On April 19, 2024, Bitcoin miners witnessed the block reward halving from 6.250 BTC to 3.125 BTC. This event, which occurs every four years, has historically triggered Bitcoin bull runs, generating excitement throughout the cryptocurrency community.

Bitcoin price action has been lukewarm since the halving, so some analysts are calculating when a Bitcoin bull run might begin.

Bitcoin bull market starts on average 170 days after halving

Cryptocurrency analyst Quinten Francois has highlighted a consistent pattern in Bitcoin cycles . He noted that the average Bitcoin cycle begins approximately 170 days after the halving.

It has now been 150 days since the Bitcoin halving, so if historical data is consistent, a bullish reversal could occur in about 20 days.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

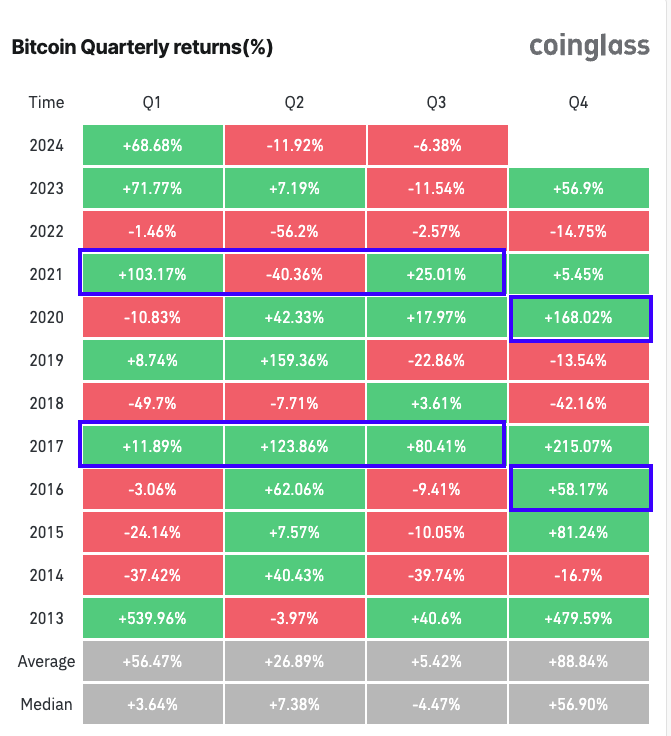

Adding to the bullish sentiment, analyst Lark Davis discusses the impressive quarterly returns in the past halving years, 2016 and 2020. He points out that the fourth quarter after the halving has been consistently bullish.

Also, in 2017 and 2021, following the halving, Bitcoin's price movement was bullish from the first to the third quarter.

“If history repeats itself, it could bring enormous benefits that most people can’t even imagine,” Davis said . He forecasts growth opportunities through 2025.

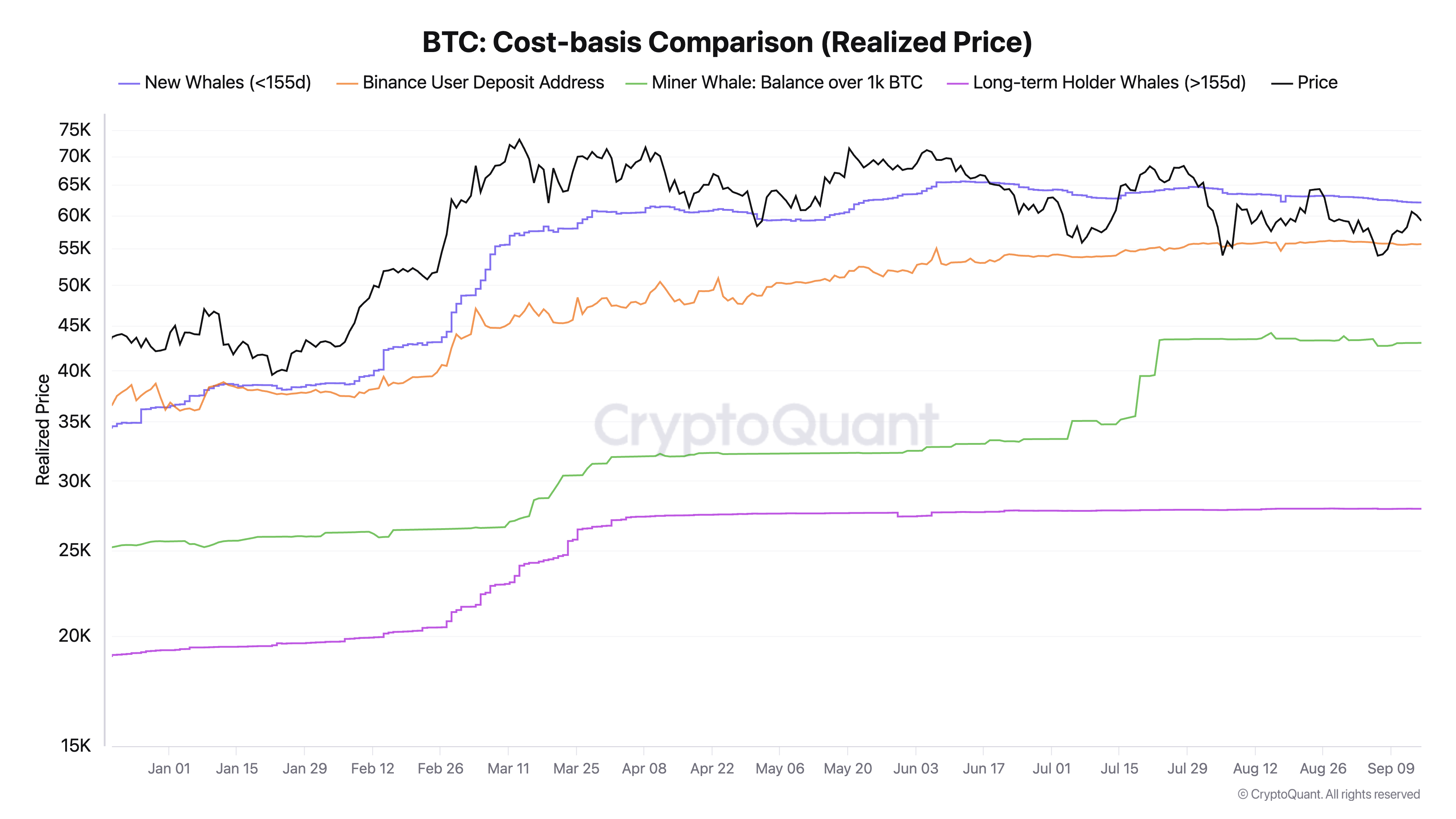

Meanwhile, Ki-Young Joo, CEO of on-chain analytics platform CryptoQuant, outlined key price levels that investors should keep an eye on. These levels represent the average cost of Bitcoin for different groups of investors and serve as important psychological and technical indicators.

The first level to watch is $62,000, which marks the cost basis for trust wallets and exchange-traded funds (ETFs) that began trading in January 2024. A loss reversal to this level could prompt some investors to liquidate their trades at breakeven, and could set up a resistance zone.

Another important level is $55,000, which is the average purchase price of Binance traders. With the current Bitcoin price around $58,500, which is about 7% above this range, this level could potentially act as short-term support.

The cost threshold for the mining sector is 43,000. Since Bitcoin is trading much higher than this, this level could act as a strong support zone in the medium term. However, a drop below this threshold could indicate difficulties among miners and put downward pressure on the Bitcoin price.

Finally, 27,000 is an important level. It represents the average entry point for Bitcoin whales . This level is considered long-term support and could represent a bottom if the market turns bearish.

Read more: Bitcoin Halving Cycle and Investment Strategy: What You Need to Know

As the anticipated bull market countdown approaches, the interaction of these price levels with established historical patterns will play a key role in determining Bitcoin’s short-term price action.