Author: YBB Capital Researcher Zeke

Foreword

The halving law has begun to fail, and a host of altcoins are languishing. Speculators are exiting, and believers are beginning to doubt themselves. The industry's despair stems not only from sluggish secondary market prices but also from a general uncertainty about the future. Criticism has become the dominant theme, analyzing everything from the lack of applications to the minutiae of financial reports from major public chains. Now, the focus is shifting to Ethereum, once the hottest spot in the crypto world. So, what exactly is the internal predicament of this king of altcoins?

I. Expand the main chain horizontally and generate multiple layers vertically.

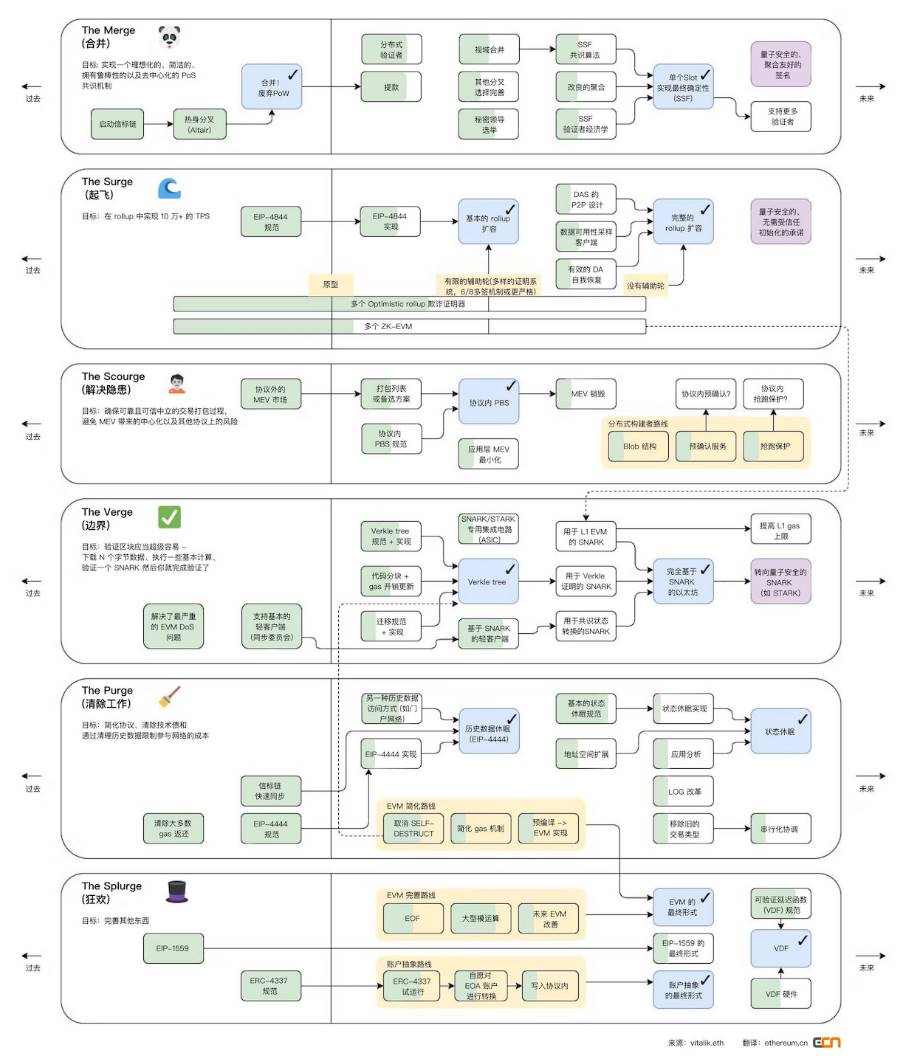

The idea of moving towards fully modular fractal scaling was Vitalik's vision for the endgame of Ethereum during 2018-2019. This involved optimizing the underlying layer around Data Availability and allowing for infinite scaling at the upper layers, thus escaping the public blockchain triangle paradox. Ethereum would then become the settlement layer for all blockchains, ultimately achieving the end game of the blockchain scaling game.

After confirming the feasibility of the concept, Ethereum's roadmap at both ends of the spectrum began to advance rapidly. In 2023, with the successful merger of the main chain and Beacon Chain during the Shanghai upgrade, the modular theme began to permeate the Ethereum ecosystem. Now, with the first step towards EIP4844 after the Cancun upgrade, the main chain itself is infinitely close to Vitalik's early vision. Its upper layers are also flourishing, with Gas, TPS, and diversity gradually crushing its former competitors. It can be said that, apart from the drawback of a sense of fragmentation, all narratives about heterogeneous chains being the "Ethereum Killer" should be put to rest. However, the harsh reality is that TON and Solana are constantly rising, and many infrastructure projects that copy the modular narrative are even outperforming ETF-backed "prototypes" in the secondary market. What is the reason for this situation?

The recent criticism of Ethereum's various "crimes"—from transitioning to Proof-of-Stake (PoS) to developing Layer 2—has been a major focus. However, in my view, Ethereum developers and Vitalik Buterin haven't done anything wrong in pushing for modularity. If there is any fault, it might be that the process was pushed too fast and was overly idealistic. I wrote something in an article earlier this year that roughly meant: if blockchain has significant value beyond the financial sector, and Mass Adoption eventually arrives, then Ethereum's shift to modularity will make sense. Clearly, Ethereum is overly idealistic in this regard; there's currently no evidence to prove these two points are real. The same applies to the pricing curve of Delegated Accounts (DA). Given the current state of Layer 2, the imagined explosion in application layers hasn't materialized. Furthermore, among many general-purpose chains, only a few top players like ARB, OP, and Base remain active; DA revenue alone cannot possibly sustain Ethereum's positive cycle. Many problems remain. For example, gas consumption has decreased by tens or even hundreds of times; tasks that once required 0.1 ETH can now be completed with just 0.001 ETH. However, user activity hasn't increased by tens or hundreds of times, resulting in a market supply far exceeding demand. Nevertheless, pushing public chains towards mass adoption while maintaining decentralization and security to the maximum extent seems reasonable. Ethereum's ability to gradually turn its eight-year-long promises into reality is already remarkable in the crypto world. Unfortunately, reality is inherently pragmatic; the market won't pay for ideals. In the current climate of scarce applications and liquidity, the conflict between technological idealists and investors will continue to deepen.

II. Human Nature

Ethereum's idealism isn't just reflected in its predictions of the application layer's future, but also in its assessment of human nature. Currently, the two most discussed issues regarding Layer 2 are: 1. Centralized Sequencers; 2. Tokens. From a technical perspective, Layer 2 can achieve decentralization. However, from a human perspective, leading Layer 2 projects are unlikely to relinquish the enormous profits generated by their sequencers. Unless, of course, decentralization can revitalize tokens and generate even greater profits. For example, the leading Layer 2 projects mentioned earlier certainly have the capability to decentralize their sequencers, but they won't. This is because they are all top-down projects, funded through massive amounts of capital, their creation and operation are very Web2-like. The relationship between community members and Layer 2 is more like that between consumers and cloud server operators. For instance, frequent users of Amazon's AWS servers might receive coupons and cash back; Layer 2 projects are similar (airdrops). But sequencer revenue is the lifeblood of Layer 2, from the project team's perspective. Design, financing, development, operation, and hardware procurement—none of these steps require community support. In their logic, users contribute little (which is why many Layer 2 projects are often rude to users), let alone the community's desire to decentralize the sequencer. Moral constraints alone cannot bind Layer 2. To truly decentralize the sequencer, a new sequencer solution must be designed from the perspective of the Layer 2 project teams' interests. However, such a solution would obviously be highly controversial. A better approach is to remove the decentralized sequencer part from the roadmap or postpone it to a hidden location. Currently, Layer 2 completely contradicts Ethereum's original intention of embracing modularity; most Layer 2 projects are simply using a deceptive tactic to seize everything of value from Ethereum.

Let's talk about tokens. Layer 2 public chains are still a relatively new concept in crypto. From the perspectives of Ethereum, Layer 2 project teams, and the community, the existence of tokens is quite contradictory. Let's start in order. From Ethereum's perspective, Layer 2 shouldn't have tokens. For Ethereum, Layer 2 is simply a "high-performance scaling server" needed for cross-chain communication, charging only user service fees. This is healthy for both, as maximizing the stability of ETH's value and position is crucial for long-term business development. To put it more concretely, if we compare the entire Layer 2 ecosystem to the European Union, maintaining the stability of the Euro is essential. If many member states issue their own currencies to weaken the Euro, then the EU and the Euro will eventually cease to exist. Interestingly, Ethereum doesn't restrict Layer 2 token issuance, nor does it restrict whether Layer 2 uses ETH as a gas fee. This open approach to rules is indeed very "Crypto." However, with the continued weakening of ETH, "EU members" are already showing signs of activity. Leading Layer 2 blockchain launch tools generally explicitly state that projects can use any token as gas and can choose any integrated DA solution. Furthermore, one-click blockchain launches will likely foster the emergence of smaller Layer 2 alliances.

On the other hand, from the perspective of Layer 2 and the community, even if ETH rebounds strongly in the future, Tokne's situation remains awkward. Leading Layer developers were initially very hesitant about issuing their own tokens. Besides the issue of being on the opposite side of ETH mentioned above, there are several other factors: regulatory risks, not needing funds to sustain development through tokens, difficulty in determining the appropriate level of token empowerment, and the fact that directly using ETH can most quickly promote TVL and ecosystem growth, while issuing their own tokens might conflict with this, and liquidity is unlikely to be stronger than ETH's.

It's still a matter of human nature: printing billions of dollars out of thin air—no one can resist. Furthermore, from the perspective of community members and ecosystem development, tokens seem to be necessary. This way, besides collecting fixed service fees, there's a readily available treasury—why not? However, token design must address these issues and minimize empowerment. Thus, a bunch of worthless tokens, requiring no POS staking or POW mining, were born. Their function is solely voting, and each linear release draws significant liquidity from the market. As time goes on, these unmotivated tokens will continue to depreciate after a one-time airdrop, failing to provide a satisfactory explanation to the community and investors. So, should they be empowered? Any valuable empowerment will contradict the above issues, ultimately leading to a dilemma. The token situations of the four major cryptocurrencies perfectly illustrate this problem.

Coinbase, which doesn't issue tokens, is far more successful than Zks and Starknet, with its sorter revenue even surpassing that of Superchain's creator, OP. This was mentioned in a previous article about the attention economy; leveraging social media influence, operations, and pump-and-dump schemes to create wealth effects for MEMEs and multiple projects within the ecosystem is essentially a form of indirect, multiple small airdrops, far healthier than a one-time, direct token airdrop. Besides creating sustained appeal, it avoids numerous problems; allocating a portion of sorter revenue each month ensures continued activity and a healthy ecosystem. Furthermore, current Web3 point systems only scratch the surface of PDD's approach; Coinbase's long-term, sustainable operational strategy far surpasses that of nouveau riche like Tieshun.

III. Unfair Competition

Layer 1 and Layer 2 are homogenized, and even among Layer 2 chains, they are largely similar. This situation stems from a crucial problem: few independent applications can support a complete application chain in this round, and the few that manage to stand firm have "run away" (DYDX). Currently, it's fair to say that all Layer 2 chains target the same users, even the same users as the main chain. This has led to a very undesirable phenomenon: Layer 2 chains are constantly eroding Ethereum's ecosystem, and there's vicious competition for TVL (Total Value Limit) among them. Nobody understands the differences between these chains; users can only rely on points programs to determine where to store their money and where to conduct transactions. Homogenization, fragmentation, and a lack of liquidity—in the Web3 public chain ecosystem, Ethereum is currently unique in simultaneously addressing all three. These problems also stem from the drawbacks of Ethereum's open spirit; we may soon see a large number of Layer 2 chains naturally eliminated, and centralization issues will trigger various forms of chaos.

IV. The leader does not understand Web3

Whether it's the former "Vitalik" or the "Little V" mentioned by KOLs now, Vitalik's contributions to infrastructure have undeniably fostered the prosperity of the entire blockchain community since the Satoshi Nakamoto era. However, the reason Vitalik is now called "Little V," besides his personal life, is due to an interesting argument: that the Ethereum guru doesn't understand DApps, let alone DeFi. I agree with this statement to some extent, but before continuing the discussion, I want to clarify one thing: Vitalik is Vitalik, and only Vitalik. He is neither an omnipotent god nor a useless dictator. In my eyes, Vitalik is actually a relatively humble and proactive public blockchain leader. If you've read his blog, you'll know he updates one to three posts each month discussing philosophy, politics, infrastructure, and DApps. He's also happy to share on Twitter. Compared to some public blockchain leaders who like to criticize Ethereum from time to time, Vitalik is much more pragmatic.

Having said the good things, let's talk about the negative aspects. In my opinion, Vitalik has three problems:

1. His influence in this circle is enormous, ranging from individual investors to venture capitalists. Everyone is affected by his every word and action. To Vitalik's entrepreneurial ventures also represent a morbid trend within Web3 projects.

2. He is quite persistent in the technological directions he believes in, and sometimes he will even go to the event to endorse them;

3. He may not really understand what encrypted users need.

Let's start with Ethereum's scaling. The argument that Ethereum urgently needs scaling is often supported by the extremely high on-chain access driven by the overflow of external liquidity in 2021-2022. However, Vitalik seems genuinely unclear about this issue, considering it a clearly short-term phenomenon, and questioning the purpose of users being on-chain in the first place. Another point is that while he repeatedly emphasizes the technological superiority of ZK in Layer 2, ZK is clearly not user-friendly or conducive to ecosystem development. Currently, many ZK Rollups founded by Vitalik, not to mention those in the T2 and T3 tiers, even the two top players are on the verge of collapse. The three giants of Optimistic Rollups are also outperforming the combined performance of dozens of ZK Rollups. There are other similar issues. For example, the criticism of MPC wallets in the middle of last year was considered biased, directly supporting AA wallet. Even earlier, SBT was proposed, but its practical application proved ineffective, leading to its eventual demise. It's fair to say that the technological solutions Vitalik has supported in recent years have underperformed in the market, and his recent statements on DeFi have been perplexing. In conclusion, Vitalik is not perfect. He is an excellent and idealistic developer, but he also lacks understanding of his user base and occasionally expresses subjective opinions on matters he doesn't fully understand. The industry needs to demystify him and clarify the controversies surrounding him.

V. From the virtual to the real

From the ICO boom of 2016 to the P2E bubble of 2022, in the history of infrastructure development constrained by performance, each era has seen the emergence of corresponding Ponzi schemes and new narratives, propelling the industry towards even larger bubbles. We are currently experiencing an era of bursting bubbles, with massively funded projects self-destructing, lofty narratives repeatedly failing, and a value gap between Bitcoin and altcoins. How to do valuable things is a key point I've consistently emphasized in many articles this year. The shift from the abstract to the concrete is also a major trend. While Ethereum embraced modularity, many said the "Ethereum killer" narrative should be over. But the hottest ecosystems today are TON and Solana. Have either of them brought any innovation to cryptocurrencies? Are they more decentralized or secure than Ethereum? No, not even in terms of narrative. They simply made those seemingly abstract concepts more like applications, incorporating the advantages of blockchain into a Web2-like framework—that's all.

Against the backdrop of exponential internal growth and a lack of external liquidity, efforts to find new narratives are insufficient to fill the block space of Ethereum's Layer 2. As an industry leader, Ethereum should prioritize addressing the fragmentation and internal corruption of Layer 2. In particular, why hasn't the Ethereum Foundation (EF), mentioned above, played a corresponding role despite massive spending? Why is infrastructure funding still prioritized as the highest priority when Layer 2 infrastructure is severely oversupplied? Even the leading companies in the crypto world are lowering their standards and seeking change. EF, as a key organization accelerating ecosystem growth, is going against the grain.