Written by: Asher Zhang

On August 24, I wrote an article titled "It is difficult for the US interest rate cut to directly increase Bitcoin, and the crypto market still needs technology to drive it". At that time, the Dow Jones Index rose for the fifth consecutive day, and the crypto market was also full of optimistic expectations of interest rate cuts. However, according to observations, there is a trend between Bitcoin and the macro economy that it follows the decline but not the rise, and it lacks innovation internally, and the selling pressure is severe, so the author pointed out the risk of weakness at that time. With the correction of US stocks, Bitcoin has been falling recently, and the market seems to have gone to another extreme.

Market sentiment is clearly pessimistic. Is the bull market over?

As the U.S. stock market weakens, Bitcoin continues to fall but not rise, which makes the pessimism in the market more obvious, and some even believe that the bull market is over.

Zeneca, founder of ZenAcademy and The 333 Club, posted on X platform that the bull market may be over. I don't think so, but it may be so. You should have a plan just in case. For example, if Bitcoin falls for most of the next year and reaches $18,000, ETH reaches $900, and SOL reaches $28...are you ready?

Adam, a researcher at Greeks.live, posted on the X platform: "14,000 BTC options are about to expire, with a Put Call Ratio of 0.81, a maximum pain point of $59,000, and a notional value of $760 million. 125,000 ETH options are about to expire, with a Put Call Ratio of 0.63, a maximum pain point of $2,500, and a notional value of $290 million. This week, cryptocurrencies have been falling all the way. From the options data, it is obvious that the entire market is weak. The recent decline in the maximum pain point has not kept up with the speed of price decline. The IV of the main term has increased. With the approaching US election, the IV bulge on October 8 is gradually being smoothed out. Last week, we mentioned the trading data of previous years. September is generally slightly flat, but the market seems to be a little too pessimistic. We prefer to believe that there will be a bull market at the end of the year.

So, is the bull market really over? The author believes that the bull market in the crypto market has not ended. Although the crypto market is expected to remain weak in September and October, this is a good opportunity.

Bitcoin is linked to the macro market, a drop may be a good time to add positions

Historically, September is a weak month for the U.S. stock market. Due to macroeconomic factors, Bitcoin is expected to remain weak even if the Federal Reserve cuts interest rates as expected.

Tom Lee, managing partner and head of research at Fundstrat Global Advisors, said he expects a 7% to 10% correction in the U.S. stock market over the next two months, which will provide investors with a "buy the dip" opportunity. People are more concerned about economic growth right now, so the employment report and unemployment claims data seem to have triggered a bigger market reaction. I think this will be the case in September as well.

“The next eight weeks should be a great opportunity to adjust your portfolio, get more diversified and really move the market in your favor,” said Chris Hyzy, head of investments at U.S. Bank Private Bank.

“The risk of a setback for equities could increase again,” said Ulrich Urbahn, head of multi-asset strategy and research at Berenberg. “Given the renewed rise in positioning and valuations, we expect more volatility over the next two months.”

Atlanta Fed President Raphael Bostic wrote on Wednesday that the Fed's dual mission of stable prices and full employment is in balance for the first time since 2021, but it is not yet ready to declare victory over inflation.

Overall, if the U.S. stock market experiences a 7% to 10% correction in the next two months, the correction of Bitcoin will not be lower than this range, and Bitcoin may further fall to between $50,000 and $53,000. But just like the U.S. stock market, as long as Bitcoin falls, it can also be seen as an excellent buying opportunity. Investors should take the opportunity to adjust their investment portfolios and diversify their assets, because the bull market of Bitcoin will not end easily under the Fed's interest rate cut cycle.

Let’s talk about the reasons for Bitcoin’s decline and the driving force behind its rise

Due to the high correlation between Bitcoin and US stocks, the above article mainly discusses the factors that Bitcoin can rise from a macro perspective. So what are the internal driving forces that drive Bitcoin's rise?

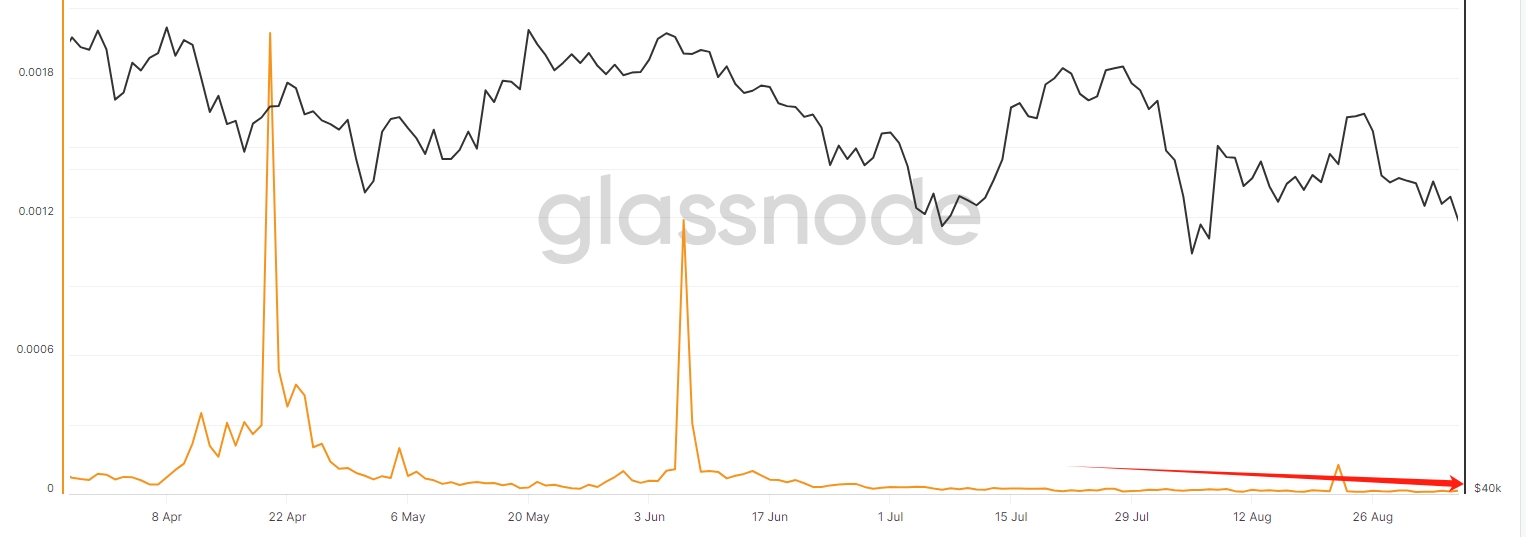

The selling pressure of Bitcoin is expected to be gradually digested in the next two months. In the article "It is difficult for the US interest rate cut to directly increase Bitcoin, and the crypto market still needs technology-driven" on August 24, the author believes that one of the main reasons why Bitcoin will be weak is that after Bitcoin reached $70,000, the selling pressure of miners increased significantly, and at the same time, the intention of institutions to increase their holdings of Bitcoin ETFs also dropped sharply; in addition, the German government continued to sell its BTC at around 60,000 Bitcoin, and then the US government, Mt.Gox, Genesis, etc. also sold their Bitcoins, which created huge selling pressure. Under huge selling pressure, the author does not think that interest rate cuts can directly increase Bitcoin. However, if Bitcoin continues to be weak in September and October, this will give Bitcoin enough time to digest the selling pressure, and institutions can also easily take over Bitcoin at low levels, thereby accumulating power for future pull-ups.

In addition, I think another reason why Bitcoin is difficult to rise directly is the lack of innovation. This can be intuitively felt from the on-chain data of Bitcoin and Ethereum.

In the first half of next year, innovation in the crypto market may begin to show results. Judging from the current development of Bitcoin and Ethereum, Ethereum is more like an innovation test field for Bitcoin. The hot inscriptions and runes in this round of Bitcoin bull market are similar to MEME, and Bitcoin's second-layer concepts and technologies also benefit from the development of Ethereum's second-layer technology. However, due to the slowdown in Ethereum's innovation, Bitcoin's development has essentially stagnated. So, where will the innovation results of the crypto market be reflected in the first half of next year?

One of the main reasons why Ethereum is weak in this round of bull market is the Layer2 strategy, which has divided Ethereum's value capture ability, but there are too many Layer2s, which directly leads to liquidity fragmentation, making the Ethereum ecosystem fight for itself. However, with the breakthrough of cross-Layer2 interoperability, this situation is expected to be broken, so that applications based on Layer2 interoperability will also break out of the circle. In addition, the Ethereum Pectra upgrade is expected to be launched in the first quarter of 2025, which will also be the most anticipated event in the entire crypto market. Pectra merges the Prague (execution layer) and Electra (consensus layer) updates. This will also be a place worth looking forward to for Ethereum. One of the biggest changes in Pectra is the way it handles accounts. In the upgrade proposal, EIP-3074 allows traditional wallets (externally owned accounts or EOAs) to interact with smart contracts, such as batch transactions. EIP-7702 goes a step further and allows EOAs to temporarily act as smart contract wallets during transactions. Temporary means that your EOA wallet becomes a smart contract wallet only during transactions. It works by adding smart contract code to the EOA address. This innovation of "EOA temporarily becoming a smart contract wallet" may be a big move that Ethereum is brewing. In addition to the innovation at the account abstraction level, this upgrade also has multiple EIPs that have a huge impact on the entire ecosystem.

Next year's crypto bull market is worth looking forward to

From a macro perspective, the US stock market is expected to rebound at the end of October. Considering the linkage between Bitcoin and US stocks, Bitcoin is expected to have a wave of market at the end of the year (starting in November), which is mainly a macro linkage market. However, by the first half of next year, Bitcoin is expected to start a new round of large-scale rising cycle driven by innovation in the encryption market and sufficient macro-financial liquidity.