Speaker: Vitalik; Compiled by: Deng Tong, Jinse Finance

On September 18, 2024, Ethereum co-founder Vitalik gave a speech at the Token 2049 conference titled "Things That Excite Me About Ethereum in the Next Ten Years". Jinse Finance has compiled the content of Vitalik's speech as follows for readers.

As people often say, we are still in the early stages of blockchain development. At this point, we are still building the infrastructure, and this is a big experiment.

We are in the early stages of crypto being truly usable

You have to ask the question: Are we really in the early stages? I don’t think we’re in the early stages of cryptocurrency, but we are in the early stages of cryptocurrency actually being usable.

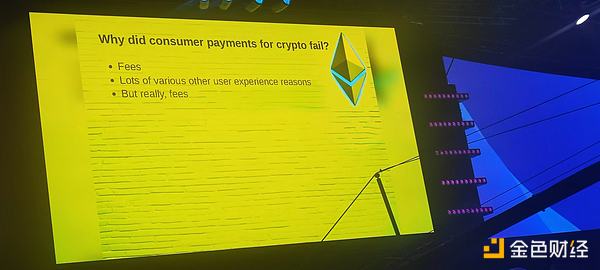

Remember back in 2013, we were all excited about Bitcoin, the next big revolution in payments. There was a really amazing, really serious effort to get regular merchants around the world to start accepting Bitcoin. Who remembers when we were in Berlin, it was a restaurant called felonious Monk Fish. It was actually the first Big Point restaurant I wanted. Back in 2013, you could be a proud Big Point restaurant and also be a proud Asian LGBT-friendly restaurant. So back then, people were really excited about that. So what happened? One way to answer that question is we can look a little further back.

I have been to Argentina for the first time in 2021. The first thing I noticed is that Argentinians are not only very excited about cryptocurrency, but they are actively using it on a large scale.

I was walking around on Christmas Day and the first coffee shop I noticed was open. I walked in, bought a coffee and had dessert with my friends.

Now, they use currency, but they don’t use decentralized technology. It turns out that the locals in Argentina are using the traditional financial system to transfer money. Why? Because the traditional financial system transfers are instant and free. I think this ultimately killed the initial wave of exploration to get everyone to adopt Bitcoin as a currency.

Ethereum absolutely supports privacy-preserving transactions. So, it is undeniable that gas prices have gone up. Basically, a lot of things ended up failing because something new happened in 2024.

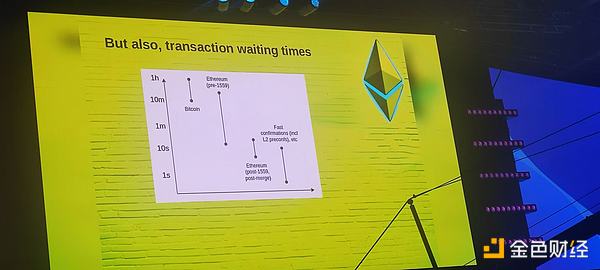

Optimism and Arbitrum are two major security milestones and are currently in phase 1. Rollups are rapidly becoming more secure, and Rollups are actually finally affordable. In addition, another issue is the confirmation time of transactions.

Now, this was after EIP 1559 was on the chain, but this particular wallet hadn't actually upgraded to EIP 1559 yet. Every 10 minutes, a large block would appear. So we had to wait 10 minutes, maybe even an hour, for a transaction to be confirmed on Ethereum. In theory, the block time is 13 seconds, but because of how inefficient it was in the past, sometimes you had to wait a completely random amount of time. If you were unlucky, 5 minutes, or even longer, for a transaction to be confirmed.

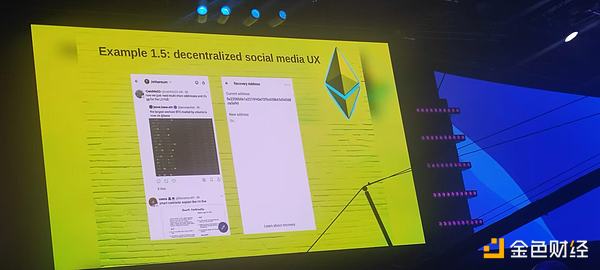

On the left, you have EtherTweet from 2015. It looked like a hockey fund demo. Now on the right, it's Firefly (Farcaster + Twitter + Lens client). If you look at the quality of the user interface like this - it looks like a Web 2 level quality. It's a decentralized application. But at the same time, this year we saw more progress. We saw more and more people using secure technology, we have better privacy protocols, I can prove that you have a pass with zero knowledge, and then you can vote on it.

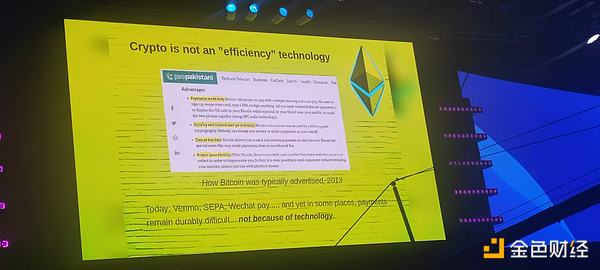

Encryption technology does not equal efficiency

We think a mistake people sometimes make is viewing cryptocurrency as an efficiency technology.

A lot of people talked about this as early as 10 years ago. So this is a random page from 2013, and it just lists the benefits of accepting cryptocurrency. Payments make it easy to be secure and control your money, and zero or low fees protect your identity. I think two of those four are other features that are unique to cryptocurrency. The other two, they were unique to cryptocurrency at the time. Although we have WeChat Pay, payments on centralized systems are getting better and better. But, in some places, payments and financing are still difficult. Why are they still difficult? It's not because of a lack of access to technology. It's basically because of the limitations of global war.

I think it's important to remember that the benefits that crypto has brought to the world have nothing to do with the same kind of technological improvements. Because going from a regular jet to a supersonic jet is a technological improvement. It's a different type of technology.

If you think about how blockchains are different from previous technologies, some of the technologies they’re based on are sensational things, like wars, like scrambles. I think you’ll realize that blockchains are all about creating structures that last, and those structures are very powerful.

A castle can be a museum that preserves a thousand years of European history. A digital castle can be all of these things, digital and all types of digital castles are things that we can build on top of this area.

Ethereum's Vision: Mainstream Adoption + Open Source + Decentralization

What should our team goals be? We need to meet the needs of mainstream adoption, while we need to uphold open source and decentralized values. What does this mean?

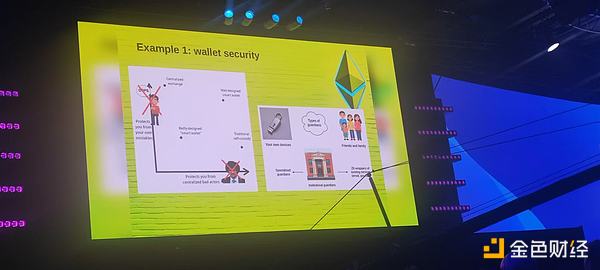

Let's take the example of wallet security. Historically, there have been basically two ways to keep your money. One way is, you like the crazy self-sovereign, maximalist way. You write down your seed phrase phrase, and you do everything offline. You carve your phrase into a piece of titanium, you put the titanium into a lockbox made of it, and then you work, but you put that box 10 meters underground, and then your crypto is safe. The other way is, you take your crypto and you go and give it to some trusted person.

If you want to protect yourself from centralized actors, then you can do traditional self-custody. If you really want to do that, you can put it in titanium and bury it 10 meters underground. So what if you want to protect yourself from centralized exchanges? What if you want to do both? That's where smart wallets with multi-protection come in. Multi-protection, as we do, means that you have multiple keys. For example, you might have six keys, four of which you need to send a transaction. You can even make a rule that for all transactions, when we need a key, these keys can be any combination of keys that control existing services for friends and family.

You can actually also get the benefits of institutional trust, like in decentralized social media, where you can set up your recovery address and have as much control over your account as your multisig. I personally trust my multisig far more than any of my centralized accounts.

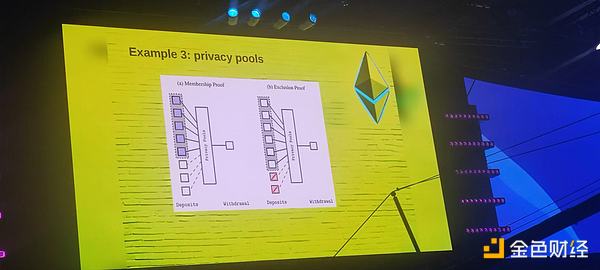

Example two payments. This is a demo. Example three, privacy rules are used as a mechanism where users can prove they are leaving. Their withdrawals came from some deposits and guarantee that their deposits did not come from bad actors.

So this is a way that allows you to provide a very high degree of privacy for the average user and meet a lot of important compliance needs. But there are actually no backdoors, for example, for zk social media, this is a zoo poll, this is a zoo pass. So we can prove that you are human, prove that you are part of the community, solve the proof of first input problem to solve the reputation problem, while still protecting your privacy. You can have privacy and you can have trust at the same time.

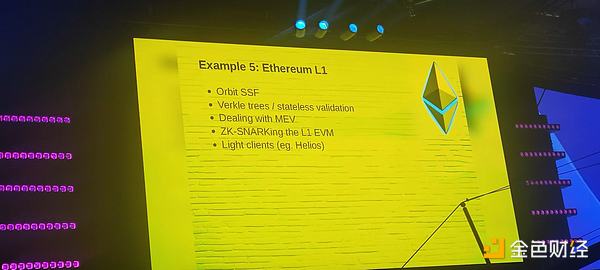

Example five, if you are Employer One, there are a lot of technological improvements happening that make Leader One better in terms of reduced finality, increased capacity over time, while being more decentralized and easier to verify. These are all ecosystem theories and where I think cryptocurrency in general is going to go over the next 10 years.

We have essentially two wrong paths: sacrificing utility for decentralization, and forever becoming an ecosystem that only appeals to itself. But we don’t have to be stuck with either of these options. We can have decentralization and utility at the same time. Thank you.