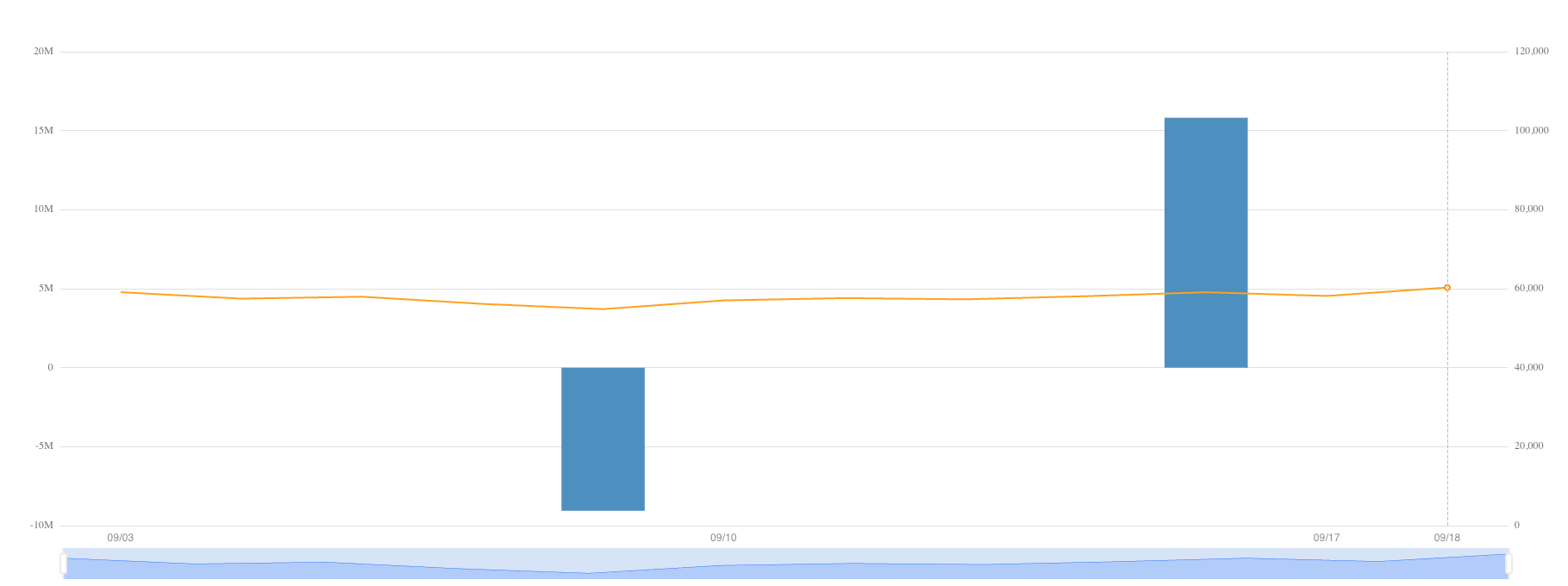

Despite a modest increase in the Bitcoin price in September, BlackRock’s iShares Bitcoin Trust (IBIT) experienced slow inflows, recording just $6.76 million in inflows this month.

While IBIT net inflows stagnated, other funds experienced outflows.

Bitcoin ETF records 155 million won outflow

BlackRock’s Bitcoin ETF – IBIT saw mixed volumes, with $158.2 million inflows on September 16.

However, this uptrend was offset by a net outflow of $9.06 million a week ago, resulting in a small net inflow overall. IBIT has recorded zero (0) net inflows for the first 10 business days this month.

Interestingly, this occurred in a month when Bitcoin’s value rose by almost 5%, a situation that typically encourages higher fund inflows.

Read more: How to Trade Bitcoin ETFs: A Step-by-Step Approach

The ETF sector as a whole showed a similar pattern. In September, all spot Bitcoin ETFs experienced an outflow of about 155.3 million won, which clearly shows that a wide range of market participants are hesitant to buy Bitcoin. Despite this volatile environment, IBIT almost alone maintained a stable inflow.

Recently, BlackRock shared new insights on Bitcoin. The asset management giant released a report titled “Bitcoin: A Unique Diversification Tool,” which discusses the cryptocurrency’s potential as a diversification tool in global portfolios.

The report highlights Bitcoin’s unique characteristics, such as its scarcity, decentralized nature, and global reach, which enhance its appeal as a hedge against traditional financial uncertainty.

According to BlackRock's analysis, Bitcoin has shown remarkable resilience over time.

It has outperformed all major asset classes in seven of the last 10 years, and in particular, has delivered annualized returns of over 100% over the last 10 years.

“This performance is despite Bitcoin being the worst performing asset over the other three years of the decade, having suffered four drawdowns exceeding 50%. Throughout this historical cycle, it has shown the ability to recover from these drawdowns and reach new highs, even during these prolonged bear market periods,” BlackRock said .

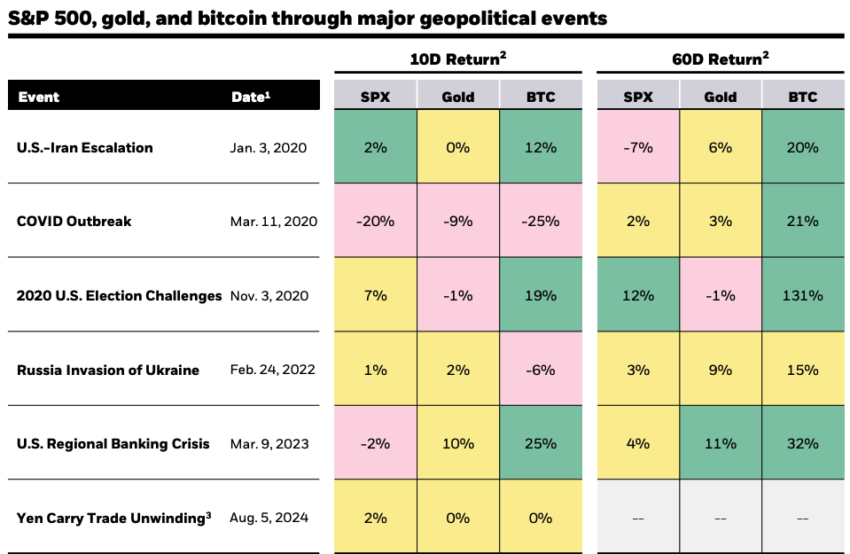

The report also explores Bitcoin’s role during global crises, identifying it as a safe haven asset. BlackRock emphasizes that Bitcoin’s non-sovereign and decentralized nature protects against geopolitical turmoil and economic uncertainty, which impact traditional asset classes.

Read more: Who will own the most Bitcoin in 2024?

The discussion of Bitcoin extends to its impact on U.S. fiscal policy . BlackRock notes that institutional interest in Bitcoin as a potential alternative reserve asset is growing as concerns about the U.S. federal deficit and debt levels increase. This interest reflects the significant debt accumulation that has prompted similar considerations worldwide.

Despite these positive aspects, BlackRock advises caution due to Bitcoin’s volatility and the changing regulatory environment that could impact adoption and valuation. The asset manager recommends that Bitcoin presents an interesting investment opportunity, but should be carefully integrated into a diversified portfolio to manage its inherent risks.