On the eve of the Federal Reserve's September interest rate decision, market expectations for a 50 basis point rate cut grew stronger, and the crypto market generally rose.

If you want to know more about the crypto and get first-hand cutting-edge information, please visit Weibo Dolphin 1 for more good articles .

Bitcoin surged to $61,000 on Tuesday, its biggest intraday gain since August 8. Mainstream currencies such as Ethereum, Dogecoin, and Solana also rose, with gains between 2% and 4%. As of press time, the trading price fell back to around $60,253, a 24-hour increase of nearly 4%.

Trading volume in October federal funds futures, betting on this week’s Federal Reserve rate decision, has risen to the highest level since records began in 1988, according to data compiled by Bloomberg, with most new contracts betting on a 50 basis point rate cut and a third of the positions created this week.

After repeated warming up by opinion articles from several mainstream financial media including the "Federal Reserve News Agency" last Thursday, the market's expectations for the magnitude of the Fed's first rate cut suddenly shifted from 25 basis points to "more likely to be a larger rate cut."

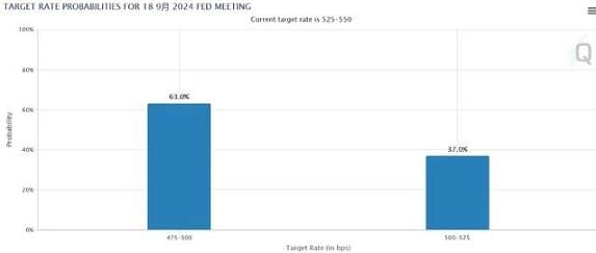

Currently, the market implied odds show that the probability of a 50 basis point rate cut before the Fed makes a decision is slightly higher than 50%. At the same time, U.S. Treasury yields have fallen sharply this week, with the 2-year Treasury yield hitting a two-year low of 3.52%.

As of Wednesday, according to the CME Fed Watch tool, the futures market is pricing in a 63% chance of a 50 basis point cut, up from 30% a week ago, and a 37% chance of a "conventional" 25 basis point cut.

As of the week ending September 10, hedge funds increased their net short positions in long and ultra-long bonds by approximately $6.4 million per basis point; a JPMorgan client survey for the week ending September 16 also showed that although long positions were closed that week, investor sentiment remained bullish.

"Rising global interest rates are driving the view that rate longs are the most crowded trade, surpassing stock longs for the first time." If the Fed's rate cuts are smaller and Powell hints that it will take a gradual approach to rate cuts, the market may face greater selling pressure.

"If the Fed cuts rates by 25 basis points instead of 50 basis points, the market reaction will be much stronger. Current market positioning, optimism and loose financial conditions may be tested." Short-term U.S. Treasuries, which are more sensitive to Fed policy, may be most affected, especially considering that they are "already priced quite aggressively."

The suspense of interest rate cut will be revealed soon

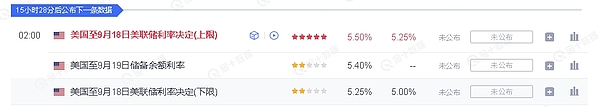

The Federal Reserve will announce its interest rate decision at 2:00 a.m. Beijing time on Thursday, and Federal Reserve Chairman Powell will hold a press conference at 2:30 a.m.

If the Fed cuts rates by 50 basis points, the price of Bitcoin could rise, but if the market views it as an emergency move, this could offset the gains. A 25 basis point rate cut would create a more uncertain outcome, while no rate cut could lead to a short-term sell-off. Looking ahead to the fourth quarter of 2024, I expect Bitcoin to perform strongly, supported by improved liquidity conditions.

End

In fact, whether it is a 25 basis point or 50 basis point rate cut, the real meaning is that the era of restrictive monetary policy is coming to an end. Risk assets like low interest rates and cheap liquidity. The Federal Reserve has already planned this route. Now is the best time to get out of the risk curve. After the interest rate meeting on the 18th, there will be a good round of market conditions. Even if there is a sharp drop, it is an excellent opportunity to enter the market. I believe that the market in late September and early October will be a surprise!

The article ends here. Follow Weibo Dolphin Dolphin 1 for more good articles. If you want to know more about the relevant knowledge of the crypto and first-hand cutting-edge information, please consult me. We have the most professional communication community, publishing market analysis and high-quality potential currency recommendations every day. There is no threshold to join the group, and everyone is welcome to communicate together!