According to a recently published survey on the use of stablecoins in emerging markets, stablecoin usage has been growing, including during the recent market downturn, and people are no longer just using stablecoins to trade cryptocurrencies, in five In emerging market countries, the most popular non-transaction application scenarios include currency exchange, payment for goods, remittances, and salary collection and payment.

This investigative report was jointly written by payment giant Visa, venture capital firm Castle Island Ventures, macro hedge fund Brevan Howard's digital asset unit Brevan Howard Digital, and data company Artemis, and was conducted by YouGov between May 29 and June 13, 2024. conduct.

Castle Island general partner Nic Carter said in an interview with "The Block" that due to the lack of data on how people around the world actually use stablecoins, especially in emerging markets, they commissioned this study of Brazil, Nigeria, Turkey He believes that this report is very enlightening for the use of stablecoins in the real world.

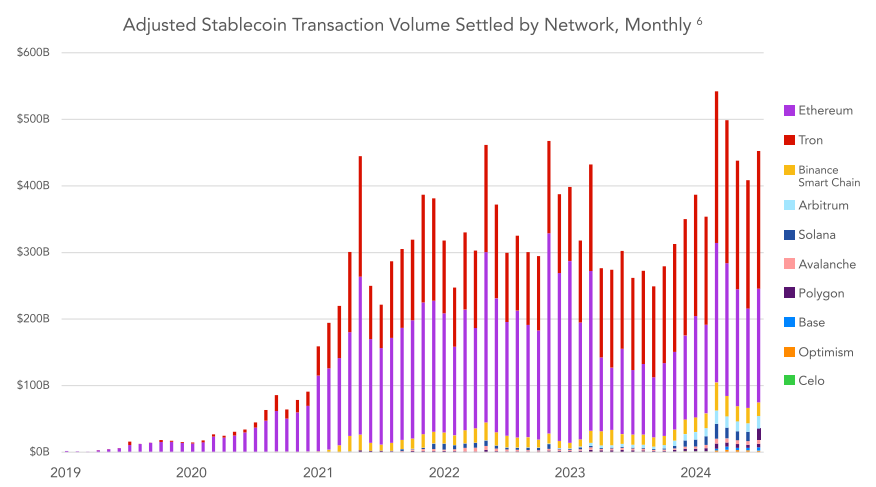

There are currently nearly $170 billion worth of stablecoins in circulation, and the author points out that these tokens, usually denominated in U.S. dollars, are "without a doubt" the "killer application" of cryptocurrencies. After removing the noise from MEV trading, arbitrage and lending transactions, and other apparently inorganic use cases (such as intra-exchange transfers), investigators conservatively estimate the value of stablecoin settlement in 2023 at $3.7 trillion.

In the first half of 2024, the value of settlement using stablecoins was approximately US$2.62 trillion, which shows that the use of stablecoins seems to be growing. Based on this speed, the total settlement volume in 2024 may reach US$5.28 trillion.

Notably, stablecoin trading volumes have grown “steadily” throughout the market downturn, which, according to the findings, suggests the stablecoin has reached new users who are using it for more than just transaction settlement. Additionally, 57% of users said they have increased their use of stablecoins in the past year, and 72% expect their usage to increase in the coming year.

Common application scenarios

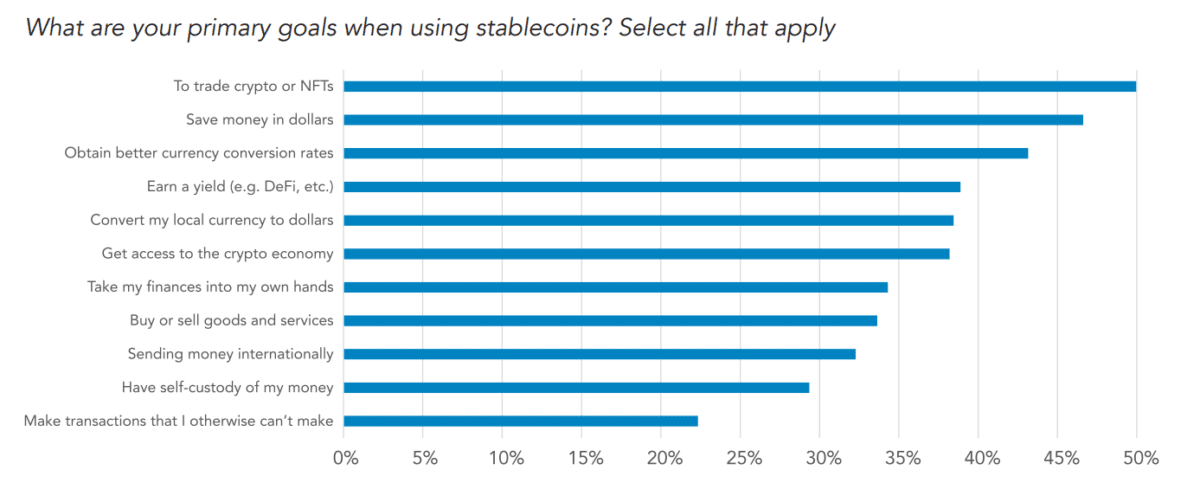

According to the survey, if users do not use stablecoins for cryptocurrency transactions, the most popular application scenarios include currency exchange, payment for goods, remittances and salary collection. The report reads:

“While the most common purpose among stablecoin users in the sample was to trade cryptocurrencies or NFTs, other non-cryptocurrency uses were not far behind. Overall, 47% of respondents stated that one of their primary goals was To save in U.S. dollars, 43% cited better currency exchange rates and 39% cited earning income. The findings are clear: non-cryptocurrency uses account for a significant share of stablecoin usage patterns in the countries surveyed. ”

There are differences in the usage of stablecoins in different regions. For example, in Turkey, the most common goal is to earn income through stablecoins, followed by cryptocurrency trading. For Nigerians, making USD deposits through stablecoins is the main purpose, followed by trading cryptocurrencies and getting better exchange rates. In addition, a report from Pintu, one of Indonesia’s largest cryptocurrency platforms, shows that users will use stablecoins for B2B payments and arbitrage:

“For many Indonesian users, stablecoins are more accessible than banks’ USD services. Registration requirements for local cryptocurrency exchanges are simpler than creating a bank USD account, so users have a lower barrier to entry.”

Meanwhile, users of Yellowcard, Africa’s largest cryptocurrency gold-mining platform, reported using stablecoins for foreign exchange transactions due to capital controls that often restrict international transactions. “As a result, people and businesses are turning to stablecoins to keep payments flowing, import imports, business operations and household support,” the company added.