BTC and ETH Weekly Overview

The overall cryptocurrency market rebounded this week:

Bitcoin: This week, Bitcoin showed an overall rebound trend. Market traders' sentiment towards economic recession trading has eased, and it is generally believed that the probability of a recession in the US economy in the future is relatively low. After the release of the US August CPI data this week, it can be seen that the CPI has been greatly alleviated and has taken another step towards the 2% that the Federal Reserve is concerned about, so most market traders bet that the Federal Reserve will cut interest rates by 25BP next week, but it only represents a defensive rate cut. The US economy has not entered a recession, so this week's rebound occurred after a sharp drop in the last two weeks.

Ethereum: This week, Ethereum's performance was weaker than Bitcoin, and its rebound was weaker than the overall market. In addition to external macro factors, the main reason is that Ethereum is now confused about its future development direction. The market does not buy into the opinions of Ethereum developers, and Ethereum developers do not adopt the opinions of market users, which has caused serious disagreements. The main reason is that there are no innovative and rapidly developing star projects on the Ethereum chain, which lacks the ability to tell stories and create wealth in the future, causing funds to be transferred from the Ethereum chain to other public chains, making the construction of the Ethereum ecosystem face severe challenges.

Welcome to join the exchange group →→ VX: ZLH1156

Altcoin Overview of the Week

Overall performance

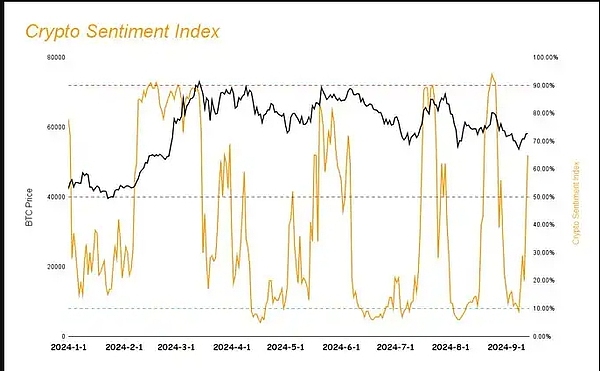

This week, the market sentiment index recovered quickly and has risen to 65.5%, a significant increase from 11% last week. As the market gradually rebounded this week, market sentiment turned from extreme fear to greed.

The Altcoin market followed the rebound trend of the broader market this week and rebounded more strongly than the broader market. This rebound was mainly because the market believed that the possibility of a recession in the US economy in the future was reduced, which eased the concerns about the recession, thus triggering this week's rise. And a lot of funds flowed out of the Ethereum ecosystem and began to flow to other public chains, causing projects in various ecosystems to rise.

Key Events

US CPI data is lower than expected and lower than the previous value

On September 11, the U.S. seasonally adjusted CPI annual rate for the end of August was 2.5%, significantly lower than the previous value of 2.9% and lower than the expected value of 2.6%, indicating that the current U.S. inflation is rapidly declining and is under very good control. The value is constantly approaching the Fed's expected value of 2%, which further confirms the Fed's interest rate cut next week. And the market is most worried about the number and magnitude of the Fed's future interest rate cuts. Through this CPI data, the market understands that the continuous decline in CPI data is in a controllable stage and will not easily cause a rebound, so the Fed's interest rate cuts will continue for many times.

Market discussion direction this week

The market discusses the difficulties faced by ETH and its future development

Ethereum has not performed very well recently, and the disagreement within the Ethereum ecosystem about the direction of development has led to an analysis of the difficulties faced by Ethereum in the market. The main reason is that as more and more transactions are processed on the second-layer solution, more and more fees and economic activities that would have benefited the Ethereum mainnet are being redirected. This shift may lead to a decrease in ETH demand and a significant reduction in Gas fees, and the sharp drop in Gas fees has also affected the amount of ETH burned, causing ETH to resume inflation.

In view of the current situation, there are many opinions on Ethereum in the market, which can be summarized as follows: it is generally believed that Ethereum should give up continuing to invest heavily in infrastructure construction, but should recognize the nature of the current predicament and introduce a large number of top applications to attract more users; increase the income from staking ETH through projects such as Eigenlayer; increase the standard of basic charging in Ethereum Gas fees to increase Ethereum's income, thereby increasing the burning of ETH through EIP-1559; modify the pricing mechanism of Blob, etc.

Crypto Events Next Week

Tuesday (September 17) US August retail sales monthly rate; Stable Rise

On Wednesday (September 18), the verdict of the Trump "hush money" case was announced; TON Asia-Singapore

Thursday (September 19) Federal Reserve interest rate decision; Solana Breakpoint; DeFi 2049—Beyond THE Horizon; Impact 2049

Friday (September 20) ETHGlobal Singapore

On Saturday (September 21), the U.S. Securities and Exchange Commission (SEC) decided on Bitcoin ETF options

Outlook for next week

1. Bitcoin: Currently, Bitcoin lacks its own positive factors. Its price fluctuations are mainly affected by market news and macro data, and it cannot independently develop its own trend. However, I expect that the trend of Bitcoin will fluctuate around the Fed’s decision to cut interest rates next week, and will be greatly affected by the dot plot released by the Fed.

2. Ethereum: Ethereum has been weaker than the broader market this week, and the ETH/BTC exchange rate has been on a downward trend. I expect ETH to perform worse than BTC in the future, and the ETH/BTC exchange rate will continue to fall.

3. Altcoin: Although Altcoin closely followed the rebound trend of the market this week and the rebound was stronger than the market, there is no unified market hotspot in Altcoin, and the innovative tracks that have emerged are in the early stage and are not perfect, so the funds are scattered and cannot form a joint force for a certain track or project. In addition, the funds in the market are not sufficient at this stage and the trading users lack confidence in future development, which will make Altcoin only follow the trend of the market in the future and will not develop its own independent trend. Therefore, it is expected that Altcoin will continue to follow the trend of BTC next week.

The article ends here. Follow the official account: Web3 Tuanzi for more good articles.

If you want to know more about the crypto and get first-hand cutting-edge information, please feel free to consult me. We have the most professional communication community, publishing market analysis and high-quality potential currency recommendations every day. There is no threshold to join the group, and everyone is welcome to communicate together!

Welcome to join the exchange group →→ VX: ZLH1156