Author: Bitke Editor: Daheilong

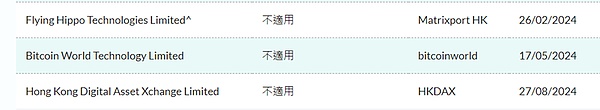

According to the official website of the Hong Kong Securities and Futures Commission, only two crypto companies have submitted applications for virtual asset trading platform licenses since February this year. The community seems to be wondering whether Hong Kong’s slow attitude towards cryptocurrency regulation will inhibit the growth of digital assets?

Bitkoala Finance will analyze it with you in this article.

Hong Kong’s virtual asset market faces growing competition

Hong Kong is committed to positioning itself as a global hub for cryptocurrency, but so far there are only two fully licensed virtual asset trading platforms: Hash Blockchain and OSL Digital Securities . Many other cryptocurrency exchanges are still waiting for full operating licenses in Hong Kong.

Vincent Chok, CEO of First Digital, said: “ Hong Kong’s current approach to trading regulation is more conservative and slower than some other jurisdictions, which is understandable as it prioritises investor protection. We would like to see the pace of regulation increase to ensure it does not lag behind the rapid development of the industry. ”

As of June 1 , operating an unlicensed virtual asset trading platform (VATP) in Hong Kong is a criminal offense. At the same time, the Hong Kong Securities and Futures Commission has issued a " warning list " of " suspicious virtual asset trading platforms " or unlicensed entities operating in Hong Kong. The SFC said these entities may target Hong Kong investors.

Frankly speaking, Hong Kong is facing competition from other jurisdictions, such as Dubai, which has made progress in the stablecoin field.

Tether, the world’s largest stablecoin provider, has announced plans to launch a stablecoin pegged to the UAE dirham in collaboration with a UAE-based partner.

Notably, several companies have begun offering cryptocurrency custody services in the region.

Recently, the UAE allowed Standard Chartered Bank to provide such services, starting with Bitcoin and Ethereum.

Hong Kong has reportedly launched its first cryptocurrency-focused exchange-traded funds ( ETFs ), potentially competing with popular bitcoin products in the United States.

Will Hong Kong follow Dubai's lead?

On July 17 , the Financial Services and the Treasury Bureau ( FSTB ) and the Hong Kong Monetary Authority ( HKMA ) released the results of a study on local stablecoin regulation. A week later, on July 24 , JD Technology Group subsidiary JD Coinlink Technology Hong Kong Limited announced plans to issue a stablecoin pegged 1 : 1 to the Hong Kong dollar ( HKD ). The HKMA admitted the company as a participant in the sandbox program.

Meanwhile, Dubai has taken a leading role in the stablecoin space and made significant global progress. On August 21 , Tether, the largest stablecoin provider, revealed plans to launch a new stablecoin pegged to the United Arab Emirates dirham (AED) in partnership with Phoenix Group and Green Acorn Investments in the UAE.

Hong Kong needs to improve standards for integrating its financial system with Web3

While progress may be slow on a licensing regime for digital asset trading services, the city has made progress in other areas of Web3 , including the application of central bank digital currencies ( CBDCs ) and the tokenization of real-world assets.

Vincent Chok said: " It is worth noting that Hong Kong's BTC and ETH exchange-traded funds allow the use of a unique ' physical ' subscription mechanism, allowing direct subscription and redemption using BTC and ETH . This innovative structure provides investors with a flexible and simple investment process. Hong Kong's Trust and Company Service Provider License also allows trust structures to hold digital assets, which is a favorable and unique feature compared to other jurisdictions. At the same time, this sound system paves the way not only for custody services, but also for complex services related to them, such as estate management."

Initiatives such as the Hong Kong Monetary Authority’s Project Ensemble regulatory sandbox are paving the way for the tokenization of real-world assets and the use of tokenized currencies for interbank settlements. On August 28 , the Hong Kong Monetary Authority launched the Project Ensemble sandbox. The program explores the tokenization of real-world assets and interbank settlements using wholesale central bank digital currencies (wCBDCs) .

The HKMA said the project aims to study the technical interoperability of tokenized assets, tokenized deposits and wCBDC . The Ensemble project is the culmination of several earlier initiatives. These include using Ant Group technology to conduct tokenized deposit settlement trials with HSBC, and using the Hong Kong Monetary Authority's pilot e-HKD CBDC to conduct settlement trials for transactions between HSBC and Hang Seng Bank.

Summarize

At present, Hong Kong is still focused on ensuring compliance and security to build a robust and trusted market environment. It is not known whether Hong Kong will learn from Dubai’s experience in the future, but it seems that it can try to adjust its regulatory policies to attract more virtual asset trading platforms. Specifically, it can explore the following aspects:

1. Simplify and make the application process transparent: The current application process is relatively complicated and time-consuming. Simplifying the process and improving transparency can reduce the difficulty and time cost of platform applications.

2. Introduce a sandbox regulatory mechanism: Drawing on the experience of Singapore and other places, allow emerging platforms to conduct pilot operations in a controlled environment to reduce innovation risks while accumulating regulatory experience.

3. Improve the legal framework: Currently, Hong Kong’s virtual asset regulation mainly relies on existing securities and futures legal documents and lacks a specialized legal system. For example, we can refer to the EU’s MiCA Act to establish a unified virtual asset regulatory framework.

4. Strengthen international cooperation: Strengthen cooperation with other leading virtual asset regulatory regions such as Dubai and Singapore, share regulatory experience and information, and enhance Hong Kong’s competitiveness in the international market.

5. Provide more market incentives: such as tax incentives, technical support, etc., to attract more platforms to set up and operate in Hong Kong.

6. Strengthen public education and market promotion: Through education and publicity, enhance public awareness and trust in virtual assets and promote the healthy development of the market3.

These measures can help Hong Kong attract more virtual asset trading platforms and promote the prosperous development of the market while maintaining market safety and compliance.