Author: Ben Schiller, CoinDesk; Translated by: Tao Zhu, Jinse Finance

Trading platform eToro agreed on Thursday to settle with the U.S. Securities and Exchange Commission, which accused it of operating as an unregistered broker and clearing agency and facilitating the trading of some crypto assets that are securities. Under the settlement, eToro paid a $1.5 million fine and means the company can only trade three digital assets: Bitcoin (BTC), Bitcoin Cash (BCH) and Ethereum (ETH).

Israel-based eToro is not a big player in the U.S. cryptocurrency market. It has just 240,000 customer accounts, compared with Coinbase’s 100 million. But lawyers contacted by CoinDesk said the SEC’s agreement is important because it provides clues about how the regulator views a key legal question: which digital assets are not securities and therefore fall outside its regulatory purview.

Here are some reactions from leading attorneys specializing in digital assets:

Joseph Tully, a securities litigator at Tully & Weiss:

“It appears that the SEC has officially approved BTC, BCH, and ETH, so we know that the SEC considers at least these three to be commodities rather than securities. The key word here is ‘at least’. There may be others, but there is no legal guidance based on this settlement at this time.”

Lowell Ness, partner at Perkins Coie:

“It is interesting that the parties agreed to such an aggressive settlement, contrary to the federal court’s ruling that program trading is not securities trading. This settlement highlights the wide gap that can exist between regulators and some earlier court decisions.”

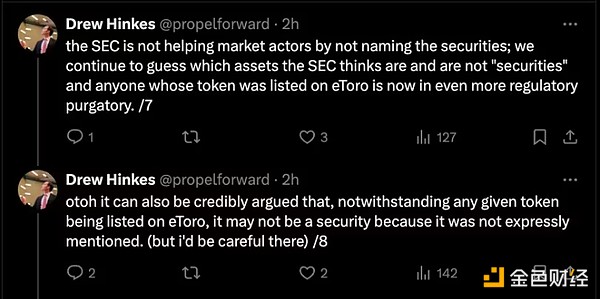

Drew Hinkes, Partner at K&L Gates:

“As we learned from the cease and desist order, eToro submitted a settlement offer, which the SEC accepted,” said Joshua Ashley Klayman, U.S. Fintech Leader and Head of Blockchain and Digital Assets at Linklaters LLP . “eToro neither admitted nor denied the findings set forth in the cease and desist order, except as to the scope of the SEC’s jurisdiction.

“It is important to remember that, unlike in court cases where allegations must be proven, parties have the contractual freedom to agree to a settlement. Here, we know virtually nothing about which digital assets the SEC might allege were the subject of securities transactions. We also do not know eToro’s motivations for settling, nor its business plan or overall strategy.

“For these reasons, I believe that we should be cautious about assuming that the existence of a cease and desist order will have any impact on any enforcement action that may be pursued in court now or in the future. In other words, there is no substantiated evidence that any of the allegations in the cease and desist order are true, and the Commission does not even appear to have made any allegations indicating which specific digital assets the Commission believes are securities or constitute securities transactions.”

Consensys lawyer Bill Hughes:

Alexandra Damsker, former SEC attorney:

“It’s really disappointing to accept the settlement.

“These people are cowards — we have an opening post [Supreme Court ruling] Loper: They should go to court for a ruling. The SEC doesn’t actually have the final say.

"But they just cut off the business and ran away with their tails between their legs. Forget it."