According to CME's "Fed Watch", the probability of a 25 basis point rate cut in September is 69%, which is basically a done deal, neither good nor bad, as expected. At 8:30 p.m., Congress will release the August CPI data. If the data released is far lower than expected, it will affect the rate cut basis points, thus causing huge market fluctuations. Please pay attention here.

I also watched the presidential debate. Trump was at a disadvantage throughout the whole debate and did not mention cryptocurrency at all.

On Polymarket, Harris's chances of winning the debate just hit 92%.

Trump was anxious at the debate and was beaten by Harris. Regardless of their policy content, Harris won in terms of debate skills and logic.

Yesterday's market review, BTC fell back to around 57,000 after hitting a high, and the market generally did not see a sharp rise or fall. After the opening of the U.S. stock market, BTC fell slightly, and began to rise after 0 o'clock and hit 58,000 without falling back. Just now there was a small drop, falling below 57,000. It is still hovering here.

Current market sentiment (assuming good liquidity, from a macrocyclical perspective)

The long-term market, especially the cottage market, has been falling since March. Now most cottage markets have fallen by 90%! There is no more room for decline, especially with the recent declines of the BTC. Many cottage markets have obviously stopped falling. This is a very obvious signal! The turning point of each big decline is that the cottage markets no longer fall with the BTC!

This wave of plunge,

Time: The price of copycats fell from March to September now

In terms of space: the prices of copycats have basically fallen by 5-10 times

Regardless of time or space, retail investors have almost finished their cleansing, and many people have begun to doubt the bull market and question the copycats!

Emotions are like a big spring. The more they are compressed now, the harder they will rebound later!

This is also the reason why I am very optimistic about the future market. In addition, there are many short orders accumulated in the contract market, which is many times that of the long army. The fuel is sufficient, and the only thing missing is a fuse!

So there are always people who think that they were born in the wrong era, did not enter the crypto circle early, and missed the bonus period. Isn’t it easy to make money with such a simple rule?

But only those who have experienced several rounds of complete bull markets can feel how difficult it was! How can making money be that easy? !

The most amazing thing about the main force is that he can make the BTC come in cycles every time, but because the means of operation are different every time, he can also make it happen before the real big market comes, so that most people dare not believe that the bull market is coming.

Retail investors all sell at the bottom, and they are afraid that the market will fall again if the price rises a little, so they leave the market in a hurry.

Then I will keep pulling you until you regain your confidence, until you become jealous, and until you rush back to All In in regardless of everything!

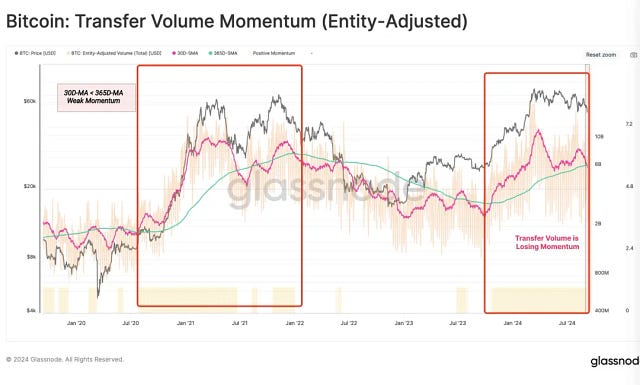

In addition, the Bitcoin chain Tx Volume chart in Glassnode's latest weekly report is very confusing. The 30-day SMA structure of Tx Volume from October 2023 to the present has a strong similarity with that from October 2020 to September 2021, which will lead some people in the market to conclude that "we are already in a super bull market and the bull market is already halfway through."

The so-called "bull market" we experienced from October 2023 to March 2024 was not a real super bull market , but a market composed of two seasonal markets (one autumn market + one spring market) and the new asset issuance boom.

The myth that halving brings a bull market and a bull market every four years has been disproven this year. The reason for this myth is that the Bitcoin halving cycle has always been highly coincident with the Federal Reserve's monetary cycle. This is because Bitcoin was born in the era of the subprime mortgage crisis, and the production reduction every four years happened to be at the end of the Federal Reserve's interest rate cut cycle and the recovery period of the Merrill Lynch clock.

But this time, the Fed’s monetary cycle was delayed by one year, so although the 24th year was reduced by half a year, there was only seasonal market and no super bull market. However, there is no need to be pessimistic about this . Even if there is no super bull market in 24 years, it means that the super bull market will come in 25 years.

Follow me and go through the super bull market together!!!

Create a high-quality circle

Spot mainly

I will share some content: as shown below:

The overall position is ≥ 5,000u. If you want to join, scan the QR code below!

This is the end of the article. I will do a more detailed analysis in the communication group. If you want to join my circle, please contact me directly through the WeChat below!

Note: If the QR code is invalid, please leave a message in the background