While the overall market sentiment is bearish at the moment, Cardano [ADA] on-chain data such as the long/short ratio, futures open interest, and OI weighted funding rate are sending bullish signals.

These on-chain indicators are bullish, and with the announcement of a rate cut by the United States, the two-digit market has gained momentum, with ADA prices rising sharply by 4.83% in the past 24 hours.

ADA looks optimistic on-chain

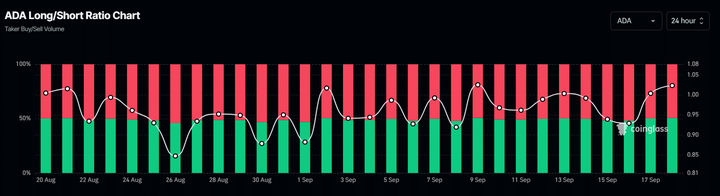

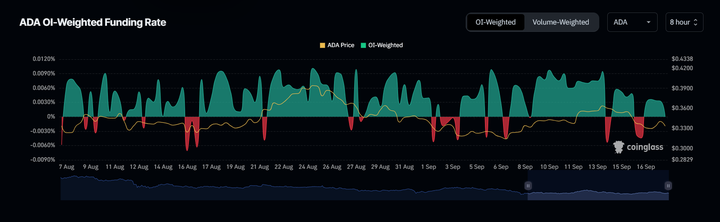

According to on-chain analytics firm Coinglass, ADA’s long/short ratio is at $1.0167 at press time, indicating bullish market sentiment among traders. Its futures open interest has increased by 3% over the past 24 hours and has been rising steadily since early September 2024.

Traders and investors often use the combination of an increase in open interest and a long/short ratio above 1 to build their positions. According to the data, if the long/short ratio is above 1 and open interest is increasing, it indicates that traders may be building long positions. Conversely, if open interest increases and the long/short ratio is below 1, it indicates that short sellers are betting more on short positions.

At press time, 51.2% of top traders hold long positions, while 48.8% hold short positions, which indicates a positive outlook for ADA. Additionally, ADA’s OI-weighted funding rate is positive, which further indicates bullish sentiment towards the asset.

Whale Recent Activity

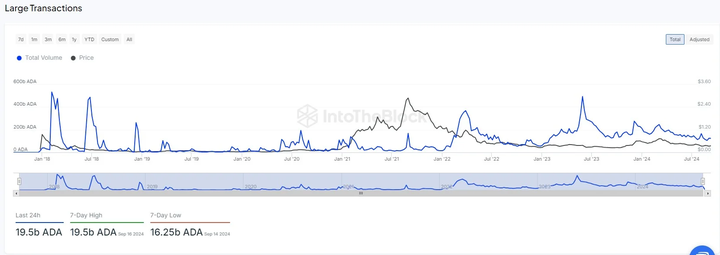

Cardano Whales Influence This epic price rally was not caused by market sentiment, but by Cardano whales. According to IntoTheBlock, large transactions increased by more than 10% in 24 hours. After the surge, whales transferred 19.5 billion ADA, worth $6.48 billion.

By definition, large transactions are those worth $100,000 or more. When this particular whale metric rises, market sentiment is generally positive. Cardano is no stranger to such large transaction flows, with its trading volume often exceeding that of Ethereum. According to data from IntoTheBlock, more than 3,100 of these large transactions were carried out in a 24-hour period. Considering that this is compared to the previous record high of 3,320 transactions per week, it is certain that ADA whale are doing something big. The impact of large purchases of Cardano is usually reflected in price increases. If this buying spree continues in the next few days, the coin could be in for its best week of the month.

The Battle for Cardano Hegemony

In addition to the core network activity, Charles Hoskinson, the founder of the Cardano protocol, has also made headlines over the past week. From his global outreach with Input Output Global to his technical comparisons with Solana, one message resonated: Cardano is superior. However, current technical analysis shows that both protocols have strengths and weaknesses. Cardano is known for its durability and security, while Solana prides itself on flexibility and speed. At this point, it remains a question of which protocol is better, that is, which protocol can withstand the most rigorous tests in the market.

Cardano Technical Analysis and Key Levels

According to technical analysis, and with the announcement of the US rate cut, ADA is showing a bullish trend and is trading close to the key resistance level of $0.35. On the daily chart of ADA, there is no bullish price action pattern, which suggests a possible rise in the coming days.

However, based on historical price momentum, if ADA closes the weekly chart above $0.35, there is a high chance that it could surge by 20% to $0.42 in the coming days. Meanwhile, the 200 exponential moving average (EMA) suggests that it is in a downtrend as ADA has been trading below it since April 2024.

In simple terms

Recently, ADA whale have transferred 19.5 billion ADA tokens. And as the U.S. announced a rate cut, it supported the price increase. Currently, its price is at the $0.35 mark. If ADA's weekly closing price is higher than $0.35, it may push it to rise further and test a breakthrough of $0.42.