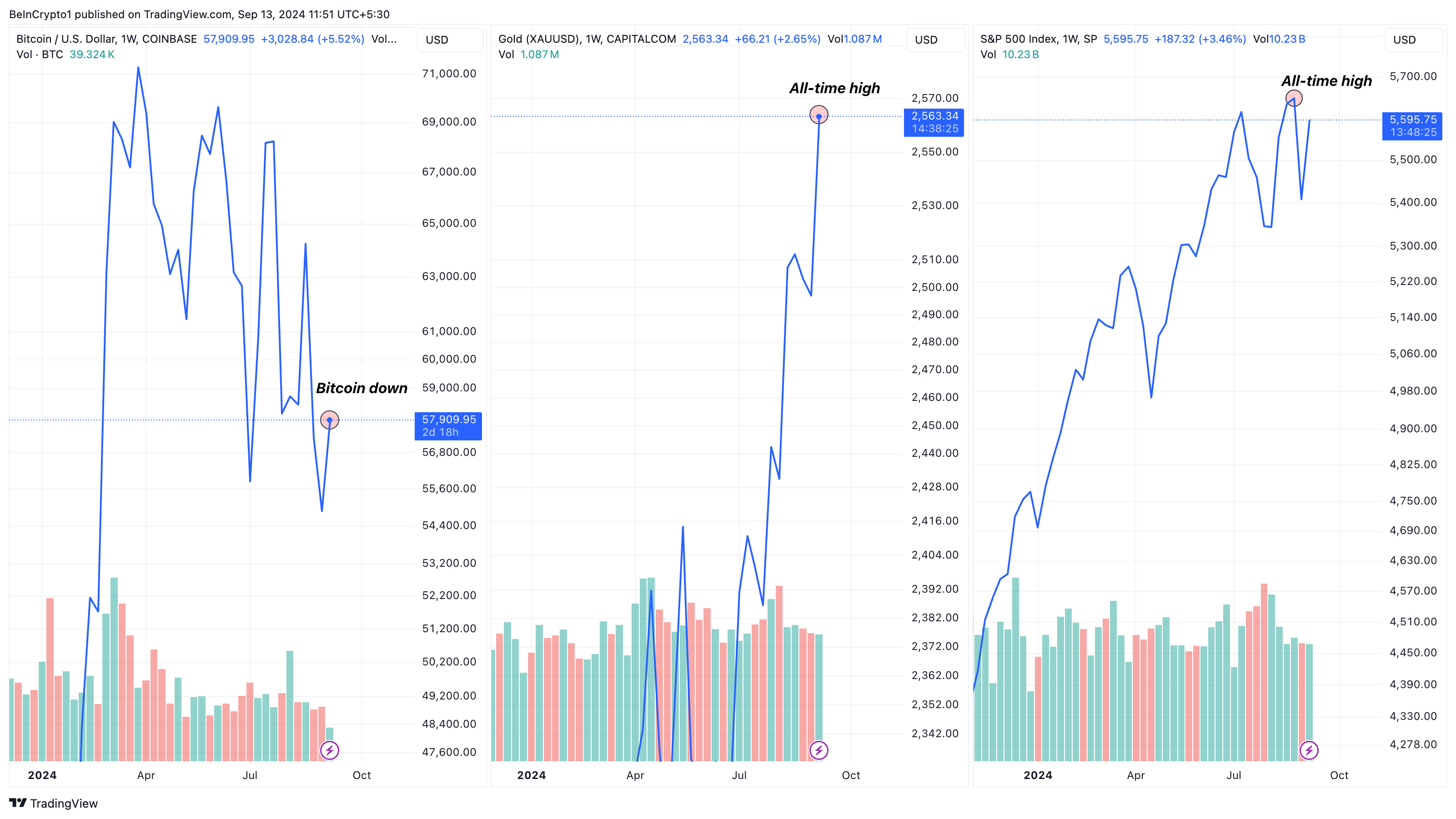

Traditional assets, including gold and the S&P 500, have hit new all-time highs. Meanwhile, Bitcoin (BTC) has been isolated and has continued to underperform, a trend that has persisted for nearly six months.

As a result, investors are questioning whether cryptocurrencies still function as inflation hedges compared to traditional assets. This on-chain analysis delves into whether BTC will continue to lag behind or whether its status as a safe haven asset still holds up.

Bitcoin lags behind gold and other assets

Bitcoin is now at $58,166, down 21% from its all-time high in March. Gold, on the other hand, recently hit a new all-time high, worth $2,564. The famous S&P 500 has also surpassed $5,650, and silver is set to do the same soon.

According to BeInCrypto’s research, the surge is due to the positive US CPI report released earlier this week. Meanwhile, the gap between BTC and these traditional assets is similar to what cryptocurrencies experienced in May 2021.

At that time, the price of Bitcoin fell by 36%. The current situation is similar to the performance in November 2021, when the coin reached the peak of the last bull market.

Regarding this issue, CryptoQuant, a cryptocurrency on-chain data analytics platform, explained in its weekly report that investors tend to prefer less risky assets.

“During periods of negative correlation between Bitcoin and gold, gold increases and Bitcoin decreases, which generally indicates a risk-off environment where investors prefer traditional safe-haven assets like gold over speculative assets like Bitcoin,” the report highlighted .

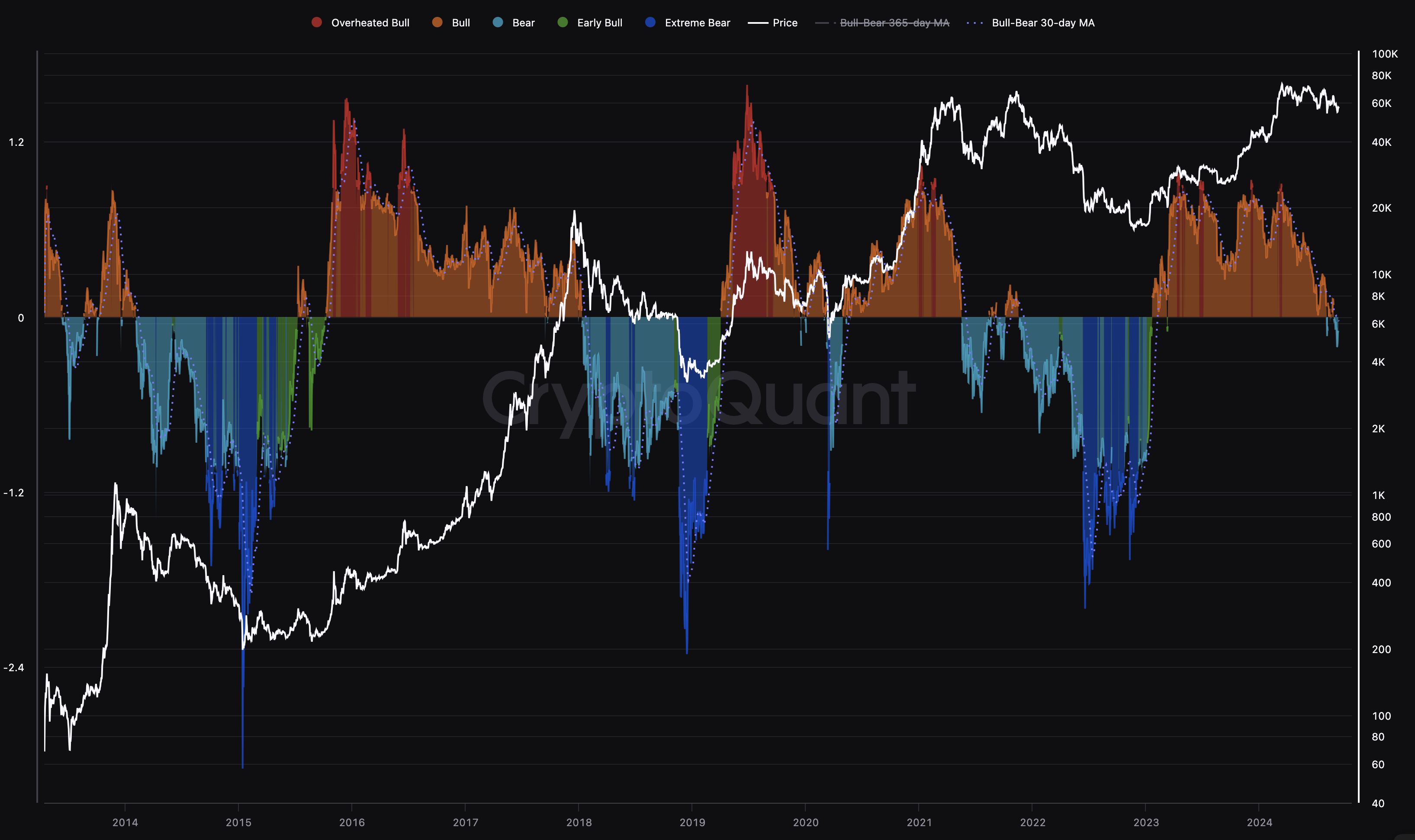

Following these milestones, Bitcoin could continue its downward trend. One reason for this bias is the current state of the bull/bear cycle. This momentum indicator measures the difference between the profit and loss index and the coin’s 365-day moving average.

When the indicator is above zero, it is a bull cycle. On the other hand, when it is below zero, it indicates a bear market . As of this writing, the bull/bear cycle indicator has fallen below the threshold, suggesting that Bitcoin’s price may have entered bear mode.

Read more: Who will own the most Bitcoin in 2024?

BTC price risk unless fresh capital flows into the market

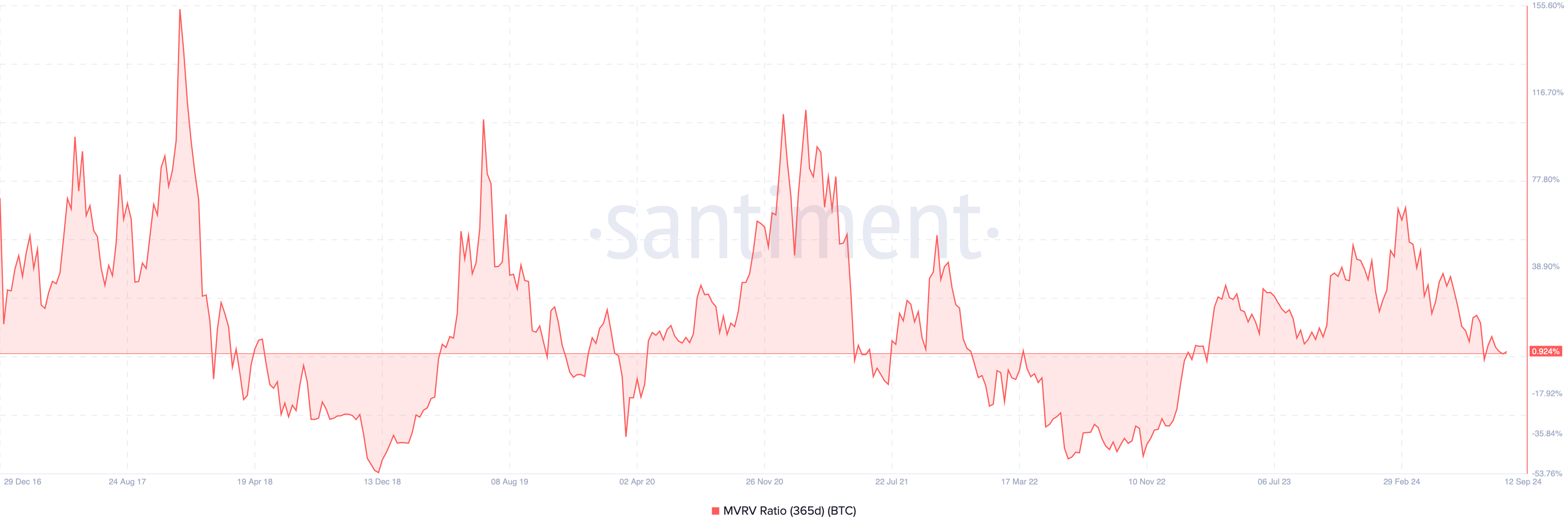

Another indicator that supports this downward bias is the 365-day Market Value to Realized Value (MVRV) ratio, which shows how far or close Bitcoin’s price is to its realized price, or the average price at which all coin holders purchased the cryptocurrency.

A high value for the MVRV ratio indicates overvaluation. Conversely, a low value suggests undervaluation.

According to Santiment, an online cryptocurrency data platform, Bitcoin’s 365-day MVRV ratio is below 1%, indicating that the cryptocurrency may be headed for a downtrend. As you can see in the chart below, if BTC slides into negative territory, it will be difficult to turn around and start an uptrend.

Therefore, if the ratio eventually falls below the green zone , the price of Bitcoin could fall to $45,000 , and this bull market could eventually turn into a bear market.

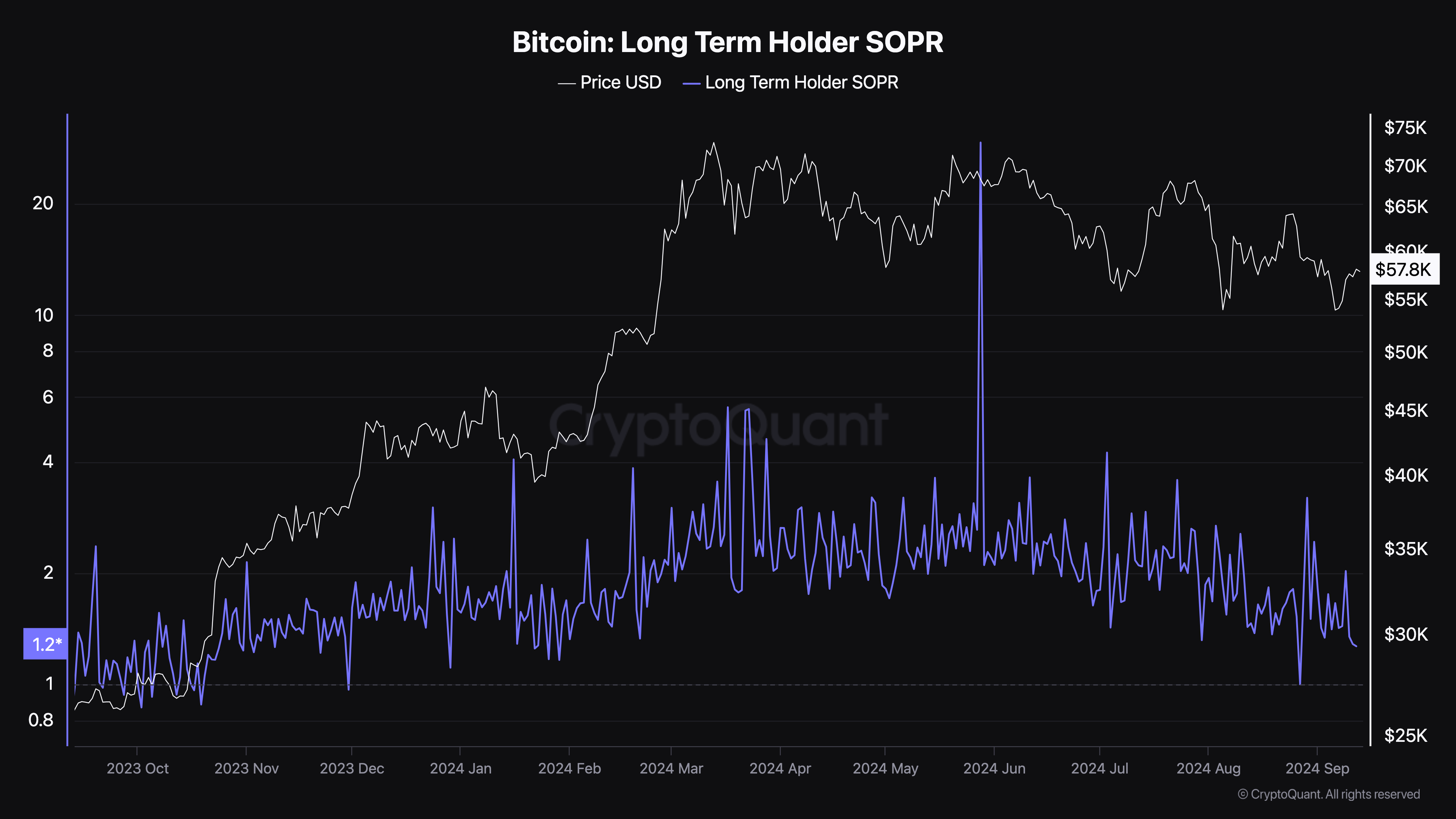

Additionally, the long-term holder (LTH) spending output profit ratio (SOPR) has been decreasing since July. The increase in LTH-SOPR indicates that holders are selling at higher profits, making it easier for BTC to attract new demand.

The continued decline suggests that long-term holders are selling at low profits, which could make it difficult for Bitcoin to generate the higher demand needed to drive the price higher .

Read more: 7 Best Cryptocurrency Exchanges to Trade Bitcoin (BTC) in the United States

However, if profits from traditional assets flow into Bitcoin and other cryptocurrencies, Bitcoin could rally to an all-time high.

Bitcoin is currently seeing a wave of positive sentiment linked to recent milestones achieved by gold and other assets. According to Santiment, a significant level of skepticism may be needed for Bitcoin to make a strong run toward its all-time high.

“Once the crowd starts to show doubt again, Bitcoin will truly start to test its March all-time high market valuation,” said the on-chain analytics platform X.