Three on-chain data indicators analyze the TON ecosystem

Q: Why do we need to look at the data on the chain directly?

A: Because this is first-hand data, which is obtained directly from the operation of the blockchain. It is relatively true, open and transparent, and cannot be tampered with.

Three commonly used on-chain data indicators:

Number of addresses/Active addresses (accounts) Number of Active Addresses

Number of Transactions Transactions/Volume

Total Value Locked TVL - How much funds are locked on-chain

1. How many accounts do TON have? How many active accounts?

Source: TON Stat

The total number of accounts on the TON chain has grown from 3.3 million a year ago to 59 million currently, a 16-fold increase in one year.

Account definition: Within TON, accounts refer to any type of smart contract on the network. These include wallets, NFTs, staking contracts, and other similar entities.

The definition of account is relatively loose and includes all contracts on the chain. If you only look at the generally defined wallet address:

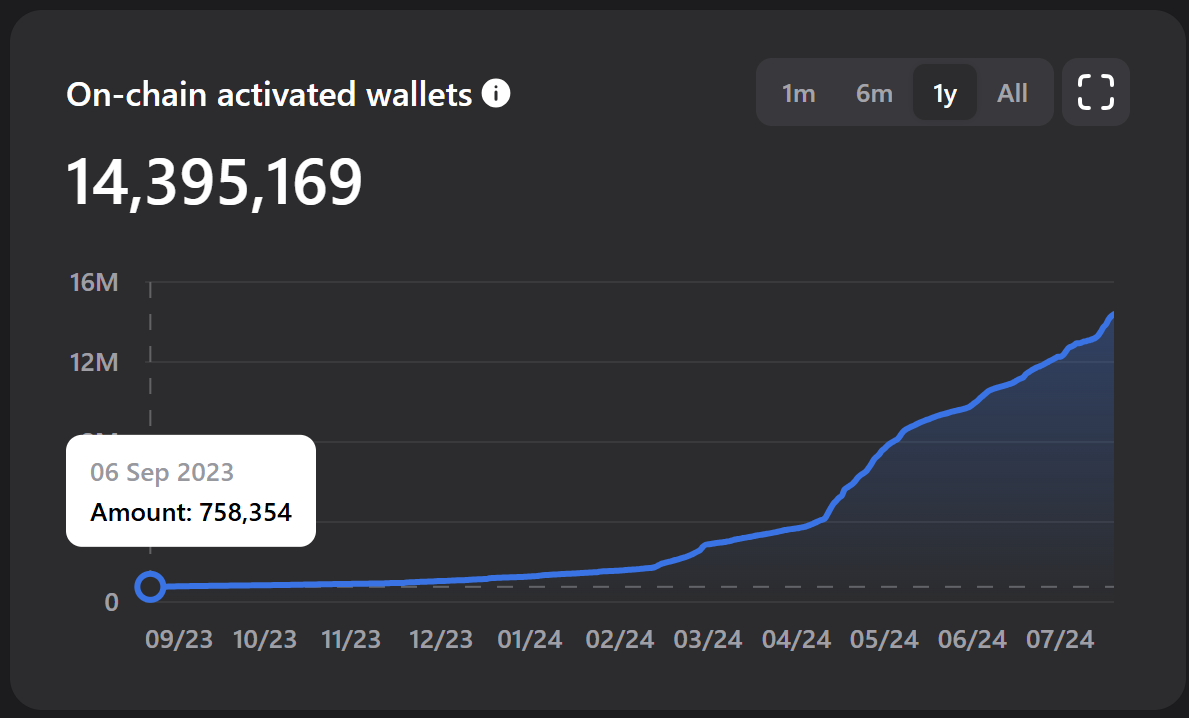

This number is the number of addresses that have been active (initiated at least one transaction), which has grown from 750,000 to 14 million, an increase of about 18 times in one year.

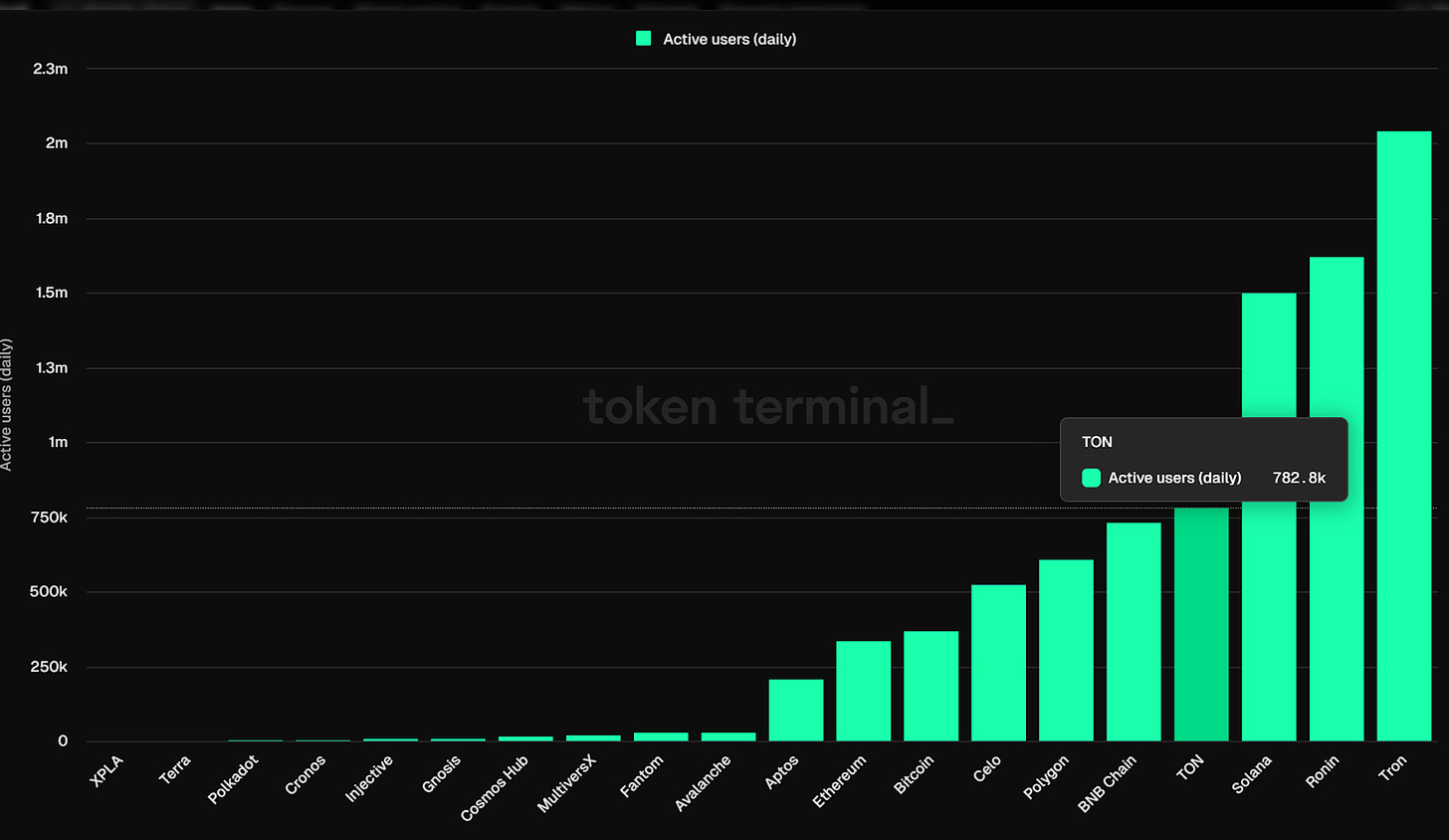

When comparing with other public chains, the main comparison is the activity status. This is the number of daily active addresses of several mainstream L1 public chains:

Source: Chain Compare | Artemis Terminal

TON is the light blue line. The time range in the picture is from this year to the present. It can be seen that the light blue line is the lowest from the beginning and gradually surpasses Avalanche and Ethereum. The current number of daily active addresses is about 500,000, ranking fourth among the top L1 public chains, and is gradually closing the distance with the third-placed BNB chain.

The number of Token Terminal , another on-chain data tool, has surpassed that of the BNB chain, and only lost to Tron and Solana among the top L1 public chains. Ronin is a game public chain.

2. Number of transactions/transaction volume on the TON chain

Source: TON Stat

The daily trading volume has experienced two peaks of exceeding 10 million times, growing from 200,000 a day a year ago to 7.7 million today, a growth of more than 30 times is amazing.

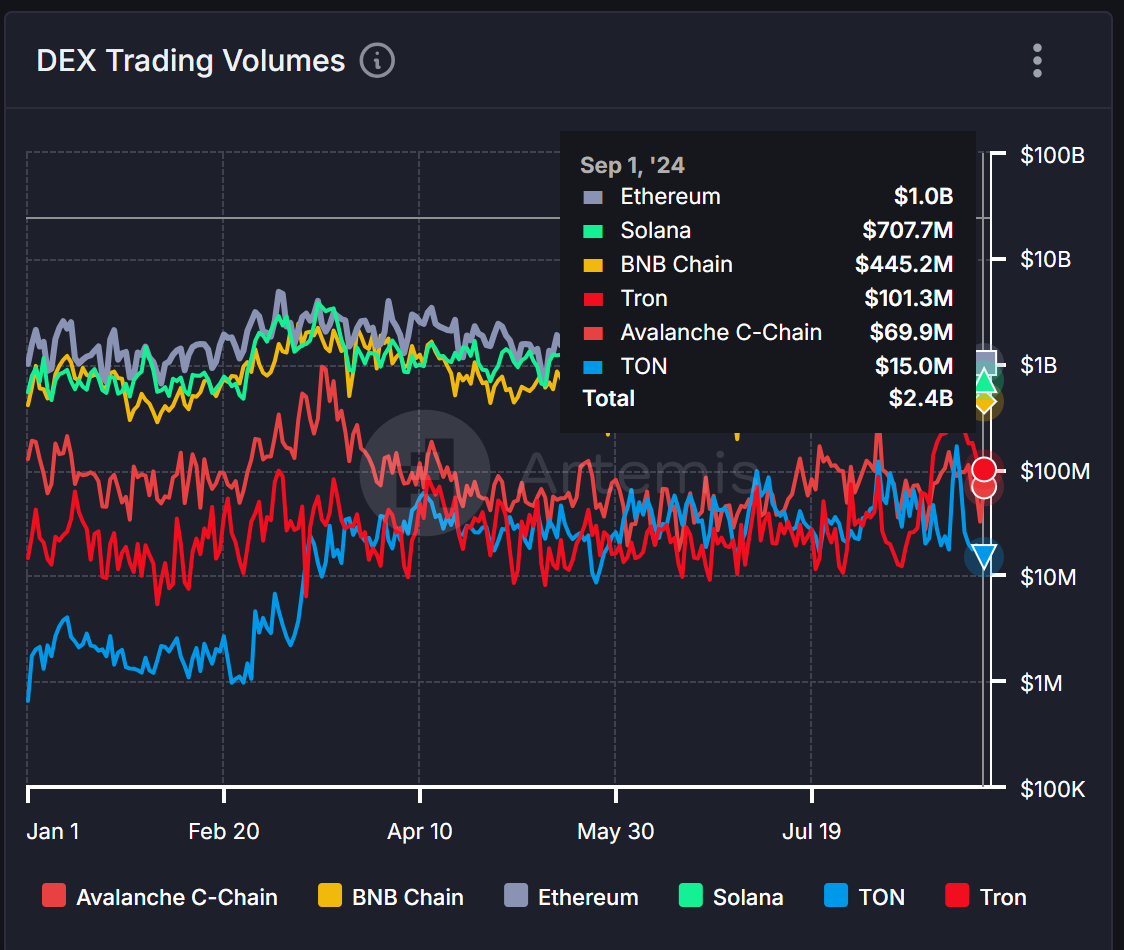

Source: Chain Compare | Artemis Terminal

Transactions: number of transactions

Judging from the number of daily transactions, TON has also gradually caught up and surpassed it from the lowest. Currently, it has 1.8 million transactions a day, ranking fourth among the leading L1 public chains.

Trading Volume: Trading volume, total transaction amount.

If you only look at the DEX transaction volume, TON ranks last among these leading L1 public chains, and the gap is very large. It can be judged that the activity on the TON chain is high, but the main force should not be DeFi related applications, or the average single transaction amount is very high Low.

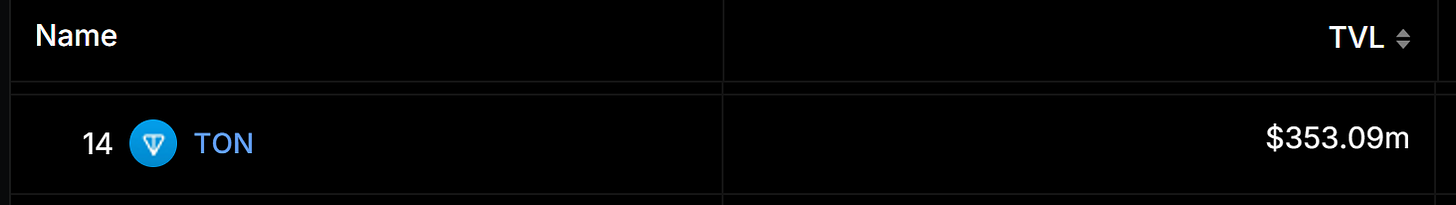

3. How much will the capital TVL on the TON chain grow?

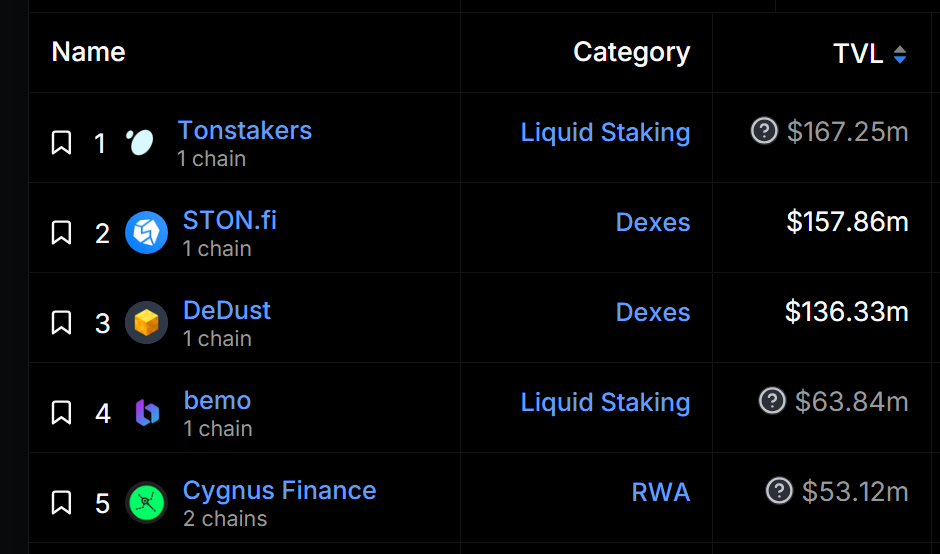

TON's TVL is not high, ranking only 14th on DeFiLlama, with a total of more than 300 million US dollars. This echoes the previous judgment: the main application on the TON chain should not be DeFi.

Although the amount is not high, it is growing very fast:

Source: TON - DefiLlama

It has grown from 10 million US dollars to 350 million US dollars in one year, a 34-fold increase!

The TVL in July this year was as high as US$770 million, and it has now fallen by more than 50% from its high point. One of the main reasons for the explosive growth of TVL this year is the integration with Telegram. Telegram is the most mainstream communication software for cryptocurrency, with 900 million active users. This brings a lot of room for imagination, and it is also in the early stages. The promotion brought many advantages. In addition, due to the popular click games on TON (such as NOT), the price of $TON currency also hit a new high at that time.

Then, as the market declined, the price of TON dropped by more than 40%, and there was no next popular project in the ecosystem that could be succeeded. The overall TVL experienced a wave of retracement, but it still grew dozens of times compared to the beginning of the year.

Those shown in gray indicate that the protocol will inject funds into other protocols. There is a possibility of double counting of TVL, so it will be excluded first during calculation.

The TVL on the TON chain is mainly concentrated in two DEXs. The TVL of other common lending, income and other protocols are very low. DeFi is not active on TON, and the ecological development is not yet complete.

What are the most active DApps on TON?

Source: TON chain | DappRadar

As of this writing, there are five most active DApps (based on the number of active addresses) on the TON chain within 24 hours, three of which are games and two are DeFi. The activity ranking of each DApp on DappRadar has also been marked on the graph.

This is again consistent with the judgment mentioned in the previous paragraph. The main force on the TON chain should not be DeFi. The most active DeFi DApp of the top-ranked TON chain only ranks in the 30s in the total DeFi category.

Judging from the rankings on DappRadar, the current leading game DApps are mainly distributed on L1 chains such as Ethereum, Ronin, BNB, and NEAR, as well as L2 chains such as opBNB, Arbitrum, and BASE.

If we take a closer look at the game DApp data on these chains, TON performs quite well. There are three games with more than 10,000 active users UAW, and seven games with more than 1,000 active users. The data in the above chains are similar or higher. There are only three of them: Ronin, opBNB, and BASE.

Then match two numbers:

DeFiLlama shows that there are only 24 protocols on the TON chain, more than a thousand on Ethereum, and most other leading public chains have hundreds of protocols.

DappRadar shows that there are only 108 DApps on the TON chain, thousands on Ethereum and BNB, and hundreds on other leading public chains.

Here we can make a simple conclusion:

TON has experienced very significant growth this year, whether in terms of funds or the number of users, the huge growth of more than ten to dozens of times, mainly driven by several popular mini-games; after popular applications attracted a large number of new players, currently The ecological development on the chain is not yet complete, and the number of protocols and DApps is much lower than that of other leading public chains . Although there is no obvious decline in the number of transactions on the chain, it has no longer continued to grow, showing the following stagnant state.

However, the number of active users continues to increase. The number of active users continues to increase but the number of transactions on the chain has stagnated. This means that the "average number of transactions per user" is declining. It may be interpreted that there are not many things that can be done on the chain. The old Although players have not left, the number of transactions has dropped and their activity level has decreased.

Conclusion: TON has indeed attracted a large number of users. It currently lacks infrastructure and will need more on-chain protocols and applications.

After growing so much, is TON making money? Income status?

Source: TON|Token Terminal

In the past six months, the revenue (Fees) does not seem to have grown particularly, and the overall situation has continued to be in a state of loss. Earnings is negative, with a daily loss of 200,000-400,000 US dollars. The calculation here will treat token incentives as expenses. If the amount exceeds the income Token incentives, then there will be no profit but loss.

This cannot be too harsh on TON. Projects that are still in the growth period usually have a large number of token incentives. There are not many L1 public chains that can achieve profitability. Let’s take a look at a few others:

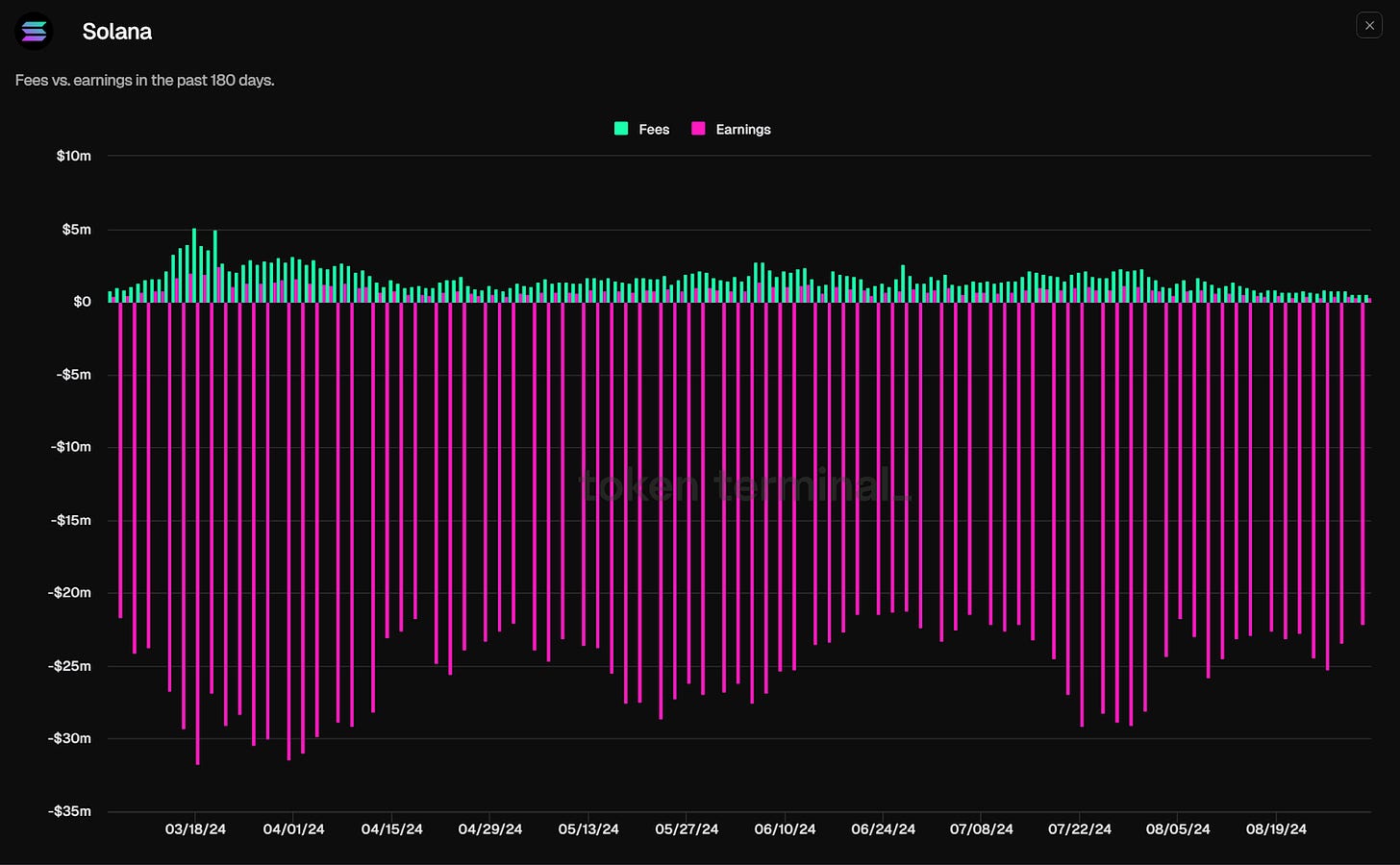

Solana's revenue/loss is even worse, with losses of $20 million to $30 million a day on most days. Among the top L1 public chains, only TRON & BNB are currently able to make stable profits.

Summary- Facing the public public chain, what is needed is continuous outbreak

The initial design of TON was based on Telegram's hundreds of millions of users and wanted to bring billions of people into web 3. Speed and simplicity were the two key points.

With a multi-chain sharding structure, the TPS limit can exceed one million, coupled with multiple applications combined with Telegram, such as the ability to use the wallet directly without a private key, transfer and payment in Telegram, and match several popular mini-games. Innovative tap to earn and other mechanisms have attracted a large number of players to join.

TON has become the leading L1 public chain with the fastest growth and best price performance this year.

Recently $TON was listed on Binance and became a Binance Launchpad project. Together with the meme currency in the TON ecosystem $DOGS first grew rapidly due to its simple currency issuance mechanism, and then was also listed on major exchanges. From these two Judging from this big move, TON’s growth continues and continues to attract more new users.

But then what? If people come in and have nothing to do, they will stay there for a short time. What we need to pay close attention to in the future is whether the overall infrastructure of TON is gradually improving? Are there more and more complete applications and protocols, whether games or DeFi? Is there an "ecology" rather than a "single hot project"?

If we observe the emergence of relevant basic applications, coupled with the rapid growth of TON itself, there should be opportunities for faster development than other chains.

Conclusion: As long as TON's growth trend of attracting new users continues, it is worth investing some time to pay attention to the development of applications on TON.

However, if the number of protocols and applications on the TON chain is still scarce after a period of time, and the ecosystem is still incomplete, it will be difficult to sustain the growth brought about by popular projects alone.