Market conditions

At present, the market has been moving within expectations. Today, it broke through the 60,000 mark in one fell swoop. It is still the same as before. If you have short-term buy the dips or short-term profits with good profits, you can exit first. You must gamble at 60,000 on Saturday and Sunday. If it stabilizes at 60,000, then the copycat will have opportunities to enter the market. If it cannot stabilize, it will go down again, and you can find a good position to enter.

VX:TTZS6308

At present, the BTC is rising, but the copycats are not following the trend. Even if there is an increase, it is only a little bit. Only a few of the more resilient ones will follow the market, and the rest are still lying dormant. Once the BTC falls, these ones will fall faster than anyone else, so in the short term, you must pay attention to protecting profits.

Now everyone is concerned about interest rate cuts and elections

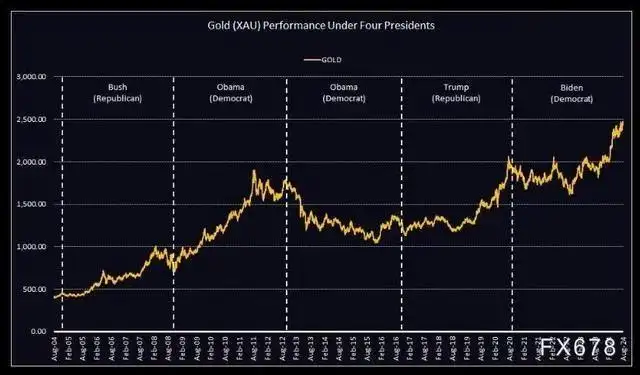

The US presidential election still has a significant impact on the short-term trend of US stocks. Historically, there are often large fluctuations in the months before the election. Therefore, the market often chooses to wait and see, and wait for the results to be announced before making major decisions. It is worth mentioning that US stocks often perform better in the year after the election.

Interestingly, the election also has a certain impact on the short-term trend of gold. Similar to the US stock market, gold, as a hedge fund, also has a higher demand during the election, so it will continue to rise in the months before the election.

Although the US presidential election will have a significant impact on US stocks and gold in the short term, it has little impact on their price performance in the long term and has not caused any abnormalities in the financial market. In fact, in the short term, the election has little impact on the trend of the US dollar and the macro economy.

This is because the medium- and long-term performance of financial markets is often affected by economic parameters such as inflation trends. Who is elected is not a big factor.

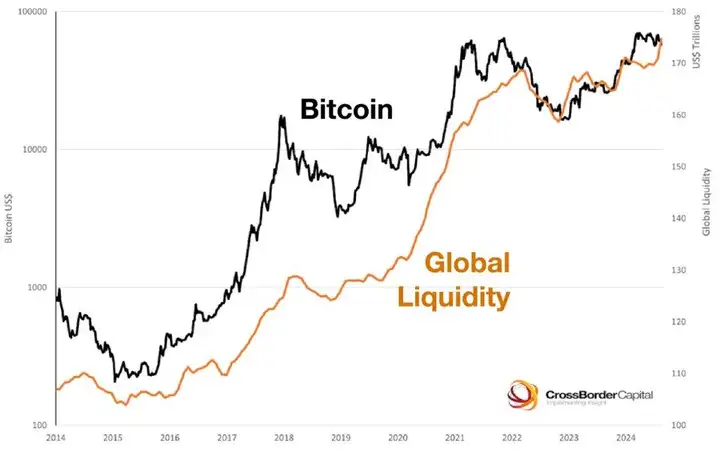

At present, the crypto market, led by Bitcoin, has risen to trillions of dollars. It has entered the mainstream vision from the so-called alternative assets and is no longer on the edge. Bitcoin is also increasingly affected by macro factors, including market liquidity, interest rate cuts and increases by the Federal Reserve, and the US election.

When the Federal Reserve cuts interest rates and global capital liquidity increases significantly, BTC prices continue to rise. Macro liquidity still plays a decisive role in the crypto market.

In addition, in recent months, the non-farm payrolls and CPI data, which are of great reference value to the Fed’s interest rate cut decision, often bring considerable volatility to the crypto market in the short term once released. BTC is currently becoming increasingly linked to the macro-financial market.

As an investor in the crypto market, the influence of macro factors can no longer be ignored.

How big of an impact will the election have on the cryptocurrency market?

In the long run, the impact is not significant

Trump was in office from 2016 to mid-2020, and Biden was in office from 2020 to 2024. The crypto market dominated by BTC has experienced strong bull markets during their respective administrations.

If we count from the election period to September, the chart below shows that although the BTC price fluctuates, it still has a certain return. The market return is the highest during the earliest Trump administration.

The bull market cycle in 2017 and the unlimited QE launched in 2020 due to the COVID-19 pandemic brought huge capital inflows to the crypto market.

During his administration, Trump mentioned Bitcoin as a cryptocurrency on Twitter, but did not endorse its value.

During Biden's administration, he continued to be tolerant of cryptocurrencies. After the FTX incident, the US SEC's crackdown became stricter. However, overall, the United States is still in a leading position in technological innovation and capital inflows in the encryption field.

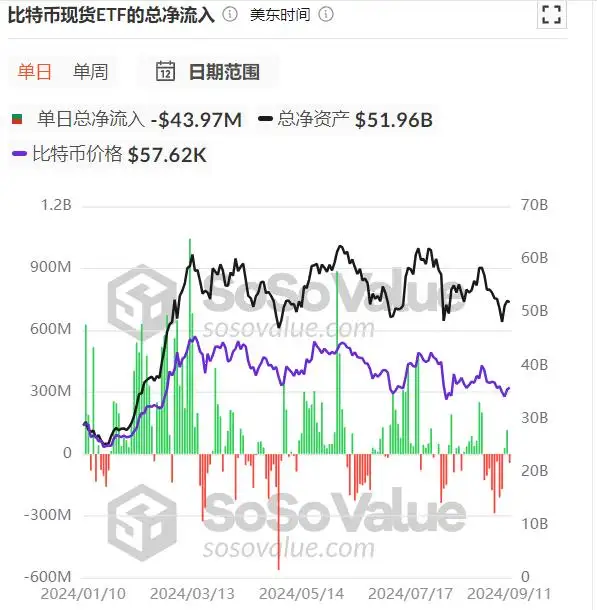

The bull market cycle in 2021 and the approval of the Bitcoin spot ETF by the US SEC in early 2024 also brought considerable activity to the crypto market. As of September 11, the total net inflow of BTC spot ETFs reached US$17 billion.

It can be seen that judging from the market historical performance in the past two cycles, no matter who comes to power, it does not affect the upward trend of the crypto market.

Although the election has limited impact, key factors that will have a real long-term impact on the crypto market are still the industry’s own technological development, the Federal Reserve’s meeting decisions, and other key factors.

In the short term, the impact is greater

Although its impact on the election is not significant in the long run, it has shown a considerable impact in the short term.

On the morning of July 14, Trump was assassinated. BTC rose by 2% that day, breaking through the $60,000 mark, and rose again by 6% the next day to around $65,000, and then fluctuated upward.

On July 28, Trump attended the much-anticipated Bitcoin conference. Afterwards, the market paused and the negative news appeared after the positive news was exhausted.

On July 29, just after Bitcoin broke through $70,000, it began to decline all the way, and even experienced panic selling in early August.

On August 23, when independent presidential candidate Robert Kennedy Jr. suspended his campaign and endorsed Trump, Bitcoin soared from $60,000 to around $65,000, a single-day increase of more than 6%.

In the recent debates among U.S. presidential candidates, the market reaction was generally cold because neither Harris nor Trump mentioned cryptocurrencies.

Therefore, the next important time node is November 5. By then, BTC may experience drastic fluctuations after the election results come out.

From the past cycle, when the US SEC's strict law enforcement leads to negative effects and causes a decline, it is often the short-term bottom range of the market. When the dust settles on the US presidential election and everything is a foregone conclusion, the strong wait-and-see funds in the crypto market change their hesitant style and start to bet boldly.

The US election will have a certain impact on the regulation and policies of the crypto industry, but there will not be major changes. The election will also have a certain boosting effect on some product protocols such as Polymarket. In terms of market conditions, the long-term impact is not significant, but at important time points, it will still bring short-term fluctuations to the market.