The Solana (SOL) price prediction is bullish despite its recent failure to break above the $140 resistance level. Breaking above this level could be the boost SOL needs to reach $160, especially with the growing institutional interest.

As more investors show confidence in Altcoin, the likelihood of SOL rising becomes greater.

Institutions Reclaim Solana

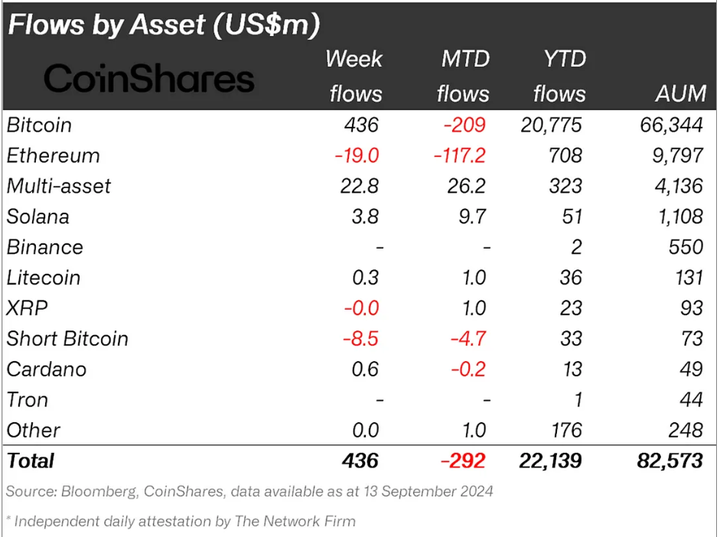

Institutional interest in Solana is on the rise again, especially after a relatively bearish August. This month, institutional investors have invested over $9.7 million into SOL, with inflows reaching $3.8 million in the week ending September 13. Such strong inflows from institutional investors indicate a renewed confidence in Solana’s long-term potential and could serve as a driver of its price gains. The surge in institutional capital is helping to sustain Solana’s current momentum. If these trends continue, the price of SOL could rise further, especially as large investors accumulate the cryptocurrency. Institutional support often provides stability and can serve as a key catalyst for price increases.

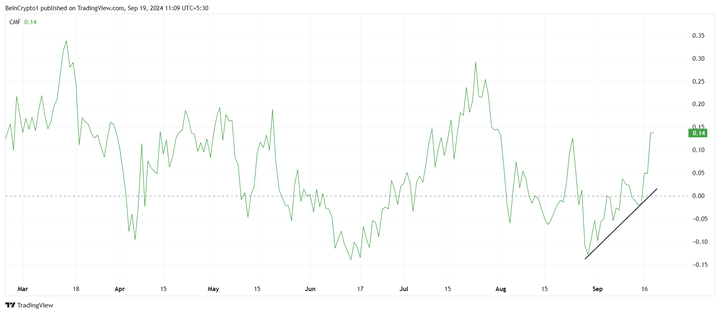

Additionally, Solana’s macro momentum appears to be building, as shown by the Chaikin Money Flow (CMF) indicator, which has reached its highest point in a month and a half. While net flows were mostly negative in early September, they have turned positive in the last three days, largely due to increased institutional activity. The positive change in net flows suggests that the trend may be turning in Solana’s favor. The combination of bullish technical indicators and rising institutional interest provides a favorable environment for further price gains, but maintaining the momentum remains challenging as SOL approaches higher resistance levels.

Medium-term Solana price forecast

The Solana (SOL) ecosystem will be concentrated in Singapore for the next two days and await major announcements that could spark bullish sentiment. The large-cap Altcoin, which has a fully diluted valuation of around $80 billion and an average daily trading volume of around $3.4 billion, has been consolidating in a horizontal channel between $122 and $192 for the past six months.

The continued consolidation in SOL's price has allowed long-term investors to buy more tokens. According to weekly data from CoinShares, Solana's investment products saw a net cash inflow of approximately $3.8 million last week, bringing total assets under management (AUM) to approximately $1.108 billion. Solana's price must rebound from the current weekly support level to avoid a further drop towards $80. However, the Federal Reserve's 50 basis point rate cut on Wednesday changed the outlook for the entire cryptocurrency market, and bulls are expected to dominate. In addition, there are less than two weeks left in October, which is expected to kick off the fourth quarter bull run and continue into next year.

Rise of War

Solana is currently trading around $138 and turning this barrier into support could be crucial in driving the price towards $155 and $160. While a successful breakout would allow SOL to test these higher levels, sustained bullish momentum will be key to sustaining this uptrend.

Furthermore, while the aforementioned factors suggest a possible move above $140, bullish momentum is likely to wane before Solana reaches $160. This could limit the Altcoin’s ability to surpass this critical level, keeping it in a lower trading range.

in short

SOL is eyeing a bullish rebound and after breaking the $138 resistance level turning it into support, it will target $155 and $160 amid growing institutional interest. This month, institutions have invested $9.7 million in SOL, which indicates renewed confidence and drives net fund inflows.