The Federal Reserve will hold a monetary policy meeting on the 17th and 18th, Eastern Time, and announce the latest interest rate policy at around 2 a.m. on the 19th, Taiwan time. At present, it seems that it is a certainty to start cutting interest rates. The key point is that it will be cut once. Size 1 or size 2?

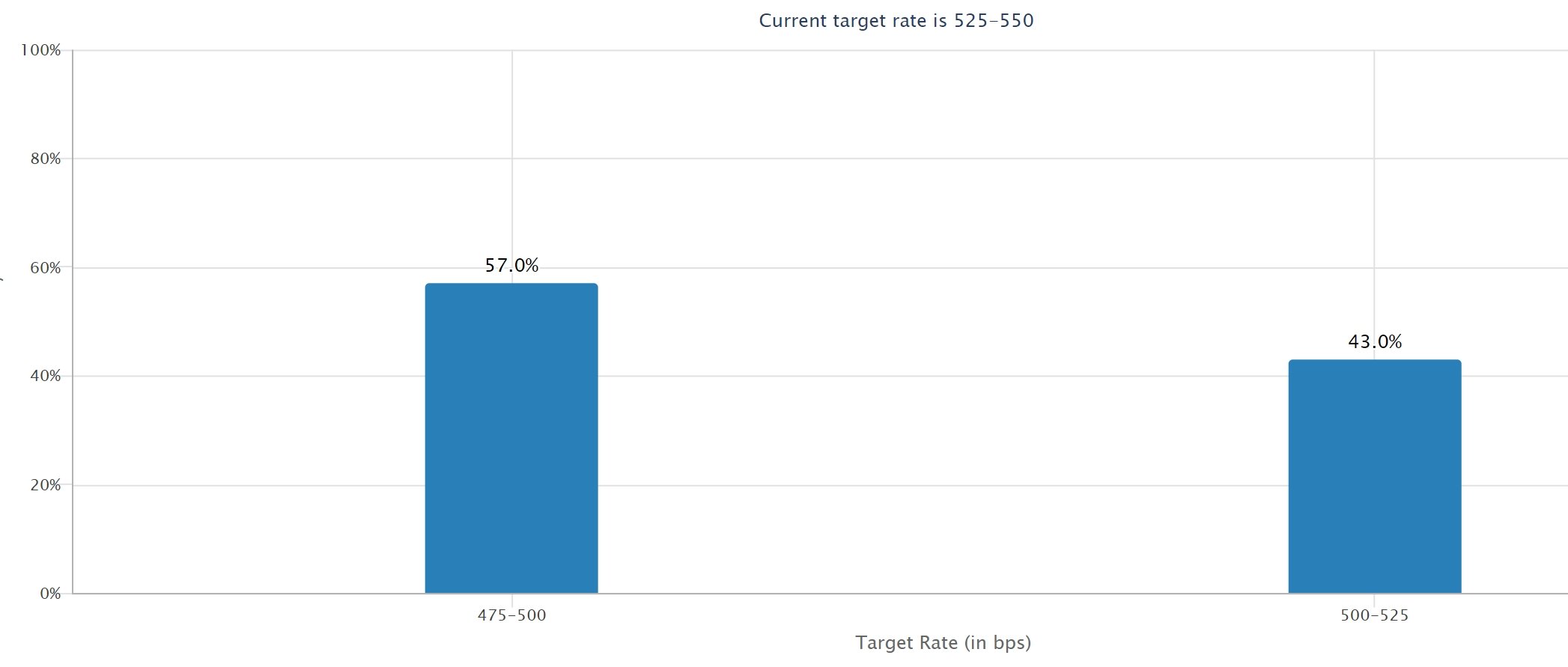

FedWatch data shows that current market expectations are that the probability of a 1-digit rate cut is 43%, and the probability of a 2-digit rate cut has risen to 57%. Usually an interest rate cut is a major benefit to risky assets such as Bitcoin and will bring huge liquidity to the market; however, many experts are worried that if the interest rate is cut by 2%, the market will suspect that the U.S. economy is in recession, and the pace of interest rate cuts will lag behind, causing the currency to Markets and stock markets plummeted, and volatility intensified.

At the same time, the U.S. presidential election in November has also drawn much attention to the decision-making of the Federal Reserve. Republican presidential candidate and former U.S. President Trump recently warned that the Federal Reserve should not cut interest rates before the election. Democratic Senator Elizabeth Warren He asked the Federal Reserve to cut interest rates by 3 percentage points. If interest rates are cut by more than 2 percentage points at a time, Trump may criticize the Fed for helping the Democratic Party in the election.

In addition to interest rate decisions, investors and analysts will be paying close attention to two key points:

- The " dot plot " in the Fed's quarterly forecast update will show Fed members' expectations for interest rate trends in the next few years. If it is too aggressive, it may deepen market recession expectations;

- Federal Reserve Chairman Jerome Powell's press conference at 2:30, analyzing his remarks on future policies.

JPMorgan Chase CEO warns of recession risk

JPMorgan Chase CEO Jamie Dimon recently warned that although people's confidence in inflation easing is increasing, he did not rule out the possibility of stagnant inflation, that is, an economic recession and rising inflation. He mentioned increased government spending, Factors such as rising deficits mean that although inflation data are improving, indicators such as employment and manufacturing show that the economy is in a state of tension:

Basically in the short term, inflation will continue for years to come.

Jamie Dimon emphasized that despite some positive economic signals, there are still major uncertainties, and inflationary pressure may drag down the U.S. economy. He has been warning about the economic slowdown. He predicted last month that a soft landing of the U.S. economy may be possible. The ratio is only 35% to 40%, suggesting that the United States may enter an economic recession and mentioning uncertainties such as geopolitics, housing, and consumption.

JPMorgan Chase is the only major U.S. bank to insist that the Federal Reserve will cut interest rates by two percentage points.

Last month, Ball hinted that if the unemployment rate rises, he would be open to a 2-point cut. If the Fed lags behind in cutting interest rates, the consequences will be disastrous. Former Fed Vice Chairman Alan Blinder once pointed out that in the history of the United States, the Fed has The Legislature has only once succeeded in achieving an apparent soft landing, in the mid-1990s, when high interest rates managed to curb inflation without tipping the economy into recession.

Bitcoin may experience major fluctuations

10x Research also recently pointed out that if the Federal Reserve decides to cut interest rates by 2% this week, it may indicate that the Fed is increasingly worried about the economy, or it may be lagging behind in cutting interest rates in response to the upcoming economic slowdown, which will cause investors to reduce their interest in Bitcoin. Exposure to risky assets such as currencies and stocks.

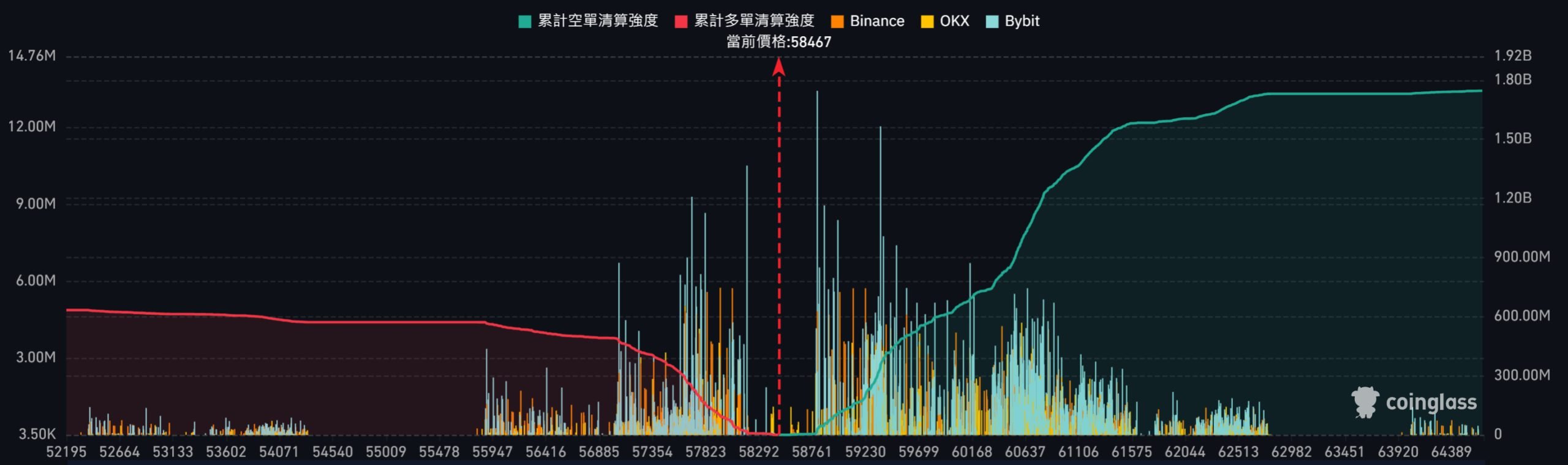

Coinglass data shows that if Bitcoin rebounds and exceeds US$62,000, the cumulative short order liquidation intensity of mainstream centralized exchanges such as Binance, OKX, and Bybit will reach US$1.6 billion. If Bitcoin falls below US$57,000, the cumulative short order liquidation intensity of mainstream centralized exchanges will reach US$1.6 billion. The cumulative multi-order liquidation intensity will reach US$490 million, so the trend may fluctuate greatly in the future.

However, it should be noted that the liquidation chart does not show the precise number of contracts to be liquidated, or the precise value of the contracts to be liquidated. The cylinders on the liquidation chart show the strength of each liquidation cluster relative to adjacent liquidation clusters.

However, it should be noted that the liquidation chart does not show the precise number of contracts to be liquidated, or the precise value of the contracts to be liquidated. The cylinders on the liquidation chart show the strength of each liquidation cluster relative to adjacent liquidation clusters.

Therefore, the liquidation chart shows the extent to which the underlying price will be affected when it reaches a certain price. A higher liquidation cylinder means that after the price reaches that point, it will react more strongly due to the liquidity wave.