- Ethereum’s 2024 triple bottom is similar to 2021, with a focus on key resistance levels and network activity.

- As ETH eyes the $3,500 resistance level, a triple bottom pattern suggests a possible breakout.

- Exchange outflows and RSI levels suggest a possible bullish move, but network growth remains flat.

If you want to know more about the crypto and get first-hand cutting-edge information, please visit Weibo Dolphin 1 for more good articles .

Ethereum [ETH] is expected to make a major breakout as it forms a triple bottom pattern in 2024, reminiscent of the 2021 rally.

At press time, ETH is trading at $2,314, up 0.31% over the past 24 hours, a development that has fueled optimism that the fourth quarter could see significant growth.

Can a Triple Bottom Drive a Bullish Reversal?

A triple bottom is a well-known pattern that often signals a bullish reversal. In 2021, Ethereum followed a similar structure before a massive rally.

If Ethereum maintains this trend, a breakout above $3,500 could further boost investor confidence.

To confirm the bullish momentum, Ethereum must break through a critical resistance level. The $2,800 mark is the first major hurdle, a break above which could set the stage for a test of $3,500.

How strong is ETH?

Technical indicators show a bullish outlook for Ethereum. At press time, the relative strength index (RSI) is 45.63, indicating that ETH is neither overbought nor oversold.

The Bollinger Bands (BB) indicate that ETH is trading in a narrow range and volatility is likely in the future.

A break above the upper limit could trigger a strong rally, so these indicators will be crucial in the coming days.

Do exchange rate flows signal a rebound?

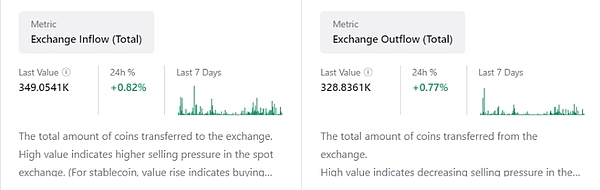

At press time, exchange flow data presents mixed signals but points to a possible bullish move.

Exchange inflows have increased by 0.82% over 24 hours to 349.05K ETH at press time, indicating some selling pressure as traders move tokens to exchanges.

However, exchange outflows have increased by 0.77% over 24 hours to 328.83K ETH at press time, suggesting that many investors are still not placing their tokens on exchanges.

If outflows continue to increase, it could indicate reduced selling pressure and growing confidence in ETH’s upside potential.

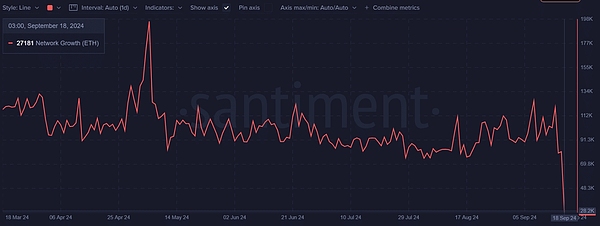

Is Ethereum scaling?

Ethereum network growth remains relatively slow, with 27,181 new addresses recently added, a growth rate of 0.24% over the past 24 hours at press time.

A neutral signal indicates that while Ethereum’s network is stable, it is not seeing a surge in new user activity.

ETH Price

At the time of writing, Ethereum is trading around $2,300, having fallen 1% over the last week.

Will Q4 bring a breakthrough?

Ethereum is at a critical juncture. While technical patterns such as the triple bottom, RSI, and Bollinger Bands suggest a possible breakout, network growth and mixed trading flows suggest a need for caution.

With volatility expected, the fourth quarter may determine whether Ethereum can break through key resistance levels and regain the bullish momentum that has driven its 2021 rally.

The article ends here. Follow Weibo Dolphin Dolphin 1 for more good articles. If you want to know more about the relevant knowledge of the crypto and first-hand cutting-edge information, please consult me. We have the most professional communication community, publishing market analysis and high-quality potential currency recommendations every day. There is no threshold to join the group, and everyone is welcome to communicate together!