TechFlow by: TechFlow

Last week, we released V2 of Visa and AlliumLabs ’ on-chain analytics dashboard.

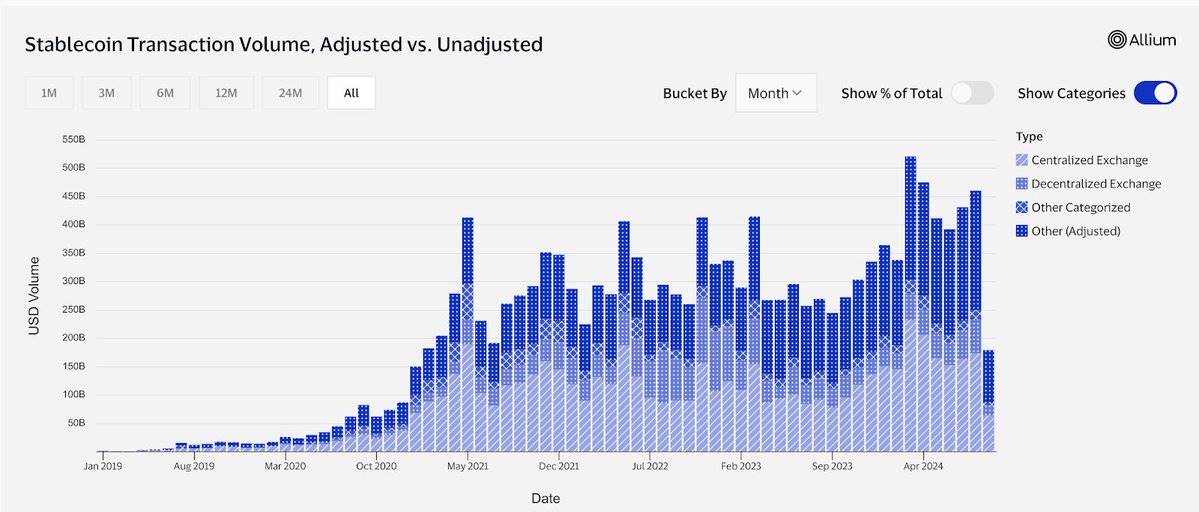

Check out some key insights from the data and view the full revised dashboard here. Since 2019, annualized stablecoin volume has increased by an average of 225% over the market cycle. 41% of 2024 adjusted volume comes from deposits and withdrawals on centralized exchanges.

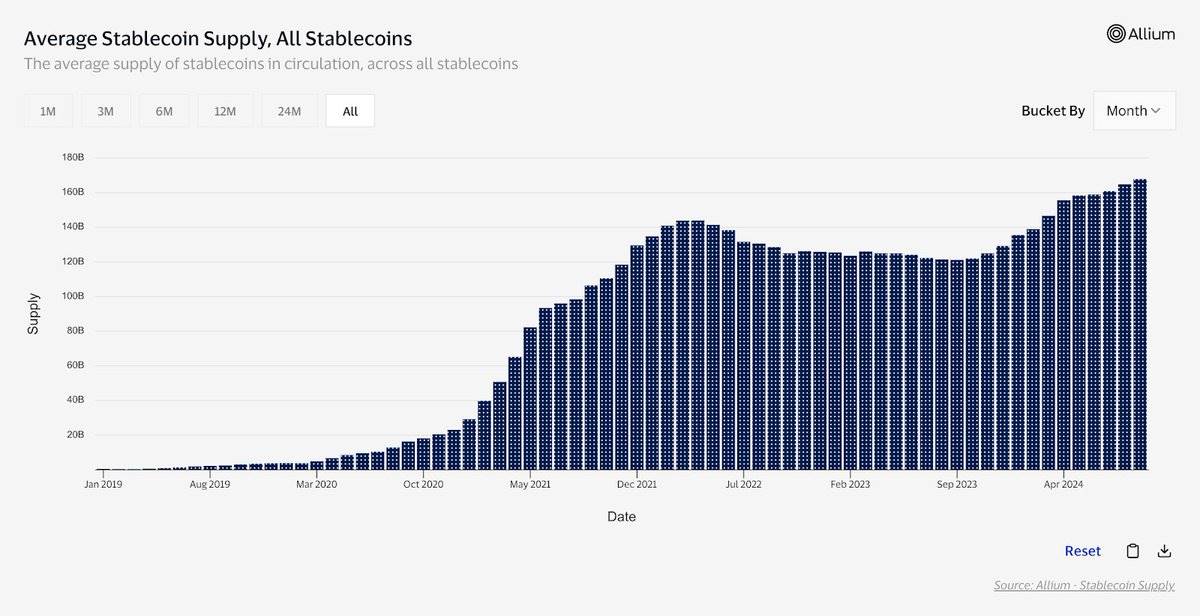

The total supply of the leading fiat-backed stablecoin has reached an all-time high, with an average daily supply of over $168 billion, an increase of $40 billion over the past 12 months.

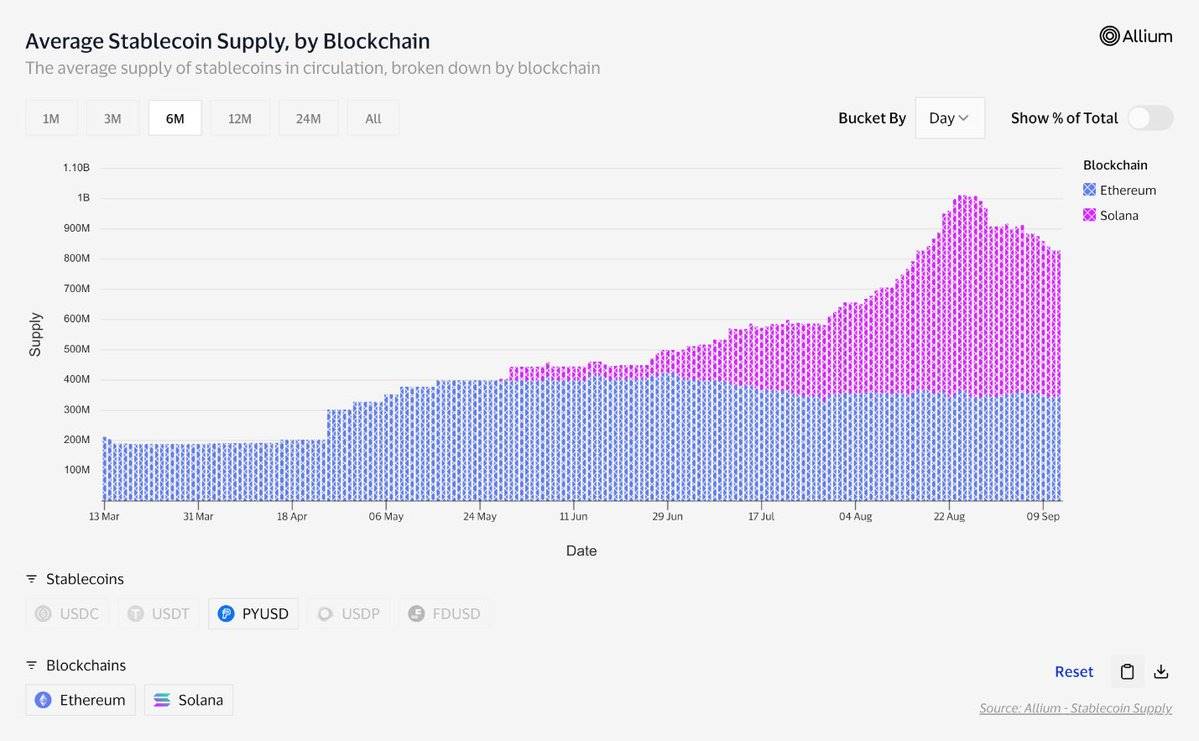

PayPal ’s stablecoin, PYUSD, has seen its supply more than quadruple in the past six months, from $208 million to over $1 billion at one point. This surge was mainly due to its launch on SOLANA in May, which now accounts for 59% of the total PYUSD supply.

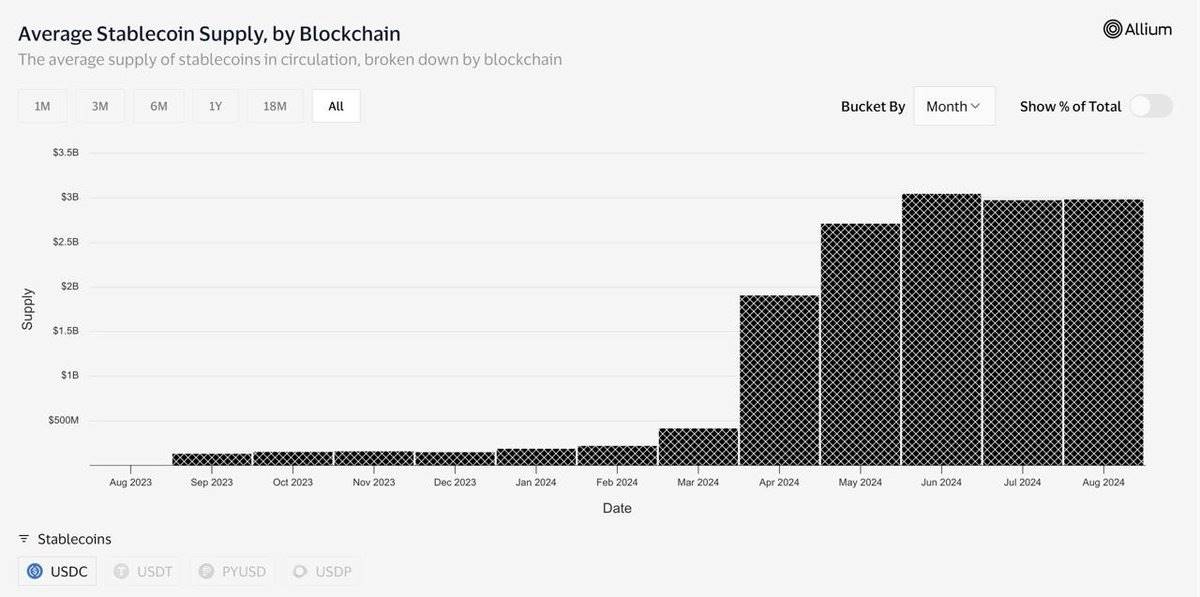

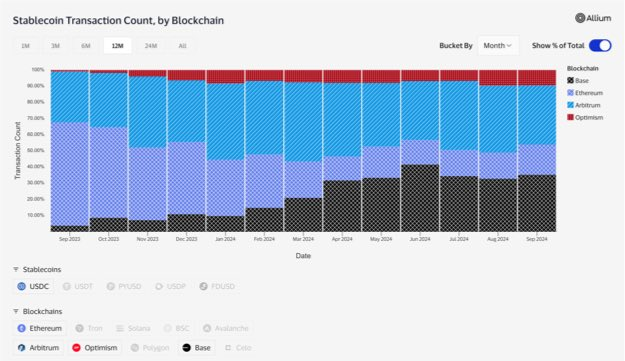

USDC’s average adjusted monthly trading volume on BASE increased from $2.6 billion in March 2024 to $5.6 billion.

Base now holds approximately 10% of the USDC EVM L1 and L2 supply, totaling $3.2 billion.

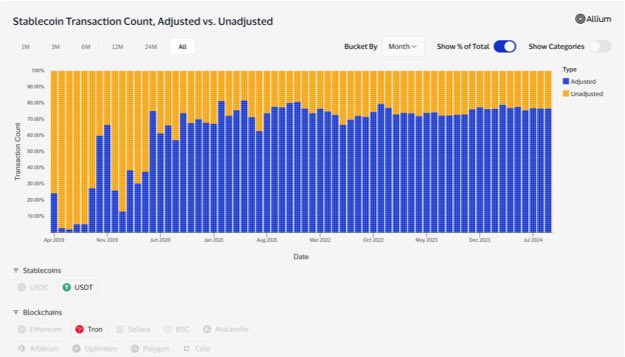

Over the past 12 months, Tron’s adjusted USDT transaction volume has approached 80%, while Tron’s adjusted USDT transaction volume has exceeded 50%.

Both ratios are the highest of any stablecoin-to-blockchain combination.

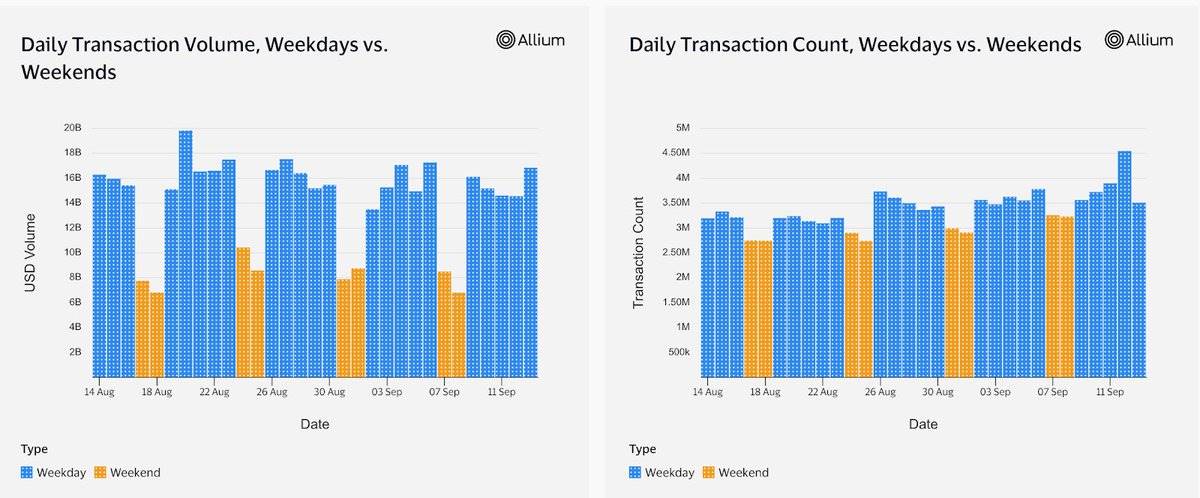

Over the past 6 months, average weekday stablecoin trading volume has been 93% higher than average weekend stablecoin trading volume, but over the same period, average weekday trading volume has been only 17% higher.

Total adjusted stablecoin trading volume over the past 6 months on weekends was $463.4 billion.

In November, Ethereum L2’s monthly adjusted stablecoin transaction volume exceeded all stablecoin transaction volumes on Ethereum L1.

A year ago, Ethereum accounted for 64% of adjusted monthly USDC trading volume. Now, it accounts for just 19%, while Base accounts for 35%.

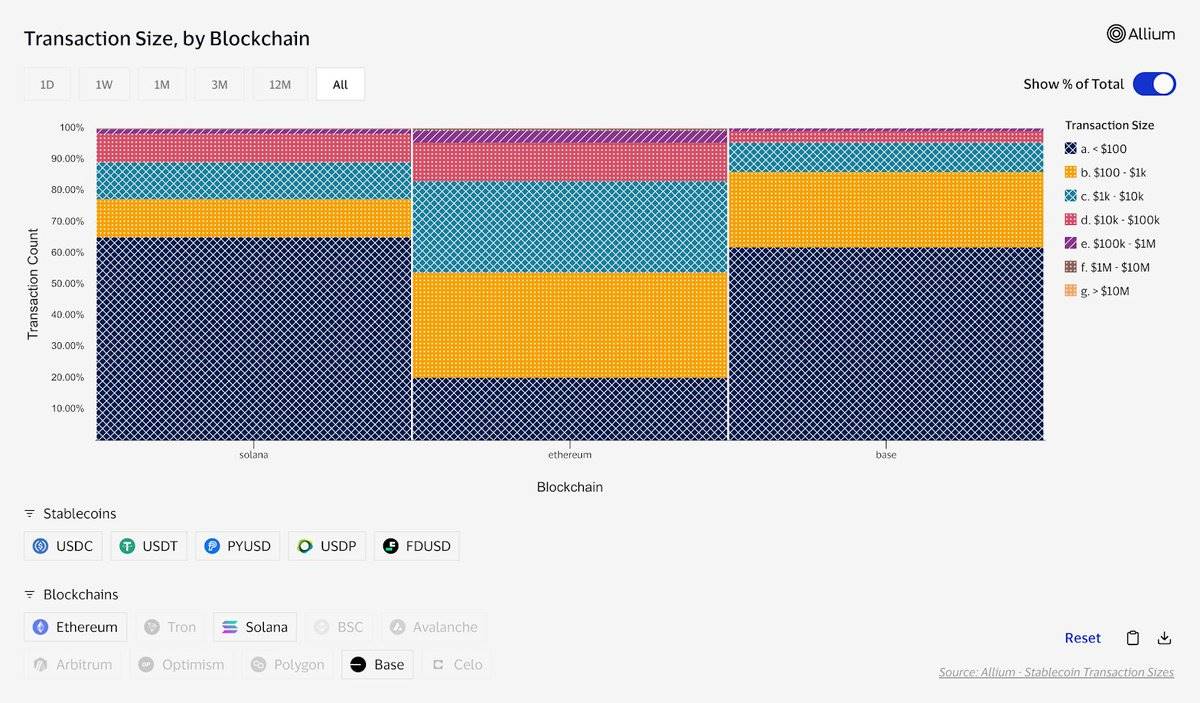

High-throughput, low-cost blockchains have different user behaviors and consumption patterns than high-cost blockchains.

On Solana, network fees can be less than 1 cent, and 65% of historical transactions are less than $100.

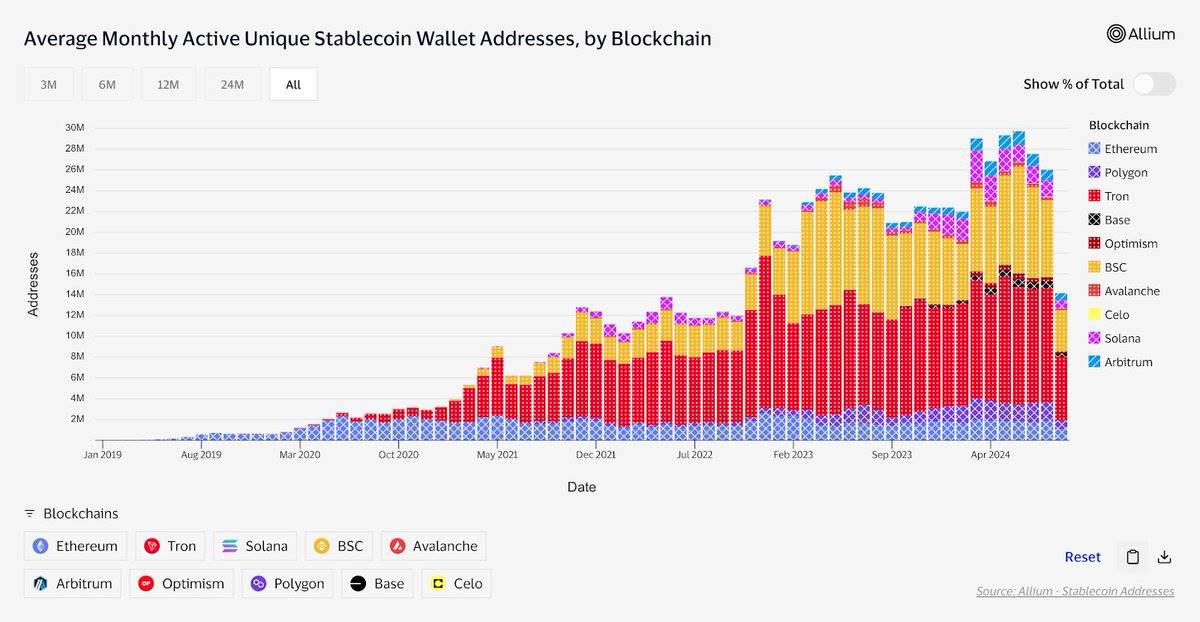

Since 2019, monthly stablecoin wallet addresses have grown from 23,000 to 26 million.

We hope this dashboard will advance the discussion around stablecoins and welcome feedback on how we can continue to improve it. We are excited about the opportunities that stablecoins present and are always looking to work with the next generation of stablecoin-based fintech companies.