Just 24 hours ago, the consensus among analysts was that the US Federal Reserve (Fed) could cut its benchmark federal funds rate by just 25 basis points at its meeting next week, but that prediction quickly changed.

The jobs picture in last week’s August jobs report showed the labor market remains strong. And inflation in this week’s CPI and PPI reports continued to hold up slightly above expectations.

However, the Wall Street Journal's Nick Timiraos reported Thursday afternoon that the decision on the size of the rate cut is still being debated.

“I think it's going to be very close,” Jon Faust, formerly a senior adviser to Fed Chairman Jerome Powell, told Timiraos.

“There are many reasons for the Fed to cut 50 basis points,” said Esther George, former president of the Federal Reserve Bank of Kansas City. She noted that the Fed has been quick to tighten policy, so it is possible the central bank will also move quickly to ease.

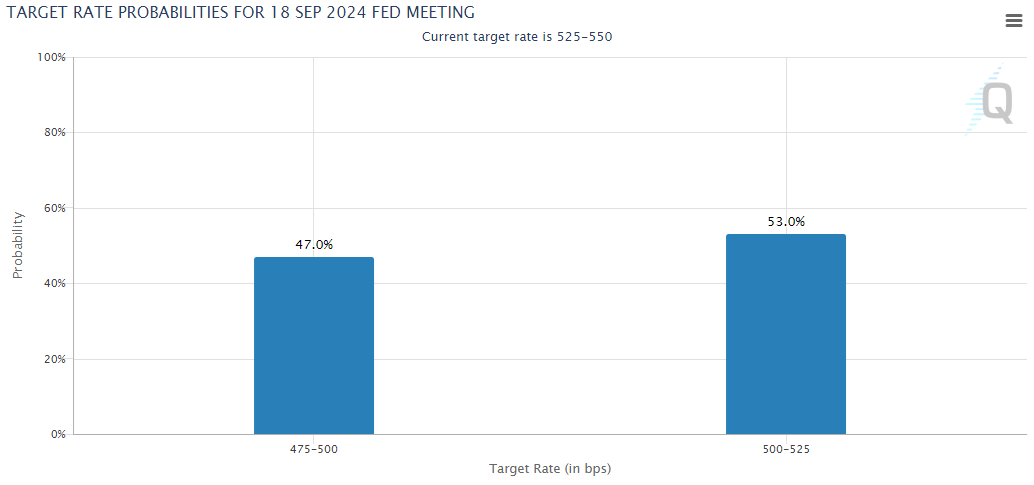

Immediately after the article, according to CME FedWatch, the probability of the Fed cutting by 50 basis points next week increased to more than 40% from just a few percentage points in previous days. At the moment, the odds of a 50 basis point cut have increased slightly to 47%.

Source: CME FedWatch

The news may also have been responsible for the U.S. stock market's quick reversal on Thursday, closing in the green after posting losses earlier in the session. Bitcoin (BTC) also rose to its highest level in more than a week at $58,400.

Monetary policy easing is generally considered good for risk assets, including Bitcoin. But at this stage, forecasts can still change quickly.

You can XEM coin prices here.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Viet Cuong

According to CoinDesk