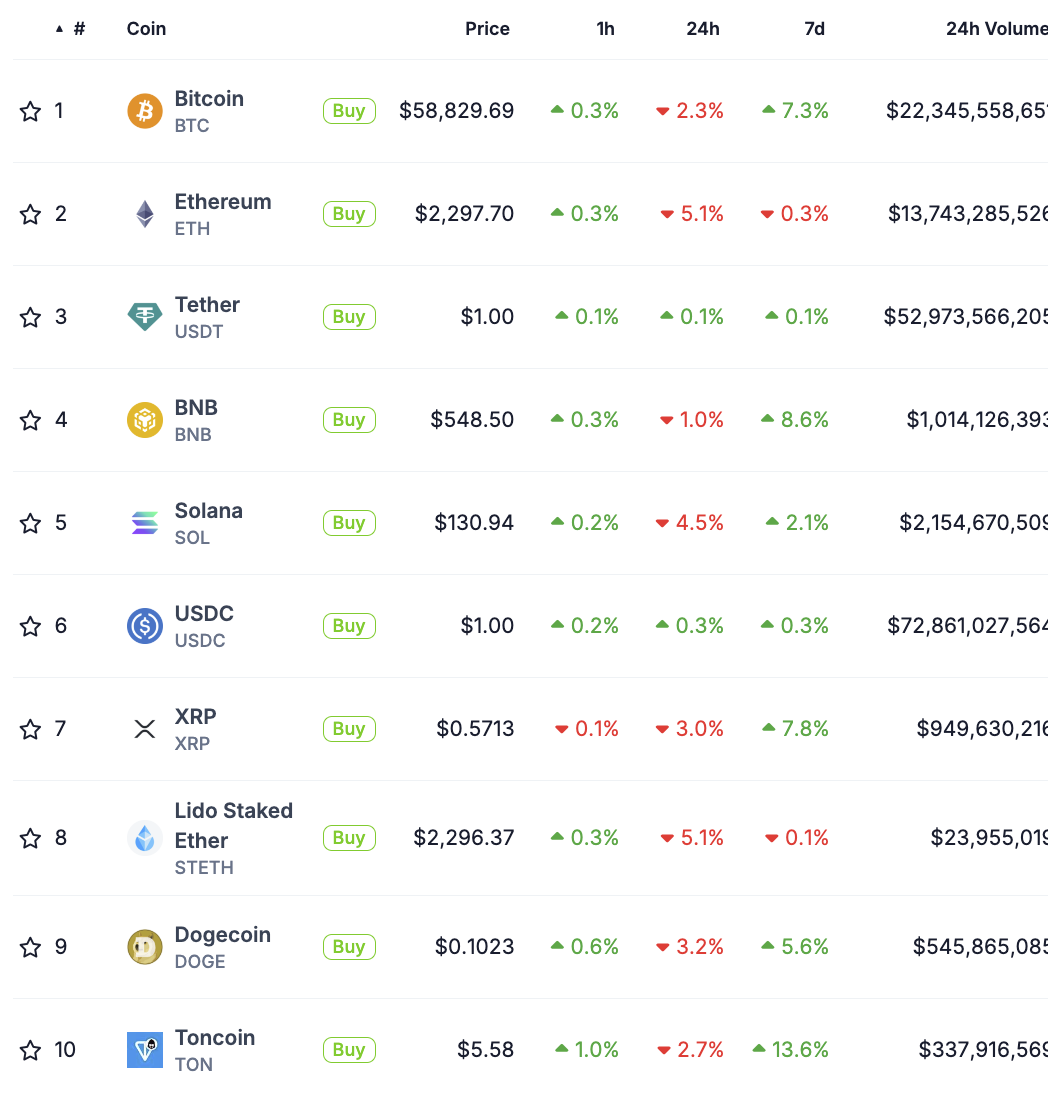

Over the past 24 hours, Bitcoin (BTC) has fallen 2.3% and Ethereum (ETH) has fallen 5.1%, ahead of a crucial week of interest rate decisions from central banks around the world. The total cryptocurrency market Capital is now $2.13 trillion, down 3.8% over the past day.

Volatility increased over the weekend as Bitcoin fell to a low of $58,200, before recovering slightly and trading above $58,800. The market remains Chia , with bulls and bears debating Bitcoin’s future direction.

Source: Coingecko

As Bitcoin fell, altcoins suffered. Over the past 24 hours, Ethereum fell 5.1% to below $2,300, while Solana (SOL), Dogecoin (Doge), and Ripple (XRP) fell 3-4.5%. Among the top 100 Cryptoasset , FET (ASI), Injective (INJ), Internet Computer (ICP), PEPE (PEPE), and Ondo (ONDO) posted the biggest losses, Medium 7%.

Cryptocurrency markets are bracing for more volatility as the US Federal Reserve’s interest rate decision approaches. Economists warn that a 25 basis point rate cut could lead to a “sell the truth” phenomenon, as the market has been anticipating it.

Market sentiment around the Fed's rate decision has shifted dramatically. The CME FedWatch tool now shows a 41% chance of a 25 basis point cut and a 59% chance of a 50 basis point cut, up from just 30% last week.

Source: CME

Market participants appear to favor a 50 basis point cut. According to economist Steve Hanke of Johns Hopkins University, the cut could boost the cryptocurrency market, although a potential recession could trigger a sell-off in risk assets.

The Fed is scheduled to make a key decision on Wednesday, September 18, which could mark the first rate cut since 2020. At the same time, the Bank of England and the Bank of Japan will also announce their interest rate decisions on September 19. The Bank of England just cut its interest rate from 5.25% to 5% on August 1, marking the first cut since the tightening cycle began in late 2021. The Bank of Japan, with its long-term tight monetary policy and negative interest rates, is also closely watched at its upcoming meeting.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Annie

According to Cryptobriefing