What is blockchain consensus mechanism

First of all, the first important point: the public blockchain is decentralized.

Decentralization means that it is not handled by a single unit. There are many participants in the system and operate in a decentralized manner. Since there are many participants and there is no single unit in charge (no boss who can call the shots), there must be a set of A mechanism for coordinating everyone to work together.

If you don’t know much about decentralization yet:

What is decentralization? What are the pros and cons? What’s the relationship with blockchain?

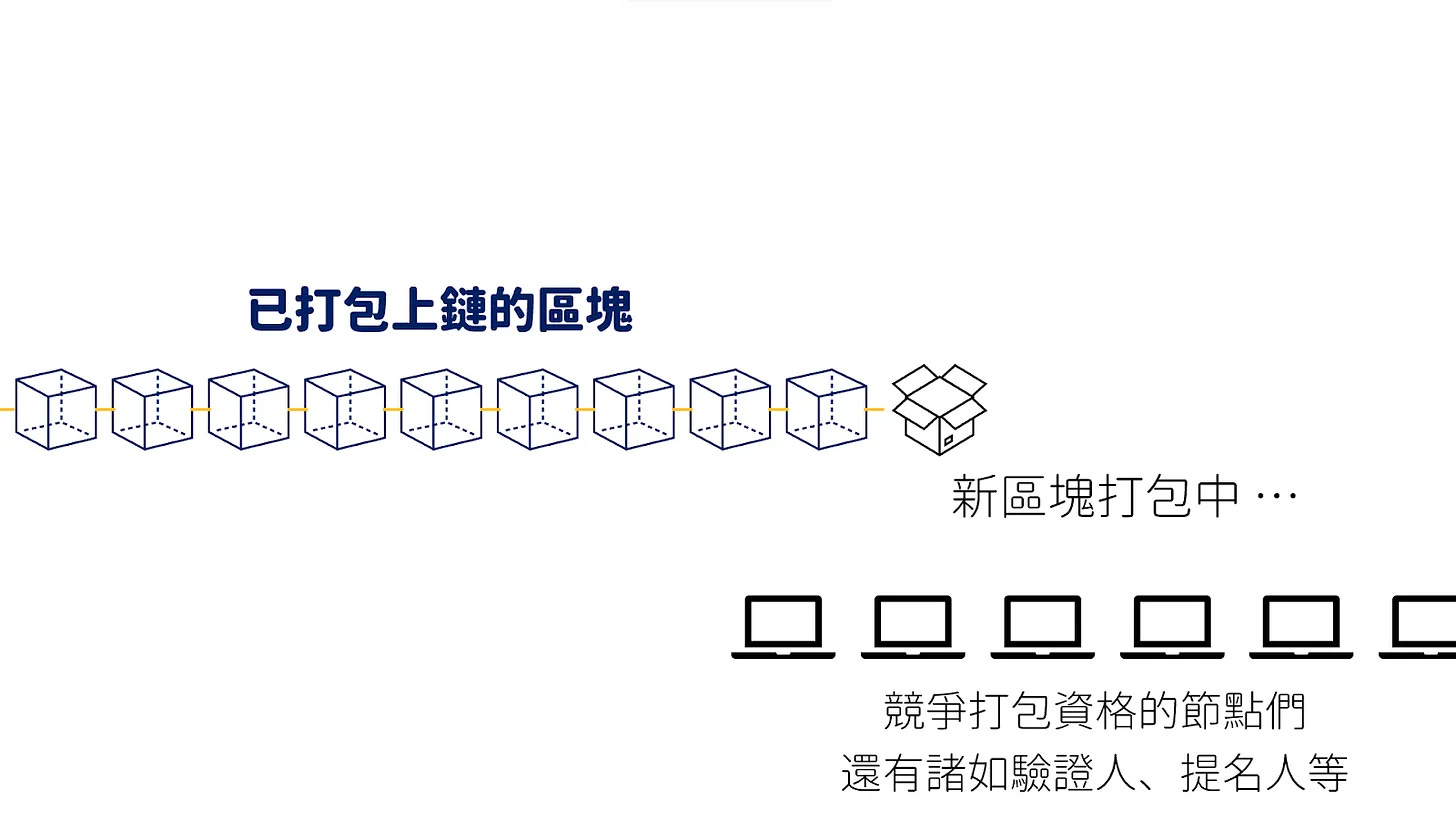

The consensus mechanism of the blockchain basically refers to the mechanism in which the blockchain is operated by many nodes (miners) together, but only one new block is produced each time. How to determine who is responsible for the production and verification of the block.

There are tens of thousands of miners in the Bitcoin blockchain, and a new block is produced every ten minutes on average. How to decide who among these tens of thousands of miners will be responsible for producing this block? Other miners who are not assigned to produce the block are responsible for verifying the block. What should I do if there are problems during verification?

Blockchain consensus: a set of standard practices for block production and verification

Common consensus mechanisms POW/POS

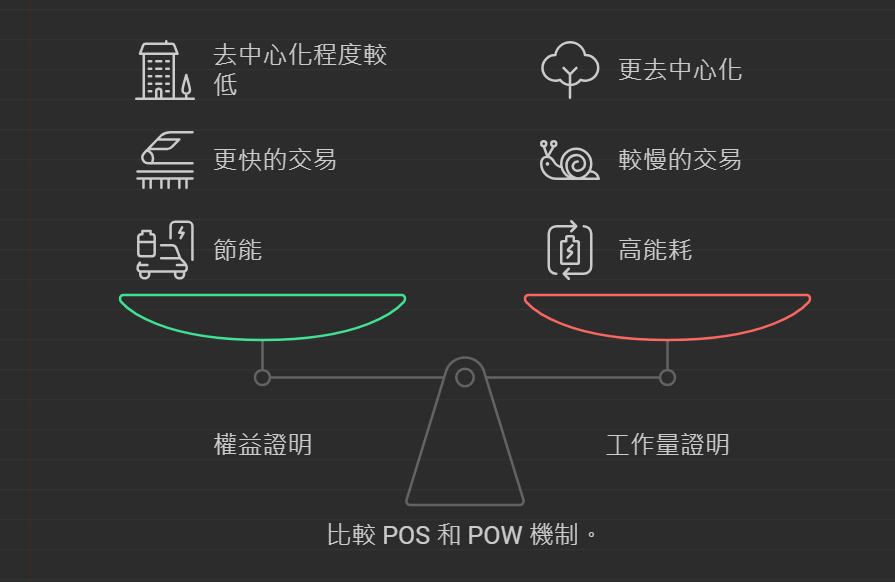

The two most common and basic categories of blockchain consensus are:

POW Proof of Work

POS Proof of Stake

The main difference between the two lies in the different ways of "deciding who is responsible for producing blocks" . There are two common variants of POS extensions, NPOS and DPOS. Other well-known ones include the historical proof POH proposed by the leading high-speed public chain Solana ( Proof of History).

Proof of Work What is POW?

The most well-known POW chain at present is Bitcoin, Proof of Work, which determines who is responsible for producing blocks based on the workload. The work here refers to calculation. All node miners have to expend computing power and continue to calculate and solve problems. The first node to solve the answer is responsible for producing the block, and the others are responsible for verification.

Computing is work, and the person who determines the production block based on the workload - Proof of Work POW

The advantage is that it is the most secure and the most decentralized. The disadvantage is that it consumes the most energy and has poor overall efficiency.

Proof of Stake What is Proof of Stake POS?

The most well-known POS chain at present is Ethereum, a proof-of-stake system that determines who is responsible for producing blocks based on the cryptocurrency held. The holding here refers to the pledge. All nodes must pledge Ethereum coins. The current minimum limit is 32 $ETH. There is no need to calculate and solve the problem. The node with more coins pledged has a higher chance of being selected. The nodes in are responsible for producing the block, and other nodes are responsible for verification.

Equity is pledge, and the number of pledges determines who produces blocks - Proof of Stake

The advantages are energy saving and faster speed, but the degree of decentralization and security are slightly worse than POW.

In addition, there are two common consensus mechanisms: NPOS (Nominated Proof of Stake) and DPOS (Delegated Proof of Stake). Both of these are basically POS, but they have different qualifications for becoming a node and the participation methods of other small currency holders. Same, the difference is very detailed and I won’t go into details here.

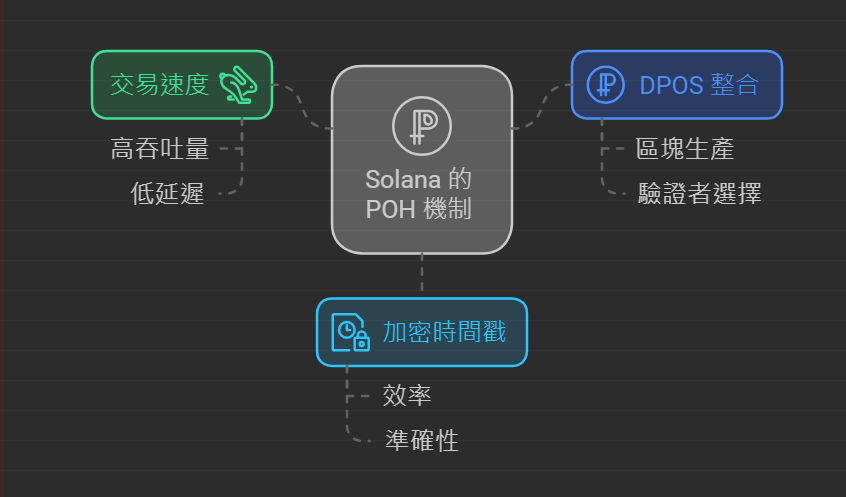

Proof of History launched by the well-known high-speed public chain Solana. History proves what POH is.

Let’s briefly review the previous sentence: “Blockchain consensus: a set of standard practices for block production and verification.” Solana is one of the leading public chains. Its biggest features are its high speed and innovative POH consensus mechanism. .

In terms of choosing who will produce blocks, Solana is a DPOS mechanism. The difference with POH is that it sets an encryption clock and adds timestamps to all transactions. This speeds up the efficiency of other nodes in verifying blocks and allows Solana to use very Process transactions faster and reach finality in less time.

POH is mainly used to speed up the verification of blocks, and is not a consensus mechanism used to determine production blocks.

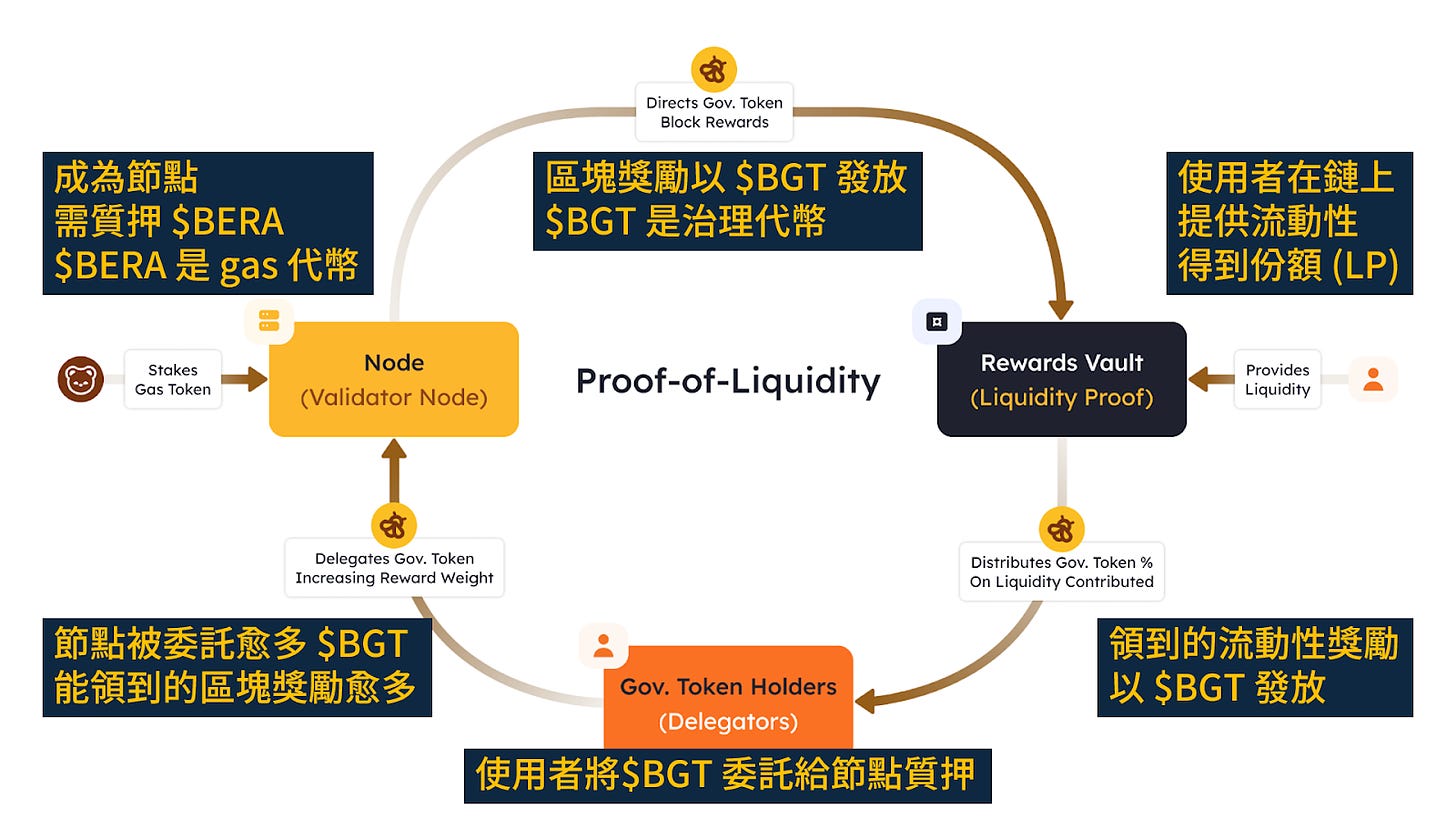

What is the Proof of Liquidity POL proposed by Berachain?

Proof-of-Liquidity is referred to as POL. As you can roughly guess from the name, this consensus mechanism is related to liquidity.

Conceptually close to POS, tokens are also required to be pledged. The node selected to package the block will receive the block reward for the block, but the mechanism is more complicated and has two additional elements: liquidity and additional governance tokens.

Important: There are two tokens participating in the POL consensus, the gas token $BERA and the governance token $BGT.

Three main differences between POL and POS

Probability of being selected <br>In POS, the more coins you stake, the higher the probability of a node being selected; POL has a basic staking threshold, but all nodes that meet the qualifications have the same probability of being selected.

Block rewards received <br>The node selected to produce the block will receive the block reward for the block. This is the main source of profit commonly known as mining or staking. In POS, block rewards are available to all nodes. The same, regardless of the amount of pledge, but it is a bit more complicated in POL.

The block reward in POL is more like a liquidity incentive, not a fixed block reward, but will be affected by the number of entrusted tokens, the amount of liquidity provided, etc. Compared with POS, having one more will affect the amount of reward received. Provides a mechanism for liquidity integration .

(It doesn’t matter if you don’t understand it yet, I’ll explain it in more detail later, just know it’s related to liquidity first)

Token role in the system

Let’s first exclude the re-staking track that has only appeared recently. In the general POS mechanism, the pledged tokens and the block reward tokens received are the same token. For example, in Ethereum they are both $ETH, and in Berachain’s POL In the mechanism, there are two different token roles.

Similar to POS, tokens must be pledged to qualify as nodes. The token that a Berachain node must pledge is $BERA, which is also a gas token on the chain. Its role is similar to that of common public chain tokens, no matter how much $ is pledged. BERA, nodes have the same probability of being selected.

Generally, pledgers entrust $BGT to the node for pledge. The number of $BGT that the node is entrusted to is different, and the block rewards that can be distributed are different. Berachain block rewards are issued in $BGT tokens, which is a kind of soul. Bind a non-tradable governance token.

POS: The more you stake, the higher the chance of being selected/The block rewards are the same/There is a single token in the mechanism

POL: With more or less pledges, the probability of being selected is the same/Providing liquidity and delegation will affect the allocable block rewards/There are two tokens in the mechanism

POL four key points

Provide liquidity and earn governance token $BGT

Liquidity is an important concept in DeFi. Providing liquidity is like depositing tokens in DEX or lending protocols. Providing liquidity will get receipt tokens (such as LP). The only way to earn $BGT on Berachain is to provide liquidity or interact with specific protocols on the chain.Delegate more $BGT and be assigned more rewards to validators <br>The concept is like general public chain staking, and the mechanism is like NPOS. Delegate your own $BGT coins to other validators; be delegated more $BGT It will not increase the probability of the validator being selected to package the block, but it will increase the block reward that can be distributed when it is selected. The more $BGT = the more rewards, the more you want to obtain $BGT = more liquidity or more on-chain interactions.

Security is provided by $BERA tokens <br> There are dual tokens in the consensus mechanism. The nodes have to pledge $BERA coins. If there is any evildoing, they will also be fined $BERA coins. $BERA is a safe asset on Berachian , the security is determined by $Bera the total pledge amount, which is also the gas token on the chain and is a tradable platform token.

Reward Token: Non-transferable governance token $BGT

There are dual tokens in the consensus mechanism. $BGT is a reward and governance token. There is only one way to obtain it, which is to provide liquidity.

$BGT is non-transferable and can be used to participate in governance voting or be delegated to validators. The realization channel is to destroy it and exchange it for $BERA at a ratio of 1:1.

The above two paragraphs are the basic concepts of POL liquidity proof, but they are still quite abstract. In the next paragraph, we will explain it in more detail:

Briefly describe the POL liquidity certification process

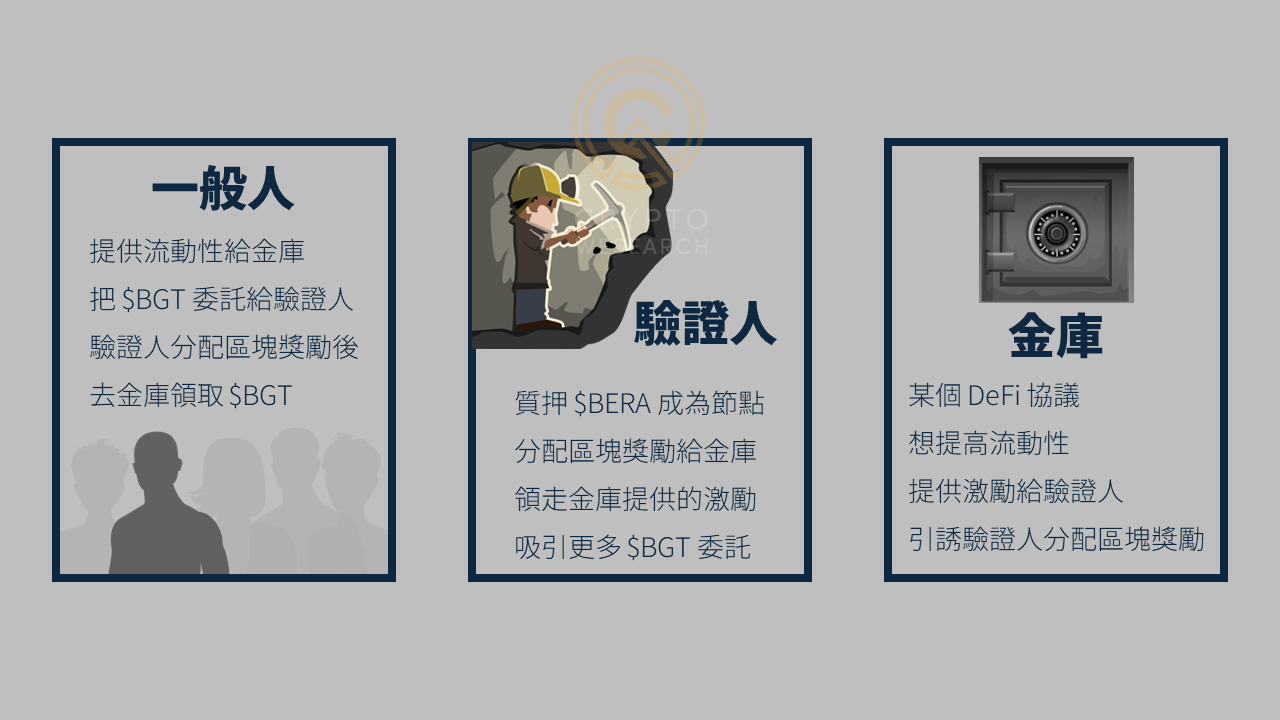

Three major roles: validator (node), client (general investor), treasury (contract of each agreement)

Two tokens: $BERA, $BGT

Two types of rewards: block rewards and treasury incentives

The following examples illustrate:

A certain vault is basically a certain DeFi contract, such as the Dongdongcoin-Xixicoin trading pool in DEX, where ordinary people can inject liquidity and obtain receipt tokens (LP).

A verifier is a node. If you want to become a verifier, you need to pledge a minimum amount of $BERA coins. Each node has an equal chance of being selected to package a block.

Ordinary people can entrust their $BGT tokens to validators.

The probability of a validator being selected to package a block is equal, but when selected, the allocated block reward (issued as $BGT) will increase as the number of delegates increases, the more $BGT delegated to the node , the larger the block reward when the node packs the block.

Block rewards are not collected directly by the verifier, but the verifier distributes these rewards to its designated treasury, such as the Dongdongcoin-Xixicoin liquidity pool mentioned earlier. The treasury is transferred to Berachain from each protocol/DApp Submit an application to log in.

Ordinary people receive receipt tokens (LP) after adding liquidity to the pool. When the treasury is allocated block rewards, they can receive the corresponding $BGT according to the share ratio in the pool.

It’s a bit abstract, but let’s look at it from the perspective of three of the characters:

The role of ordinary people is like a pledger of a general public chain. What is pledged here is the governance token $BGT. It is not pledged directly, but entrusted to the verifier. The way to make profit is to provide liquidity to the treasury and then receive the block rewards allocated to the treasury. If you want to earn more rewards, delegate more $BGT to the validators who will distribute the rewards to the vault.

The validator is the node miner who packs the blocks. The main profit is the fee income from the packed blocks and the incentives provided by the vault. The number of incentives the validator can receive is related to how many block rewards it allocates to the vault. The more allocated. Block rewards, the more incentives you can receive. The more block rewards you want to distribute, the more $BGT you must be delegated.

The treasury is a liquidity protocol. If the protocol wants to attract more liquidity, it needs better liquidity rewards, but the reward distribution depends on the verifier. The treasury can provide additional incentives to the verifiers to induce the verifiers to allocate block rewards to they.

Summary - POL liquidity proof that combines staking and liquidity and comes with a bribery mechanism

Simply put, Berachain's POL liquidity proof mechanism combines and binds the pledges in general public chains with the liquidity in general DeFi.

Want to earn staking income? Liquidity must be provided first.

Want to earn more liquidity rewards? The pledge must be delegated to a more suitable validator first.

Through such binding, two things become one thing. The characters have their own interests. If they want to obtain the maximum benefit, they must participate in and bribe each other.

Vault > Provide incentives to bribe validators to allocate block rewards to it

Validators > allocate block rewards to some specific vault, bribing that vault's liquidity providers to delegate more $BGT to it

Ordinary people> entrust $BGT to the verifier who can maximize their profits based on their own liquidity provision

At the same time, users are encouraged to participate more actively in on-chain applications through mechanisms, and the mechanism is directly designed at the bottom of the consensus to accelerate the establishment of ecological liquidity on the chain.

You can no longer just pledge but not participate in on-chain applications <br> This can be done on other public chains, simply pledging to earn staking income, but not interacting with the on-chain protocol at all.

There will no longer be interactions on the chain for half a day but you can’t even earn basic staking income <br>This may also be the case in other public chains, participating in various liquidity mining and lending, but the profit is not as stable as simply staking.

POL turns staking and providing liquidity into one thing. What impact will this have?

The biggest impact is that this requires Berachain chain participants to provide liquidity. The ecology on the chain can more easily gather liquidity, and users are more willing to interact with on-chain applications. It should be difficult to appear on this chain, and there is no high-value chain. Funds but no one in the ecology can interact and participate.

It can be clearly seen that Berachain's POL innovation mechanism focuses on liquidity issues, and liquidity is the biggest issue in DeFi. Therefore, the most anticipated thing on Berachain is the application development of DeFi, which will be the launch of the Berachain mainnet. The final focus.