Have you noticed that the market after the opening of the U.S. stock market this week is quite regular? The trend of BTC is to fall first and then rise. I don’t know how long this pattern will continue. Yesterday, the BTC fell sideways and did not fluctuate much. In the evening, the U.S. stock market opened and fell first, then went up and down again. In the second half of the night, the market went up again. It’s really a bit unpredictable. The $58,000 mark needs to be defended to test both the long and short sides. Which side places the heavy bet, the dog dealer will definitely arrange it.

At the daily level, this is already the second attempt to break through this week. Tonight, we are looking forward to whether there will be a third attempt. If the breakthrough cannot be completed tonight, then it can only fluctuate and wear people out until the interest rate meeting next week. During this period, the bulls will gradually exhaust themselves, causing the market to fluctuate and fall.

The problem BTC is facing now is that if it doesn’t break through, the attention will decrease. After the breakthrough, will the attention support funds to continue to push up the price?

If we look at it optimistically, the continuous attempts to break through have already consumed a lot of selling pressure at the resistance level, which will lay a certain foundation for the third breakthrough.

The sentiment in the Asian market is still not very good and remains low

Features of recent market:

BTC has been fluctuating and slowly declining since reaching ath in March 24, constantly testing lower low and lower high. This is the overall trend of the Fed's net liquidity since it began to decline in March.

Since the merge upgrade (POS change), the exchange rate of ETH to BTC has been fluctuating downward. The Shanghai upgrade (withdrawal) and the most optimistic Cancun upgrade (DA) during this period did not change this trend and ETF. This issue has been discussed a lot recently. In short, application is king, new asset issuance is king, and I will not go into details.

BTC's market share has been rising since the end of 2022, and this trend has not changed so far. This also means that the Altcoin market has not really arrived.

Subsequent turning points:

1 — The election results may be a key point

The interest rate cuts in February-September should be fully priced in and will not have a big impact on the overall market.

3 — A more critical point of uncertainty is when the Fed will stop QT, which is estimated to be at the end of the year.

The violent bull market is about to come, but some copycats still cannot return to their highs?

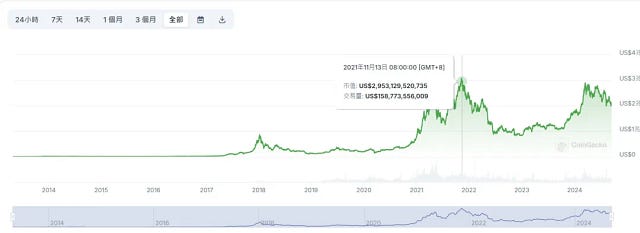

Let me tell you my thoughts. The current market value of the crypto is about 2 trillion, and the peak of the crypto market in 2021 was about 3 trillion. Everyone knows that with monetary easing/ crypto cycle/economic growth, the bull market is coming!

The following assumes that the market value of this bull market can reach twice that of the previous bull market! That is 6 trillion! This is an extremely optimistic assumption.

Assuming the total market value of the crypto is 6 trillion, how should this pie be divided?

First of all, in the alt season, BTC.D (Bitcoin Dominance Index) has dropped to about 40%, or 2.4 trillion, and the coin price is about 126,000 dollars, which is also in line with the reasonable estimated target of everyone!

But the remaining pie of 3.6 trillion (60%) is embarrassing. Let’s take the king of memes, DOGE, as an example. The highest price of the last round was 0.73, and Dogecoin accounted for 4% of the total crypto market value!

But now the meme sector only accounts for 2% of the total cryptocurrency market value, and Dogecoin only accounts for 30% of the total meme sector market value! Assuming that memes can account for 3% of the total cryptocurrency market value in the bull market, Dogecoin will also account for 30% of the total meme market value (this does not take into account the endless new memes that will emerge in the future), so DOGE can account for more than 80% of the meme market value, which is impossible now!

The main reason is that there are too many projects/themes now. Even if the fish tank doubles in size and the number of fish in it increases by 4-5 times, the market liquidity increases, but the fish will not get fatter. In the second half of the bull market, the better strategy is to stick to the BTC income and pay attention to market hotspots to grasp the block rotation, which is more stable!

Follow me and go through the super bull market together!!!

Create a high-quality circle

Spot mainly

I will share some content: as shown below:

The overall position is ≥ 5,000u. If you want to join, scan the QR code below!

This is the end of the article. I will do a more detailed analysis in the communication group. If you want to join my circle, please contact me directly through the WeChat below!

Note: If the QR code is invalid, please leave a message in the background