There are dozens of active L1 blockchains, and the number of L2 chains is growing rapidly with the rise of rollup services. Reducing the trade-offs of transferring cryptocurrencies across chains can unlock value for all chains, improve user experience, and create tighter spreads for users. These features are urgently needed for the growth of blockchain users, applications, and protocols. Bridges are how users transfer assets and liquidity between chains. This is critical for on-chain price stability and, more importantly, to provide consumers with competitive price spreads. Current crypto bridges face a trilemma between speed, cost, and permissionlessness.

Three types of bridges:

- Custodial bridges: Using a CEX like Coinbase or Binance for bridging is fast and low cost, but not permissionless.

- Permissionless bridges: Bridges like Hyperlane, Portal, Hop, or LayerZero are relatively fast, but not cheap. They can be permissionless, with liquidity providers charging fees, or rely on trusted minters to create wrapped standard assets (which are not trustless and unnecessarily create more assets).

- Intent bridges: Current solutions are permissionless, but are generally slower and their costs are not significantly lower than permissionless bridges due to rebalancing. They are also limited to large tokens.

Intent bridges have the potential to solve the trilemma, but face problems with liquidity fragmentation, lack of standardization, and rebalancing costs.

Everclear’s clearing layer is designed to solve all of these problems, significantly reducing the friction of inter-chain transfers, lowering costs for application builders and users, and simplifying the experience for developers and users.

Expected Results

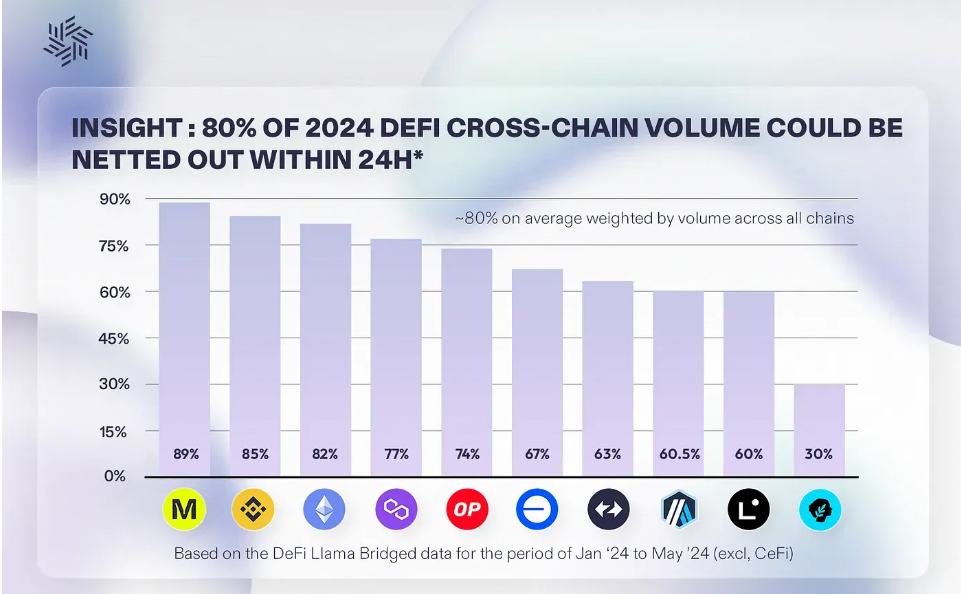

Intent Bridge leverages the insight that 80% of cross-chain volume “nets back” within 24 hours, meaning that for every dollar that leaves a chain across all chains, 80 cents returns within 24 hours. There is always traffic in and out between chains, but 80% of that net traffic ends up back where it started.

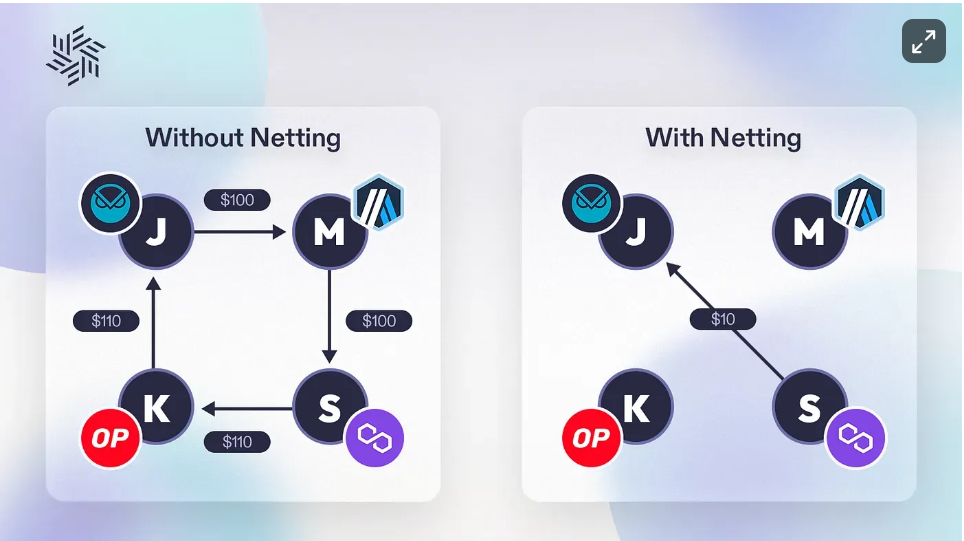

Intent protocols leverage netting by exchanging liquidity on each chain instead of bridging. For example, if a protocol like UniswapX has one user swapping $100 from Arbitrum to Polygon, and another user swapping $100 from Polygon to Arbitrum, UniswapX will directly allow these two users to transfer tokens to each other natively on their respective chains, which is many times cheaper than traditional bridging methods.

The core problem that Everclear solves is that this perfect match rarely happens. When it doesn’t happen, the protocol must “rebalance” by moving the remaining funds in a slower manner, either through traditional custody or permissionless bridges. This approach is slow, complex, and expensive.

Net positive effect

Key stakeholders of IntentBridge include:

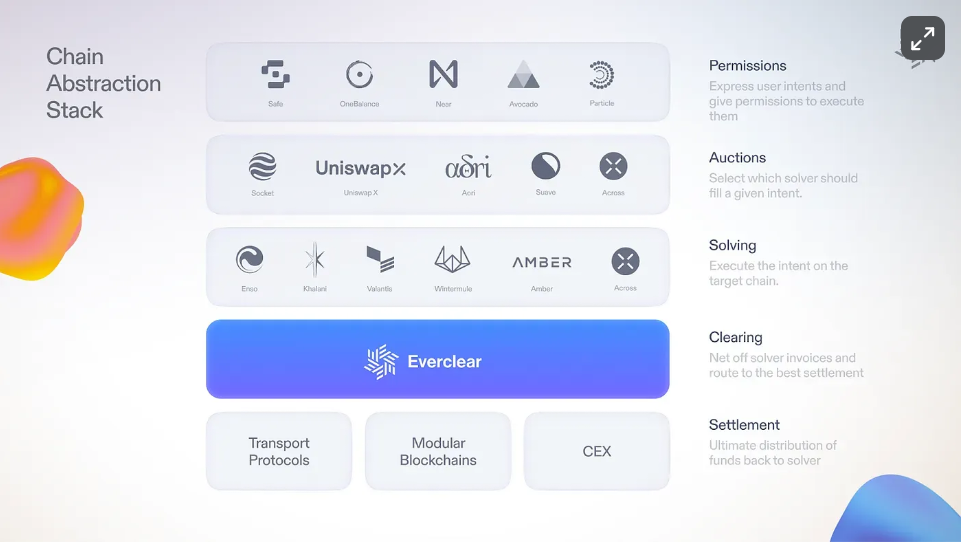

- Chains (permissions) that want to integrate with the bridge, but this is usually a long process

- Protocols (auctions), which have order flow of intent, but only their own order flow

- Market makers (solvers) that fill intent on certain chains but have no efficient way to rebalance

Everclear is the silver bullet that standardizes this process for everyone. On each chain, Everclear deploys standardized contracts where users can generate "invoices" for their intents, and solvers can balance these invoices against each other. If no one takes an invoice within a certain period of time, a Dutch auction for that invoice will begin. For example, if a user has an intent to transfer 10 ETH from Arbitrum to Polygon, and no solver initially fulfills that request, the intent will be discounted to 9.99 ETH, and then further down until a solver fills that invoice.

This standard benefits all stakeholders and creates a permissionless system that aggregates order flow from applications, gives market makers more order flow to maximize net settlement, and works with any chain that has smart contracts with this standard.

Partners

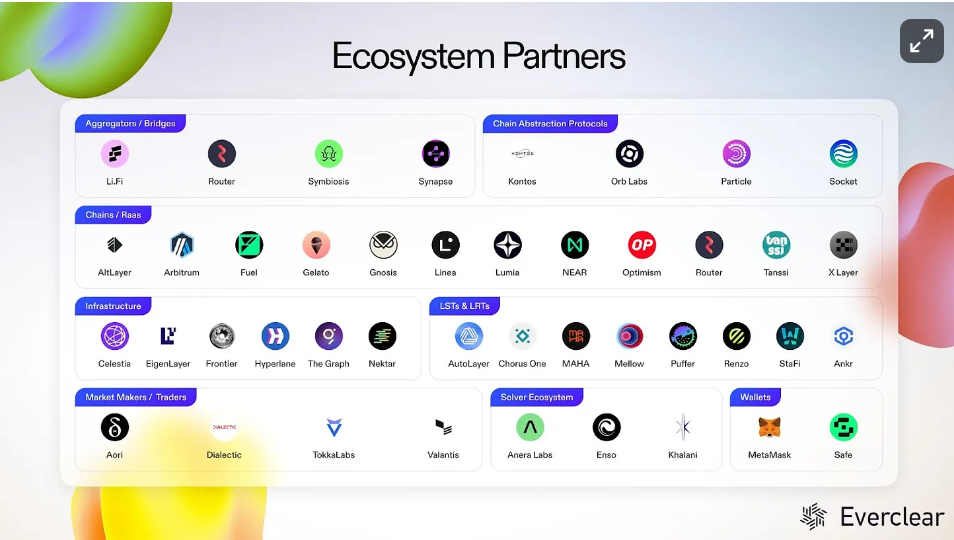

Everclear is designed to benefit everyone; existing stakeholders get a standardized system that almost guarantees that intentions will eventually be met, and users get more competition for their order flow, which drives down prices. This also means that the more stakeholders that sign up, the more efficient the market becomes.

With this in mind, Everclear has already formed partnerships with countless stakeholders such as aori (rebalancer), StaFi Protocol (L2 liquidity staking and staking application), Tokka Labs (rebalancer), Renzo (liquidity re-staking), Anera (rebalancer), and more.

Mainnet launch

Everclear is the first clearing layer to coordinate global settlement of inter-chain order flow, solving the liquidity fragmentation problem of modular blockchains. Everclear’s mainnet was launched yesterday (September 18).