Written by Zhu Xueying, Wall Street News

Overnight, the Federal Reserve slashed interest rates by 50 basis points, officially starting an easing cycle. However, the internal voting process for the resolution was not as smooth as expected by the outside world, and the Federal Reserve even staged a "rare disagreement."

This has caused traders who have successfully predicted the extent of this rate cut to begin to doubt the Fed's subsequent rate cut rhythm. Will there be further significant rate cuts in November and December? This also means that the upcoming employment and inflation data reports may become a major factor in determining the pace of the Fed's rate cuts.

Will there be a further sharp rate cut in November? Disappointed traders: It’s hard to say

According to Bloomberg, although Akshay Singal, a Citi trader, accurately predicted a 50 basis point rate cut a few weeks ago, he became confused after seeing the rare dissenting votes and the latest dot plot of the Fed resolution that was not dovish enough:

This 50 basis point rate cut is a fairly hawkish decision… Overall, the Fed may be satisfied with the result, which is not considered overly accommodative, but the negative impact is that the market is puzzled.

Bloomberg commented that Singal's attitude also reflects the broader market sentiment in many ways.

Singal believes that although Powell holds great power in promoting policy and his attitude is obviously more dovish than other members, the extent of subsequent rate cuts is questionable due to internal differences:

Powell wields a lot of power, and the key over the next few months will be to understand just how dovish he really is.

The "source" of traders' confusion: the first "board member's dissenting vote" in 19 years + the dot plot that is not dovish enough

One of the major factors that confused Singal was the first "board member dissenting vote" in 19 years.

The resolution statement shows that not all FOMC voting members support a 50 basis point rate cut. A total of 11 members voted in favor of a 50 basis point rate cut, and only one voted against it, that is, Federal Reserve Board member Michelle Bowman, who advocated a small 25 basis point rate cut to start this round of easing cycle.

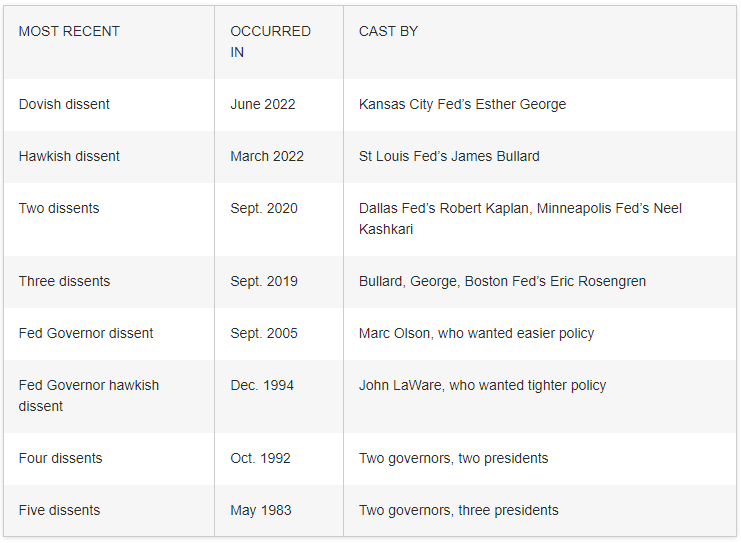

Bowman thus became the first Federal Reserve Board member since 2005 to vote against the decision of the majority of FOMC members at an FOMC interest rate meeting.

Looking back at history, the Fed's meeting decisions rarely encounter dissent, especially during Powell's tenure as chairman. The last time an FOMC voting member disagreed with the overall decision was in June 2022, when a regional Fed president voted against it. Esther George, then president of the Kansas City Fed, advocated a small rate hike.

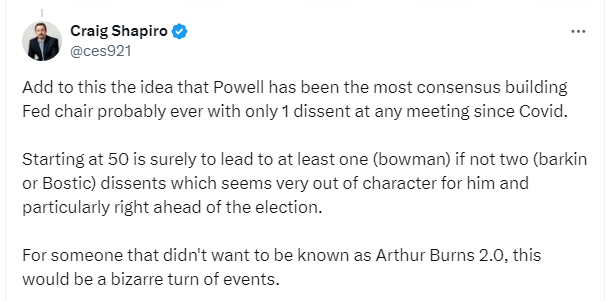

Some traders commented that from Powell's overall style of "unity is strength", this situation actually looks quite "strange", especially on the eve of the US election:

Powell may be the most consensus-building Fed chairman ever, with only one dissenting vote at each meeting since the COVID-19 pandemic.

Starting with a 50 basis point rate cut would surely result in at least one (Bowman) and possibly two (Balkin or Bostic) dissenting votes, which would be highly uncharacteristic of him, especially so close to an election. It would be a rather odd turn for a man who does not wish to be known as “Arthur Burns 2.0.”

Note: Arthur Burns served as Chairman of the Federal Reserve in the early 1970s, and his policy stance was considered too loose in dealing with inflation, laying the groundwork for the subsequent "stagflation".

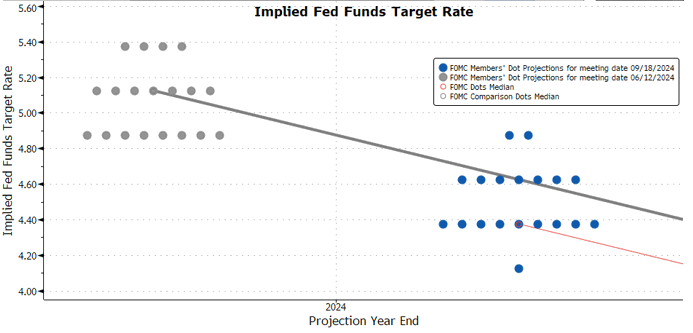

In addition, the latest dot plot, which is not dovish enough, also makes it difficult for market traders represented by Singal to judge the pace of subsequent interest rate cuts. Currently, only slightly more than half of the decision makers expect a total interest rate cut of at least 50 basis points this year.

Of the 19 officials who provided forecasts, all expected rates to be below 5.0% this time, compared to only eight who did so last time. Only two expected rates to be between 4.75% and 5.0%, seven expected rates to be between 4.5% and 4.75%, nine expected rates to be between 4.25% and 4.5%, and one expected rates to be below 4.5%, between 4.0% and 4.25%.

That is to say, only ten of the 19 people, accounting for nearly 53%, expect that the interest rate will be cut by at least 50 basis points this year. Slightly more than half of the officials expect that the remaining two FOMC meetings in November and December this year will cut interest rates by at least 25 basis points each time, which is somewhat contrary to the market's expected pace of easing.

What to focus on next? Data, data, and more data

Since the pace of the Fed's subsequent interest rate cuts is still difficult to determine, data may once again play a leading role.

As Singal said, “Whether the Fed cuts by 25 or 50 basis points at the November meeting is a coin toss…it will be data dependent.” He believes the next two non-farm payroll reports (October 4 and November 1) will have a significant impact on the Fed’s next move.

In his overnight press conference speech, Powell also further emphasized the non-farm payroll and inflation data reports when he was asked what information should be known between now and November to determine the extent of the interest rate cut at the next meeting:

You know, more data. As usual. Don't look for anything else. We're going to see two labor reports, we're also going to get inflation data, all of which we're going to be watching.

You know, it's always a question of looking at the data that's coming in and asking, what does that mean for the changing outlook and the balance of risks? And then thinking through our process, what's the right thing to do? Is policy in line with what we want it to be and is it helping to achieve our objectives. So that's what we do.

He also stressed the importance of paying attention to the Fed's Beige Book:

We have had a lot of data since the last meeting, two non-farm payrolls reports for July and August, two inflation reports, one of which was released during the Fed's quiet period, and the QCW report that suggests our non-farm payrolls may have been artificially inflated and will be revised down.

We also see anecdotal data like the Fed Beige Book, so we collect all of that data and then we go into a quiet period of speaking publicly and we think about what to do and make it clear that this is the right thing for the economy, for the American people that we serve, and that's how we make our decisions.