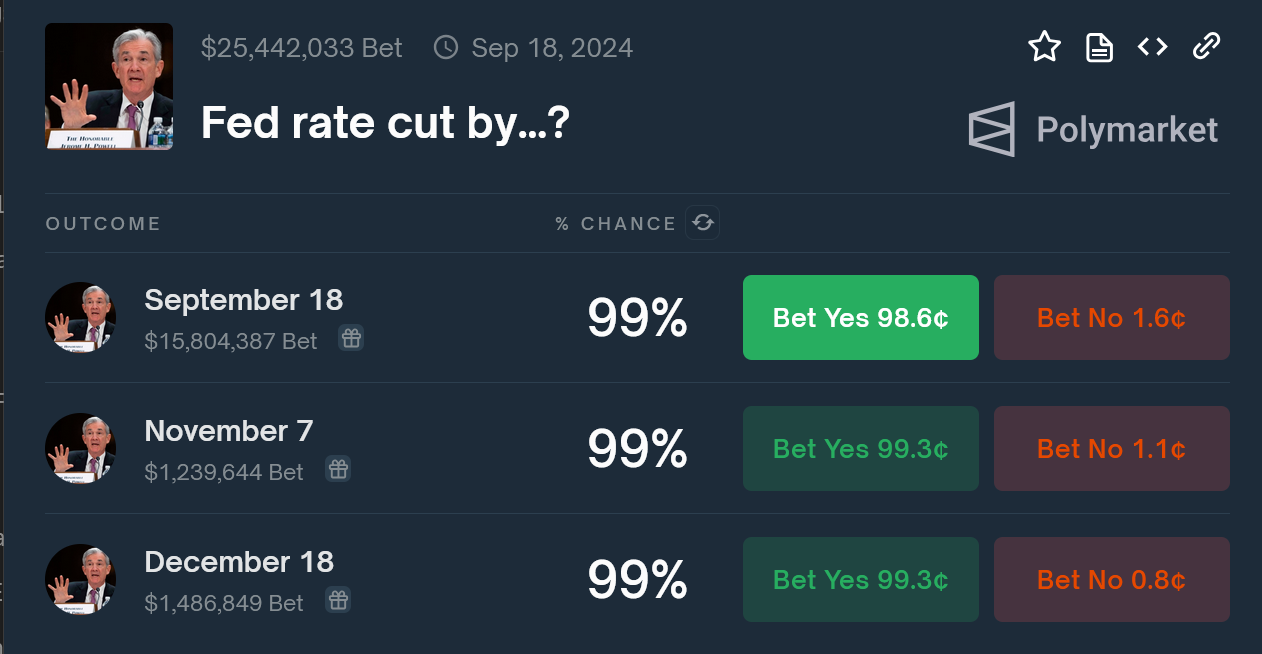

Traders at Polymarket are now betting heavily on the US Federal Reserve (Fed) to cut interest rates at its next meeting on September 18, 2024, with odds as high as 99%. Current predictions suggest the Fed could cut rates by 25 basis points, lowering the federal funds rate to a range of 5% to 5.25%.

Source: Polymarket

While some economists are predicting a deeper cut, namely 50 basis points , the general consensus is still leaning towards two cuts this year, with an end-of-year rate target of around 4.75% to 5%.

According to CME's FedWatch tool, the probability of a 50 basis point cut has risen to 65%, surpassing the 35% odds for a 25 basis point cut previously.

This interest rate adjustment is expected to have a significant impact on risk assets like Bitcoin. Lower interest rates typically lead to increased liquidation in the market, driving investors to higher-yielding and riskier assets. As a result, many analysts predict a sharp rise in Bitcoin prices, although this could also lead to short-term market volatility.

A Bitfinex analyst predicts that Bitcoin could fall 15% to 20% after the rate cut, with a potential low of $40,000 to $50,000. The prediction is based on historical data showing declining returns at cycle peaks and price declines during bull market corrections. However, these predictions are subject to change due to changes in macroeconomic conditions.

The Fed last cut interest rates in March 2020 in response to the impact of the COVID-19 pandemic.

Earlier this week, one economist warned that a 25 basis point rate cut could lead to a “sell the truth” event, putting pressure on risk assets.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Annie

According to Cryptobriefing