Bernstein analysts suggest that DeFi could perform well if the Federal Reserve cuts interest rates in the US. International liquidity and interest rate differentials could be important for cryptocurrencies.

These predictions contradict concerns that rate cuts would hurt investments in Bitcoin and Ethereum.

Interest rate cuts could cause problems

As the U.S. economy continues to suffer from inflation and rising living costs, pressure is growing on the Federal Reserve to cut interest rates. While 0.5%p has already been discussed, there are now voices calling for a cut beyond that level. On the 16th (local time), Bloomberg reported on the appeal of three Democratic senators for a 0.75%p cut in the benchmark interest rate. They cited rumors that the Fed's rate cut could be minor.

Senators Elizabeth Warren, Sheldon Whitehouse, and John Hickenlooper called for a 75-point rate cut in a letter to ease potential risks to the labor market. The exact terms of the cut are disputed among factions, but it is very likely to pass in some form.

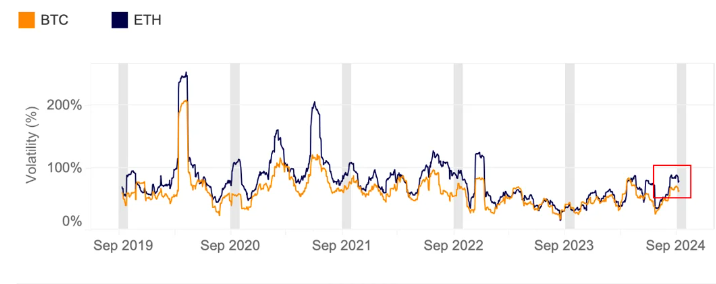

However, from the perspective of the cryptocurrency community, this proposed cut is more controversial. According to research by Bitfinex, Bitcoin’s price could bounce back immediately after the rate cut, but the data ultimately shows a bearish signal.

The rate cut attracts new investment into the US market, but it also suggests overall weakness. Bitcoin is perceived as a risky asset, so the rate cut could have unintended consequences . Overall investment increases, but the market is averse to risky assets.

Additionally, September is generally a bearish month for stock markets. These declines, independent of the market, could be challenging for cryptocurrencies.

Bernstein's narrative

However, a report from Bernstein analysts paints a more positive picture. Analysts Gautam Addagni, Mahika Sapra, and Sanskar Chandalia argue that DeFi can capitalize on new opportunities.

Specifically, global traders can provide liquidity in decentralized markets for US dollar-based stablecoins, allowing DeFi to capitalize on US-specific market conditions and profit from the performance of the dollar.

This view is consistent with Arthur Hayes’ comments on the rate cut in August 2024. In particular, he noted the interest rate differential between the US and other currencies, especially the yen. Global traders can use this differential to leverage DeFi and generate new profits.

“With interest rate cuts looming, DeFi yields are looking attractive again. This could be the catalyst to reopen crypto credit markets and revive interest in DeFi and Ethereum,” Bernstein analysts argued.

Read more: Bitcoin crash, US elections, emergency rate cuts: Polymarket traders’ top bets

These predictions prompted Bernstein to add Ethereum-based liquidity protocol Ave to his portfolio. Specifically, the firm removed two derivatives protocols, GMX and Synthetix, and added Ave.

This clearly shows two market trends that Bernstein sees. First, lending markets and international liquidity could be key to long-term gains. Second, despite recent underperformance, he is betting on Ethereum and the protocols built on its blockchain.

So far, many factors remain uncertain. The rate cut could be anywhere from 25 to 75 points, or it could not happen at all. Nevertheless, Bernstein’s bold prediction could help build optimism in the sector.