Author: IceFrog Source: X, @Ice_Frog666666

It turns out that Layer2 was not falsified, but L2 of expected PUA users through airdrops was falsified.

As the overall performance of the Ethereum ecosystem is poor and there is an imbalance between Infra and Application, L2 has to face a brutal market elimination competition. The liquidity segmentation problem that the market is concerned about will also disappear in the elimination competition. Looking ahead, on the basis of solving interoperability, once the Ethereum application side makes a breakthrough, L2 may regain its former glory.

1. L2 Overview: From Capacity Expansion and Cost Reduction to PUA Users

L2 as infrastructure: low threshold, flourishing; homogeneity, weak narrative

After Ethereum switched to the POS mechanism, the competition of Layer2 (L2) has become the most anticipated field in Ethereum and even the blockchain world. In essence, the L2 solution reduces transaction costs and increases throughput by sacrificing a small amount of security. In the mainnet roadmap of Ethereum, this is a key link towards the ultimate sharding.

After Optimism open-sourced OP Stack, one-click chain launch became a reality. The technical threshold of L2 has been lowered to the lowest level. There are endless layers of various projects. According to incomplete statistics, there are more than 60 active L2s on the market. On the one hand, this shows that Ethereum is still very attractive, but on the other hand, it makes people wonder whether so many L2s are really necessary, especially the increasingly serious liquidity fragmentation problem caused by the high degree of homogeneity of each L2. This also led to the introduction of EIP-4844 in the Ethereum Cancun upgrade in 2024. Although the transaction fees of L2 have been greatly reduced, Ethereum and even the L2 ecosystem have not prospered as imagined. Homogeneity, weak narrative, and oversupply of infrastructure, market criticism and pessimism continue.

L2 development model: winning by ecosystem or PUA users

When the market still had great expectations for L2, the four king projects (Arbitrum, Optimism, ZkSync, StarkWare) have always been the focus of the community and the entire market. They have become the leaders of the L2 track with huge financing, super high valuations, extensive ecosystems and technical strengths. However, in today's L2 track, some of them have gone from being kings to "death", while others have basically maintained their leading position and continued to widen the gap with their competitors. The difference between them needs to start with the development model of L2.

The business model of L2 is relatively simple, which is the sub-landlord model, making profits through the income from the Gas price difference between L2 and L1. Under this business model, L2s are faced with groups on both ends of the developer and user sides, requiring developers to continue to build, and users to continue to trade. Under this simple logic, the operational capabilities of the project itself are tested. This has also led to development differentiation between projects, some of which continue to lower the threshold for developers and expand the ecological alliance; some focus on cultivating native applications and strengthening core advantages, while others continue to attract users to participate in interactions and increase TVL through airdrop expectations.

Under the same profit model, different development paths and emphases have led to very different results today. At least market data proves that projects that focus on building the ecosystem are more active and have stronger risk resistance, while projects that continuously PUA users through airdrop expectations have become outdated and no one cares about them.

2. Market data: From the king to the dead, only one airdrop away

Market data: Some have daily active users as low as single digits, while others are steadily advancing

In the blockchain world, issuing coins to some extent means that the harvest period has arrived, but whether it can still attract users after the harvest period is an important indicator to test the quality of a project.

If we look at the coin issuance timeline:

The main old projects that have issued coins are: Arbitrum and Optimism;

The recently issued coins are: Zksync, Starknet, and Blast;

The coins that are expected to be issued in the near future are: Linea and Scroll.

The data are presented one by one as follows:

Arbitrum

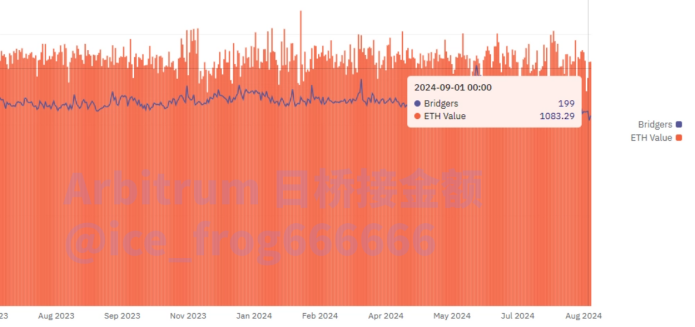

As the leader of L2, Arbitrum has a huge TVL of 13 billion. From the data, the average daily data is basically stable, and the ETH bridge can reach an average of 1000E per day, with high activity, large transaction volume, and high protocol income.

Even though other L2s have tried every possible means to divert TVL, Arbitrum's activity remains unabated, truly demonstrating its leading value.

Arbitrum daily average bridge funds, data source.

Optimism

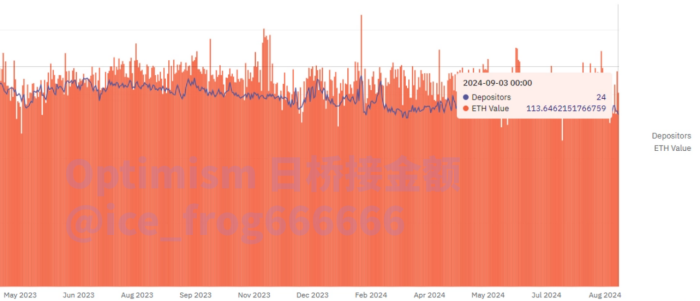

As an old L2, Optimism has a gap in data compared to Arbitrum, but in terms of data stability, its activity and stability are still well maintained.

Chart: Optimism’s average daily bridge funds

Data Link:

https://dune.com/queries/3626332/6108345

https://dune.com/queries/784244/1399124

ZKsync

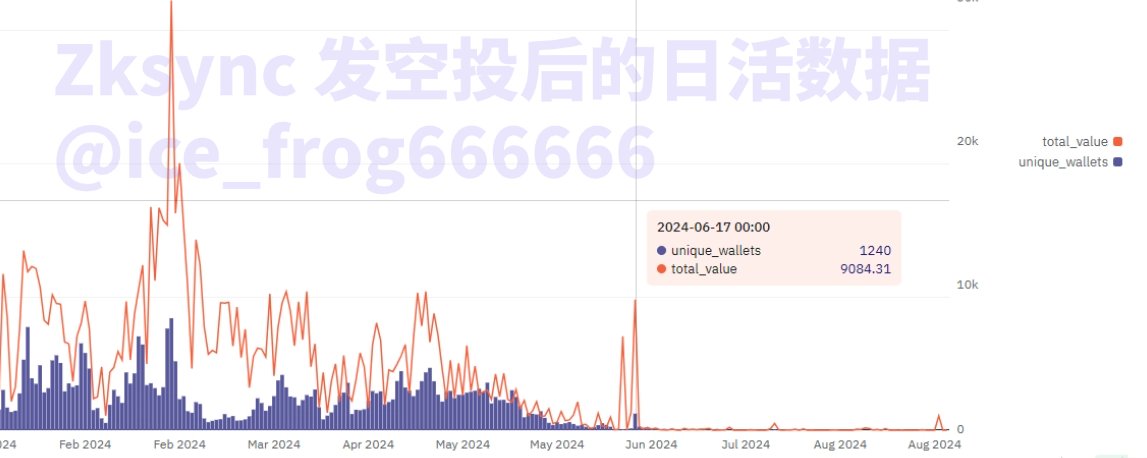

As the leader of zero-knowledge proof, it has leaped from the "king" level public chain to the "death" level with just one airdrop. Although both Vitalik and the industry believe that ZK technology is forward-looking, its market performance and controversial airdrops have made its market performance unsatisfactory.

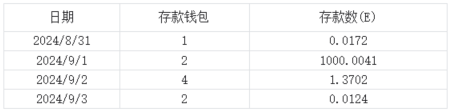

Currently, the overall activity of ZKsync is extremely low, especially after the project TGE and the airdrop on June 7, its on-chain activity has dropped precipitously. It is common for deposits to be less than 1E per day and the number of depositors to be less than 10. The daily income of the protocol is barely maintained at around 1E, and the protocol is basically operating at a loss.

Zksync protocol revenue and daily activity after airdrop

Data Link:

https://dune.com/gm365/era

https://dune.com/peyha/sequencer-profit-on-l2s

https://dune.com/queries/3813897/6414359

Further checking the recent data, the activity level is close to 0, the number of depositors is in the single digits, and the deposits are only tens of dollars. For a project with an FDV of 2 billion and financing of over 100 million, the data is so bleak that it is unbearable to look at.

Starknet

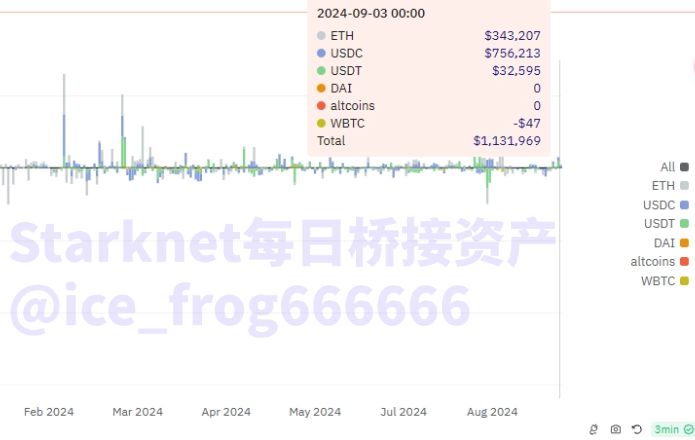

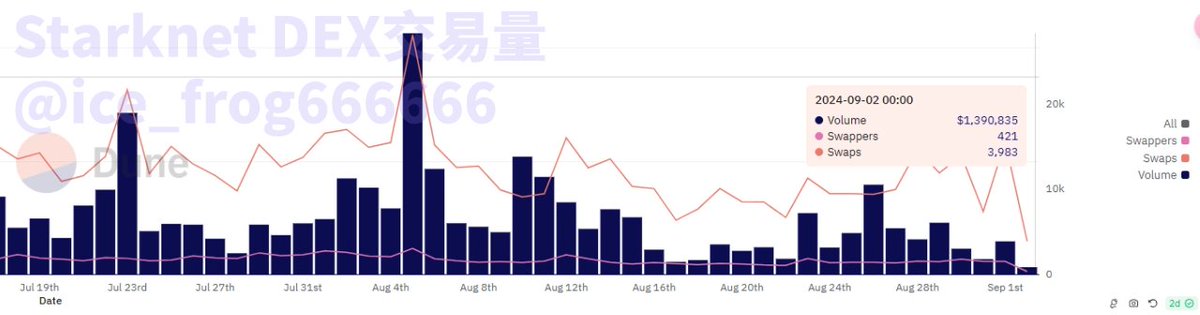

Starknet also uses zero-knowledge proof technology, but its data is slightly better than ZKsync. The average daily bridge deposit is about hundreds of thousands of dollars, but the overall number of active users is still small. The number of daily transactions has dropped to an average of 70,000 transactions per day since the beginning of this year, and the average daily transaction volume of DEX is less than 5 million US dollars. For a public chain with an FDV of 4 billion, the activity performance is still very poor.

Starknet daily average bridge funds & daily depositors & Dex trading volume

Data Link:

https://dune.com/queries/831568/1453718

https://dune.com/tk-research/starknet

Blast

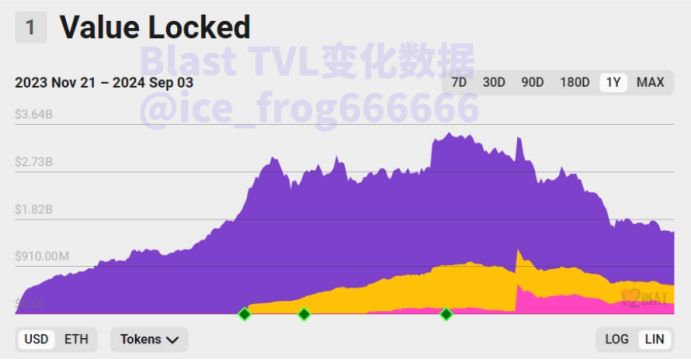

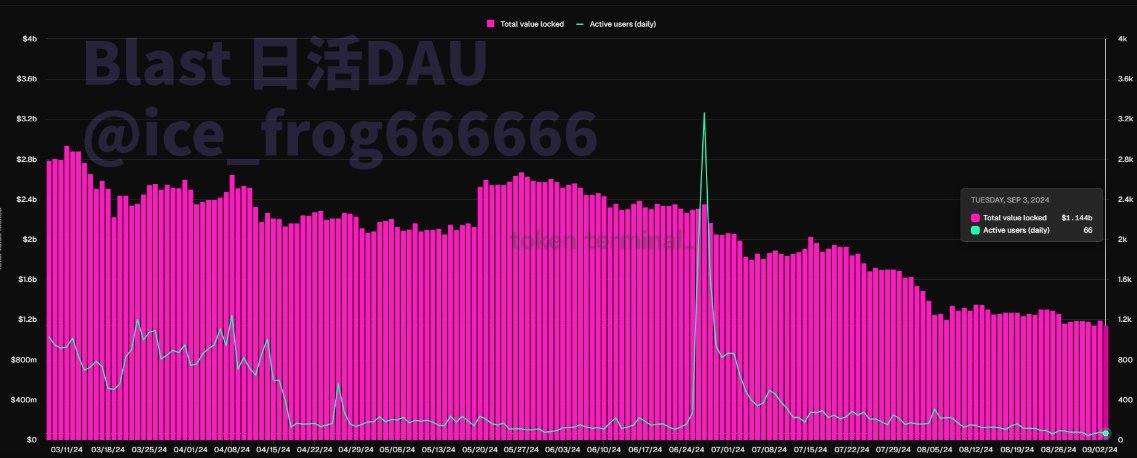

Blast has very low daily active users, and its TVL has dropped sharply from the peak of $3.5 billion at the beginning of this year to $1.5 billion, a drop of 60%. The outflow of funds from the project is very serious. From the data, it can be clearly seen that this year, only on the day of the airdrop did the daily active users exceed 3,000. Now, three months have passed since the airdrop was claimed, and the average daily active users are less than 100.

Chart: Blast TVL data & daily activity data

Data Link:

https://dune.com/alec/blast-the-new-eth-l2

https://tokenterminal.com/terminal/projects/blastbridge?v=NDhjMTQ3YzUwYzg4ZGU5MjI5MzNmYWVh

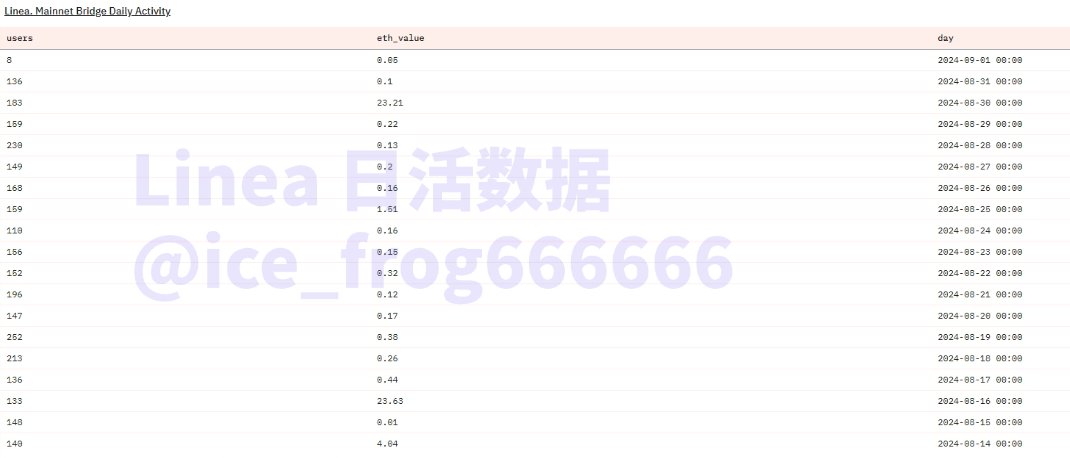

Linea

Linea performed well in the early stage, but due to the lack of a clear coin issuance plan and airdrop expectations, user activity has declined significantly recently. The daily bridge funds are sometimes less than 1E, but the number of users is large, with an average of about 150 bridge users per day. The comparison of the two data shows that the wool users have contributed many small tx. In general, due to the lack of clear expectations for Linea's coin issuance, DAU has declined. Currently, there are only more than 1,000 new users per day, far less than the previous daily increase of 100,000 new users.

Chart: Linea daily active data & daily new users

Data Link:

https://dune.com/linea/linea-overview

https://dune.com/queries/2733739/4549682

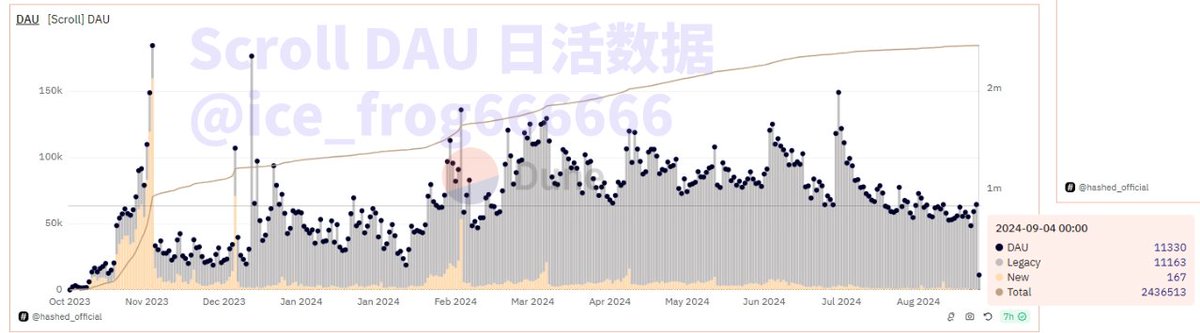

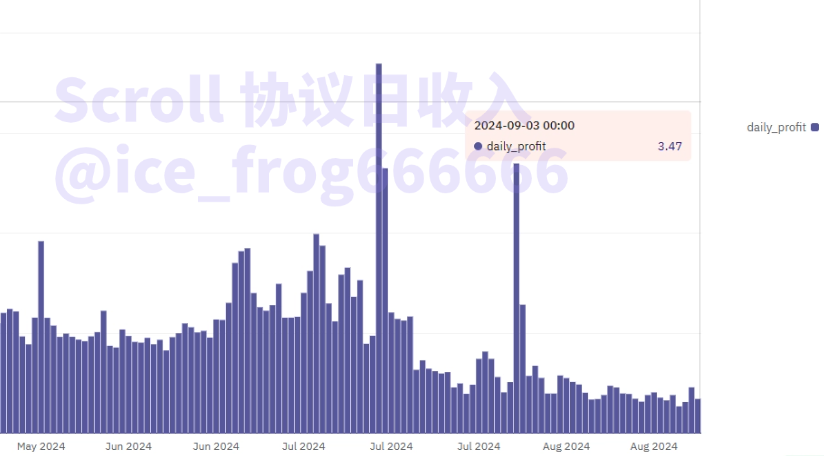

Scroll

Scroll's DAU has been declining since the beginning of this year, with the number of new users per day being around 100. However, due to the strong expectations for Scroll's coin issuance and high historical retention, the interaction with old wallets has been ongoing. In terms of revenue, the Scroll protocol's revenue is average, but compared with several other L2s that have recently issued coins, the data is relatively good.

Scroll Daily Activity Data & Average Daily Revenue of Agreement

Data Link:

https://dune.com/queries/3626340/6108370

Reasons behind the data: L2 competition is fierce, and airdrop expectations are a double-edged sword

It is obvious from the above data that due to the large number of L2s, competition is becoming increasingly fierce. From the current situation, the old Arbitrum and Optimism are showing that the strong are getting stronger, while the newly issued Zksync, starknet, and Blast are falling further and further behind. Linea and Scroll, which are about to issue coins, are barely surviving by hanging users with airdrop expectations. The reasons for this are worth analyzing, and the airdrop expectation management is particularly worth mentioning.

The myth of wealth creation brought by airdrops has made users' expectations for airdrops higher and higher, which has also become an important means for project parties to control users. However, through the above comparison, it can be clearly found that project parties can indeed continuously increase TVL through airdrops, thereby increasing valuations and obtaining large amounts of financing. However, if they cannot continue to invest time and money in user experience, ecosystem construction, and airdrop expectation management, but instead continue to raise user expectations, resulting in "loud thunder and little rain" or the results cannot be relatively fair, then the market backlash will still come quickly.

Zksync is a typical example. The market value of the platform was supported by the money-grabbing party, but after four years of waiting for airdrops, it was only greeted with community criticism of "insider trading". Its reputation plummeted, leading to a cliff drop in market data. As of now, it is difficult to restore its past glory.

On the other hand, although Arbitrum and Optimism have not reached new heights in terms of coin prices, they have continued to work hard on ecological construction and have tried to be "evenly distributed" and relatively fair in airdrops, at least maintaining stability in data and ensuring the continued stable operation of the project. Perhaps due to the lessons learned from Zksync, Scroll and Linea, which have not yet issued coins, have not given clear signals on airdrops and coin issuance, using time to exchange space, thereby winning a chance to survive and wait for the next suitable opportunity.

3. Breakthrough of L2: Integration or elimination, Sugon on the application side

Since the beginning of this year, there have been constant voices criticizing Ethereum. The main reason is that the Ethereum ecosystem is not only facing the failure of L2 growth expectations, but also the constant impact of Solana and other external projects. Coupled with the poor market conditions, the expected prosperity and sharp rise in coin prices have not yet arrived. From the perspective of L2, its core income comes from the price difference of Gas fees. However, when the mainnet Gas is as low as single digits, even the mainnet does not have a more sexy narrative, and a sharp decline in protocol revenue is foreseeable.

From the perspective of Ethereum's technology and performance, L2 is undoubtedly successful and valuable. At least it has solved Ethereum's congestion and gas problems in stages. However, as mentioned at the beginning of this article, the performance solution also brought about liquidity diversion. The internal competition between rollups has exacerbated the division. The interoperability problem is the first problem that L2 needs to overcome. Founder Vitalik obviously also realized this problem. In August this year, he announced on social media that this problem will be solved soon. In this process, what is bound to be faced is the integration or elimination of L2. After all, from the current activity, there is no need for more than 60 L2s.

If we look at it from a long-term perspective, the most important thing in L2's business model is the gas fee, which is highly dependent on C-end users. Contrary to expectations, most L2s with high financing and high expectations have chosen to continue to build dolls on B-end infrastructure. New narratives such as RAAS, DAAS, and AVS as a service continue to emerge. This is equivalent to each project building a main road or a tool for building roads, but the entrance to the road is overgrown with weeds and no one cares. Infra is popular, and Application is rare. After all, the former is faster and can get more financing, while the latter is slow and unsexy, which has led to the imbalance of Ethereum development today.

In July this year, the biggest highlight of Vitalik's speech on the theme of "The Next Decade of Ethereum" at the Ethereum Developer Conference was that he made it clear that the biggest theme of the Ethereum ecosystem in the next decade is applications. If interoperability is resolved, some L2s are further integrated or eliminated, and the next round of killer applications are launched, the L2 track can still be rejuvenated, but it is still unknown which of the L2s mentioned in this article will survive the test of time.

IV. Conclusion

By comprehensively sorting out the basic pattern, development model, market performance data and future breakthrough path of the Layer2 track, we can see:

Some projects rely on airdrops to attract expected PUA users, but once the token issuance is completed, they instantly return to their original form and are basically ignored, such as ZkSync and Blast;

Some, such as Arbitrum and Optimism, rely on their original accumulated ecological niche and user base, and continue to occupy the forefront of the market through technological innovation and good operations, and are expected to win the game in the fierce competition;

Some have luxurious backgrounds and unprecedented financing, but can only rely on the expectation of airdrop coin issuance to survive, such as Linea and Scroll.

The data facts prove that L2 has not been falsified, but L2 of expected PUA users through airdrops has been falsified.

Further analysis shows that with the overall poor performance of the Ethereum ecosystem and the imbalance between Infra and Application, L2 has to face a brutal market elimination competition, and the liquidity segmentation problem that the market is worried about will also disappear in the elimination competition. Looking forward to the future, once the Ethereum application side achieves a breakthrough on the basis of solving interoperability, L2 may regain its former glory.