordinary Investors, they usually have better project review capabilities, and it is easier to tell whether the project really wants to be developed or just wants to attract money and cheat money? Better able to judge whether the team has sufficient background to realize the project vision. And because private placements are usually accompanied by a certain lock-up period, the token allocation to investors often needs to be locked for more than 1-2 years. Unlocking is not all at once, but needs to be unlocked linearly for another 1-2 years. This means that VCs are investing Projects focus more on long-term potential than short-term rewards.

Speaking from experience, the tracks and sectors in which institutions focus their investment in advance are likely to be hot spots in six months to one year. For example, the figure below shows the financing distribution of each track in the past 90 days. It can be seen that infrastructure is still the largest investment at present, followed by DeFi, games, social networking, etc., which are the tracks we can start to pay attention to.

If you don’t quite understand what the track section narrative of cryptocurrency is, you can refer to these two articles:

One article to understand the hot spots in the crypto& sector rotation, the 5 major tracks worth ambushing in the next bull market

Is it worth investing in a project that has received high amounts of financing?

As mentioned in the previous paragraph, VCs theoretically have stronger review and research capabilities than ordinary investors. They carefully select and decide to invest large sums of money in projects, and the probability of development potential should be higher. Does that mean that we directly follow Is investing a good strategy?

This is definitely not the case. The main difference lies in whether we have channels to participate in primary market investment. The cost and funds of petty-bourgeois retail investors entering the secondary market are incomparable with investment institutions. Investment institutions often have lower costs and funds than us. More funds to build your own investment portfolio.

Simply distinguish between the primary market and the secondary market:

Buy coins directly from the project > Primary market

Buy coins from others on the market > Secondary Market

VC investment projects are in the primary market. They may see some potential and decide to invest. However, when the tokens of the project are open for trading on the secondary market, it is possible that the price has already reflected its development potential, and the price is already very high. There is not much profit margin, which is also the biggest problem of this bull market. Countless VCs have pushed up the market value of tokens, and the tokens are already at short-term highs when they are listed on exchanges.

High financing means that the valuation of the project is not low, and VCs also need to have profit margins. When it is listed on the secondary market, the token is likely to open directly from a higher market value. Simply put, the price will be high as soon as it is listed. For ordinary investors who can participate in the secondary market, it is actually more difficult to make profits.

If you don’t know much about the above paragraph, you can refer to these two articles:

Cryptocurrency investment primary (primary) market and secondary (secondary) market overview, participation in teaching

According to the logic of the previous paragraph, projects that have received high-level financing are theoretically relatively high-quality projects. However, due to limited channels to participate in the market, it is more difficult for ordinary investors to make profits when facing these projects. The key here is whether there are Opportunities to participate in the primary market and obtain the project tokens at a lower cost.

Although these private placements may not necessarily be open to the general public, and it is difficult for us to have the same early buying opportunities as VCs, there is an important and increasingly common mechanism in the development of cryptocurrency: airdrop! This is an opportunity for ordinary people to participate in the primary market and should not be missed.

Q: Why should high-value financing projects ambush if there are airdrop opportunities?

A: Three reasons:

Obtaining high-level financing or being invested by a well-known VC means that the project has a higher chance of being promising.

Receiving high amounts of financing means that the valuation at the time of listing may be higher, and the airdropped tokens have a greater chance of being valuable.

Well-funded ecosystems such as Movement, Berachain, and Monad are all high-potential Layer 1 that the market is looking forward to in the second half of the year. Ecosystems are well-funded and naturally have more opportunities to hold incubation programs, hackathons and other activities to attract more developers to the ecosystem. By building products, there will be more opportunities for token issuance in the ecosystem. Although we do not have the opportunity to invest in the above three chains, we can still earn excess income that is unmatched by other ecosystems by participating in ecological projects early.

Welcome to join the Berachain Chinese exchange group and plan for ecological Alpha as soon as possible: https://t.me/berachain_zh

However, it should still be noted that this is only based on logical inference. There is a higher probability but it is not absolute. When participating, be sure to evaluate your own abilities and never rashly invest beyond your capabilities.

If you don’t know much about what an airdrop is, please refer to this article:

What is an airdrop? How to find airdrop opportunities and make money at low cost? Airdrop Teaching 2024

Nowadays, more and more cryptocurrency projects will arrange points programs before the tokens are listed. They usually participate in some tests, interactions, and marketing promotions and then get points. When the tokens are listed, the airdrop quota will be allocated based on the points. Regarding these, there are airdrops For opportunity project introduction and operational teaching, you can pay close attention to Daily Coin Research:

▌Follow Daily Biyan Twitter account

▌Research and discuss with the Biyan community and join the daily Biyan Chinese exchange group !

▌Subscribe to the daily Coin Research e-newsletter (1-2 articles per week to quickly understand market conditions, on-chain data and potential project developments)

How to check financing news? Cryptocurrency Financing Dashboard Tool Introduction

There are many related information platforms. Here are two recommended platforms, both of which present information clearly and relatively completely:

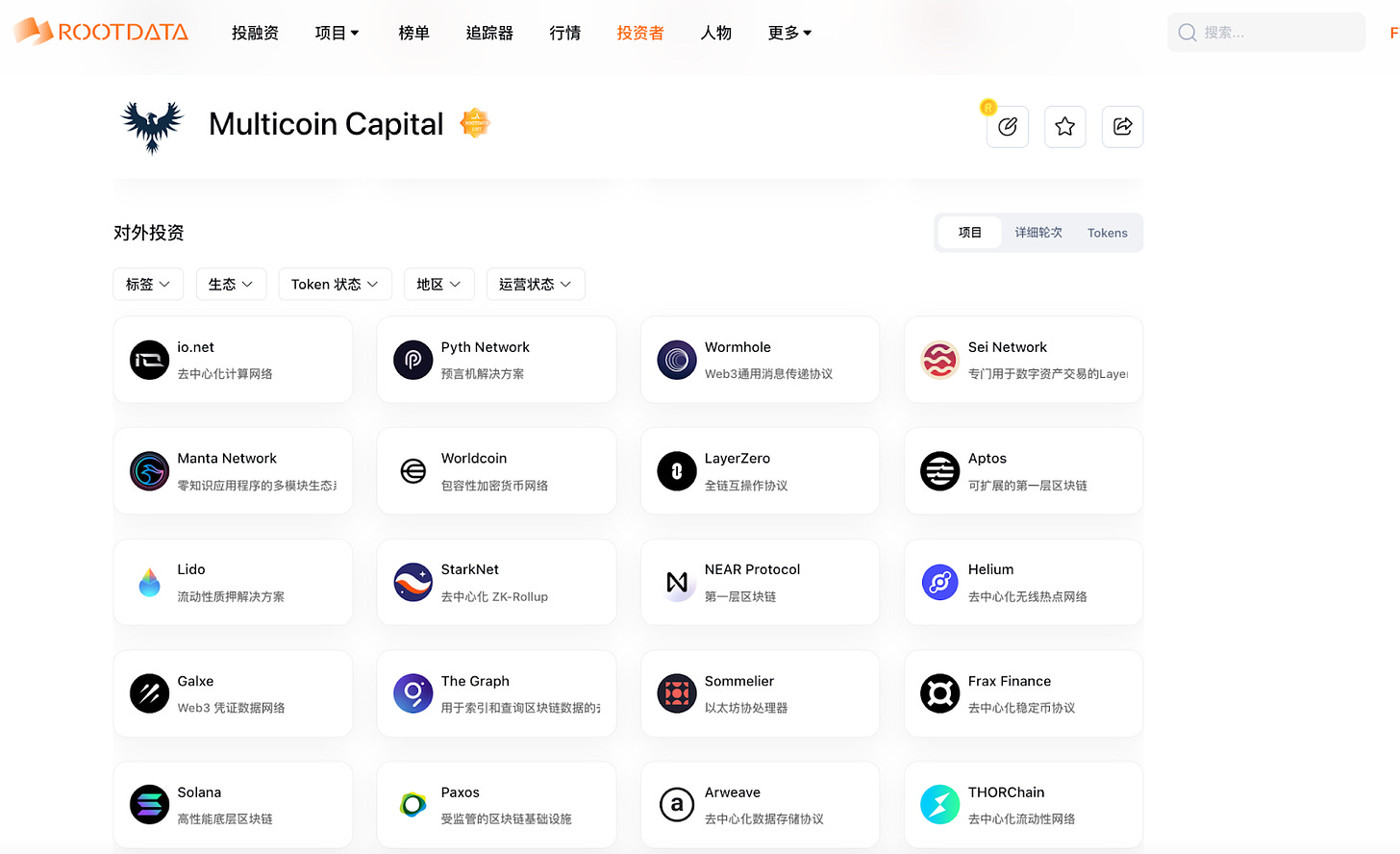

Web 3 asset data platform: RootData

Rootdata is a visual and structured cryptocurrency project database. Its functions include viewing the latest financing information, encryption project overview, list of investment institutions, ecological maps, financing trend charts, and project team information. The website supports English and Simplified Chinese .

https://www.rootdata.com/zh/dashboard

In addition to viewing individual financing projects and investors, the site also compiles overall financing statistics as shown above, allowing us to quickly see which ecology and tracks institutions currently prefer to invest in.

If we are particularly interested in a single institution, we can use Rootdata to find out what projects they have invested in in the past:

For detailed introduction and teaching about RootData, please see this article:

Stand on the shoulders of VC giants, play with RootData and find Alpha

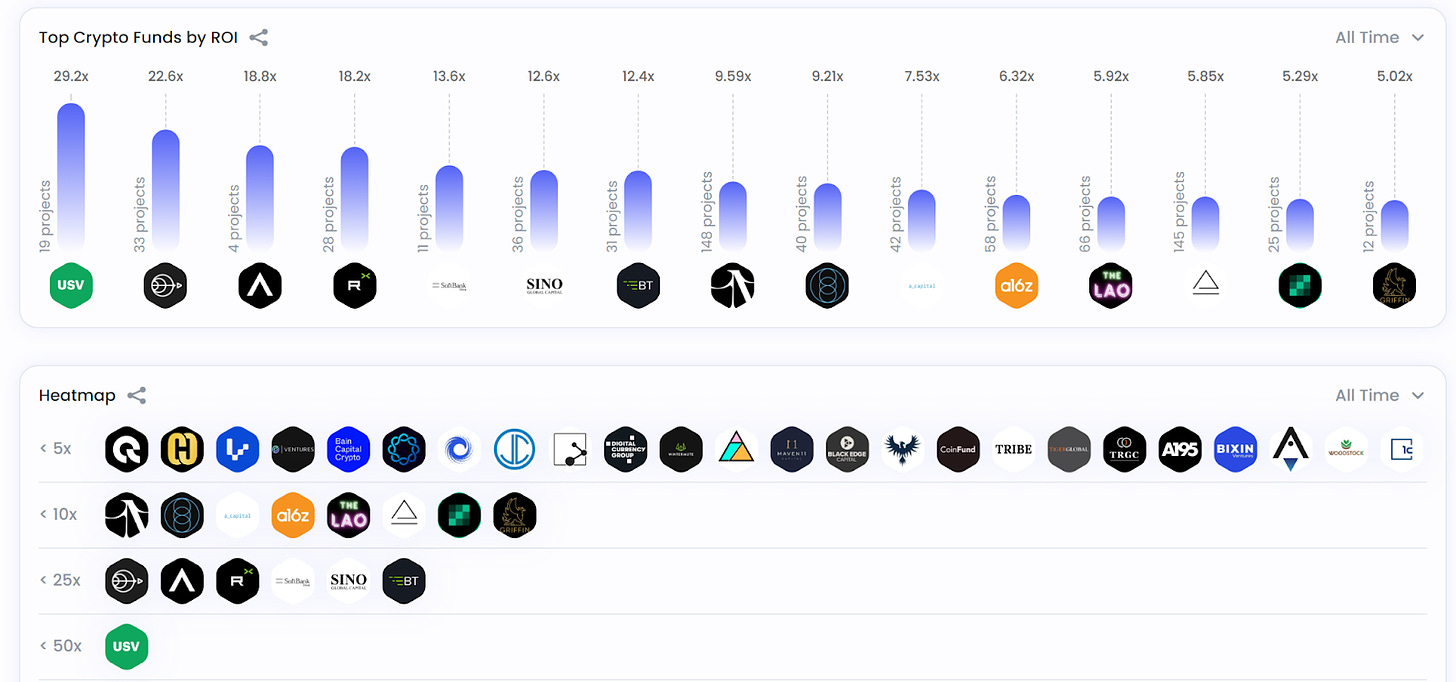

On-chain financing tracking artifact Chain Broker

A platform focused on integrating cryptocurrency financing events, providing data and information on investment institutions and blockchain project fundraising, allowing you to peek into institutional investment lists and investment performance portfolios.

You can directly check the investment performance of major venture capital funds. Click in to view their investment projects, recent investment dynamics, etc.

For a detailed introduction and teaching on Chain Broker, please see this article:

Chian Broker, an on-chain financing tracking artifact, allows you to take a peek at institutional chip costs and portfolios

summary

Let’s give a brief summary of the entire article:

Cryptocurrency is increasingly entering the real world, and more and more institutions and funds are willing to invest in cryptocurrency. It can be seen from the data that the amount of funds invested in the field of cryptocurrency has increased significantly in recent years compared to the past.

Investment institutions have stronger review and research capabilities, and we can observe the distribution of financing to understand where potential tracks may appear in the future.

If there is no channel to participate in the primary market, projects that receive high amounts of financing may not necessarily be good investment targets.

If there are airdrop opportunities, projects that have received high amounts of financing may have better potential profits and are more worthy of participation.

These are differences in probabilities, not absolute. It is very likely that the income from airdrops is far less than what you pay. Be sure to evaluate and participate appropriately before participating.