Bitcoin (BTC) is struggling to break through $60,000, but there has been no selling among holders. Instead, many are holding onto the asset, which has been reflected in the decrease in exchange activity.

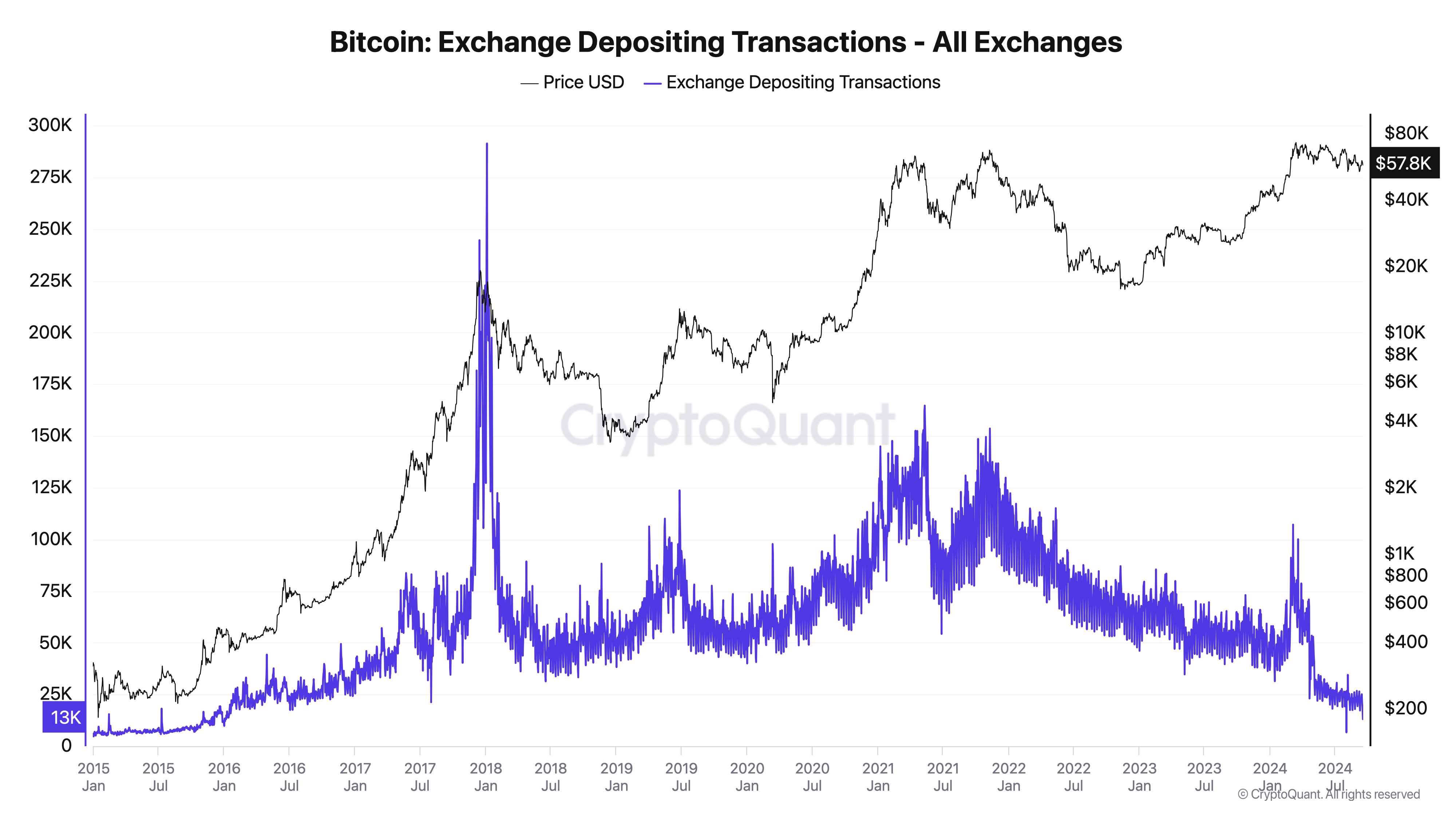

The number of daily addresses sending BTC to exchanges has hit a multi-year low, which is in line with market expectations as they await the Federal Reserve’s decision on September 18.

Bitcoin traders keep holding their coins

On-chain data shows a decline in BTC exchange deposit addresses , which tracks the number of addresses sending transactions from the Bitcoin network to cryptocurrency exchanges. The metric has been in a downward trend since reaching a yearly high on March 5.

The number of addresses depositing coins to exchanges decreased by 19% last week. A decline in this indicator means that traders or investors are holding coins rather than selling them.

The recent decline in trading activity is consistent with market expectations that there is a 50% chance of a 0.5 percentage point rate cut at Wednesday's Federal Reserve meeting.

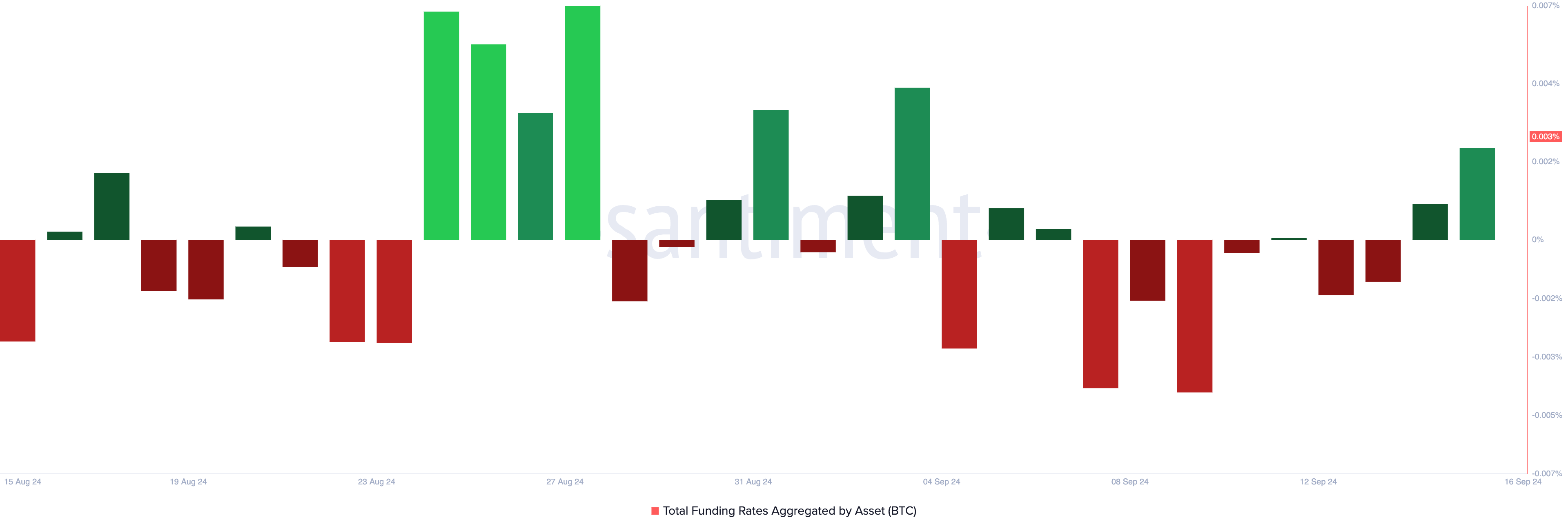

When selling pressure on Bitcoin eases ahead of a possible rate cut, it often suggests that investors are anticipating a more favorable market environment. This bullish sentiment is reflected in Bitcoin’s funding rate, which turned positive two days ago after six consecutive days of negative values.

At press time, BTC’s funding rate is 0.003%, indicating stronger demand for long positions than short positions.

Read more: 5 Platforms to Buy Bitcoin Mining Stocks After the 2024 Halving

BTC Price Prediction: Rise Above $61,000 Possible

At press time, Bitcoin (BTC) is trading at $58,726 and has been in a downward trajectory since last weekend. However, the rising Chaikin Money Flow (CMF) suggests that accumulation is occurring.

Currently, the CMF tracks the flow of funds into the BTC market and is at 0.06, forming a downward price and upward divergence, indicating that market participants are accumulating more BTC ahead of Wednesday’s Federal Reserve meeting.

If the coin bounces, it could retest the $61,388 resistance level, which could push Bitcoin’s price towards $64,312 .

Read more: A comprehensive guide to trading Bitcoin futures

However, if the accumulation slows and the downtrend continues, BTC could lose the $54,302 support and fall to the August 5 low of $49,000.