Skeptical about BTCFi

The main points of this article are:

Bitcoin is mainly regarded as digital gold. Gold does not generate income and its value lies in its preservation.

Maintaining value and generating income, it’s difficult to have both

There is very little overlap between Bitcoin holders and yield seekers.

As an anti-inflation asset, Bitcoin's main value comes from price increases (appreciation of legal currency), offsetting the decline in purchasing power caused by inflation, and its positioning is close to digital gold; if more people hold Bitcoin for this reason, then It is very likely that they are not pursuing returns. If they hold Bitcoin, they can just hold it safely and do not need to generate returns.

If this argument holds true, then the demand for BTCFi is not high.

Explanation of terms BTCFi: Various usages of xxFi are common in the crypto, usually referring to xx to earn, a mechanism that can earn coins and generate income. BTCFi is also similar to the concept of BTC to earn, and some mechanisms that allow Bitcoin to generate income are similar to application.

Low Liquidity Bitcoin Will Bitcoin Holders Chase Yield?

This article provides two data supports:

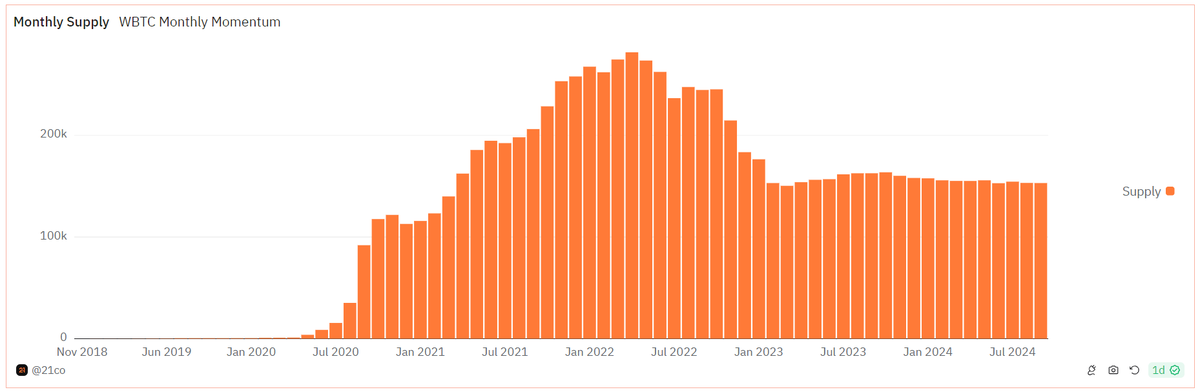

This is the supply trend of $WBTC . $WBTC is the most well-known packaged Bitcoin asset. In the past, because there were no applications on the Bitcoin chain, if you want Bitcoin to generate income, you usually choose to cross-chain Bitcoin to other ecosystems. For example, cross-chain to Ethereum, and WBTC is the encapsulated Bitcoin that goes out across the chain. If more people move their Bitcoin across the chain, theoretically we will see the supply of WBTC increase.

This data shows that WBTC has not increased significantly in the past few years, and people holding Bitcoin have no obvious signs of cross-chain transfers in pursuit of profits.

$WBTC has faced a wave of controversy and market doubts recently:

The $WBTC custody dispute continues to ferment, where will BTC-related assets go?

Another piece of data on Bitcoin activity. Since 2012, the active supply of Bitcoin has been declining, which means that more and more Bitcoins are being bought and then not moving. They are just holding them.

These two data echo the original author’s point of view:

Bitcoin holders just hold it after buying it, and there is no sign of actively pursuing returns. In this way, there will not be much demand for BTCFi, and the current valuation of related projects is likely to be too high.

Is BTCFi fake demand?

What is BTCFi? What problem are you solving? Towards what kind of future?

After these opinions and data, what the author wants to discuss is: Is this a result or a cause?

In the past, Bitcoin did not have many applications. Firstly, the Bitcoin blockchain does not support smart contracts, and there is a lack of protocols and applications on the chain. Secondly, the gas cost on the Bitcoin chain is very high, and you have to pay several U to do any operation. Not many people can afford the handling fees of dozens of U, or even hundreds of U when it is popular; thirdly, if you cross-chain to other ecosystems, you will lose the native characteristics of Bitcoin, which not only has security issues, but also is not as good as directly using other ecosystems. Asset considerations.

Do Bitcoin holders "really not pursue" returns?

Or do Bitcoin holders "choose not to pursue" returns after taking into account the above-mentioned inconveniences and costs?

There may be no need to speculate on this part, as there are relevant historical events for reference. At the beginning of last year (2023), Bitcoin inscription ordinals was born. This is a protocol for issuing coins and NFTs using the Bitcoin blockchain, which directly detonated the Bitcoin ecosystem. The inscription craze has made the gas fee on the Bitcoin chain remain high, and the popularity It has even spread to other public chains, and various public chains that can run smart contracts have also begun to "make inscriptions" in order to avoid the loss of users.

What are Ordinals NFTs? What is the BRC-20 token? |Bitcoin NFT Protocol|Operation Tutorial

Then there is the Rune Protocol, which was launched this year. This can be understood as an improved version of the inscription, which has once again detonated the Bitcoin blockchain. Although the halving has just been completed, the block reward has been reduced by half, but due to the handling fees brought by the rune craze, The income of miners directly hit a record high.

After the halving, the cost of mining one Bitcoin soared past 100,000, but miners’ income soared?

Do Bitcoin holders really just want to hold it and have no other investment needs? Or is it because there is no product that can meet their needs yet?

BTCFi Q&A

Q: What is BTCFi?

A: Bitcoin (BTC) + Finance, financial protocols and applications related to Bitcoin, including operating financial applications on the Bitcoin chain and allowing Bitcoin to generate income

Q: What problems does BTCFi solve?

A: Solve the problem of Bitcoin’s lack of low-cost and high-security return solutions, increase related applications, reduce costs, and ensure security.

Q: What does BTCFi’s ideal future look like?

A: You can also earn income by holding Bitcoin. Bitcoin will become an asset that is both anti-inflation and can continue to generate income on the chain.

Q: What parts does BTCFi include?

A:

Allow the Bitcoin blockchain to perform more complex operations, such as BitVM / CKB / Babylon native staking, etc.

Let Bitcoin operations enjoy lower costs, such as Bitcoin layer 2 / side chain or modular blockchain, etc.

Let Bitcoin generate income and related DeFi applications

In a broader sense, you can refer to Ethereum. The various applications surrounding Ethereum make Ethereum $ETH more valuable. The same thing can also happen on the Bitcoin chain, such as DA layer, ENS domain name, GameFi, SocialFi, etc. , after all, Bitcoin is the largest public chain in terms of scale.

Related reading:

Bitlayer - The first Bitcoin Layer 2 built on BitVM

Why is BTCFi important?

An important entrance to cryptocurrency: Attracting more people to invest in Bitcoin

If Bitcoin does not have many applications and cannot generate income as in the past, then there will only be one type of people who want to invest in it, those who are optimistic about its long-term appreciation and anti-inflation properties; but if Bitcoin can also generate income, then there will be More people are willing to invest in it.

With the passage of Bitcoin and Ethereum ETFs, cryptocurrency continues to reach more people, and its popularity and popularity have increased significantly. How many of the public want to invest in assets that can resist inflation, and how many people want to invest in assets that can generate income. As an asset, Bitcoin in the past could only attract one of them, but with the development of BTCFi, Bitcoin in the future can attract both.

More people are willing to invest in Bitcoin, which means more capital inflows, higher market value, and more abundant funds and users in the overall cryptocurrency industry.

So why Bitcoin? Why can't it be other coins? For example ETHFi or SOLFi? The key reason is that Bitcoin is hard to replace. It is the king of cryptocurrencies and has the highest popularity. Bitcoin is more famous than "encryption", "blockchain", etc.

The world of cryptocurrency is too complicated. Even if outsiders want to invest, facing tens of thousands of cryptocurrencies, the safest choice must be Bitcoin, which has the longest history, the highest reputation, and the strongest value consensus. But if Bitcoin is bought, With nothing to do but hold and no income to be generated, some investors will give up.

As the most representative cryptocurrency, Bitcoin is the first choice for most people to invest in cryptocurrency. It is the entrance to cryptocurrency. As an entrance, it is of course important to make it larger and more attractive. The original Bitcoin It can only satisfy some of the investors. With the addition of BTCFi, it can meet the needs of more investors and attract more people to start investing in Bitcoin.

The current focus of BTCFi is: the ecosystem surrounding Bitcoin’s native staking

Why is this important? Because this is an application based on the native Bitcoin, the native Bitcoin can be pledged on the Bitcoin chain, generating income while holding the Bitcoin, and there is no need to transfer to other chains, and there is no need to bear additional security risks.

The concept of liquidity staking and re-pledge extends from staking. Bitcoin is pledged on the Bitcoin chain, and the minted LST liquidity staking tokens are issued on other chains with cheaper gas, and participation in the DeFi protocol generates income. Liquidity staking, re-staking, and DeFi are all mechanisms that have been verified in other public chain ecosystems. Now combined with native Bitcoin, they must be the focus of ecological development in the next stage.

If you are also paying attention to the BTCFi track, you can learn about the following projects first:

The core Babylon protocol

Bitcoin can also be pledged to make money | Introduction to Babylon raising US$96 million | Sharing the security of Bitcoin

Babylon staking starts! Only 1,000 BTC will be opened in the first phase, take a look!

Extensive various Bitcoin liquidity staking, re-staking and DeFi projects

Lombard|LBTC|Bitcoin Liquid Staking Protocol Raises $16 Million

▌Research and discuss BTCFi with the Biyan community. Welcome to join the daily Biyan Chinese exchange group !

▌Subscribe to the daily Coin Research e-newsletter (1-2 articles per week to quickly understand market conditions, on-chain data and potential project developments)