Chainlink [LINK] has made significant progress through collaborations with various industry players, which has boosted its adoption in the cryptocurrency space.

At the time of writing, the price of LINK appears to be moving in a descending trend channel on the daily timeframe. While this has been the case since June, it has recently found a potential bottom. A bottom could be confirmed if the price breaks above the short-term high of $13.

The price of LINK has been trending down recently, with liquidity dropping below $13 and finding support at $9.42. A Double Botto seems to be forming here.

Welcome to join the exchange group →→ VX: ZLH1156

The MACD has also turned bullish, partially confirming the pattern. That being said, the key test will be whether LINK can break above the $13 level.

If the price climbs above the trendline and holds there, it could signal a 35% rally (if the total Altcoin market cap supports such a move). However, if LINK breaks below its current support zone, it could continue to fall.

If the current bottom holds, the fourth quarter of 2024 could be favorable for LINK. This would provide an ideal entry point for traders and investors betting on a price recovery.

Chainlink Long-Term UDPI Risk Model

LINK’s long-term Upside-Downside Potential Index (UDPI) risk model is also currently at historical lows.

The model evaluates risk-reward scenarios over time and shows that LINK has greater profit potential when the UDPI is lower.

Market sentiment around LINK is currently extremely low, with weak price action and bullish activity. However, the UDPI shows LINK at its lowest risk level – a key point to watch as Q4 approaches.

Historically, such levels have marked deep value zones for LINK. And, if market conditions align, a reversal could be imminent.

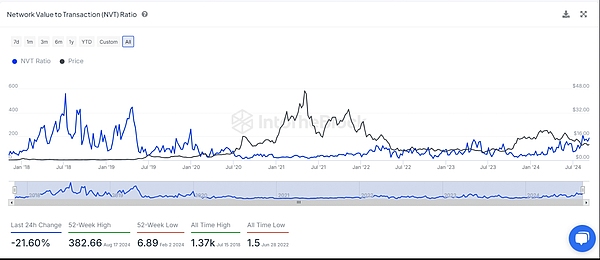

NVT ratio continues to grow

Additionally, Chainlink’s on-chain activity is also increasing, with its network value to transaction (NVT) ratio showing growth.

NVT’s steady rise since the beginning of the year indicates a surge in activity on the Chainlink blockchain.

This is a bullish sign for LINK, supporting the idea that the price has found a solid bottom and could soon move higher.

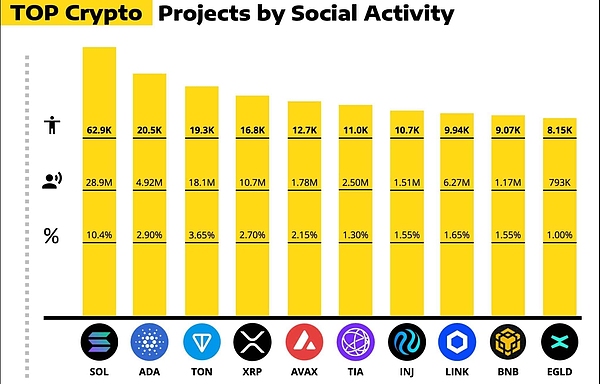

Chainlink’s Social Dominance

Finally, LINK’s social activity has also surged. Among the top 10 crypto projects, Chainlink’s social dominance rate is 1.65%, based on social posts and interactions on various platforms.

Growing social engagement further strengthens bullish sentiment towards LINK. Especially since increased social visibility tends to correlate with higher interest and potential price movement.

In summary, Chainlink’s recent partnerships, on-chain activity, and social dominance all suggest the potential for price increases if market conditions improve.

If LINK holds the current support level and the Double Botto pattern comes into play, the price could surge significantly higher in the coming months.

The article ends here. Follow the official account: Web3 Tuanzi for more good articles.

If you want to know more about the crypto and get first-hand cutting-edge information, please feel free to consult me. We have the most professional communication community, publishing market analysis and high-quality potential currency recommendations every day. There is no threshold to join the group, and everyone is welcome to communicate together!

Welcome to join the exchange group →→ VX: ZLH1156