- ETH funding rate hits this year’s lowest point.

- ETH is trading around $2,300.

If you want to know more about the crypto and get first-hand cutting-edge information, please visit Weibo Dolphin 1 for more good articles .

Ethereum [ETH] derivatives markets have seen a notable decline, signaling a possible shift in market sentiment.

However, the interpretation of this downward trend may lead to different conclusions depending on the performance of other factors such as spot volume.

Ethereum’s funding rate drops

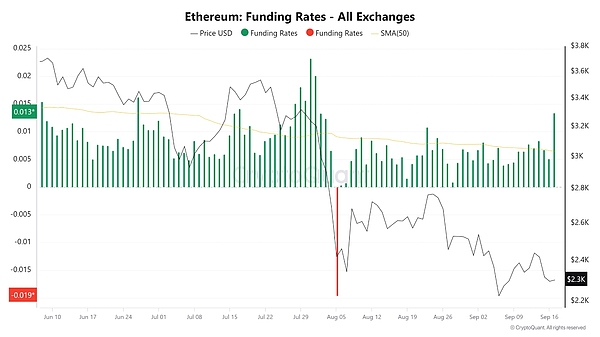

The latest data from CryptoQuant shows that Ethereum’s funding rate has fallen to its lowest point this year, indicating a sharp drop in buying interest among derivatives traders.

Funding rate is a key indicator in the futures market that measures the cost of holding a long (buy) or short (sell) position.

A negative funding rate means short sellers are paying long holders to maintain their positions, which indicates bearish sentiment.

ETH’s funding rate fell to its lowest level this year, reflecting a drop in demand for buying Ethereum through leveraged derivatives. This could be a bearish signal for prices in the short term.

The decline in funding rates suggests a lack of enthusiasm among traders in the derivatives market, which could further pressure Ethereum’s price.

The possibility of an Ethereum short squeeze

With fewer traders willing to take long positions, Ethereum’s downtrend is likely to continue unless spot buyers step in to absorb the selling pressure.

However, while low funding rates indicate bearish sentiment, they also set the stage for a potential short-term liquidation chain reaction. If spot buyers fully enter the market, negative funding rates could quickly reverse.

This forces short sellers to close their positions, which results in forced buying (short squeeze), which pushes prices higher.

How is ETH's trading volume trending?

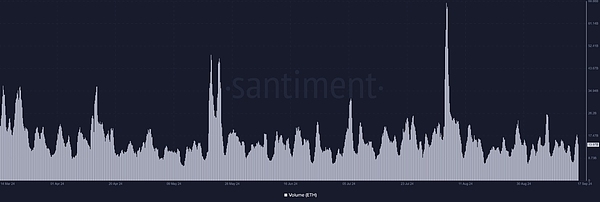

Analysis of Ethereum spot trading volume on Santiment shows that the current average trading volume has stabilized at around $14 billion in recent weeks.

This sustained volume is critical to maintaining price stability, especially as Ethereum’s funding rate has fallen to its lowest level this year.

Ethereum’s spot trading volume has remained relatively stable, averaging $14 billion. This steady volume could help ETH avoid a more severe price drop.

This is despite the bearish sentiment among derivatives traders remaining, as reflected in negative funding rates.

Additionally, Ethereum could face greater downward pressure if spot volumes fall below the $14 billion range.

With funding rates already at historic lows, a drop in spot volumes will reduce buying interest, which is needed to balance negative sentiment in the derivatives market.

The current low funding rates indicate that the derivatives market is dominated by short positions. If spot volumes decline, there may not be enough demand to absorb the selling pressure, leading to a drop in prices.

The article ends here. Follow Weibo Dolphin Dolphin 1 for more good articles. If you want to know more about the relevant knowledge of the crypto and first-hand cutting-edge information, please consult me. We have the most professional communication community, publishing market analysis and high-quality potential currency recommendations every day. There is no threshold to join the group, and everyone is welcome to communicate together!