Consumers' Research, a consumer protection organization, issued a warning to stablecoin issuer Tether in a report released on September 12, accusing the company of problems with the transparency of its U.S. dollar reserves.

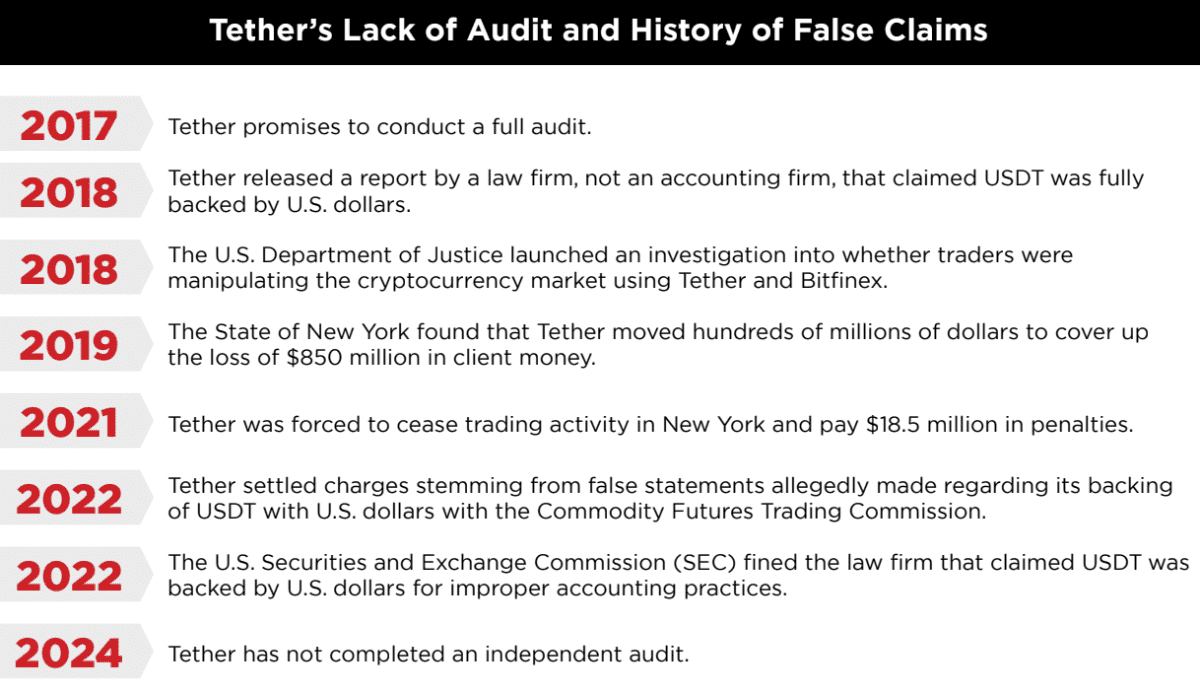

The organization claims that despite Tether’s repeated promises that its reserves will be audited, it has yet to provide any complete audit report of its U.S. dollar reserves from a major accounting firm. The report's authors believe this lack of transparency is similar to what happened before the collapse of FTX and Alameda Research.

The organization also published an open letter to governors across the United States, alerting them to Tether’s lack of transparency. In addition, the consumer watchdog group elaborated on its accusations through advertisements and a dedicated website.

At the end of the report, the organization also accused Tether of collaborating with criminals and failing to prevent illegal entities from using USDT to circumvent international sanctions.

Despite the doubts, the market is not unanimously questioning Tether's reserves. In January this year, Cantor Fitzgerald, an American securities portfolio management company responsible for custody of Tether’s assets, assured the public that Tether’s cash reserves were sufficient. The company’s CEO said at the time:

"Based on our investigation, they do have the funds they claim to have."

In order to increase transparency, Tether also hired former Chainalysis chief economist Philip Gradwell in July to write USDT adoption reports. These reports will be provided to U.S. regulators and investors to help explain the use of stablecoins.