Bitcoin ( BTC ) Miners are showing strong determination as the Hash rate approaches a record high, according to a new report from Glassnode.

The report said that the 14-day average Hash rate has increased to 666.4 exahashes per second (EH/s), just 1% below its all-time high. This reflects continued investment in new mining hardware by Miners, despite the unfavorable market conditions.

Along with the increase in Hash rate, mining difficulty has also increased, with the Medium number of Hash required to mine a Block now reaching 338,000 exahashes, the second highest in Bitcoin history.

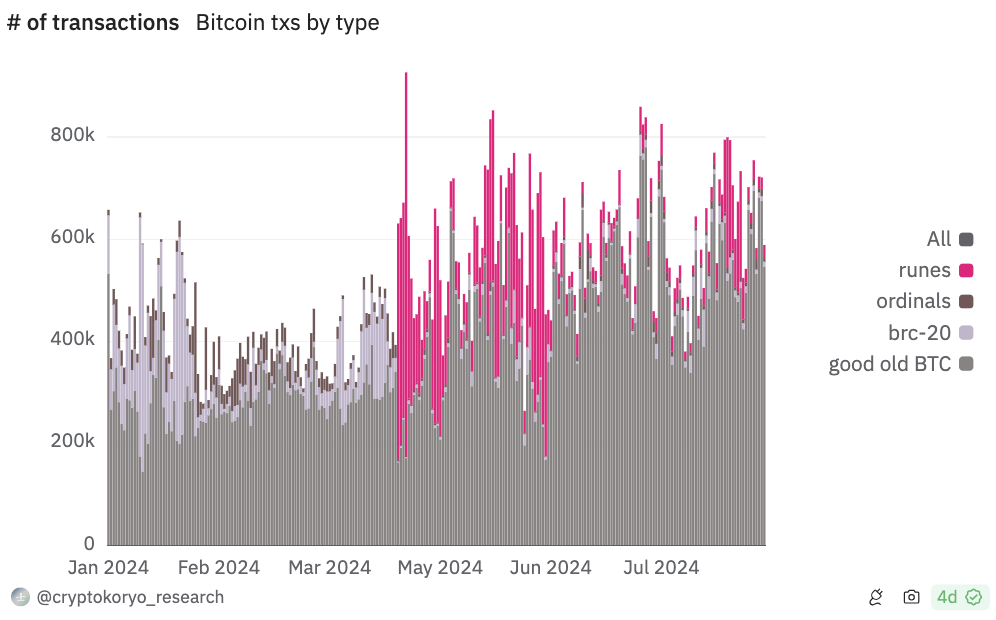

At the same time, Miners ' income has dropped sharply since Bitcoin's price peaked in March. The main reason for this decline is the pressure on transaction fees, due to a decrease in the demand for transfers and a decrease in the number of transactions related to Runes and Inscriptions.

Currently, Bitcoin Miners ' revenue from creating new Block is around $824 million on a 30-day Medium , while revenue from transaction fees is only $20 million over the same period.

According to data from Dune Analytics, the number of transactions involving Runes and Inscriptions did not reach the 50,000 threshold for the majority of the period from August 30 to September 6. Since the Runes protocol was launched on April 20, this 50,000 transaction level has rarely been maintained.

Source:Dune Analytics

The report also notes that most Miners sold their BTC to cover operating costs, a factor associated with the fierce competition and high Capital requirements of the mining industry. However, Miners have now shifted from selling all of their BTC to keeping a portion in reserve.

This is considered a “significant development” because Miners tend to operate in cycles: selling when the market is down and holding on when the market is up. This change may stem from the increasing Hash rate and mining difficulty, which makes the cost of creating BTC higher and could negatively affect Miners ’ profits in the near future.

Meanwhile, the report said Bitcoin traders appear to be moving to “hodling” rather than trading, although Miners remain resilient. on-chain volume have declined, with the network processing about $6.2 billion in daily volume . This decline is generally seen as a negative signal for network usage and transaction throughput.

The report also pointed out that monthly inflows to centralized exchanges have fallen below the annual Medium , indicating a decline in investor demand and speculator trading activity at current prices.

Glassnode analysts also highlighted a steady decline in spot trading momentum over the past 90 days, further reinforcing the overall decline in trading activity over the past quarter. However, the Cumulative Volume Delta (CVD) metric shows that selling pressure has increased on centralized exchanges over the same period. CVD estimates the net balance of buys and sells on centralized markets.

Glassnode also XEM at Bitcoin’s price action in August, noting both positive and negative trends. However, with other indicators showing less-than-optimistic signals, Bitcoin is currently in a low-risk zone. These zones are often sensitive to external factors, such as macroeconomic developments, which can lead to sharp price swings in either direction.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Mr. Teacher

According to CryptoSlate