Whether a project can go far, whether the coins issued are valuable, and whether it is worthwhile for us to interact with airdrops or obtain tokens early through various means, has a lot to do with the composition of the team's investors. Grasping the trends of investment institutions is also a way for us to earn excess returns before these tokens are listed on exchanges.

If you often read news and updates about cryptocurrency, you must have often seen news like this: "Blockchain OO project completed X round of financing of XXX million, led by OOO and OOO."

VX:TTZS6308

What do these financing news mean? How to interpret them? What are the appropriate actions to take next?

What is financing? What does it mean to complete a round of financing of xx million?

Financing here means getting investment

Completing XX million in financing means that someone has invested XX million in the project, but has the money been received? This is not necessarily the case. Each investment plan is different and the details of the content may not be disclosed.

Not all financing will be announced publicly. Some will disclose the amount and investors, and the private placement price of tokens will also be disclosed. Some will only disclose the amount or investors, and some will not be disclosed at all. Even if there is no financing information, it does not mean that no one has invested in the project.

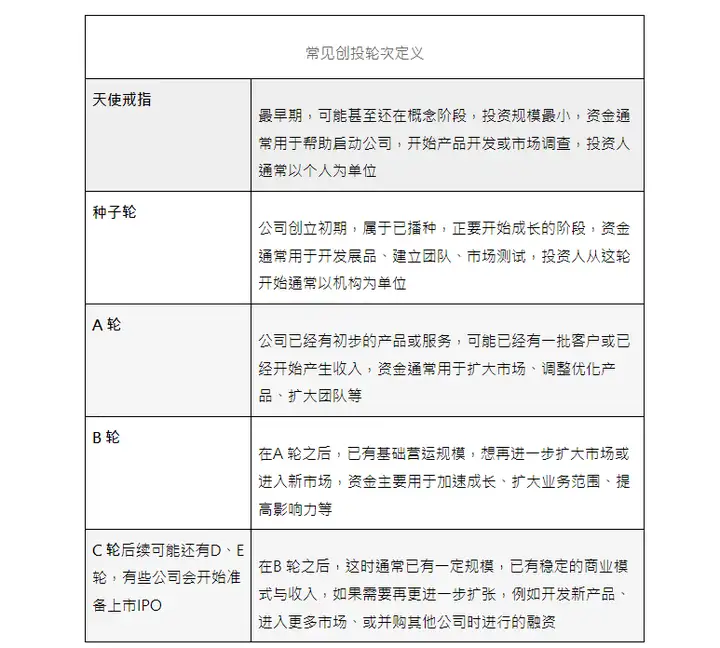

As for the X round in the news, the more common ones are seed round, A round, B round, C round, etc. This is a classification of the stage of the "invested company" in the venture capital field. Just by looking at the round number of the financing news, you can roughly judge which stage the project is in.

After the B round, the company usually has a certain scale, a stable business model and revenue, and if it needs to expand further, such as developing new products, entering more markets, or acquiring other companies, it can raise funds.

The scale of investment funds is usually larger in later rounds, but this is limited to individual cases. For the same project, the amount of financing in different rounds will be larger in later rounds, but the difference in amount between different projects is not necessarily related to the round.

The definitions in the table are relatively general. In reality, there will be individual differences. But after understanding these, when you see the X round of financing in the news reports in the future, you can quickly know what market stage the project is in and whether it has specific products and services.

Why should early-stage projects focus on financing?

Let me first talk about the conclusion, which mainly focuses on two directions:

Understanding the flow of institutional funds helps us find potential tracks

High financing means high valuation, and if there is an airdrop opportunity, there is more potential for reward

Most of the investors in new start-up projects are venture capitalists, or VCs for short. They hold large amounts of cash, and their most important task is to find the next potential project and invest in it as early as possible, expecting high returns in the future.

As cryptocurrency investors, we may have other full-time jobs and may not have the time or ability to research projects. VCs’ job is to research, and they even have professional research teams. Although VC investments cannot guarantee that they will make money, they usually have better project review capabilities than ordinary investors. They can more easily see whether the project really wants to be developed or just wants to attract money and cheat money. They can also judge whether the team has enough background to realize the project vision. And because private placements are usually accompanied by a certain period of lock-up period, the token allocation to investors often needs to be locked for more than 1-2 years, and the unlocking is not all unlocked at once, but it will take another 1-2 years to unlock linearly, which means that VCs will pay more attention to long-term potential rather than short-term returns when investing in projects.

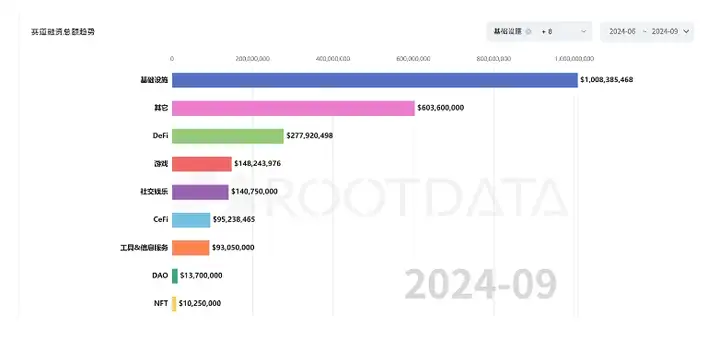

From experience, the tracks and sectors that institutions have concentrated their investments in advance are likely to become hot spots in six months to a year. The figure below shows the financing distribution of each track in the past 90 days. It can be seen that infrastructure is still the largest investment at present, followed by DeFi, games, social networking, etc., which are the tracks we can start to pay attention to.

Are projects that receive high amounts of financing worth investing in?

As mentioned in the previous paragraph, VCs theoretically have stronger review and research capabilities than ordinary investors. The projects that they carefully select and decide to invest large sums of money in should be more likely to have development potential. Does that mean that it is a good strategy for us to just follow suit and invest?

This is definitely not the case. The main difference lies in whether we have channels to participate in primary market investment. The cost and funds for small retail investors to enter the secondary market are incomparable to those of investment institutions. Investment institutions often have lower costs and more funds than us to build their own investment portfolios.

VC investment projects are in the primary market. They may see some potential and decide to invest, but when the project's token is open for trading in the secondary market, it is possible that the price has already reflected its development potential. The price is already very high and there is not much profit margin. This is also the biggest problem in this round of bull market. Countless VCs have pushed up the market value of tokens, and the tokens are already at a short-term high when they are listed on the exchange.

High financing amounts mean that the project’s valuation is not low, and VCs also need to have profit margins. When the token is listed on the secondary market, it is likely that it will open directly at a higher market value. In simple terms, it will be priced high as soon as it is listed. For ordinary investors who can only participate in the secondary market, it is actually more difficult to make a profit.

According to the logic in the previous paragraph, projects that receive high amounts of financing are theoretically relatively high-quality projects. However, due to limited market access, it is more difficult for general investors to make a profit from these projects. The key here lies in whether there is an opportunity to participate in the primary market and obtain the project token at a lower cost.

Although these private placements may not necessarily be open to the general public, and it is difficult for us to have the same early purchasing opportunities as VCs, if there is an opportunity, it should not be missed.

If there is no access to the primary market, a project with high financing may not be a good investment target. If there is an airdrop opportunity, a project with high financing may have better potential profits and is more worthy of participation.

These are all differences in probability and are not absolute. Be sure to evaluate and participate appropriately before participating.