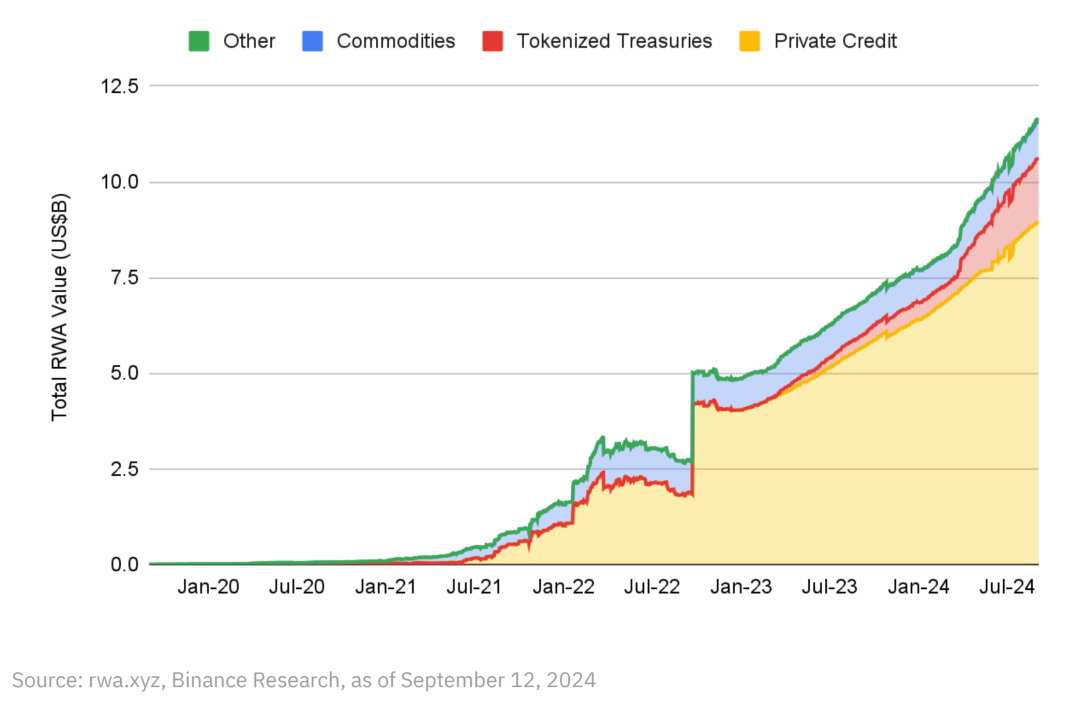

As of 2024, the total value of on-chain RWAs has exceeded $12 billion (excluding the $175 billion+ stablecoin market. The tokenized US Treasury market was $769 million at the beginning of 2024 and has rapidly grown to $2.2 billion by September.

Original text: RWAs: A Safe Haven for On-Chain Yields? (Binance)

Author: Shivam Sharma, Chloe Tan

Compiled by: AiYing Compliance

The RWAs market has experienced significant growth since 2024, becoming one of the most promising application scenarios in the blockchain world. According to the report data, as of 2024, the total value of RWAs on the chain has exceeded 12 billion US dollars (excluding the 175 billion+ stablecoin market) . This huge market size mainly comes from tokenized bonds, real estate, and commodities, reflecting the integration trend of traditional financial assets and blockchain technology.

Among them, tokenized U.S. Treasuries are the most prominent asset class, showing significant growth potential. As U.S. Treasuries are widely regarded as one of the safest investment tools in the world, their tokenization has attracted a lot of attention from investors. The report pointed out that the tokenized U.S. Treasury market was worth $769 million at the beginning of 2024, and had grown rapidly to $2.2 billion by September . In just a few months, the market size has nearly tripled. This growth reflects investors' demand for assets with stable returns and high security in a high-interest rate environment.

The tokenization of U.S. Treasuries provides a new investment channel, especially in the field of blockchain, which enables investors to trade these assets more conveniently around the world. In addition, the participation of institutional investors such as traditional financial giants such as BlackRock has greatly promoted the expansion of this field. The tokenized treasury products they launched have enabled more traditional investors to enter this emerging market, driving the rapid development of the RWAs market. As more and more financial institutions bring real-world assets to the chain, the market size of RWAs is expected to continue to expand, especially in asset classes that are frequently traded and have high security, such as government bonds and commodities such as gold. At the same time, with the gradual clarification of the regulatory framework and the continuous innovation of technology, RWAs are expected to attract more institutional and individual investors, further promoting the application of blockchain in traditional finance.

Aiying Aiying will summarize the market status of RWAs based on Binance’s report titled “RWAs: A safe haven for on-chain returns?”

Introduction to RWAs

Real-World Assets (RWAs) refer to the digital tokenization of tangible or intangible assets in reality through blockchain technology. These assets can include asset categories in traditional finance such as currency, real estate, bonds, and commodities. The tokenization process is to convert these traditional assets into digital form on the blockchain so that they can be traded and managed in the decentralized finance (DeFi) ecosystem. The tokenization of RWAs aims to provide a more efficient, transparent, and global financial tool for the traditional financial market.

Through RWAs, traditional financial users can take advantage of the advantages of blockchain technology, such as higher transparency, real-time transaction speed, and removing middlemen to reduce costs. In addition, Web3 users can also obtain real-world investment opportunities through RWAs, such as purchasing tokenized treasury bonds, real estate, or commodities, thereby breaking the limitations of high investment thresholds and closed markets in traditional finance.

The introduction of RWAs has built a bridge between traditional finance and blockchain technology. For investors who are more concerned about the volatility of cryptocurrencies, RWAs provide a relatively stable on-chain asset option . Both institutional investors and individual investors can obtain real asset returns on the blockchain through RWAs, thereby realizing the organic combination of traditional finance and DeFi ecology.

Main categories of RWAs

In the real world assets (RWAs) market, different types of assets are tokenized on the chain, and each asset class has its own unique characteristics and market opportunities. The following is a detailed analysis of several major categories:

1. Tokenized U.S. Treasury Bonds

U.S. Treasury bonds are widely considered one of the safest investments in the global financial market, as they are backed by the U.S. government and carry very low risk. As a result, tokenized U.S. Treasury bonds have become one of the most popular real-world assets on the chain . In the current high-interest environment, tokenized U.S. Treasury bonds provide investors with a significant return and are often seen as a source of "risk-free returns."

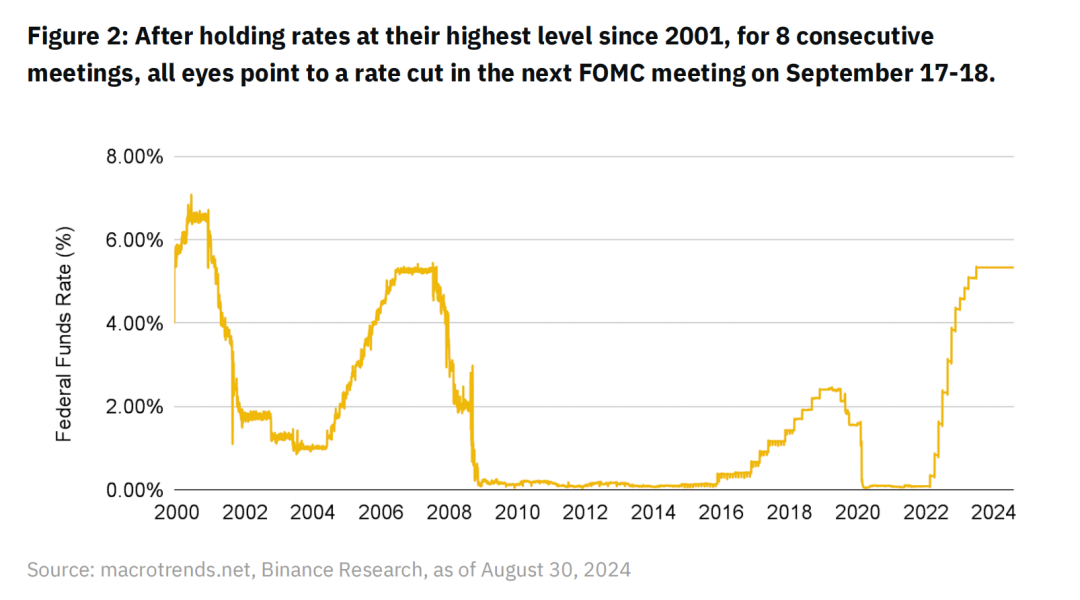

Due to the Federal Reserve's multiple rate hikes in the past few years, the yield on U.S. Treasury bonds has reached its highest level in nearly 23 years, which has attracted a large number of investors to participate in the tokenization of this asset class. Tokenized U.S. Treasury bonds allow investors to participate in the Treasury market more flexibly through blockchain technology, reducing transaction costs, increasing transaction speed, and increasing market transparency. Investors can trade these Treasury bonds 24 hours a day around the world without relying on the time constraints of traditional financial markets.

However, the report notes that the Federal Reserve is expected to begin a rate-cutting cycle in the coming months. This means that while tokenized Treasury bonds have performed strongly in the current high-interest rate environment, their appeal may diminish as interest rates fall. Nevertheless, given the security and stability of Treasury bonds, it may continue to attract users who want to make a solid investment on the chain.

2. Private credit

The private credit market refers to debt financing provided by non-bank financial institutions to businesses or individuals, usually for the financing needs of small and medium-sized enterprises.

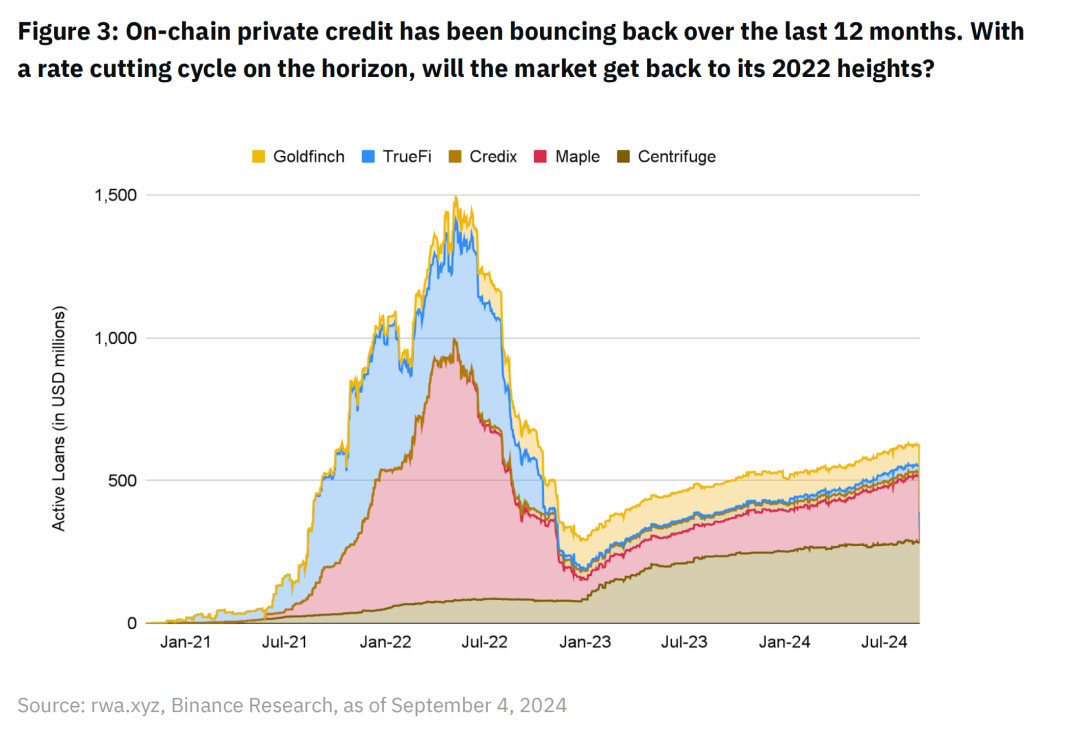

On-chain private credit grew rapidly in 2021 and peaked in mid-2022, with loan volume approaching $150 billion. However, the market subsequently experienced a significant decline, especially in the second half of 2022. (Mainly affected by the collapse of institutions such as FTX and 3AC) The private credit market is huge in the world. According to the International Monetary Fund (IMF), the global total value of the market will exceed $2.1 trillion in 2023. The size of the on-chain private credit market is currently about $9 billion, accounting for 0.4% of the global private credit market.

Although the on-chain private credit market is relatively small, it is growing rapidly, especially in the decentralized finance (DeFi) sector. On-chain private credit provides investors and borrowers with greater transparency, efficiency, and automated processes . Smart contracts can ensure the execution of lending agreements without the need for third-party intermediaries, which reduces transaction costs and time, while also reducing the risk of default.

For example, projects such as Centrifuge provide financing to small and medium-sized enterprises by tokenizing invoices, real estate and other assets and using them as collateral, which enables private credit to be more liquid on the chain. Although the overall size of the private credit market is small, the potential for private credit on the chain remains huge as blockchain technology becomes more popular.

3. Commodities

Commodity markets, especially gold, are another important area for tokenization in RWAs. As a stable, inflation-resistant asset, gold has historically been favored by investors . Tokenized gold allows investors to trade and hold gold more conveniently without actually keeping physical gold bars or paying storage fees.

In the tokenized gold market, Paxos Gold (PAXG) and Tether Gold (XAUT) dominate, together accounting for about 98% of the market share. The total market value of tokenized gold is about $970 million. Both Paxos Gold and Tether Gold provide 1:1 gold backing through blockchain technology, ensuring that each token has a corresponding physical gold reserve, allowing investors to participate in the gold market with higher liquidity and transparency.

Although the tokenization of gold has been widely accepted, the tokenization market for other commodities such as oil, natural gas or other precious metals is still in its early stages and the market size is relatively small . These commodities have not yet been widely adopted on the blockchain due to storage, transportation and other issues, but as technology develops, more commodities may be tokenized in the future. Related articles: [Stablecoin] Tether launches gold-collateralized stablecoin innovation and analysis of the legal framework in El Salvador where it is located

4. Bonds and Stocks

The market size of tokenized bonds and stocks is relatively small, at about $80 million, and is in its early stages of development. Although the market is small, tokenized bonds and stocks provide investors with a more flexible way to invest, especially cross-border investments.

In terms of bonds, there are currently some tokenized non-U.S. Treasury products, especially European debt products and a few corporate bonds. These tokenized bonds allow investors to trade traditional bond assets on the chain at a lower cost and higher efficiency. In addition, tokenized bonds enhance market transparency through blockchain technology, allowing investors to track bond price fluctuations and transaction records in real time.

In terms of stocks, there are already some tokenized stocks of popular technology companies in the market, such as Coinbase and NVIDIA. By tokenizing stocks, investors can trade them on decentralized trading platforms with higher liquidity and in a global manner, without being restricted by the trading time and geographical restrictions of traditional stock markets.

5. Real estate and air rights

Real estate tokenization is one of the earliest proposed blockchain application scenarios, but despite its high potential market, it has not yet achieved large-scale adoption. Real estate tokenization allows ordinary investors to participate in the real estate investment market, which originally required a high capital threshold, by dividing property assets such as real estate assets or real estate investment trusts (REITs) into small tokens.

For example, the Parcl project focuses on tokenized real estate indices, allowing users to gain price exposure to real estate markets in different regions through blockchain without directly owning properties. This form of tokenization breaks the high financial barriers of traditional real estate investment and enables small investors to enter the global real estate market.

The tokenization of air rights is an emerging field. Although the market is still small, it is gradually attracting the attention of investors. Air rights refer to the right to develop and use the air space above a certain building or land. Through blockchain technology, this right can be tokenized and traded on the chain, providing a new way of investment that is not physically restricted.

Infrastructure for RWAs

The tokenization of real-world assets (RWAs) relies on a complex and highly integrated set of technical infrastructure. These technologies include smart contracts, oracles, identity authentication and compliance systems, and asset custody mechanisms, which together constitute the core technical system to ensure the security, transparency, and compliance of the RWA project. The following is a detailed description of the RWAs infrastructure:

1. Smart Contracts

Smart contracts are the core technology of RWAs. They support the tokenization of assets and distribute off-chain benefits to the chain through automated mechanisms. Smart contracts are self-executing contracts that automatically execute contract terms when pre-set conditions are met without the intervention of intermediaries. This automation greatly improves efficiency and reduces human errors and opacity.

In RWAs, smart contracts usually use token standards such as ERC-20, ERC-721 or ERC-1155:

- ERC-20 : Used to represent homogeneous assets, such as tokenized currencies or bonds. These tokens are exactly the same in quantity and nature and are suitable for assets with high liquidity requirements.

- ERC-721 : Used to represent unique non-fungible assets, such as real estate or art. Each token corresponds to an asset with unique properties, which is suitable for non-interchangeable assets.

- ERC-1155 : Supports mixed management of homogeneous and non-homogeneous assets. It is a more flexible standard suitable for scenarios that need to handle both large-scale assets and individual unique assets.

Through smart contracts, RWAs can automate returns on the chain. For example, investors can receive interest or rental income related to tokenized assets regularly through smart contracts that hold tokenized assets. This process requires no manual intervention and is extremely transparent.

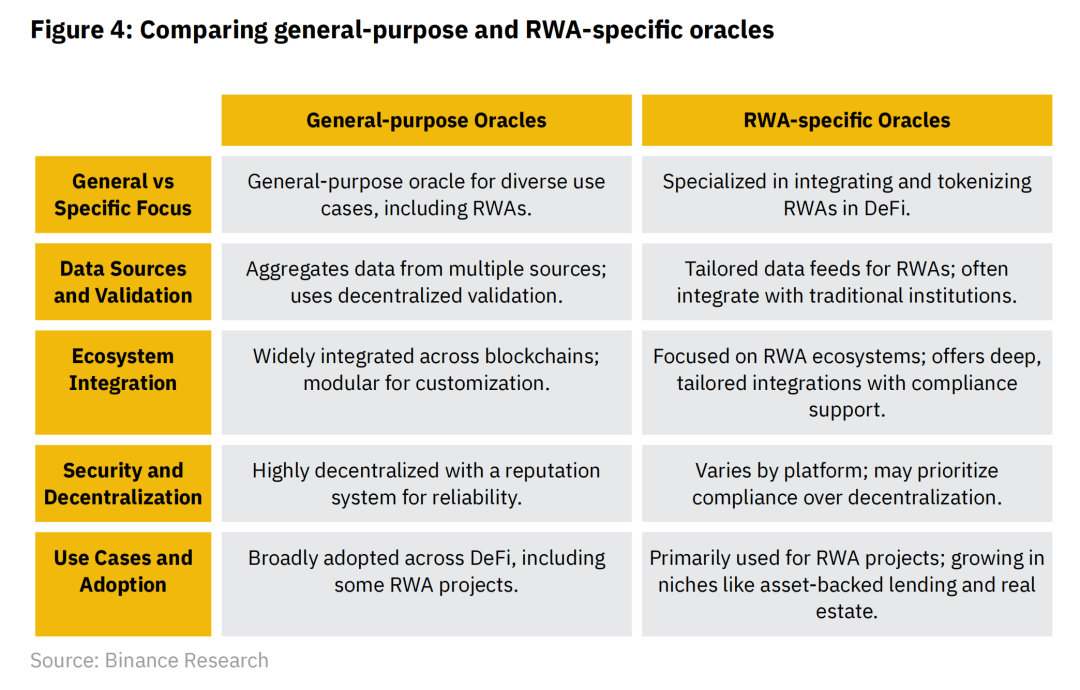

2. Oracle

Oracles are a key technology to ensure that on-chain assets can correctly reflect real-world data. Since the blockchain itself cannot directly obtain information from the off-chain world, the oracle acts as a bridge between on-chain and off-chain data. It provides off-chain real-world data, such as asset prices, legal events, market changes, etc., to smart contracts to trigger corresponding on-chain operations.

In RWAs, oracles not only provide off-chain market data, but can also trigger on-chain transactions based on legal agreements or contract terms . For example, in a loan agreement, when a borrower defaults, the oracle can automatically execute the default handling clause in the contract based on off-chain data (such as court rulings), ensuring that the execution of the on-chain contract is consistent with the real legal framework.

As the RWAs market grows, oracles designed specifically for RWAs are gradually emerging to meet more complex compliance and data verification requirements. For example, Chainlink's Proof of Reserve (PoR) system is an oracle solution specifically designed to verify whether on-chain assets actually exist, ensuring the correspondence between tokenized assets and real-world assets. This type of specially designed oracle will make the operation of RWAs more secure and compliant.

3. Identity verification and compliance

In the process of tokenization, compliance is a crucial factor for RWAs, especially when it comes to assets such as commodities, bonds, and real estate. The balance between the openness of the blockchain and the strict regulatory requirements of traditional finance (such as KYC/AML) is a key part of the compliance infrastructure of RWAs.

To ensure compliance with these requirements, the tokenization process of RWAs usually requires strict identity verification procedures. Specifically, KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements must be met before users participate to ensure the legitimacy of user identities and compliance of transactions. These processes are usually implemented through permissioned chains or hybrid models:

- Permissioned chains : Unlike fully decentralized public chains, permissioned chains control the access rights of participants, and only authenticated users can participate in transactions or tokenization processes. This model ensures that compliance requirements are met, especially when dealing with regulated assets.

- Hybrid mode : Some RWAs protocols adopt a hybrid mode, allowing specific functions (such as transactions) to be performed on the public chain, while keeping sensitive data and compliance processes in the permissioned chain. This ensures openness and transparency while meeting strict regulatory requirements.

Additionally, future technological developments may include Zero-Knowledge Proofs (ZK-Proofs) , which allow users to prove their identity in compliance with regulatory requirements (such as KYC) without disclosing any personal information, further enhancing the privacy protection of identity authentication on the blockchain.

4. Asset Custody

In the management of real-world assets, custody is a crucial link. RWAs’ asset custody is usually managed through a combination of on-chain and off-chain methods:

- On-chain custody : usually managed through multi-signature wallets or **multi-party computing (MPC)** technology. These technologies ensure the security of digital assets. For example, multi-signature wallets require multiple trusted parties to sign transactions before assets can be transferred, which improves security while reducing the risk of single point failure.

- Off-chain custody : Off-chain custody is to manage actual physical assets (such as real estate, physical gold, etc.), which need to be kept by a dedicated traditional custodian. Custodians are usually government-approved or regulated entities to ensure the security and compliance of real assets.

The on-chain and off-chain custody systems need to be tightly integrated to ensure the authenticity and security of tokenized assets. For example, in a tokenized gold project, the off-chain custodian must provide regular reports to prove that the actual amount of gold held is consistent with the number of tokens issued on the chain, thereby ensuring that the actual assets behind the tokens are properly protected.

In order to ensure user trust, RWA projects usually use third-party audits and regular reports to prove the management of assets by custodians. Chainlink's PoR oracle technology can also verify the custody of off-chain assets in real time to ensure the correspondence between tokenized assets and real assets.

Related articles:

- From the launch of Bitcoin and Ethereum trading and custody services by Switzerland's largest cantonal bank (ZKB), analyzing the Swiss cryptocurrency market and regulatory policies

- Analysis of crypto asset custody requirements and compliance in the United States, Hong Kong, and Singapore from the SEC's allegations against asset management company Galois Capital

- Learn about the latest application policy of Hong Kong Virtual Asset Custody Service Provider (TCSP) in 24 years

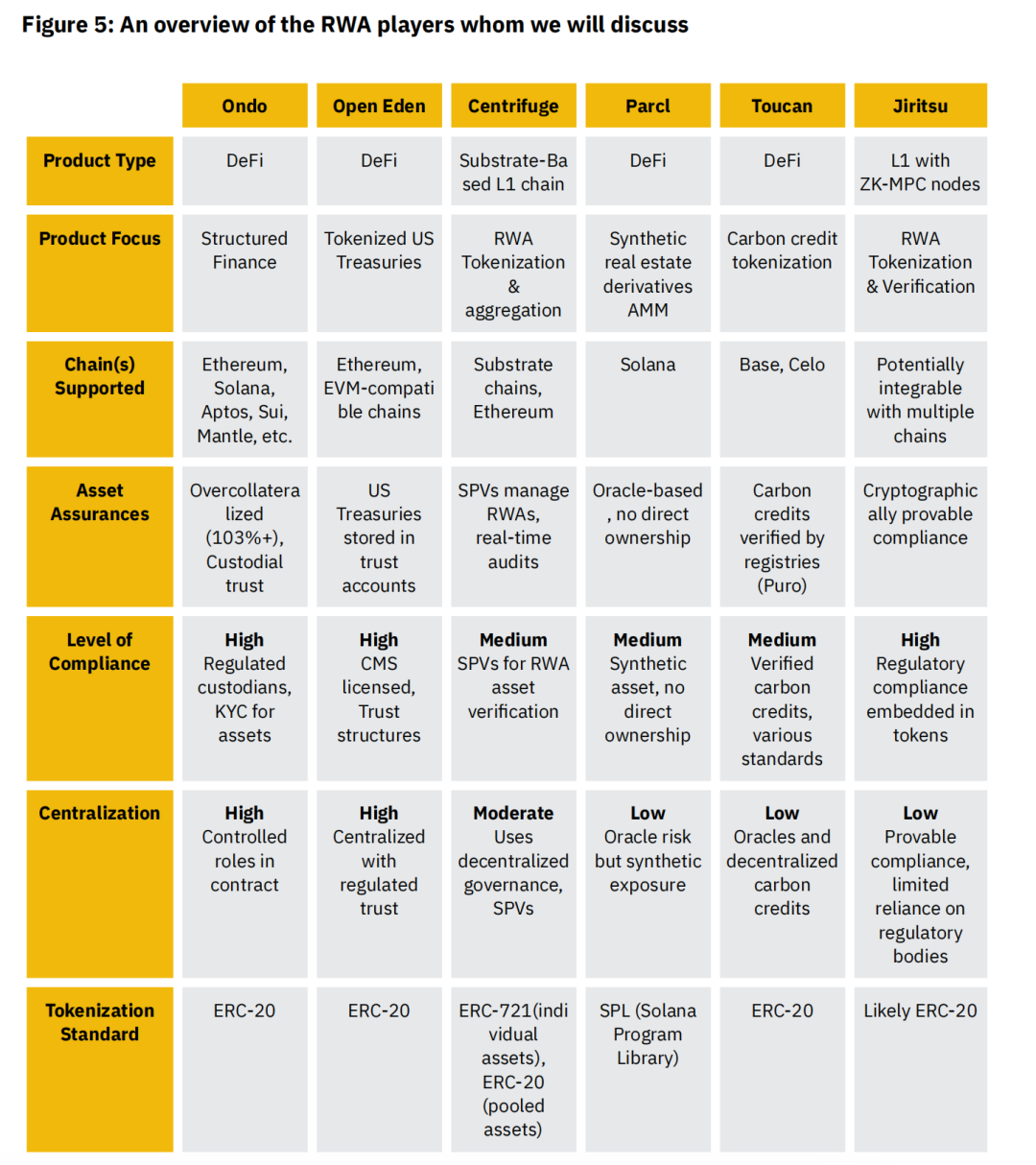

Analysis of RWAs’ main projects

The report analyzes six leading projects in the field of real world assets (RWAs) in detail. These projects cover different categories of assets such as US Treasury bonds, private credit, real estate, carbon credits, etc., and demonstrate their unique application scenarios and technical advantages. The following is a detailed analysis of these projects:

1. Ondo Finance

Ondo Finance is a project focused on bringing traditional financial assets to the blockchain. The platform provides users with stable US dollar returns through tokenized US Treasury bonds and bank deposits, with the goal of meeting the needs of investors seeking low-risk, stable returns. Its main products include USDY (US Dollar Yield) and OUSG (Ondo Short-Term US Government Bonds), which provide a variety of options from short-term Treasury bonds to fund management.

- USDY : Provides users with stable US dollar income. Users can deposit US dollar assets into the Ondo platform and obtain income that is automatically managed and distributed on the chain. This product is mainly aimed at investors who want to participate in the treasury bond market through on-chain financial products, reducing the complex procedures and fees in traditional finance.

- OUSG : This is a tokenized short-term U.S. Treasury product that provides relatively high security and stability and is suitable for risk-averse investors. The core value of OUSG is that it allows investors to easily access the U.S. Treasury market through blockchain while enjoying the transparency and high liquidity of decentralized finance.

By tokenizing low-risk assets such as U.S. Treasuries, Ondo Finance enables global investors to participate in these traditional asset markets more conveniently, further promoting the diversification of on-chain assets and the popularization of decentralized finance.

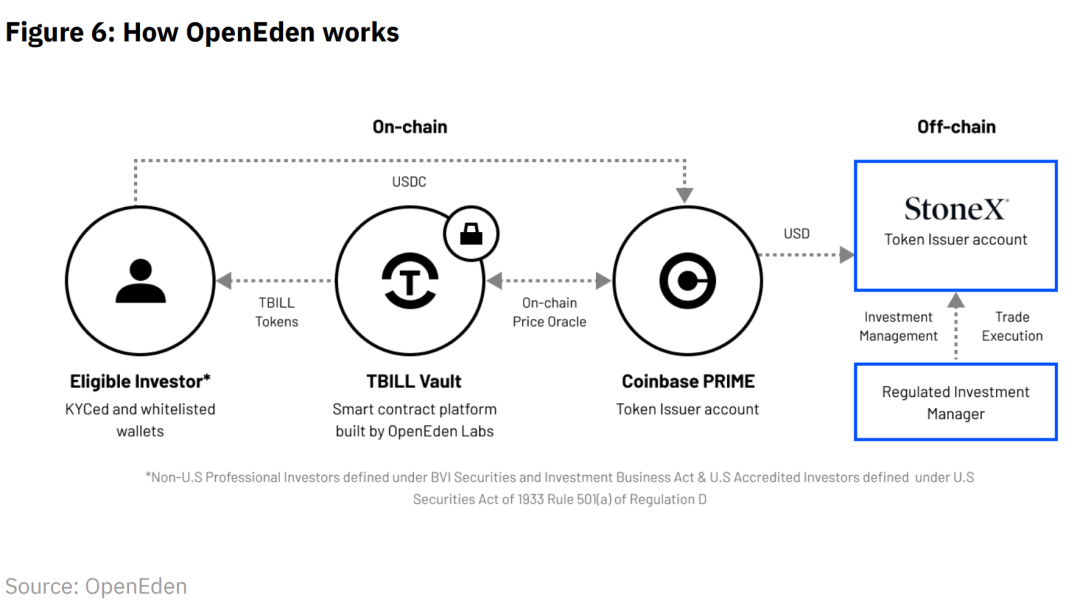

2. OpenEden

OpenEden focuses on tokenized U.S. short-term Treasury bonds, providing qualified investors with a channel to obtain stable returns on the chain. Its core product is the TBILL token, which is linked to the U.S. short-term Treasury bonds. Through TBILL, OpenEden brings the traditional bond market to the blockchain, providing investors with a transparent experience without intermediaries.

- TBILL tokens : TBILL tokens are linked to traditional short-term U.S. Treasury bonds, and each token corresponds to a certain share of U.S. Treasury bond returns. The advantage of this tokenized product is that it simplifies the process of traditional Treasury bond investment. Through blockchain technology, investors can track returns in real time and conduct more flexible buying and selling operations.

- Qualified investor restrictions : Currently, OpenEden's TBILL tokens are limited to qualified investors, which means that participants need to meet certain net assets or income standards to ensure compliance. This is also a significant difference between the platform and a fully decentralized open market, reflecting its balance between compliance and decentralization.

OpenEden's focus is to provide institutional investors and high net worth individual investors with high-yield U.S. Treasury bond investment channels while ensuring transaction security and transparency.

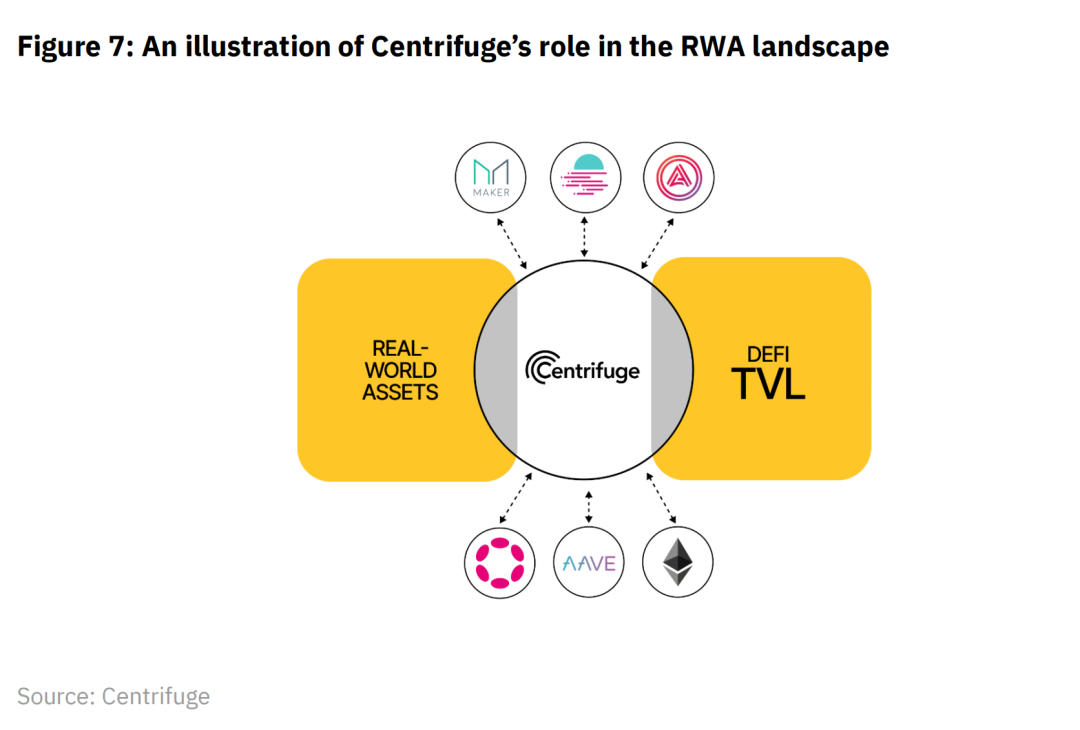

3. Centrifuge

Centrifuge is a Substrate-based Layer-1 blockchain platform that focuses on tokenizing real-world assets such as invoices and real estate. Centrifuge's main goal is to provide decentralized loan solutions for small and medium-sized enterprises and other entities that need financing. By tokenizing real-world assets such as accounts receivable, Centrifuge allows businesses to use these assets as collateral to obtain on-chain funding support.

- Invoice Financing : Through Centrifuge, businesses can tokenize their accounts receivable (i.e. invoices) and use these tokens as collateral for loans, thereby accelerating the flow of their cash flow. Compared with traditional invoice financing methods, Centrifuge improves transparency and efficiency through blockchain while reducing intermediary costs.

- Tokenization of real estate and other assets : In addition to invoices, Centrifuge also allows users to tokenize real estate and other high-value assets and use them for lending. This process provides businesses with more liquidity options and enables investors to gain exposure to these asset classes in a decentralized financial environment.

Centrifuge's advantages lie in its decentralized governance and asset transparency. It ensures the security and transparency of asset management through the Layer-1 blockchain, becoming an important promoter in the DeFi ecosystem to introduce real assets onto the chain.

4. Parcl

Parcl is a tokenization project focused on the real estate market, providing an innovative blockchain-based way for investors to gain price exposure to the real estate market without actually owning real estate. By creating an index of the real estate market, Parcl allows users to flexibly invest in real estate markets in different regions without having to directly purchase properties, lowering the threshold for real estate investment.

- Real Estate Index : Parcl has created multiple real estate market indices on the chain, which reflect the price fluctuations of real estate markets around the world. Users can purchase these index tokens to obtain price exposure similar to that of the real estate market, but without having to deal with the complex processes in traditional real estate investment (such as purchase, management, leasing, etc.).

- Low threshold investment : Traditional real estate investment usually requires a high capital threshold, while Parcl's tokenization solution enables small investors to participate in the global real estate market. Users can purchase small amounts of real estate index tokens and enjoy the added value of the real estate market without facing high housing costs.

Parcl provides a new way for investors who want to participate in the real estate market but cannot afford the high capital threshold, and also introduces decentralized liquidity to the global real estate market.

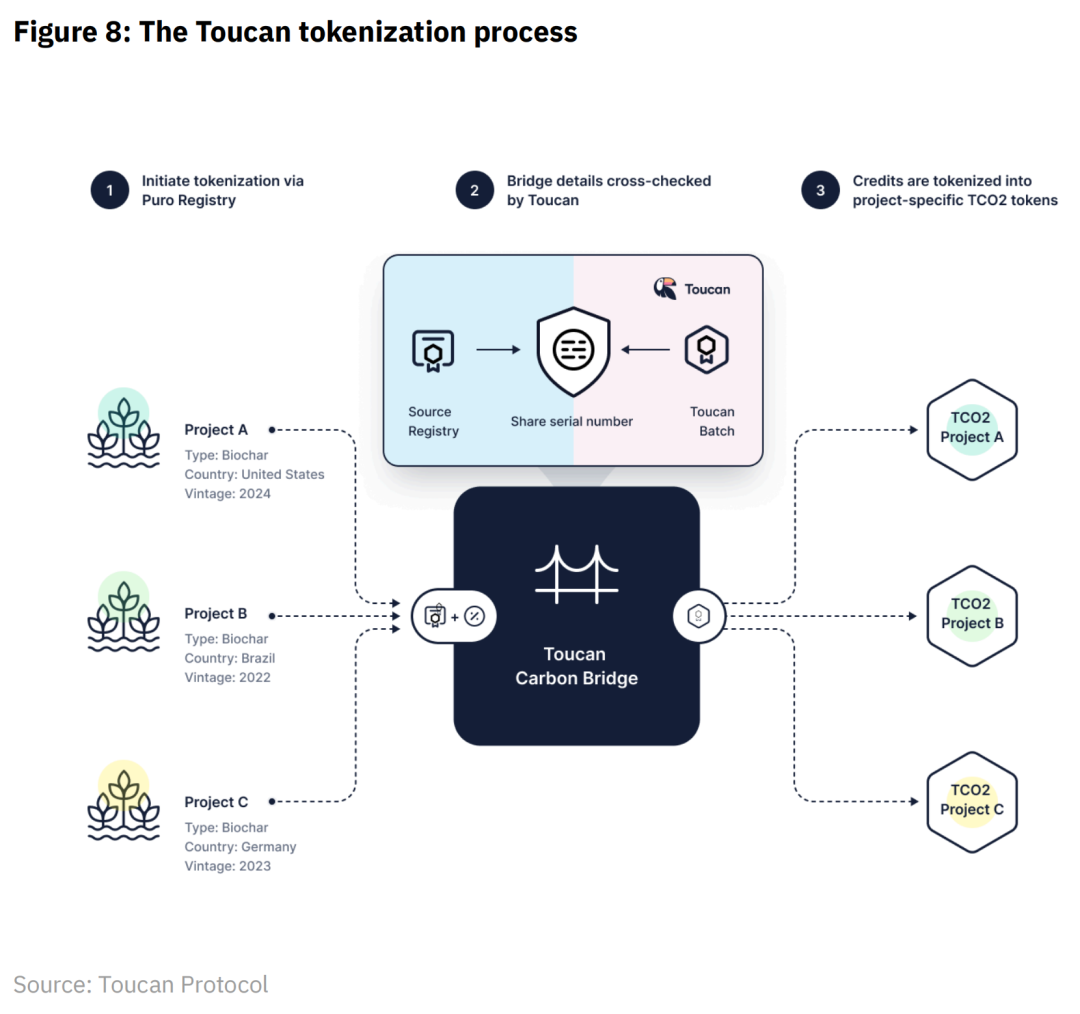

5. Toucan Protocol

Toucan is a platform focused on carbon credit tokenization, aiming to make carbon credits more transparent and tradable through blockchain technology. Through Toucan, individuals and companies can buy and trade carbon credit tokens, offset their carbon footprint, and support environmental projects. Toucan brings the traditional carbon credit market to the blockchain, making it more liquid and transparent.

- Carbon Credit Tokens : Toucan tokenizes traditional carbon credit certificates and creates carbon credit tokens that can be freely traded on the blockchain. Each carbon credit token represents a certain amount of carbon emission offsets. Companies or individuals can purchase these tokens to offset their carbon emissions and achieve environmental goals.

- Environmental protection project support : Through Toucan, users can not only offset carbon emissions by purchasing carbon credit tokens, but also directly support environmental protection projects around the world. Toucan's platform provides financial support for global environmental protection actions and ensures the transparency and authenticity of each transaction.

Toucan's tokenization solution has injected new vitality into the traditional carbon credit market and brought decentralized financial innovation to the environmental protection field.

6. Jiritsu

Jiritsu is a Layer-1 blockchain based on zero-knowledge proof (ZK-Proofs) technology, focusing on tokenizing real-world assets (such as gold, inventory, real estate) and ensuring their privacy and security under a compliant framework. Jiritsu's goal is to provide compliance solutions for asset tokenization projects through advanced privacy technology while maintaining decentralized privacy protection.

- Zero-knowledge proof technology : Zero-knowledge proof technology allows users to prove the legality and compliance of an operation without disclosing sensitive information. Jiritsu uses this technology to provide users with a balance between privacy protection and compliance, allowing tokenized real-world assets to be freely traded in regulated markets without disclosing too much sensitive information.

- Compliance and Privacy : Jiritsu pays special attention to the tokenization of high-value assets (such as gold and real estate), ensuring that these assets comply with international regulatory requirements during transactions while protecting user privacy. This provides additional confidence for institutional investors who are concerned about privacy protection, ensuring that they maintain control of their assets while meeting regulatory requirements.

By combining zero-knowledge proof and blockchain technology, Jiritsu provides a strong technical foundation for the tokenization of assets that require strong privacy and compliance protections.

Technical and Compliance Risks of RWAs

Although the tokenization of real-world assets (RWAs) brings many opportunities to the traditional financial and blockchain sectors, they also face unique technical and compliance risks. These risks include centralization issues, reliance on third-party custodians, the reliability of oracles, and the balance between privacy and compliance. The following is a detailed analysis of these key risks:

1. Centralization Risk

One of the core advantages of blockchain technology is decentralization, that is, no single entity controls the network. However, the design and operation of RWAs often inevitably rely on certain centralized factors. This centralized risk mainly comes from the following aspects:

- Asset custody : Since real-world assets (such as real estate, bonds, or gold) are not on the blockchain themselves, they need to be managed and held by off-chain custodians. This means that the security of these tokenized assets depends in part on centralized custodians, such as banks, trust companies, or storage facilities. Although blockchain provides transparent ledgers and automated smart contracts, the behavior of custodians still affects the value and security of on-chain assets.

- Compliance requirements : In most countries and regions, financial activities involving real-world assets are subject to strict regulatory requirements, including anti-money laundering (AML) and know your customer (KYC) regulations. These compliance requirements usually require centralized control points, such as compliance audits, identity verification, and transaction monitoring. This centralized control conflicts with the decentralized nature of blockchain and may cause some RWAs projects to be highly dependent on centralized institutions in actual operations.

Although the risk of centralization is unavoidable in some cases, it also weakens the decentralized advantages of the blockchain itself and may lead to doubts about the security of the system. Ways to solve this problem include using multi-party escrow, decentralized governance models (such as DAO) and other means to disperse control and reduce dependence on a single centralized entity as much as possible.

2. Third-party dependencies

The current situation of RWAs relying on third-party custodians and asset managers also brings unique risks. These third-party institutions are usually responsible for holding and managing real-world assets, and the on-chain tokens are only used as digital representations of assets. In this process, if the third-party custodian behaves improperly, encounters financial problems or goes bankrupt, the on-chain assets may be affected or even face significant losses. Specific risks include:

- Custodian behavior risk : If the custodian makes management errors, financial fraud or breaches of contract, the security of on-chain assets will be directly affected. For example, the physical assets in custody may be misappropriated or lost, resulting in the disappearance of the actual assets behind the on-chain tokens.

- Bankruptcy risk : The bankruptcy of the custodian may lead to the liquidation or freezing of assets, which will be devastating for the tokenized assets that rely on these assets for endorsement . Although smart contracts and blockchains can automatically execute on-chain transactions, the actual custodial assets still rely on legal frameworks and centralized entities for management. Once the custodian is unable to perform its duties, on-chain investors may not be able to obtain the asset protection they deserve.

In order to deal with this dependency risk, RWAs projects usually use third-party audit and insurance mechanisms. For example, the custodial assets are audited regularly to ensure their 1:1 correspondence with the on-chain tokens. In addition, some platforms are exploring ways to reduce the risk of a single custodian through multi-party signature custody and multi-custodian participation in management.

3. Oracle Risk

Oracles are key components that ensure that on-chain smart contracts can access off-chain real-world data, acting as a bridge between the on-chain and off-chain worlds. However, there are inherent risks in the design and operation of oracles.

- Data accuracy and reliability : The data collected by the oracle from the off-chain is used to drive the execution of smart contracts, so erroneous data from the oracle may lead to serious consequences . For example, in projects of tokenized bonds or commodities, if the market price transmitted by the oracle is biased, it may lead to incorrect execution of the contract, thereby harming the interests of investors.

- Single point of failure risk : Many existing oracle systems rely on centralized data sources or single data suppliers. If these data sources fail or are maliciously manipulated, it may cause large fluctuations in on-chain assets or even be exploited by malicious users to attack . Although decentralized oracle solutions such as Chainlink are becoming mainstream, they still face challenges in data source selection and consensus mechanism design.

- Delay and synchronization issues : On-chain operations are usually real-time, while off-chain data collection and transmission may be delayed . For example, market prices may change faster than the oracle updates, which can cause smart contracts to make incorrect judgments and decisions based on delayed data.

To solve these problems, the RWAs project began to introduce decentralized oracles, integrating multiple data sources and using consensus mechanisms to verify the accuracy of data. In this way, the security of oracles and the reliability of data have been improved. At the same time, developing more prevention mechanisms, such as setting time windows for data updates and abnormal data detection, can further reduce risks.

4. Balance between privacy and compliance

As the application of RWAs expands, how to protect user privacy while meeting compliance requirements has become a key challenge. Traditional financial institutions usually rely on compliance measures such as KYC/AML, requiring users to provide a lot of personal information for verification, while blockchain users are accustomed to anonymity and privacy protection.

- Privacy risks : In order to comply with the requirements of regulators, RWAs projects usually require users to submit detailed identity information and undergo strict KYC review. This information may be stored in off-chain databases, increasing the risk of privacy leakage. Especially in the context of frequent data leakage incidents, users' personal information may be used by criminals, leading to financial and identity fraud and other problems.

- Compliance pressure : On the other hand, regulators need RWAs projects to ensure that they comply with financial regulations to prevent illegal activities such as money laundering and terrorist financing. Therefore, RWAs projects need to find a balance between privacy protection and regulatory compliance, meeting regulatory requirements without completely sacrificing users' privacy rights.

To resolve this contradiction, zero-knowledge proof (ZK-Proofs) technology is being widely explored. Zero-knowledge proofs allow users to prove that their identity information has been verified without revealing any sensitive information. For example, a user can prove that they have passed the KYC audit without disclosing their identity information. This technology ensures that RWAs projects protect user privacy while meeting compliance requirements. In the future, as zero-knowledge proof technology matures, RWAs are expected to achieve a better balance between privacy protection and compliance. In addition, the separation of on-chain data and compliance operations is also a coping strategy. For example, some projects can use a hybrid chain model to place compliance operations such as identity authentication on a private chain, while transactions and asset transfers are performed on the public chain to achieve information isolation.

Future Outlook: Macroeconomic and Technological Development

With the changes in the global macroeconomic situation and the continuous advancement of blockchain technology, the development prospects of real-world assets (RWAs) on the blockchain are broad. The future outlook of RWAs will not only be affected by interest rate policies, legal and regulatory environments, but will also be driven by innovations in compliance and privacy protection through the application of emerging technologies. The following is a detailed analysis of several key factors that may affect the development of RWAs in the future:

1. Impact of interest rate cut cycle

The U.S. monetary policy has a huge impact on the global financial market, especially the Fed's interest rate hike or cut cycle, which directly affects the return rate of assets and investor behavior. The report pointed out that the current U.S. interest rate is at a historic high, which has driven the rapid growth of the tokenized U.S. Treasury market. However, as the Fed gradually enters a rate cut cycle, the RWAs market, especially the tokenized Treasury market, may face new challenges.

- Impact of falling yields : Tokenized U.S. Treasury bonds have become a popular choice for on-chain investors due to their security and high yields. However, once the Fed starts to cut interest rates, the yields on Treasury bonds will fall, which may weaken their attractiveness to investors. Rate cuts usually mean that investors will look for investment channels with higher risks but greater returns, which may lead to a decrease in the demand for tokenized Treasury bonds.

- Advantages of diversified assets : Although interest rate cuts may reduce the appeal of government bonds, the advantage of RWAs is that they can provide diversified asset selection. In addition to government bonds, RWAs also cover a variety of asset classes such as real estate, commodities, and private credit, which may show higher returns or stability in an environment of interest rate cuts. Therefore, the diversity of RWAs enables it to maintain a certain appeal in different economic cycles and help investors balance risks through asset allocation.

- Transparency and accessibility : One of the major advantages of RWAs is the transparency and global accessibility brought by blockchain. Even in a low interest rate environment, RWAs can still attract investors by reducing intermediary costs and providing a more transparent investment environment. Especially for international investors who find it difficult to directly participate in the Treasury market in the traditional financial system, RWAs can provide a more flexible way to participate and compensate for some of the impact of lower yields.

Therefore, although the interest rate cut cycle may weaken the attractiveness of some RWAs (such as tokenized Treasuries) in the short term, the diversity and transparency of RWAs will make them competitive in different macroeconomic environments.

2. Legal and regulatory environment

The legal and regulatory framework for RWAs is still evolving, especially when it comes to cross-border asset management and transactions. Since RWAs bring real-world assets to the blockchain, these assets are inevitably subject to the laws and regulations of various countries. The report points out that although some projects have adopted the SPV (special purpose company) structure to cope with some compliance requirements, the overall legal environment of the market is still full of uncertainty, especially in terms of cross-border supervision and transparency requirements.

- The role of SPV : SPV is a legal structure used to isolate assets and liabilities and is widely used in securitization transactions in the financial market. In RWAs, SPV is used as an independent legal entity to hold ownership of tokenized assets, thereby simplifying the legal management of assets and reducing risks. Through SPV, RWAs projects can ensure that tokenized assets comply with the legal requirements of various countries, isolate risks in the event of bankruptcy or legal disputes, and protect the interests of investors. However, although SPV provides certain legal guarantees, it still cannot completely solve the complexity of cross-border laws, especially the transfer and management of assets between different countries or regions.

- Cross-border regulatory challenges : Cross-border regulation is one of the biggest challenges facing RWAs. Due to different legal requirements for financial assets, taxation, capital flows, etc. in different countries, RWAs projects must comply with regulations in multiple jurisdictions when tokenizing assets and trading them globally . This not only increases compliance costs, but may also limit the global liquidity of certain asset classes. For example, the financial regulatory standards in Europe and the United States are different, and RWAs projects must find a balance between different markets to ensure compliance with local laws without compromising the transparency and tradability of on-chain assets.

- Future regulatory trends : In the future, with the digital transformation of global financial regulation, more countries may introduce legal frameworks for tokenized assets. For example, the European Union is launching the Markets in Crypto-Assets Act (MiCA) , while the United States is exploring how to incorporate tokenized assets into existing securities laws or commodity laws. As these laws are gradually implemented, RWAs will face a clearer compliance path. Although legal uncertainty may hinder the advancement of the project in the short term, in the long run, the gradually improved regulatory framework will provide more opportunities for the global development of RWAs.

3. Application of new technologies

Technological advances, especially the development of privacy protection and compliance technologies such as zero-knowledge proofs (ZK-Proofs), will further promote the development of RWAs. These emerging technologies can not only improve the privacy and security of RWAs protocols, but also help RWAs achieve greater decentralization while meeting regulatory requirements.

- The role of zero-knowledge proofs (ZK-Proofs) : Zero-knowledge proofs are a cryptographic technique that allows one party to prove the authenticity of a statement to another party without revealing any sensitive information. In RWAs, this technology can be applied in the field of compliance. For example, users can use ZK-Proofs to prove that they have passed the KYC/AML audit without disclosing specific identity information to the blockchain or a third party. This not only protects the privacy of users, but also meets the requirements of regulators for identity verification. Through ZK-Proofs, RWAs projects can achieve greater decentralization and reduce reliance on centralized identity verification agencies.

- Decentralized compliance systems : With the popularity of technologies such as ZK-Proofs, RWAs projects are expected to develop decentralized compliance systems in the future. These systems can automatically execute KYC/AML processes through smart contracts, while using encryption technology to protect users' sensitive information. For example, on-chain compliance protocols can verify the compliance of users before they make transactions and ensure that only compliant users can participate in investments. This technology will help RWAs projects comply with financial regulations around the world without sacrificing privacy.

- Improve transparency and security : In addition to privacy protection, new technologies such as ZK-Proofs can also improve the transparency and security of on-chain assets. For example, ZK-Rollups technology can package multiple transactions and reduce the on-chain load, thereby improving transaction efficiency. This is especially important for processing large-scale RWAs transactions, which can significantly reduce transaction costs and enable more real-world assets to be traded and transferred on the blockchain in a low-cost and efficient manner.

Through the application of emerging technologies, future RWAs projects will be able to find a better balance between privacy protection, compliance, and decentralization. This will not only reduce the technical and legal risks of the project, but also promote the further popularization and global development of RWAs.

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal opinions of the author and guests, and have nothing to do with the position of Web3Caff. The information in the article is for reference only and does not constitute any investment advice or offer. Please comply with the relevant laws and regulations of your country or region.

Welcome to join the Web3Caff official community : X (Twitter) account | WeChat reader group | WeChat public account | Telegram subscription group | Telegram exchange group