Centralized organizational decision-making, L2 tail that is difficult to get rid of, and periodic liquidity tightening are the "three big mountains" facing Ethereum.

Author: Wenser

Original: Odaily Odaily

Cover: Photo by Shubham Dhage on Unsplash

In the previous article "Counting the Seven Deadly Sins of Ethereum, Who Can Play the "Saving Song" for It?" , we briefly explained the past behavior of the Ethereum Foundation from the perspective of the "Seven Deadly Sins". In a nutshell, all the current disputes of Ethereum originated from the poor price performance, and the reason was the various operations of the official forces represented by the Ethereum Foundation in the past. However, the problems mentioned are more superficial phenomena. Odaily Odaily will further analyze this in this article and point out the three major problems currently facing the Ethereum ecosystem, mainly involving organizational management, ecological landscape and cyclical chronic diseases.

The primary problem of Ethereum ecosystem: centralized decision-making ecosystem vs decentralized technology ecosystem

Unlike Bitcoin, whose founder disappeared, the birth, development and slightly rigidity of Ethereum, which is under the banner of "programmable currency", are all driven by official forces represented by the foundation. In addition to Vitalik, the "key man", the face of the Ethereum Foundation also includes Executive Director Aya Miyaguchi (took office in early 2018) and Board Member Patrick Storchenegger.

Other active official personnel include researchers Justin Drake , Dankrad Feist , Fredrik Svantes , Anders Elowsson , Carl Beekhuizen, Julianma , developer Hsiao-Wei Wang , project manager Rodrigo , protocol support team leader Timbeiko , team leader Péter Szilágyi , core developer consensus layer leader Danny Ryan , etc. For more technical personnel, please refer to the article "Who is responsible for Ethereum development?"

Nevertheless, at the 12th AMA of the Ethereum Foundation, when asked "Is Ethereum's development facing a shortage of manpower?", Ethereum co-founder Vitalik Buterin answered that "In the field of p2p networks, there is a clear shortage of personnel, and this issue is rarely discussed." The Ethereum Foundation's research department also gave a positive answer: "Core development work does require more personnel, especially important areas such as fork selection. These areas are in urgent need of more attention and contributors."

It can be said that although the decision-making process of the Ethereum Foundation has various decentralized designs, it is limited by factors such as limited human resources and the high uncertainty of the development of technical routes. In many cases, Vitalik and other front-end figures have actively or passively become the "centralized decision-making focus" of the Ethereum ecosystem. This is also why many people have heard about Vitalik's personal blog before, and many project parties have regarded it as a golden rule or even as a "startup guide". There is indeed a "criminal record" of an article giving birth to several startups.

But this is obviously an abnormal phenomenon, and the Ethereum Foundation actually discussed this as early as 2019:

During a roundtable at the ETH Denver hackathon, Ethereum Foundation community relations manager Hudson Jameson, Ethereum Foundation researcher Vlad Zamfir, and Ethereum Foundation developer Piper Merriam spoke about blockchain governance, all of whom agreed that the current hybrid decision-making process for the Ethereum protocol is not a long-term solution.

“I don’t think blockchain governance will be like any open source governance we’ve seen before…Is Ethereum’s structure sustainable? I think the answer is no,” said Vlad Zamfir.

Piper Merriam is optimistic about Ethereum’s current “opaque” form of governance, adding that he is confident that core developers will continue to contribute and make reasonable decisions (about the blockchain protocol) at least for a while.

On this issue, Aya Miyaguchi believes that when it comes to a blockchain full of infinite possibilities (such as Ethereum now), the way forward may not only include "one, two, or three voices", but many voices. She concluded, "Our job is to coordinate, but not to make actual decisions. Decisions can be made by our members, and they can certainly be part of the decision-making process, but not necessarily all of it."

——From "The Gentle Pusher Behind Ethereum, the World's Second Largest Blockchain by Market Value"

As time goes to 2024, we can see that this problem has not changed much. We can also get a glimpse of it from the respondents and answers of the 12th AMA of the Ethereum Foundation. (For details, see "A 10,000-word review of the latest AMA of the Ethereum Foundation: ETH value, the current status of the foundation, the future of the mainnet, the development and research focus of L2" )

It can be said that although the degree of decentralization of the Ethereum ecosystem technology level has not been greatly affected after the POW transition to the POS mechanism, the degree of centralization of the decision-making ecosystem remains the same.

This is also one of the reasons why many people have expressed dissatisfaction with the decisions made by the Ethereum Foundation. For example, in "Is dissolving the Ethereum Foundation the only way out?", it is mentioned that " Justin Drake and Dankrad Feist, researchers at the Ethereum Foundation, chose to become project advisors for Eigenlayer, which violated the trusted neutrality guidelines Vitalik had mentioned before." The spearhead points directly to the chaotic management of the Ethereum Foundation members, and even needs to "either promise to dissolve the foundation at an appropriate time, or formulate a constitution that stipulates certain principles that the organization must abide by and must not violate. Allowing its key decision makers to obtain a large number of advisory shares is equivalent to Supreme Court judges holding a large number of shares in the companies they rule on."

In addition, the most concerning issue of the Ethereum Foundation's spending is also difficult to satisfy. In the article "Spending transparency is questioned, how does the Ethereum Foundation use its ETH?" , crypto KOL Ignas mentioned, "The Ethereum Foundation lacks a comprehensive and transparent total expenditure report. Who is auditing the Ethereum Foundation? Its latest is the 2021 report, which shows internal expenditures and external grants and bonuses totaling US$48 million." When the issue of transparency in the Ethereum Foundation's financial expenditures was rampant in August this year, Ethereum Foundation member Josh Stark stated that "EF is about to release an updated report covering 2022 and 2023, which is expected to be released before Devcon SEA (November 12-15)." It's hard to believe that it is not "trying to balance the accounts in the short term."

According to Vitalik's previous statement that "the current budget strategy of the Ethereum Foundation is to spend 15% of the remaining funds each year", combined with Justin Drake's statement that "EF's main Ethereum wallet is worth approximately US$650 million" and "the Ethereum Foundation's annual budget is US$100 million", can the survival of the Ethereum Foundation really be as stable as imagined?

Minor issues of Ethereum ecosystem: No new growth points in the mainnet vs. L2 network dominating the market and being too big to fall behind

Although Vitalik himself has "decided" the development path of L2, and even wrote in August that "I am very sure that EIP-4844 alone has saved users more than $100 million in transaction fees", at present, the dozens of L2 networks have still become a "segmented ecosystem" of "separating one side" and "occupying the mountain as king".

Danny Ryan, a core member of the Ethereum Foundation (the head of the consensus layer of the Ethereum Foundation core developers mentioned above), emphasized this point in his article "Analysis of the Key Issues of Ethereum in 2023" in February 2023. He mentioned:

“Given that all the eggs are in the L2 basket, one thing I worry about is the alignment of L2, both in the short and long term. There are two main concerns — (1) L2 is parasitic and will eventually fork into L1, and (2) L2 is the Ethereum standard where users interact but do not believe in Ethereum’s values — decentralization, censorship resistance, support for public goods, radical cooperation, etc. The former is more of an existential question — is there actually value in being anchored to the Ethereum security enclave? This is essentially the argument for the L2 roadmap — these scalable environments that inherit Ethereum’s security and native bridges are valuable to users and therefore valuable to the developers, companies, and communities that build and maintain them.

I believe the argument - achieving sufficient cryptoeconomic security is hard, and in an increasingly competitive environment, most blockchains will inevitably fail to achieve sufficient levels. Cryptoeconomic security is a limited resource that is a function of the ongoing economic demands of these systems. So while I do expect some L2s to "abandon" Ethereum and attempt to leave - some may succeed, others fail - I do not believe this will happen on a large scale, and a few L2s leaving does not break the cryptoeconomic security as a service thesis.

As for (2), I have more concerns. L2 will inevitably become the primary touchpoint for the vast majority of users. In most cases, they will exist in L2, interact with L2, and build bridges between L2s because these L2s are both secure and affordable. Therefore, L2 becomes the facade of Ethereum. This approach may be secure, but is it decentralized, censorship-resistant, and upholds the values of Ethereum, inspiring the world to constantly reimagine itself? At this point, the answer to these questions is clearly not yes.

VCs are entering the L2 space, tokens are being arbitrarily allocated to insiders everywhere, and most governance models are plutocracy and upgrade without notice. Not to mention that most L2s make sacrifices in their security models to go to market in hopes of iterating on decentralization (e.g. no fraud proofs, single sequencer, unclear emergency exit mechanisms, etc.). There is an interesting balance here. L2s can and want to put more effort into advertising and business development to compete with alt-L1s who are very aggressive in this space. This makes Ethereum L1 neutral in this regard while the layers above try numerous user acquisition and onboarding technologies. But it is not obvious whether L2s will retain the brand, values, and soul of Ethereum by default. Management of a healthy L2 ecosystem is critical and requires a multi-faceted effort to do so - researching and promoting secure structures, realizing the value of L2 (letting it show what it is, not what it is portrayed to be), and discussing L2 governance risks, security tradeoffs, poor token allocations, value alignment, and other emerging issues when possible. And we can't just focus on the negative, but celebrate the positive, secure, and consistent parts. The Ethereum community today has tremendous power to set the specifications that will define how the L2 movement evolves over the next few decades. We must ensure that L2 inherits not only the security of Ethereum, but also its legitimacy.”

It can be said that everything Danny said hits the vital point of the current L2 network of the Ethereum ecosystem.

At the same time, as Open_Rug’s manager Crypto Wei Tuo previously analyzed : "L2 ecological projects are highly overlapped with the main chain and cannot cause explosive trading prosperity." Since then, the Ethereum ecosystem has entered a series of vicious cycles of "Matryoshka-style staking-re-staking-points-tokens-listing", and the final result is - "The ETH-based pricing system has lost everything since then."

In addition, now that the POS mechanism has become a foregone conclusion, "there is no fiat currency cost to obtain ETH output, and the handling fee is also a currency-based cost. Therefore, there is no 'mining machine price'. Pledgers will not maintain the lower limit of the ETH price like miners, but can mine, sell and withdraw unlimitedly."

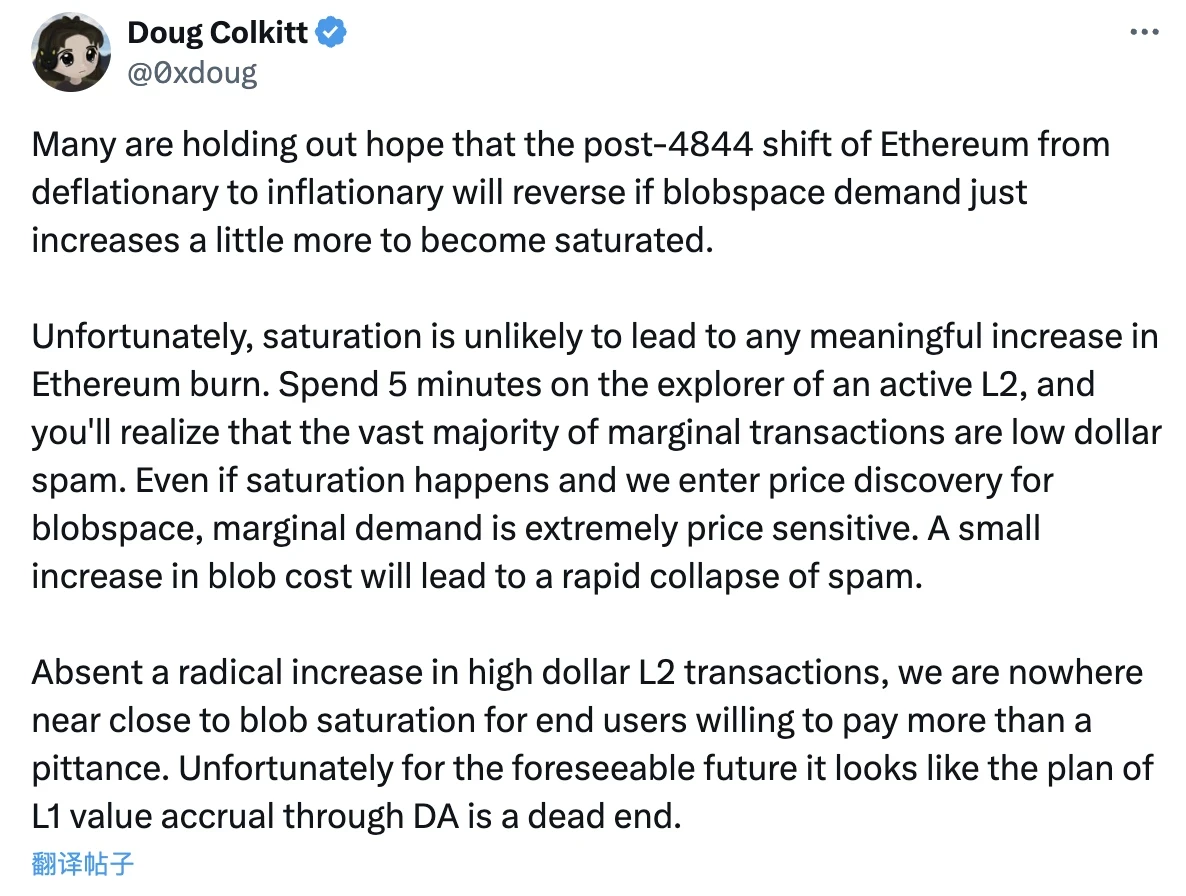

As mentioned in the article "The Great Debate on L2's Value Feedback Ability: Can ETH Reverse the Inflation Trend?" : "ETH has experienced a significant increase in supply while demand has not changed significantly, and the imbalance between supply and demand has led to a decline." In response to this, Doug Colkitt, founder of the DeFi protocol Ambient, also put forward his own point of view: "The saturation of Blobs is unlikely to lead to any substantial increase in the destruction of ETH" because "most marginal transactions on L2 are 'junk transactions' with low amounts. If Blobs reach saturation and enter bidding mode, the transaction costs on L2 will inevitably increase significantly, and marginal transactions are often extremely sensitive to prices. Therefore, the increase in Blob costs will indirectly lead to a sharp decrease in small transactions on L2." This will further lead to "Ethereum will not be able to accumulate value for the mainnet through DA (Blob fees) in the foreseeable future."

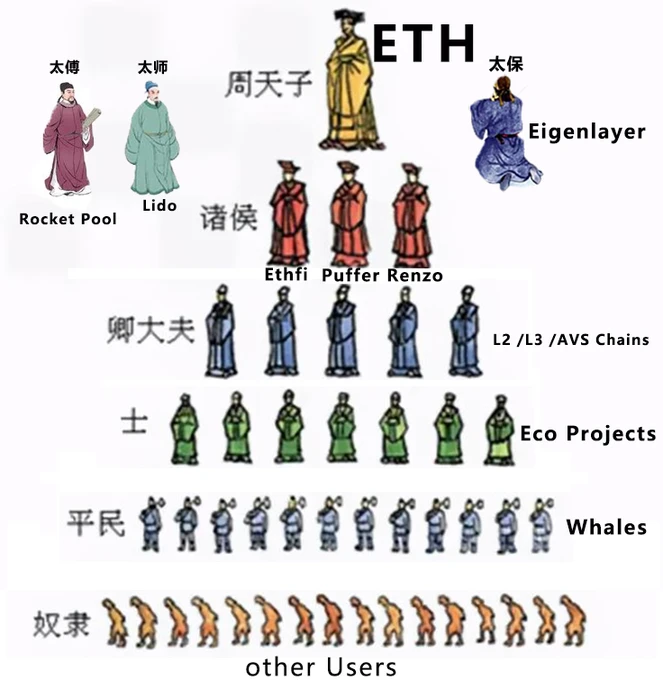

If ETH is the "Emperor of Zhou" in the Spring and Autumn Period and the Warring States Period, then L2 has become the "feudal state" that is "beginning to show its fangs" - after all, according to L2 Beat statistics, there are currently as many as 74 L2 projects, which was also an era of "a hundred schools of thought" in the pre-Qin period.

The L2 network is also in a dilemma - on the one hand, the project party has to maintain its own currency price; on the other hand, it has to "build with peace of mind" (or create a "false prosperity"?). It must be said that it is also a kind of "sweet torture" - although the currency can be sold, it also requires time, excuses and even "market fluctuations".

Perhaps Vitalik has also realized the problems related to the Ethereum ecosystem. He has been posting frequently recently. According to statistics, the number of posts in August has exceeded that of the previous 18 months . Not only that, he also said before: "I don't plan to invest in L2 or other token projects in the future, and I will only donate to valuable projects." Just the day before yesterday, he also publicly stated: "Starting next year, I will only publicly mention L2 in the Stage 1+ stage, regardless of whether I invest or not."

Perhaps in the near future, the L2 network will also usher in a "merger moment", or the official forces represented by the Ethereum Foundation will take the initiative to "cut down the vassal"? For this, we can only keep an eye on it and wait and see.

The most serious problem of Ethereum ecosystem: Ethereum spot ETF approval VS market cyclical liquidity tightening

It should be noted that under the "four-year cycle paradigm" pioneered by Bitcoin, the current cryptocurrency industry still shows a relatively regular bull-bear conversion pattern. Ethereum, as the second largest cryptocurrency by market value, cannot escape this "curse".

It is not the first time that Ethereum has been caught up in a "hot dispute". What's more, Steven Nerayoff, the former legal counsel and consultant of the Ethereum Foundation, even "revealed" that the hack of Ethereum's The DAO was done by insiders, and that the Ethereum Foundation and Slock.it, the initiator of The DAO, were the notorious behind-the-scenes manipulators. He even pointed out: "Ethereum has become a system influenced by a small number of developers, regulators and investors, and its behavior is contrary to the intentions of the community." (For details, see the article "Ethereum Foundation was reported by its "predecessor": The theft of The DAO was self-directed and self-acted" )

Looking back now, these accusations are of course nonsense, but they are somewhat similar to the current situation of the Ethereum ecosystem being "attacked from both sides" - in the external environment, the Solana, TON ecosystem and the Move language ecosystem that are closely linked to the EVM are coming on strong; in the internal environment, innovation and growth are sluggish, and the L2 network is emerging. The approval of the Ethereum spot ETF did not bring in a large amount of liquidity funds, and even triggered the outflow of some liquidity.

According to data from the Sosovalue website , since the launch of the US Ethereum spot ETF, as of September 12, the outflow of funds has reached US$582 million, with a single-day net outflow of approximately US$20.14 million.

It is no wonder that some people previously believed that “the four-year cycle theory is the biggest scam in the cryptocurrency industry”

The concept of a cryptocurrency “four-year cycle” needs to be completely destroyed so that cryptocurrency can truly cross the chasm and become something entirely new.

As long as the concept of a “four-year cycle” exists, the default incentives are to: 1) prioritize short-term behavior (whether builders or investors); 2) perpetuate the “greater fool theory” because people always believe that the current cycle will eventually collapse. Crypto is becoming a zero-sum game as low-hanging fruit is adopted. Founders and communities celebrate large financings without any products as a win. While many projects have received funding from all sides, they hide the fact that they have no real technical innovation like the previous cycle (DeFi).

What do we believe in, other than the foolish hope that someone will take over? Do we believe in Crypto Twitter? Is it just a sentiment amplifier? Do we believe in alpha, or do we believe in self-deceiving narratives?

See, that’s all we have left… narratives. We force feed ourselves stories that we don’t believe in, just hoping others will believe them. But without narratives, there can be no bull market and adoption! Yes, but narratives work best when you don’t treat them as narratives.

——From "Viewpoint: Only by destroying the "four-year cycle" theory can cryptocurrency truly cross the gap"

Although the view seems a bit extreme, it does reveal the overall dilemma faced by the crypto industry, including the Ethereum ecosystem - the industry is no longer marginal, but the so-called "positive externalities" that countless people expect are still a long way off.

In this regard, even the Federal Reserve's short-term interest rate cut is only a temporary solution and does not address the root cause.

Conclusion: Ethereum needs "self-revolution" rather than "passive waiting"

To sum up, the problems summarized in abstract form may be more heartbreaking than the specific surface phenomena, but this is indeed the current situation that the Ethereum ecosystem needs to solve urgently, and it cannot be escaped or avoided.

Fundamentally, although the on-chain world is a technological window that carries the ideals of decentralization and expectations of openness and transparency, the occurrence of many things, the emergence and resolution of many problems depend on "rule by man" and "consensus" off-chain.

To some extent, Ethereum, which is entering its 11th year, does need a "self-revolution" rather than passively waiting for the situation to deteriorate beyond control.

In the next article, we will give our own "problem-solving ideas" and solutions, and discuss with our readers, trying to find new breakthroughs and growth points for the Ethereum ecosystem.

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal opinions of the author and the guest, and have nothing to do with the position of Web3Caff. The information in the article is for reference only and does not constitute any investment advice or offer. Please comply with the relevant laws and regulations of your country or region.

Welcome to join the Web3Caff official community : X (Twitter) account | WeChat reader group | WeChat public account | Telegram subscription group | Telegram exchange group