Bitcoin exchange-traded funds (ETFs) saw inflows of about $117 million on Tuesday, with Fidelity’s Bitcoin Fund (FBTC) leading the pack with about $63 million in net inflows.

So, FBTC's total inflow over the eight months amounts to $9.5 billion.

BlackRock's Bitcoin ETF Has Yet to See Inflows

On the same day, Grayscale’s Bitcoin Mini Trust (BTC) and ARK Invest/21Shares’ Bitcoin ETF (ARKB) also saw significant inflows, attracting about $41.1 million and $12.7 million, respectively.

The figures show that spot Bitcoin ETFs have seen inflows of over $100 million for the first time in September. The inflows follow the record $28.6 million recorded on Monday, reversing a difficult period in which $1.2 billion was lost from the market over the previous eight days.

Read more: How to Trade Bitcoin ETFs: A Step-by-Step Approach

| August 23, 2024 | IBIT | FBTC | BITB | ARKB | BTCO | EZBC | BRRR | HODL | BTCW | GBTC | BTC | total |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| charge | 0.21% | 0.25% | 0.20% | 0.21% | 0.25% | 0.19% | 0.25% | 0.20% | 0.25% | 1.50% | 0.15% | |

| August 26, 2024 | 224.1 | (8.3) | (16.6) | 0.0 | 0.0 | 5.5 | 0.0 | (7.2) | 5.1 | 0.0 | 0.0 | 202.6 |

| August 27, 2024 | 0.0 | 0.0 | (6.8) | (102.0) | 0.0 | 0.0 | – | 0.0 | 0.0 | (18.3) | 0.0 | (127.1) |

| August 28, 2024 | 0.0 | (10.4) | (8.7) | (59.3) | 0.0 | 0.0 | 0.0 | (10.1) | 0.0 | (8.0) | (8.8) | (105.3) |

| August 29th | (13.5) | (31.1) | (8.1) | 5.3 | 0.0 | 0.0 | (1.7) | 0.0 | 0.0 | (22.7) | 0.0 | (71.8) |

| August 30, 2024 | 0.0 | (12.9) | (16.4) | (65.0) | (11.1) | 0.0 | 0.0 | 0.0 | 0.0 | (70.2) | 0.0 | (175.6) |

| September 2, 2024 | – | – | – | – | – | – | – | – | – | – | – | 0.0 |

| September 3, 2024 | 0.0 | (162.3) | (25.0) | (33.6) | (2.3) | (8.4) | (2.5) | (3.3) | 0.0 | (50.4) | 0.0 | (287.8) |

| September 4, 2024 | 0.0 | (7.6) | 9.5 | 0.0 | 0.0 | 0.0 | – | (4.9) | 0.0 | (34.2) | 0.0 | (37.2) |

| September 5, 2024 | 0.0 | (149.5) | (30.0) | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | (23.2) | (8.4) | (211.1) |

| September 6, 2024 | 0.0 | (85.5) | (14.3) | (7.2) | 0.0 | 0.0 | (4.6) | 0.0 | 0.0 | (52.9) | (5.5) | (170.0) |

| September 9, 2024 | (9.1) | 28.6 | 22.0 | 6.8 | 3.1 | 0.0 | 0.0 | 0.0 | 0.0 | (22.8) | 0.0 | 28.6 |

| September 10, 2024 | 0.0 | 63.2 | 0.0 | 12.7 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 41.1 | 117.0 |

| total | 20908 | 9516 | 1950 | 2292 | 345 | 385 | 521 | 574 | 211 | (20035) | 375 | 17043 |

Meanwhile, BlackRock’s iShares Bitcoin Trust has not followed this positive trend. For the past 10 trading days starting on August 27, IBIT has had no inflows, stagnant and occasional outflows. Also, on August 29, IBIT had its second outflow, losing about $13.5 million.

However, despite these challenges, IBIT maintains its market leadership with holdings exceeding $20 billion. IBIT also now boasts 661 institutional holders, with 20% of its holdings held by these institutions. Furthermore, all ETFs have over 1,000 institutional investors, as evidenced by two 13F filing periods.

These filings are mandatory quarterly disclosures for institutional investment managers and demonstrate continued and growing interest in Bitcoin ETFs.

These funds, which have received new capital after a long period of outflows, are seeing signs of recovery in Bitcoin. Since last weekend, the price of Bitcoin has risen by about 6.71%, currently at $56,600.

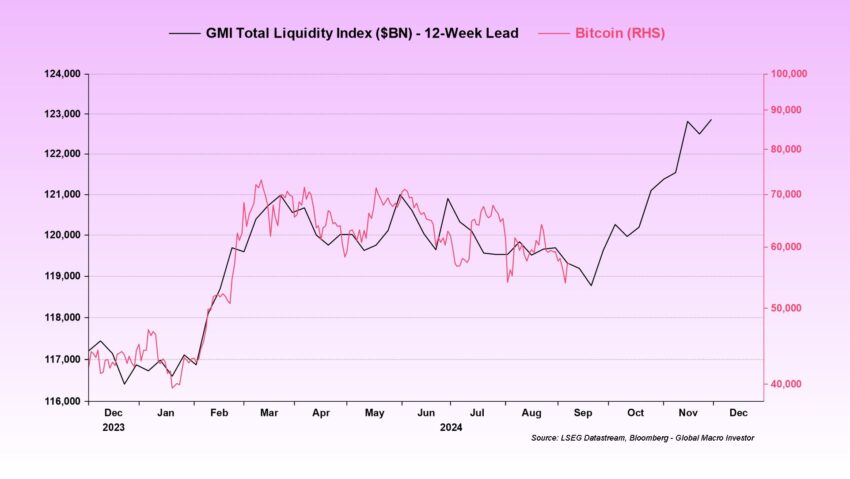

This uptrend is closely tied to broader economic indicators suggesting increasing liquidity, which is often beneficial for Bitcoin, which is sensitive to changes in liquidity.

Macro researcher Julien Vittel commented on the situation:

“Liquidity is picking up again, and Bitcoin, which is very sensitive to changes in liquidity conditions, has the potential to move explosively as new liquidity enters the system. The macro environment is changing. A major liquidity wave is now on the horizon, and when it arrives, Bitcoin is primed for a strong upside in Q4,” Bittel said .

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

The Global Money Index (GMI) measures the amount of money in circulation between consumers and banks, and is rising. An increase in the GMI generally indicates more money available, which could lead to increased Bitcoin purchases.