The native token of liquidity protocol Aerodrome Finance, AERO, has become one of the best performing crypto assets in the past two weeks, attracting the attention of many speculators.

AERO stock continued to rise, rising from $0.49 on September 6 to a multi-week high of $0.72 on September 13, erasing losses from earlier in the month.

Aerodrome has also made significant progress in grabbing DEX market share with its “landing hub” status for protocols seeking to deploy on Coinbase’s L2 scaling network, Base. In the latest manifestation of Aerodrome’s ecosystem growth, AERO has become the biggest beneficiary of Coinbase’s recently launched Wrapped BTC token.

Coinbase Launches Wrapped BTC, Driving AERO Price Up

Last week, Coinbase launched its own version of wrapped Bitcoin (cbBTC) to compete with similar forms of tokenized BTC assets on the market, including category leader WBTC from BitGo. In its announcement, Coinbase highlighted several DeFi applications, including Aerodrome, Curve, and Uniswap DEX, which will support cbBTC from day one. This wave of liquidity from cbBTC played a key role in boosting the AERO token. In just a few days, Aerodrome Finance was just one step away from taking the top spot on $BTC trading. TradingView data shows that the AERO price rose from $0.55 to $0.61 on the day of its launch, and then climbed further to $0.72 in the following 24 hours.

Outside of the spot market, Aerodrome has become a noteworthy project among its peers, with observers pointing to its unique positioning in the DeFi space as a key driver. DeFiLlama data shows that the total locked value (TVL) on Aerodrome has increased by 23% in the past 7 days, reaching $687.68 million as of this writing.

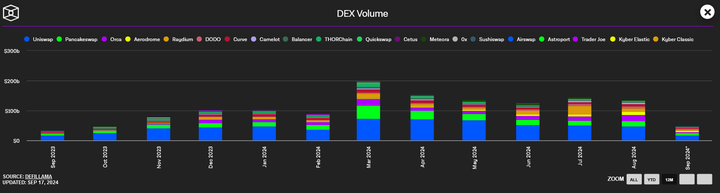

Competition among DEXs heats up again

The DEX’s monthly cumulative trading volume rose from $125 billion in June to nearly $145 billion in July, but fell to $135 last month. Despite the month-on-month decline in August, Aerodrome’s trading volume grew from $7.2 billion to $9.9 billion.

In terms of dominance, Aerodrome has maintained its position, accounting for 5.17% of the DEX market capitalization as of September 13. Although Uniswap still dominates, accounting for nearly three-quarters of the market capitalization share, this significant shift highlights the growing competition in the DEX space.

AERO Near-Term Outlook and Price Target

$AERO has had a strong year in 2024, with its price increasing more than fourfold so far this year. In February, the price of $AERO rose following news that the Base Ecosystem Fund invested in Aerodrome, acquiring an undisclosed stake in the project. At press time, AERO is trading at $0.684, up 22% in the past seven days.

On the 4-hour chart, the $0.75 level acts as an immediate resistance, with AERO/USDT last trading at this level in August.

Looking ahead

AERO is showing strong support around $0.44, indicating a possible turning point. If Bitcoin maintains its bullish trend, it will surpass our next target of $1.25 Aerodrome Finance leads the protocol ranking in terms of TVL on Coinbase’s Base network. The token’s strong performance, coupled with the growing popularity of cbBTC, could help the AERO/USD pair maintain its upward trajectory in the near term.