Author: ningning Source: X, @0 xNing0x

In the crypto world, innovations like Friend Tech are common, but PayFi is different. It is not another primitive wrapped in a flashy narrative, but a new design space for the time value of money. If Bitcoin redefined money and Ethereum redefined smart contracts, then PayFi is likely to redefine RWA (real world assets).

The pain points of the current financial system: Why do we need PayFi?

Before we delve deeper into PayFi, we must first face the pain points of the current financial system:

Inefficiency : Cross-border payments take an average of 3-5 business days.

High costs : The average remittance fee globally is 6.5%.

Liquidity dilemma : About $4 trillion of funds are locked in prepaid accounts worldwide.

Poor inclusion : 1.7 billion adults worldwide still do not have bank accounts.

These problems are not only technical problems, but also institutional problems. The traditional financial system is like an old steam engine, and what we need is a quantum computer. This is the core problem that PayFi wants to solve.

PayFi: A new paradigm for unlocking the time value of money

The core innovation of PayFi lies in its reinterpretation of the time value of money (TVM). Traditional finance uses annualized interest rates to quantify TVM, but PayFi measures it to the millisecond level. This is not only a technological improvement, but also a revolutionary change.

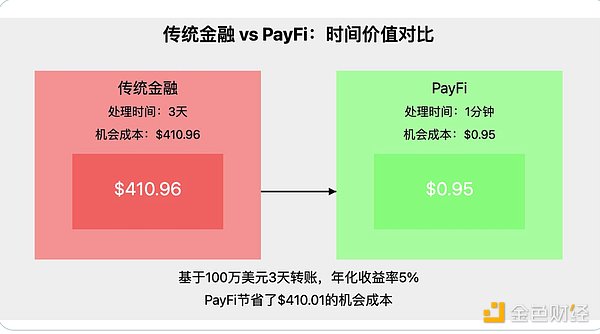

Mathematical Model: Value Creation of PayFi

Assume that there is a fund of 1 million USD, and it takes 3 days to complete the cross-border transfer in the traditional banking system. The annualized rate of return is 5%, so the opportunity cost of these 3 days is:

1 million×(5%÷365)×3=410.96 US dollars

In the PayFi system, this process is shortened to 1 minute:

1 million×(5%÷525600)×1=0.95 US dollars

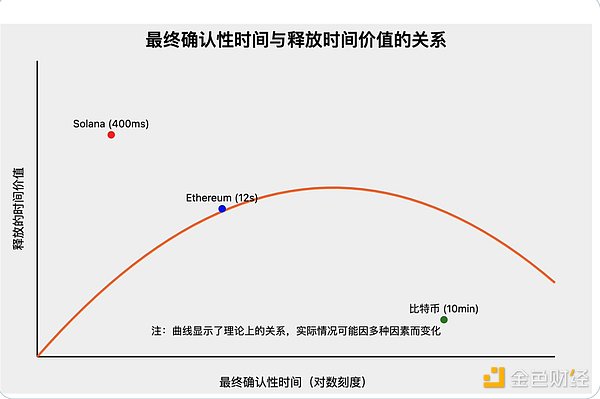

This is the value of PayFi! It not only saves costs, but also releases a huge amount of liquidity. It is worth noting that the time value of the currency released is nonlinearly related to the final confirmation time. When the confirmation time is already very short (such as milliseconds), the benefits of further shortening the confirmation time are relatively small. Therefore, PayFi needs to find a balance between speed, security and decentralization when designing.

Huma is planning to launch a T+0 settlement solution, which will push PayFi to the limit of efficiency. On a high-performance public chain like Solana, funds can theoretically be transferred and confirmed in less than half a second.

But this is not the end. Imagine new financial products that are impossible in traditional finance, such as "lending in seconds", "micropayments as a service", and "dynamic pricing insurance". PayFi will usher in a new era of financial innovation. In this fast-changing world, the old saying "time is money" has acquired a whole new meaning. And those who can most effectively use the value of time will have an advantage in the future financial world.

Huma: Pioneer in the PayFi Revolution

In the emerging field of PayFi, Huma is undoubtedly one of the most advanced players. As a project founded by former Google and Facebook executives, Huma not only brings the innovative genes of Silicon Valley, but also incorporates deep financial expertise.

Huma's core advantages are:

Technical Strength : Huma’s smart contract has over 6,000 lines of code, making it one of the most complex and comprehensive in the industry.

Risk control capabilities : The team once achieved a bad debt rate of less than 1% at Earnin, a US consumer finance giant, which is top-notch in the high-risk lending sector.

Ecosystem construction : PayFi Stack proposed by Huma provides a technical blueprint for the entire industry. This open and forward-looking mindset will accelerate the development of the entire industry.

PayFi Stack’s six-layer structure

Huma’s PayFi Stack consists of six layers: transaction layer, currency layer, custody layer, financing layer, compliance layer, and application layer. Here is an in-depth analysis of each layer:

Transaction Layer

The key to this layer is high throughput, low cost, and fast settlement. Public chains focused on payments, such as Solana and Stellar, excel in this regard. Innovations such as Solana Pay and Stellar Disbursement Platform are bringing blockchain payments into everyday life.Currency Layer

Stablecoins with strong compliance and large-scale distribution such as USDC and PYUSD play a key role in this layer. At the same time, revenue-sharing stablecoins such as USDM can not only reduce transaction costs, but also provide modular solutions for payment, savings, etc.Custody Layer

Payment financing has higher requirements for institutional-level custody, such as multi-party asset control and sophisticated account management. Products such as Fireblocks, Cobo, and Copper are meeting these needs. At the same time, self-custodial wallets based on account abstraction are also popularizing these advanced features to retail and small businesses.Financing Layer

This layer includes funding protocols and risk management infrastructure for payment use cases. Huma focuses on short-term funding common in the payment space, while credit rating solutions such as Credora attract institutional investors and deepen available liquidity.Compliance Layer

Anti-money laundering (AML) has been a major hurdle for stablecoins in real-world payments. Solutions such as Chainalysis, Elliptic, and TRMLabs, as well as emerging privacy-first authentication platforms, are significantly improving the situation.Application Layer

This layer includes various applications that use on-chain financing to achieve payment, from Arf's cross-border payment, Zeebu's telecom roaming payment, to Raincard and Reap's credit card services. With the continuous innovation of the underlying technology, more applications will be unlocked.

Huma's PayFi Stack is not only a technical framework, but also a blueprint for an ecosystem. It provides a common language and standards for innovators in different fields, allowing them to innovate and integrate within this framework. By integrating innovations at all layers, PayFi is expected to become a key link between traditional finance and the crypto economy, bringing unprecedented efficiency and inclusiveness to the global financial system.

Arf: PayFi’s real-world example

Theory is great, but practice is more important. Here is an example of how Arf, a star project in the Huma ecosystem, put the concept of PayFi into practice.

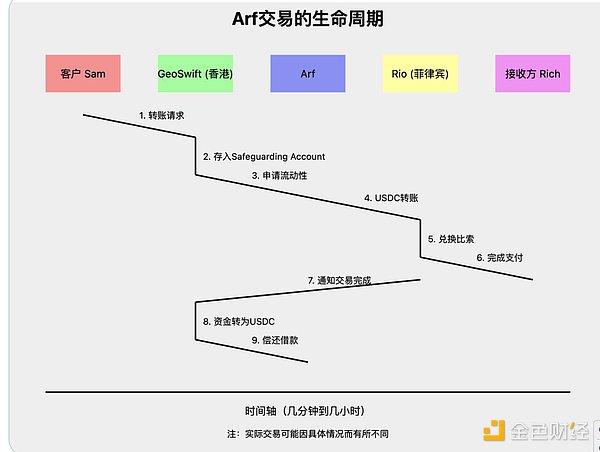

Arf's typical transaction process

Client Sam in Hong Kong wants to transfer USD 1 million to the Philippines.

Sam's money is deposited into GeoSwift's Safeguarding Account.

GeoSwift applies for liquidity from Arf.

Arf transferred money to Rio in the Philippines through Circle Wallet.

Rio converts to pesos and completes payment.

GeoSwift converts the funds to USDC and repays Arf.

The whole process may only take a few minutes to a few hours, instead of the traditional days or even weeks. This is the magic of PayFi.

Arf's business data

Capital turnover rate : 50+ times per year

Cumulative transaction volume : US$1.8 billion+

Annualized rate of return : 20%+

Credit default rate : 0%

In contrast, the current popular meme coin issuance platform http://pump.fun has achieved product-market fit (PMF) like Arf, but it is essentially a zero-sum or even negative-sum game. Arf creates real economic value and solves real economic problems, rather than just circulating within the crypto ecosystem. This is a truly sustainable business model.

Conclusion: Opening the RWA 2.0 Era

If the first generation of RWA (real world asset) projects is to move real world assets onto the chain, then PayFi is RWA 2.0 that makes these assets truly "alive".

From static to dynamic : Traditional RWAs often tokenize assets statically, while PayFi injects dynamic liquidity into these assets by optimizing the time value of funds. The Arf case perfectly illustrates this point: it not only tokenizes the cross-border payment process, but also realizes the efficient circulation of funds through smart contracts, squeezing the value of every minute and every second to the extreme.

From isolated island to ecosystem : PayFi is weaving scattered RWA projects into an interconnected ecosystem. Through the PayFi Stack proposed by Huma, we see a new financial infrastructure taking shape, which will allow various RWAs to seamlessly connect and freely combine to create new products that are unimaginable in traditional finance.

From speculation to practicality : Unlike purely speculative projects such as http://Pump.fun, PayFi is applying the advantages of blockchain technology to solve real economic problems. It is not only a value carrier, but also a value multiplier. This transformation marks that crypto finance is moving from adolescence to maturity.

From the edge to the mainstream : With the development of PayFi, we can foresee that RWA will move from the edge of the crypto world to the center of traditional finance. Arf has demonstrated how to optimize traditional cross-border payments with blockchain technology, and we may see more areas being innovated in the future, such as trade finance, supply chain finance, and inclusive finance.

From theory to practice : PayFi is not a castle in the air. Arf’s actual business data - $1.8 billion in transaction volume, 20%+ annualized yield, zero credit default - all tell one fact: RWA 2.0 is not only possible, but is already creating real value.

However, we must also be aware that as a pioneer of RWA 2.0, PayFi still faces many challenges. Regulatory compliance, technical risks, cross-chain interoperability and other issues all require the industry to work together to solve. Especially in the context of the current tightening regulatory environment, how to find a balance between innovation and compliance will be the key to determining whether PayFi can truly become mainstream.

As investors, we need to look at PayFi with a longer-term perspective. It is not only an investment opportunity, but also a revolution that reshapes financial infrastructure. In this process, infrastructure projects like Huma may have more long-term value than a single application. At the same time, we should also pay close attention to projects that already have actual businesses and revenues, because they tend to stand the test of the market better.

PayFi is writing a new chapter of RWA 2.0. It not only inherits the decentralized concept of Bitcoin and the smart contract innovation of Ethereum, but also combines these advanced technologies with the best practices of traditional finance to create a more efficient and inclusive financial ecosystem. In this new era, time is money and efficiency is king. Projects that can most effectively release the value of time will occupy an important position in the future financial landscape.

PayFi: RWA 2.0 is not only a slogan, but also a vision that is being realized. It represents the perfect combination of crypto finance and traditional finance, and is one of the most promising applications of blockchain technology in the real economy. For investors who want to take the lead in this financial revolution, it is undoubtedly a wise choice to pay close attention to the development of PayFi. The future is here, but it is not evenly distributed yet. In the world of PayFi, we may see financial services like water and electricity, ubiquitous but almost imperceptible - this is true financial inclusion.

Let us wait and see how PayFi redefines RWA and reshapes the global financial landscape. At the beginning of this new era of finance, we are both witnesses and participants. The opportunity is right in front of us, and the key is whether we are ready to embrace this RWA 2.0 era.