Despite the challenges facing Ethereum (ETH), the price still has the potential to rise. Currently, ETH is trading at $2,411.

There have been recent concerns that ETH could enter a bear market. While this is possible, on-chain analysis suggests how the cryptocurrency could avoid a downturn.

Ethereum, Strong Support Pouring from $2340

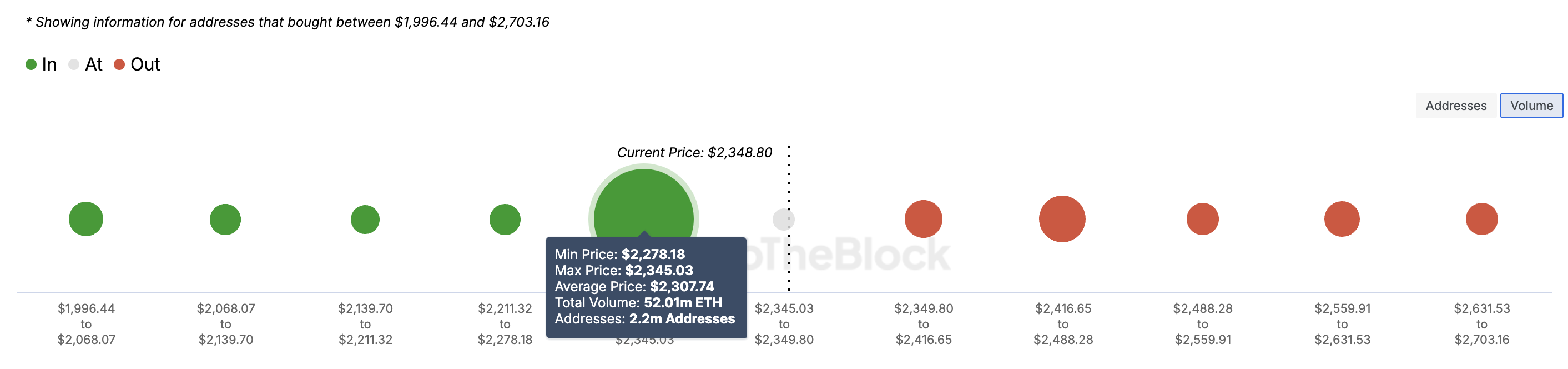

According to the In/out of Money Around Price (IOMAP) metric, which categorizes addresses that are in profit, loss, and break-even, market participants accumulated 52 million coins at an average of $2,345.

This volume is higher than the volume purchased between $2349 and $2703. Generally, larger volumes at a particular price range have a stronger impact on price movements. If there is more volume at a loss, ETH will face resistance from holders looking to sell at breakeven.

On the other hand, higher volume in the uptrend indicates strong support, as holders are less likely to sell at lower prices. Accordingly, ETH is finding significant support around $2345 , which could help push the price higher and reach $2800.

Read more: Buying Ethereum (ETH) with a Credit Card: The Complete Guide

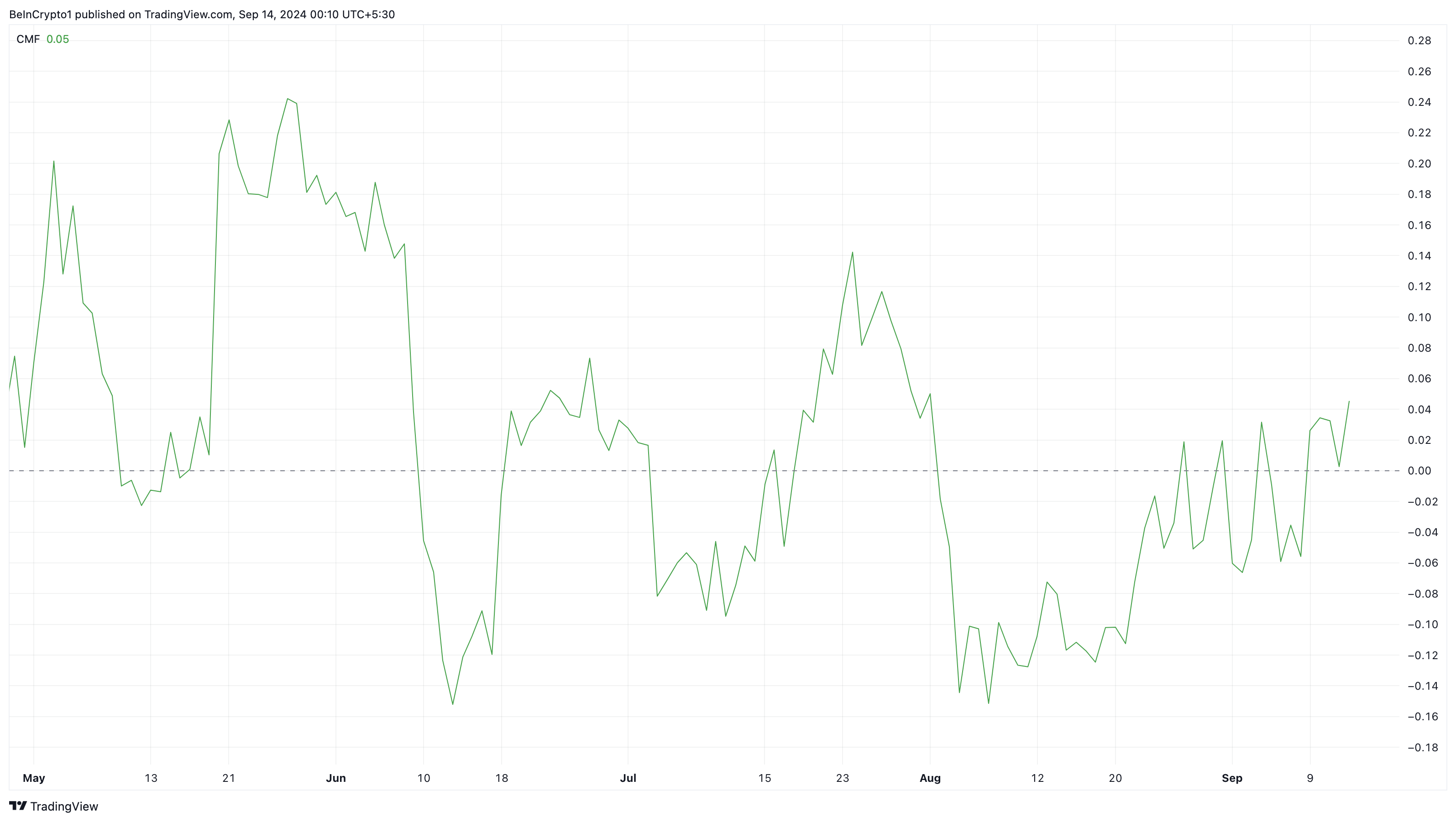

Another indicator that reinforces this view is Ethereum’s Chaikin Money Flow (CMF), which measures the balance between accumulation and distribution.

When the CMF is rising, it indicates that accumulation is outpacing selling pressure. Conversely, when the CMF is falling, it indicates that distribution is greater. On the daily chart, the CMF has moved into positive territory, which could increase buying pressure, helping Ethereum recover from recent losses and push the price higher .

ETH Price Prediction: Demand Rising

On the daily timeframe, Ethereum (ETH) is showing a steady uptrend, rising from $2,225 to $2,421, suggesting that the price could move higher.

According to the chart below, there is a supply zone around $2700 which could act as resistance. However, the $2400 area acts as a strong demand zone for ETH which could make a move above the $2581 resistance possible .

Also, the selling wall around $2744 supports the potential for ETH to push higher. If ETH overcomes this hurdle, the price could reach $2800 and possibly $2991.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

However, traders should be aware of potential market volatility . If the overall market turns from bullish to bearish, this prediction may no longer be valid. In such a situation, the price of ETH may fall to $2114.