The U.S. Federal Reserve (Fed) will announce its latest interest rate decision at 2 a.m. Taiwan time on Thursday (19th). As investors’ expectations for the U.S. Federal Reserve to cut interest rates by 2 percentage points have once again increased, U.S. stocks rose on September 13. Across the board, the S&P 500 and Nasdaq closed in the red for five consecutive days, reversing the previous week's weak performance and recording their largest weekly gains this year.

The Fed dropped 1 code and 2 codes in a five-to-five wave

This week, major central banks including the United States, the United Kingdom, and Japan will hold policy-making meetings, among which the decision-making of the U.S. Federal Reserve has received the most attention from the market. According to the Wall Street Journal, Fed officials are considering cutting interest rates by 1 or 2 percentage points, and former New York Fed President Dudley even expressed support for a 2-digit interest rate cut. This has once again raised market expectations for a substantial interest rate cut by the Fed.

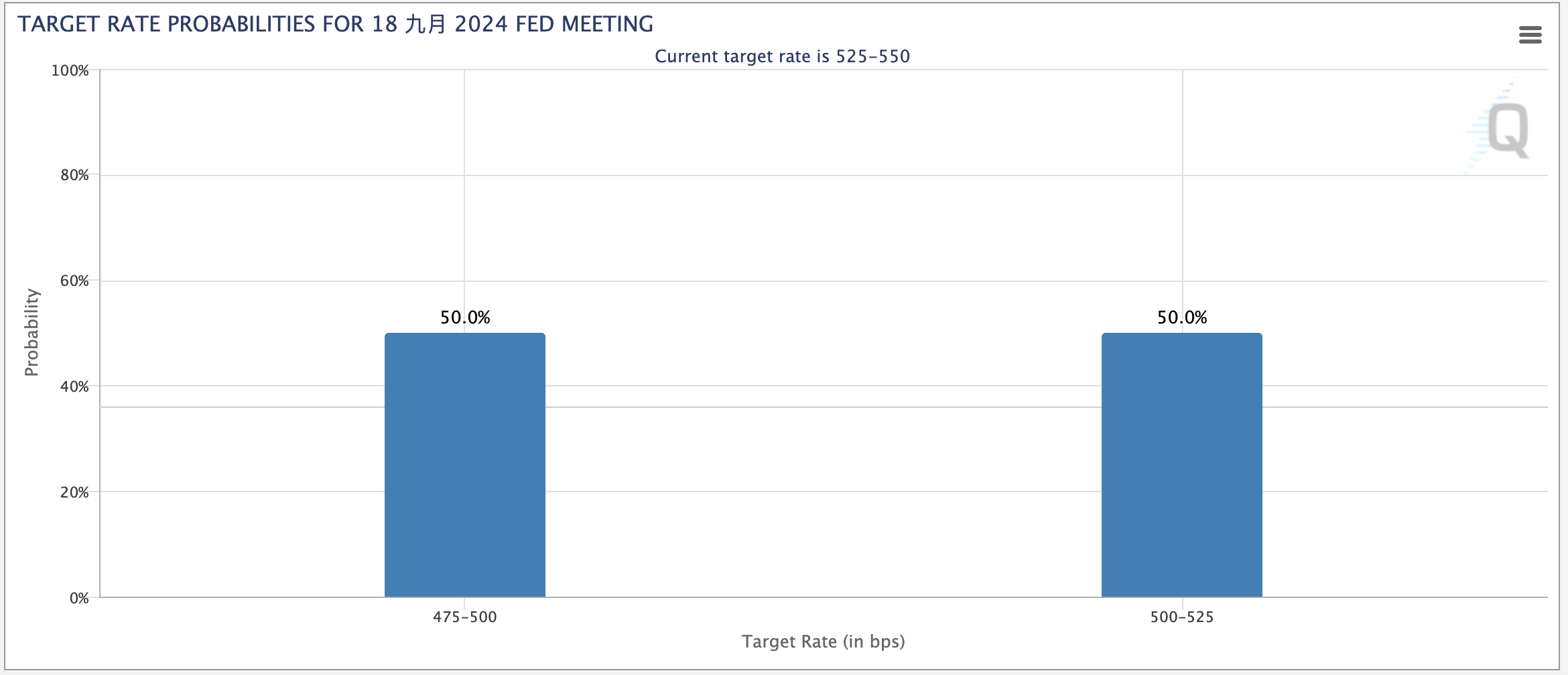

According to the FedWatch tool of the Chicago Mercantile Exchange (CME), traders are currently very close to predicting the probability of the Fed cutting interest rates by 2% and 1%, showing a 50-50 wave state. In addition, the market is also paying attention to the latest economic growth forecast and interest rate dot plot released by the Fed after the meeting, which will provide important guidance for the future direction of monetary policy.

Bitcoin rose 10% in a single week, spot ETFs performed well

On Friday, the U.S. Bitcoin Spot ETF recorded its best single-day capital inflow performance in the past two months, with total net inflows reaching $263.1 million, the highest since a massive inflow of $485.9 million on July 22. record, it was 55 days ago. Last week's total inflows reached $403.8 million, a successful rebound that reversed the net outflow trend of the previous two weeks.

Despite this, BlackRock’s IBIT, the largest Bitcoin spot ETF by assets under management on the market, has only recorded net outflows of $9.1 million in the past two weeks, with no significant trading activity on most days, the main driver of this inflow. Strength came from other funds, with Fidelity’s FBTC recording $102.1 million in inflows and becoming the leader; Ark & 21Shares’ ARKB followed closely behind, recording $99.3 million in inflows.

In terms of price, Bitcoin rose by more than 10% in a single week, returning to the $60,000 mark from around $54,000. As the market anticipates that the U.S. Federal Reserve (Fed) may cut interest rates, investors expect market liquidity to increase. The crypto market is anticipating the next wave of capital inflows and price breakouts.