Author: NingNing

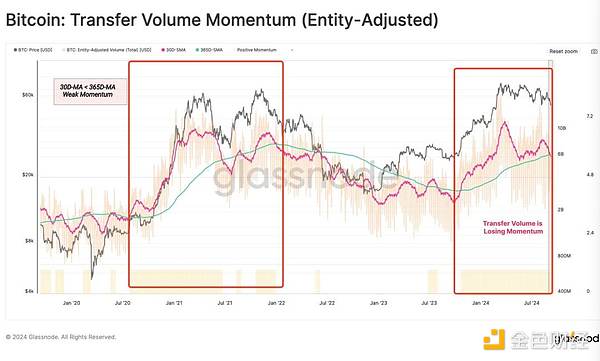

The Bitcoin on-chain Tx Volume chart in Glassnode's latest weekly report is very confusing. The 30-day SMA structure of Tx Volume from October 2023 to the present has a strong similarity with that from October 2020 to September 21, which will lead some people in the market to conclude that "we are already in a super bull market and the bull market is already halfway through."

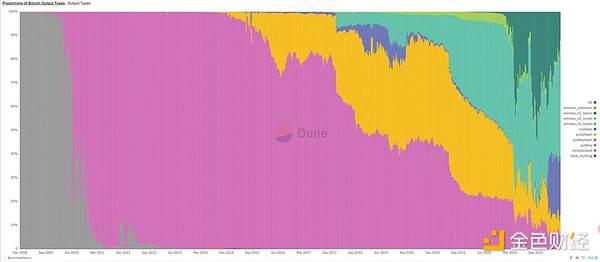

The confusing thing about this chart is that the structure of the Tx Volume used for comparison has changed dramatically. The Taproot Witness TX related to inscriptions and runes has grown rapidly since 23 years ago, accounting for 41.8% of the Tx Volume at its peak, which was not seen in the previous cycle.

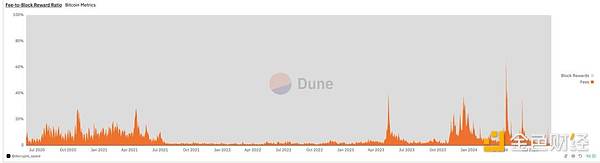

This can also be verified from the chart of changes in Bitcoin mining fees. Excluding the impact of the inscription/rune boom period, the base scale of mining fees from 23 years to the present is completely incomparable with the bull market from March 20 to July 21, and is only slightly higher than during the bear market in 22 years.

Therefore, the so-called "bull market" that we experienced from October 2004 to March 2005 was not a real super bull market, but a market composed of two seasonal markets (one autumn market + one spring market) and a new asset issuance boom.

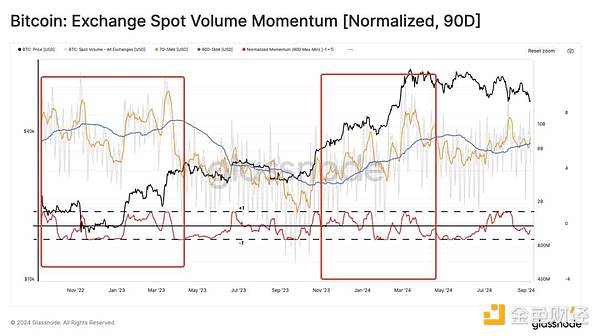

This is also proven by the changing trend of spot trading volume on exchanges from November 2022 to the present. As shown in the figure, there are only seasonal fluctuations, and no trend of increase.

To sum up, the myth that "halving brings a bull market, and there is a bull market every 4 years" has been falsified this year. The reason for this myth is that the Bitcoin halving cycle has always been highly consistent with the Federal Reserve's monetary cycle. This is because Bitcoin was born in the subprime mortgage crisis era, and the production reduction every 4 years happens to be at the end of the Federal Reserve's interest rate cut cycle and the recovery period of the Merrill Lynch clock.

But this time, the Fed’s monetary cycle was delayed by one year, resulting in only seasonal market conditions and no super bull market, although the period was reduced by half a year in 24. However, there is no need to be pessimistic about this. The absence of a super bull market in 24 means that a super bull market will come in 25-26.