The US Federal Reserve (Fed) held an interest rate decision meeting. The market expected that the interest rate cut was almost certain. As the market prepared for the first interest rate cut in more than 4 years, the cryptocurrency market rose in unison. Bitcoin broke through the $61,000 mark last night (17). Bitcoin soared to $61,000 during trading on Tuesday, the largest intraday increase since August 8. Mainstream currencies such as Ethereum, Dogecoin and Solana also rose, with increases between 2% and 4%. As of press time, the trading price fell back to around $60,340, an increase of more than 3% in 24 hours.

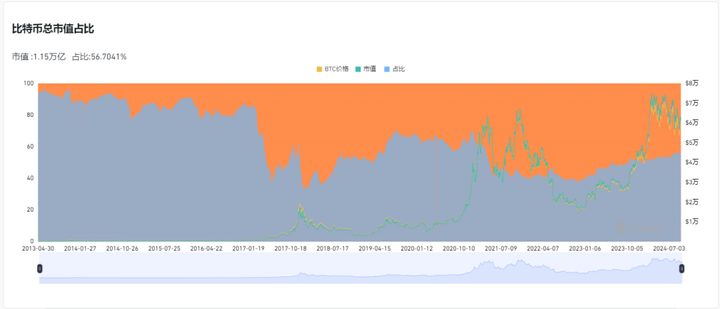

Currently, Bitcoin is still fluctuating in a relatively narrow range, and it seems difficult to make a breakthrough before the Fed officially announces the latest interest rate decision. According to the order data of the "BTC-USDT trading pair" of Binance, the world's largest cryptocurrency exchange, there are a large number of sell orders between $61,000 and $62,500, indicating that the possibility of further rise of Bitcoin in the short term is suppressed. The overall market value of cryptocurrencies is currently $2.08 trillion, and Bitcoin's market share is 57.1%.

The US Fed’s interest rate cut is almost certain!

The Federal Reserve will announce its interest rate decision at 2:00 a.m. Beijing time on Thursday, and Federal Reserve Chairman Powell will hold a press conference at 2:30 a.m.

Although the Fed is almost certain to cut interest rates, the market is still uncertain about the extent of the cut. According to the FedWatch tool of CME, traders expect the probability of a 2 basis point cut to be 65% and the probability of a 1 basis point cut to be 35%.

It is expected that the cryptocurrency market may experience sharp fluctuations this week, which is mainly affected by the market's expectations for the interest rate cut decision. The extent of the interest rate cut will affect market sentiment. If the interest rate is cut by 1 basis point, it may maintain a moderate risk appetite environment; if the interest rate is cut by 2 basis points, it may trigger stronger buying, or on the contrary, cautious institutions will take profits.

This volatility is likely to be reflected in the Bitcoin spot ETF and perpetual contract markets, and as traders adjust their positions, volatility will increase further. And because concerns about inflation and recession risks have not completely dissipated, even if the Fed cuts interest rates by 2 points as expected, the market may react negatively.

Bitcoin prices have been volatile in recent weeks, and the Fed's policy shift is expected to further amplify such fluctuations. Technical indicators show that Bitcoin's rebound momentum since falling to $52,500 on September 6 is weakening, increasing the possibility of a downward trend reversal.

In summary, the subsequent market is expected to be affected by the news of interest rate cuts, and Bitcoin may experience a short-term correction, but in the long run, loose monetary policy will be conducive to a new round of bull market, including Bitcoin, Ethereum and other market assets.

How will the market develop in the future?

The future market trend is that BTC will fall back to 56,000-54,000 in late September after the expected rate cut is realized, completing a bottoming action similar to the three tests, and then it will be bullish in October. The previous tweet also said that there is basically no point to bearish the market in October. The Fed's rate cut expectations are realized on the 19th, and there will be no economic data after the Bank of Japan's interest rate decision on the 20th. It is a news window period, so the BTC price has a chance to rebound and break through 60,000 in October, and there is a great chance to reach 65,000-68,000.

Next, let’s take a look at the current high-quality currencies that are worth investing in for the long term and waiting for the start of a bull market!

PEPE

PEPE, which was mentioned in the previous issues, is about to make a comeback. From the perspective of price trend, Pepe (PEPE) has become the biggest beneficiary of the bullish headwind of Ethereum ETF. As the leading meme, pepe coin does not have a high transaction tax, which increases the transaction and liquidity of pepe coin. The price has recovered to the symmetrical triangle, and the bulls seem to be ready to launch a bullish breakthrough. As long as the main force starts to pull, all major communities are frogs.

SUI Sui is one of the most popular copycats in the past year. Sui chain's game consoles started pre-sale this week, similar to Solana's mobile phone airdrop. And this week it can be clearly seen that funds began to enter the Sui ecosystem. The BLUB and LIQ on its chain rose very rapidly this week, creating a wealth-making effect on the Sui chain. Fundamentally speaking, whether it is trust institutions, game equipment pre-sales, or the proportion of market value, SUI's blue ocean map has begun to emerge, so this is also the benchmark that SUI has always focused on participating in.

FET technical analysis shows that it has broken through the downward trend line and is about to break through the neckline. The interest rate will be cut soon. The fundamentals, funding and environment are all right. The target is 10 US dollars. Seize the opportunity when the price is less than two US dollars now.

Looking at the daily chart, all small coins have been adjusting at the bottom for a long time, and the BTC rebounded first. After the interest rate meeting on the 18th, it is expected that there will be a good round of market conditions. Even if there is a sharp drop, it is an excellent opportunity to enter the market. I believe that there will be surprises in the market in late September and early October!